cemagraphics/E+ via Getty Images

Investors are going through a rough period, as they have incurred a double hit this year. Inflation has eroded the real value of their portfolio while the stock market has entered bear market territory due to fears of an upcoming recession. On the other hand, it is important to realize that such tumultuous periods usually provide great opportunities to purchase stocks with solid fundamentals at bargain prices. This is certainly the case for H.B. Fuller (NYSE:FUL), a high-quality Dividend King with promising growth prospects and a cheap valuation.

Business overview

H.B. Fuller was founded in 1887 and is a leading global provider of adhesives, sealants and other specialty chemical products. Its mundane and obscure products lead the stock to pass under the radar of most investors, but the products of the company are essential in their applications. This characteristic has helped H.B. Fuller grow its dividend for 53 consecutive years and thus become a member of the best-of-breed group of Dividend Kings.

Most companies are under great pressure right now due to the surge of inflation to a 40-year high. Excessive cost inflation is exerting great pressure on the margins of the companies that operate in competitive markets. However, this is not the case for H.B. Fuller. Thanks to the essential nature of its products, the company has raised its prices aggressively and thus it has passed its increased costs to its customers.

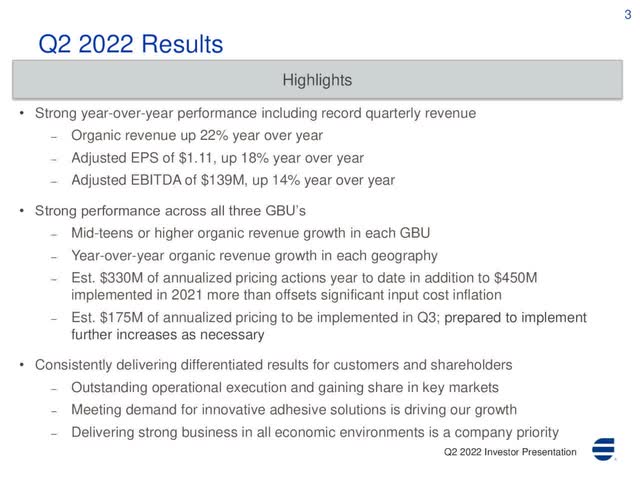

More precisely, H.B. Fuller implemented price hikes of $450 million in 2021 and another $330 million in the first two quarters of fiscal 2022.

H.B. Fuller results (Investor Presentation)

In addition, management expects to impose another $175 million of price hikes in the running quarter and is prepared to raise prices even further if high inflation persists.

The effect of price hikes is clearly reflected in the impressive performance of H.B. Fuller in the second quarter. The industrial manufacturer grew its organic sales 22% and its earnings per share 18% over the prior year’s quarter thanks to solid performance in all the business segments and geographic regions. Thanks to the sustained momentum of its business, H.B. Fuller recently reaffirmed its guidance for earnings per share of $4.10-$4.35 this year. Analysts agree with the outlook of management and expect H.B. Fuller to post record earnings per share of $4.24 this year. If this forecast materializes, it will mark 22% growth over last year’s record results.

It is also important to note that H.B. Fuller has grown its revenues at a double-digit rate for 6 consecutive quarters and has not missed the analysts’ earnings-per-share estimates for 10 consecutive quarters. This is a testament to the sustained business momentum of the company amid highly challenging business conditions, which include high inflation, increased freight costs and supply chain disruptions. Moreover, the ability of the company to raise prices aggressively with minimum effect on its volumes is a testament to the dominant business position of the company and its strong negotiating position with its customers.

Growth prospects

H.B. Fuller has grown its adjusted earnings per share at a 6.7% average annual rate over the last nine years, from $1.90 in 2012 to $3.47 in 2021. A point of concern is the somewhat volatile performance record of the company, which incurred a material decrease in its bottom line in some years. This means that its shareholders should be prepared for volatile earnings and steep moves of the stock price during periods of adverse business conditions.

On the other hand, the industrial manufacturer has significantly improved its performance in the last five years. During this period, it has grown its earnings per share by 7.5% per year on average, with much greater consistency. Given also the strong business momentum of the company, without any signs of fatigue, it is reasonable to expect meaningful growth in the upcoming years. Analysts seem to agree on this view, as they expect H.B. Fuller to grow its earnings per share by 12% in 2023 and by another 11% in 2024. Overall, H.B. Fuller seems to have entered a reliable growth trajectory for the foreseeable future.

