Sean Gallup

A lot of tech stocks have collapsed this year, but some of the companies like Shopify (NYSE:SHOP) have built better organizations during this volatile period since covid flipped the switch on online commerce. The e-commerce platform continues to expand services into offline payments and logistics providing a huge growth ramp into the future. My investment thesis is very bullish on the opportunity with Shopify, though the stock valuation isn’t the most ideal after this big gain.

Blowout Numbers

The key to the Q3’22 results for Shopify wasn’t the revenue beat, it was the ability of the company to grow revenues at a 22% clip. Shopify reported revenue jumped to $1.37 billion and the Q3’19 revenues were only $391 million. The company has reported 52% annualized growth over the period.

The stock now trades at the lows as the market as the valuation has normalized in the last year following the insane valuation when Shopify traded above $150. Amazingly, the stock would probably trade higher if not for a lack of profits even despite the limited losses providing the traditional playbook for growth investors.

The company outlined a whole host of new products set to drive growth in the future as follows:

- POS Go – launched new first-in-class mobile hardware device for point-of-sale transactions from curb to counter.

- Shopify Collabs – product brings brands and creators together to generate 50 million organic social impressions in 2 months.

- Shopify Markets – allows merchants to identify, set up, launch, optimize and manage their international markets from a single storefront with more than 175,000 merchants since Q1 launch.

- Shopify Markets Pro – cross-border solution built on top of Markets in early access starting mid-September.

- Shopify Payments/Capital/Shipping – launched in new global markets.

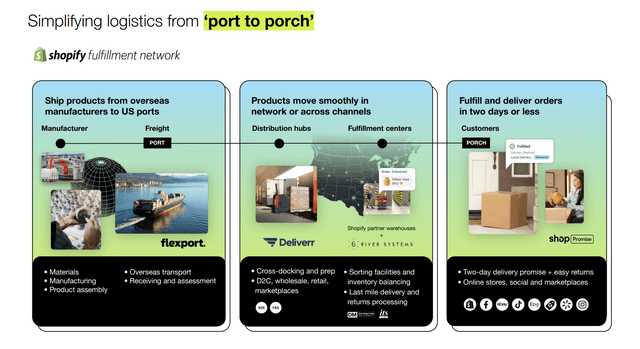

- Shopify Fulfillment Network – covers 3 complex stages of a merchant supply chain across freight, distribution and fulfillment as inventory moves from port to porch.

The most impressive opportunity is within the Shopify Fulfillment Network enhanced by the recent acquisition of Deliverr. The company can now offer merchants a complete supply chain solution covering the logistics of getting products from the ‘port to porch’.

Source: Shopify Q3’22 presentation

Shopify is in the process of solving a ton of issues for merchants. These solutions come at a cost, though the company isn’t losing a ton of money on a quarterly basis and Shopify has a cash balance of nearly $5 billion to easily afford investments. After all, the e-commerce infrastructure company only lost $30 million in the quarter despite adding on the unprofitable Deliverr business and aggressively investing for the future ahead, especially in logistics.

For Q4, Shopify guided to a similar operating profit loss. If the company can continue to generate 20%+ sales growth, investors will ultimately be rewarded with the massive investments in new products while the infrastructure platform only absorbs small quarterly operating losses.

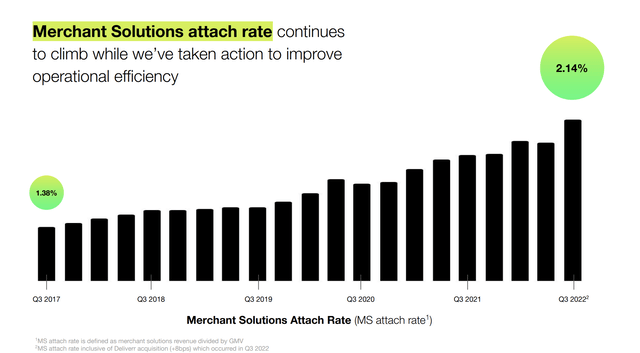

The impressive growth in Merchant Solutions take rates is a prime driver of growth and a sign of how new products are driving growth. For Q3’22, the rate reached 2.14% while GMV grew 11% to $46.2 billion.

Source: Shopify Q3’22 presentation

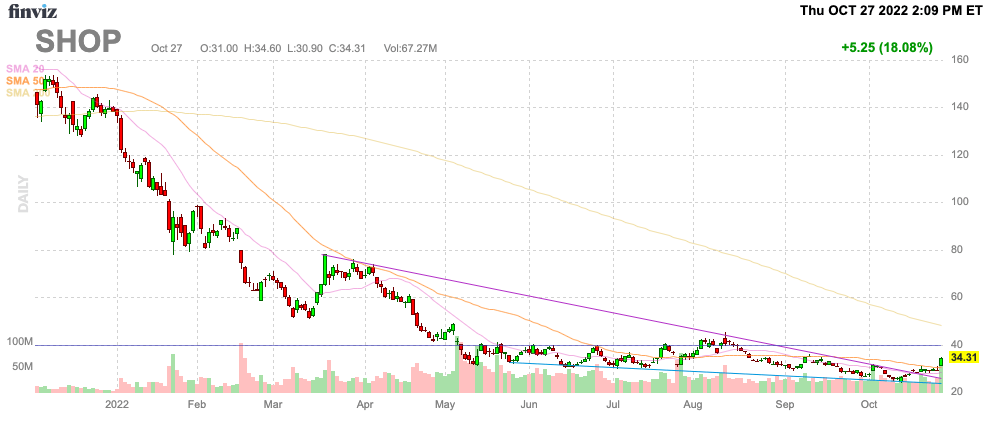

Stuck In The $30s

The stock is surging on the quarterly results, but Shopify is still stuck in the $30s for one major reason. The stock has traded in this range since May providing a strong base for anyone investing here.

Source: FinViz

The major problem is that Shopify isn’t exceptionally cheap at the lows with the stock still trading at 6.5x 2023 revenue targets. The tough economic environment and fears of slowing e-commerce growth, especially as inflation slows, definitely leaves the forecasted 24% growth rate for next year in jeopardy.

Investors should look for weakness to own the stock, not chase Shopify after an 18% jump. A retest of the lows would definitely provide the opportunity to own the business for the growth the fantastic new products will generate over the years, otherwise investors should be careful chasing the stock here likely running into strong resistance around $40.

Takeaway

The key investor takeaway is that Shopify is a stock worth chasing here. The stock is already priced for a normal economic environment and the world is possibly heading into a recession. Investors should buy the stock on weakness going forward due to the impressive suite of services offered to merchants with the business firing on most cylinders despite the macro issues.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

Be the first to comment