Johnny Greig/DigitalVision via Getty Images

Dear readers,

Martin Marietta (NYSE:MLM) is a bit of an “oddball” company. What I mean by this is that it’s a former aerospace company now associated with construction aggregates and gravel, of all things. These sorts of things are not bad investments in the least. Concrete, gravel, plastics, food – all those things that we as people need to live our lives, light our homes, eat or build our infrastructure. While some of these sectors are certainly volatile and correlated to overall market trends more than we might like, they are nonetheless solid investments if bought at the right price.

So now it’s time to revisit Martin Marietta and see what we can do with the company as an investment.

Revisiting Martin Marietta

At its heart, MLM is a very attractive business due to its very foundational sort of focus – literally. Martin Marietta is in the business of building materials, specifically aggregates, cement, concrete, asphalt and paving, and specialty materials.

These sorts of products aren’t just needed anytime someone decides to build almost anything, MLM is also one of the leading businesses in specific parts of this sector in all of the US. This goes for aggregates, where the company is leading #1 or #2 in 90% of its home markets, and being the largest producer of strategic cement in all of the state of Texas. That’s not a bad track record or quality in the least.

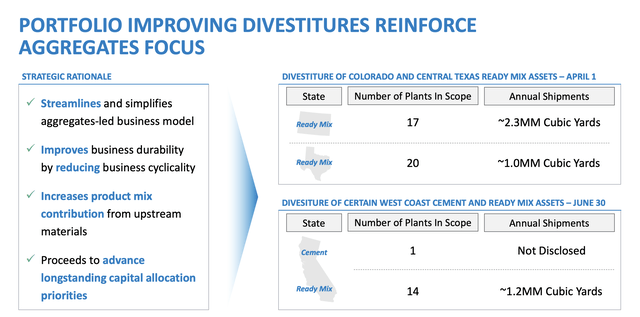

I’ve written about the business of cement and concrete before. MLM is no different fundamentally in how its business works, but it has an appealing position both geographically and in terms of its business, with 82% of the company profits coming from the upstream material segments of Aggregates and Cement. Remember, Cement and Concrete – aggregates as well – isn’t necessarily a product that makes for great transportation or logistics.

Ideally, you want a plant next to your construction site, if possible. As we’ve been through before, shipping cement over long distances is a wholly unprofitable and illogical venture. Capacity for the product needs to be built on-site, or close by, which insulates the company’s key markets from aggregate and cement competition. This usually isn’t possible of course, but it goes to show you why peers like HeidelbergCement (OTCPK:HDELY) and Holcim (OTCPK:HCMLY) usually focus on geographic advantages and command such an attractive set of assets with a very high replacement value – despite these assets at this time often being quite old.

I like HeidelbergCement and Holcim both, and I do like Martin Marietta. I just didn’t like the price when I previously looked at it, despite quite good demand. Texas demand for cement alone exceeds what MLM can output in terms of product.

Like its European counterparts, many of the questions the company is faced with are regarding ESG and carbon reduction goals, given the massive amounts of pollution that businesses of this kind are active in. The company, like its European peers, targets achieving these goals through operational upgrades of capacities, better fuels, water & waste management and R&D.

Unlike its cyclical EU counterparts, MLM has been a good deliverer of value for its shareholders. Despite the usual cyclicality common to concrete businesses and aggregate companies, MLM has delivered market-beating returns of nearly 40% more than the S&P500 over the past 15-20 years.

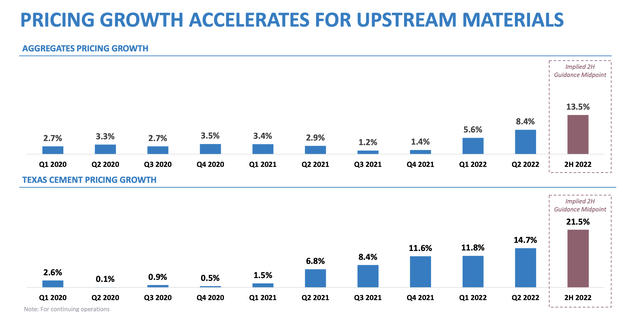

Recent results show no signs of the company fundamentally slowing down. The company is successfully applying pricing to protect its bottom line, while sales are showing very impressive trends despite the building volatility. Price growth however, is superb.