Dividend

As mentioned earlier, H.B. Fuller has raised its dividend for 53 consecutive years and thus it is a Dividend King. There are only 44 Dividend Kings in the investing universe and hence the achievement of H.B. Fuller is admirable.

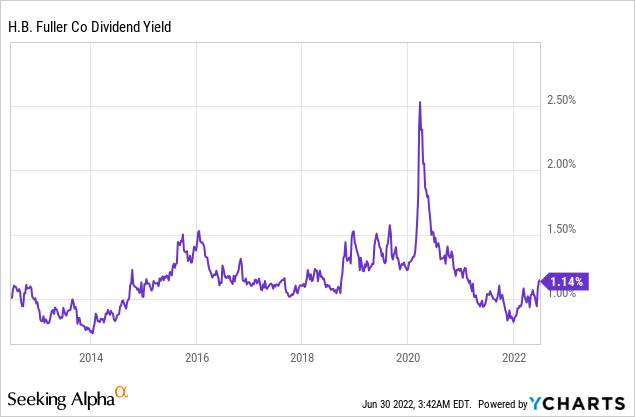

On the other hand, the stock is offering a dividend yield of only 1.3%. This yield is in line with the historical dividend yield of the stock, which has hovered between 1.0% and 1.5% most of the time throughout the last decade.

The yield of H.B. Fuller is certainly insufficient to attract income-oriented investors. In addition, the company has grown its dividend by only 4.0% per year on average over the last five years.

However, it is important to note that H.B. Fuller has an exceptionally low payout ratio of 18%. This means that the industrial manufacturer could offer a much higher dividend yield but it prefers to reinvest its earnings in its business. In other words, H.B. Fuller sees promising growth prospects in its business and thus it prefers to reinvest its earnings in its business instead of offering a much higher dividend. This certainly bodes well for the growth potential of the company.

Valuation

As H.B. Fuller is expected to post earnings per share of $4.24 this year, the stock is currently trading at a price-to-earnings ratio of 14.3, which is much lower than its 10-year average price-to-earnings ratio of 17.7.

On the one hand, the cheap valuation can be partly justified by the surge of inflation, which reduces the present value of future cash flows. On the other hand, the Fed is doing its best to restore inflation towards its long-term target of 2% via aggressive hikes of interest rates. Thanks to its aggressive stance, the Fed will almost certainly lead inflation towards its long-term target in the upcoming years. When this happens, H.B. Fuller will probably revert towards its historical valuation level.

Moreover, the valuation of H.B. Fuller is markedly cheap if its growth prospects are taken into account. To be sure, the stock is trading at only 11.6 times its expected earnings in 2024. Overall, the investors who can wait patiently for inflation to revert to its normal range are likely to be highly rewarded by H.B. Fuller thanks to its growth trajectory and its cheap valuation.

Risk

H.B. Fuller has proved remarkably resilient to the coronavirus crisis. In 2020, when the pandemic caused a fierce recession, the industrial manufacturer incurred a minor 4% decrease in its earnings per share. However, it is important to note that the recession was short in duration thanks to the unprecedented fiscal stimulus packages offered by the government.

H.B. Fuller proved vulnerable to the Great Recession, in 2009. During that recession, its earnings per share slumped 79% and its stock price plunged 66% in less than six months. Therefore, if a severe recession shows up, investors should be prepared for a volatile stock price and possibly a significant decrease in earnings. While the current business momentum of H.B. Fuller does not justify any concerns, the sensitivity of the company to recessions is a risk factor to keep in mind.

Final thoughts

The stock of H.B. Fuller has shed 22% this year, in tandem with the S&P 500, despite the solid business performance of the company. The stock has become markedly cheap and is likely to reward those who purchase it around its current price. Nevertheless, due to the strong downtrend and the remarkably negative market sentiment right now, H.B. Fuller is likely to remain in a downtrend in the short run. Therefore, I advise investors to purchase the stock near its technical support at $50-$52.

Be the first to comment