The key problem for MLM is the company’s energy cost. Much like its EU counterparts, the key driver is pricing for various sources of fuel, including but not limited to Diesel, Natgas, Bitumen and straight electricity. The company rates service costs, supplies and repairs as well as personnel costs as a lower influence here.

The company also continues its shift to aggregate, giving better visibility to the business.

You know my style of reviewing these companies if you follow my articles. I begin by looking at the top-line results, then move down to the bottom line. Top-line MLM results are great. The company saw 18% revenue increases YoY for the 2Q22 period, with a 10% gross profit increase. EBITDA was up 9%, and adjusted diluted earnings was up 4%. Even with adjustments removed, we at least see no significant negative impact to the company’s bottom line. MLM has managed to push pricing and its trends to offset for any cost increase that the market, so far, has been throwing its way.

Point to MLM – and positive, for sure.

Aggregates was a good performer with a 9% shipment increase and an 8% increase in average selling price. Cement and Downstream was even better in terms of shipment, and the company managed to push pricing here as well – as much as 24% for asphalt, which by far outperforms its European counterparts.

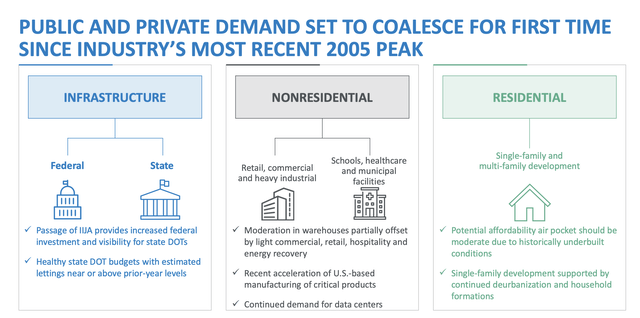

The company’s current outlook for its core business is a positive one.

And nonresidential segments show positive outlooks, barring only warehouse/distribution centers, which is set to see moderation due to the pandemic and current supply/demand trends. Despite the current market trends, the company continues to believe in solid housing demand trends, in particular due to massive underbuilding since the 2010 period and beyond. Despite a reversal, we’re not yet back at normalized higher levels.

However, despite all these positives, remember some of the challenges to the company here. The company boasts a BBB+ credit rating, and a debt/cap of less than 46%. It, unfortunately, also has perhaps one of the lowest dividends and DGR in the entire concrete/building materials sector, coming in at currently 0.8%.

This is still the biggest challenge with investing in the company, aside from the premium we seem to need to accept when investing in Martin Marietta – because make no mistake, Martin Marietta continues to trade at a significant premium to any concrete/aggregate player I follow.

Let me clarify here.

Martin Marietta – Valuation

MLM continues to trade at what I believe and judge to be at a fair bit of premium – but there is some justification for it, between significant fundamental quality and double-digit EPS growth.

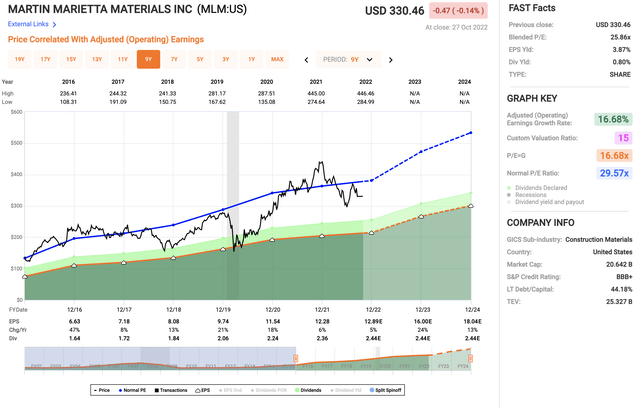

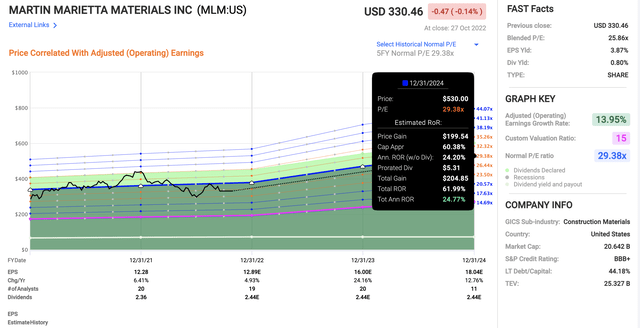

MLM valuation (F.A.S.T graphs)

Two wildly different ways of viewing martin Marietta. At conservative multiples, this company has a bare-bones upside with a low yield. There is very little to recommend it around 15-17x P/E – but once we start considering the 25-30x P/E to be more relevant, then we see upsides of double digits on an annual basis for MLM.

The current 29.5x P/E upside is around 24.7% per year, with a total 2024E RoR of 62%. This isn’t bad, but at the same time, we need to remember that we’re in a market where 20-30% annualized RoR upsides with companies with far better yield isn’t an odd or uncommon thing in the least.

The valuation is, simply put, very prohibitive when considering just what sort of company MLM is. It doesn’t behave like a volatile stock, even though it technically should.

But it trades at close to 30X average P/E, which is absolutely insane when you consider that larger European peers trade in the single-digit P/Es, and what the company does is concrete and aggregates, which is essentially “dirt”. Now, it’s high-quality dirt with one of the best supply and support infrastructures out there, but it still shouldn’t be trading quite that high, as I see it.

So from that perspective, it’s quite understandable that this company rarely comes to such valuations as we would see in some of its peers, like HeidelbergCement or Holcim. Still, it makes upsides and growth problematic, as it’s based on maintaining a premium in a recessionary market characterized by potential stagflation.

Provided we accept that 29-30X forward P/E, an investment into MLM could generate significant alpha going forward.

The one problem is that historical earnings stability isn’t the same as being easy to forecast. That’s why the MLM forecast accuracy is actually fairly bad. Analysts consequently negatively miss the forecasts for this company, which makes the current forecasts not easy to consider as fair or accurate. I believe that if we want to treat MLM more as a growth-type stock with a low dividend yield, we need better accuracy, and as things currently stand, it’s uncertain whether double-digit EPS growth is likely.

2Q22 would certainly suggest so – and the 7% price drop also helps, but I simply don’t think that this is “good enough” of a case to be made here.

To put it simply, I want more.

I want more yield, or I want a higher upside if the yield is that low.

Why should I invest in a 60% upside of total 2024E RoR with a 0.8% yield when I can have a 5-9% yield with a realistic, conservative 100-150% upside for the same time period?

Seen on its own, MLM isn’t a bad play.

Seen in the context of the broader market, I don’t quite see the appeal here.

Whenever you’re wanting to buy a company at a 30X multiple, it pays off to look at how exactly that company does in a bearish market environment or significant market downturns. The answer, unfortunately, is “not all that well”. Despite its quality, the company is liable to lose over 40% of its share price in a downturn like the one we saw in COVID-19.

This is a bit too serious for what I consider to be a low-yield investment. There are investments that cushion your downside with a fair amount of yield while offering the explosive upward potential that MLM does.

I am, therefore, maintaining my conservative and balanced view on MLM. S&P Global gives the company an upside of 17% to a PT of $400/share, down from almost $450 when I last wrote about it.

Despite this though, many of the analysts following the company still have a “HOLD”, underperform or “SELL” rating, implying a fairly low conviction to the average PT. The conviction I far higher than before, when we could see a 50%+ on the other side, but it’s still not high enough for my taste when we consider what’s on sale here.

Thesis

My thesis for Martin Marietta is as follows:

- This Is an excellent, well-managed company with a decent upside – the problem is that it’s based on the sort of multiple premia you find in luxury companies like LMVH – and MLM makes concrete and aggregates. I respect the company’s achievements, but I won’t pay more than 2X peer multiple for this sort of business.

- Superb credit safety and record-low yield compete with one another, turning the upside less than 20% annually even to a 30X forward multiple.

- I consider the company a “HOLD” in today’s chaotic market with a $320/share price target – no more than that. At such a price, the upside is what I consider to be worth it. It’s getting close to it, but it’s not yet consistently at or below my target.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment