Justin Sullivan

As good an investor as Warren Buffett is, he makes mistakes like the rest of us. What is interesting is that they tend to occur more often when he invests in deep value opportunities, than when he “pays up” for a great franchise. One clear example of Buffett falling into a value trap was his investment in IBM (IBM) a few years ago. IBM looked extremely cheap at the time, but its revenue and earnings kept shrinking, ultimately generating very poor investment results and ending with Buffett throwing in the towel. Buffett invested in IBM in November 2011, buying roughly 64 million shares at an average price of $170 each, which valued the investment at ~$10.7 billion. After six years of declining revenue, and the share price sinking into the mid-$140 range, Buffett finally decided to sell and move on to other ideas. It was fortunate for him, because one of those new ideas turned out to be Apple (AAPL), which although nowhere as cheap, turned out to be a great investment for Berkshire Hathaway (BRK.A)(BRK.B).

The HP Inc. (NYSE:HPQ) investment by Buffett is giving us flashbacks to the IBM situation, and makes us wonder why he is once again buying an old tech company with eroding fundamentals. As most investors know, HP has two main businesses, the print business and the PC business. The print business is clearly in decline, and it seems that management has resigned itself to managing it in a way that extracts as much value from it while it slowly melts away like an ice cube. There was a little more optimism about the PC business for a while, with some periods showing growth, but recently it is looking more likely that this business will also enter terminal decline. Some of the signs pointing in this direction include worldwide PC shipments decreasing by ~15% in the third quarter. Despite the company putting enormous efforts looking for new growth areas, which include 3D printing and workforce solutions, it still reported in Q3 revenue down 4.1% from the prior-year period and down 1.9% in constant currency. This makes us wonder, did Buffett overpay for this melting ice cube? Let’s run the numbers.

Financials

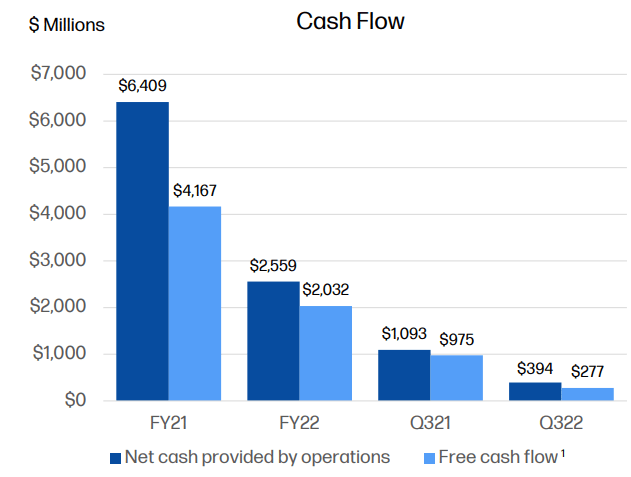

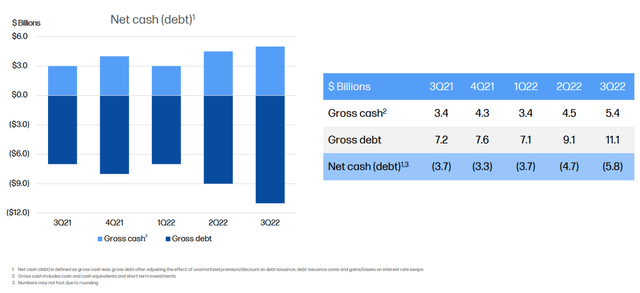

While earnings per share have been helped by significant share repurchases, the balance sheet and cash flow needed to continue doing so are deteriorating. For example, free cash flow in Q3 2022 was only ~$277 million, significantly less than the $975 million in Q3 2021.

HP Inc. Investor Presentation

Growth

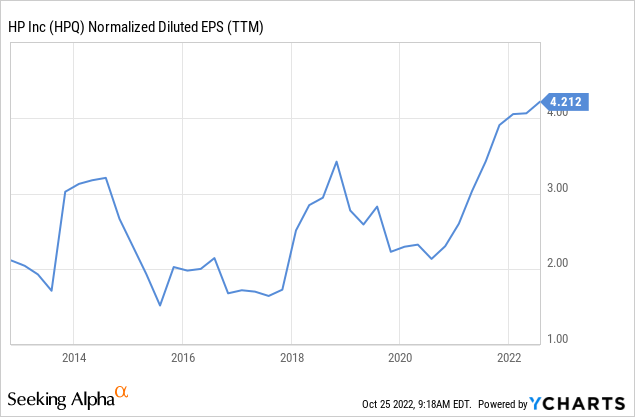

Trailing twelve-month normalized diluted earnings per share are at a record in large part thanks to the massive share buybacks that HP has done. It is clear, however, that there is also cyclicality in its earnings. So investors have to be worried about both cyclical decline, which can be quite fast, and the slower but more worrisome secular decline. One particularly worrying thing about the last earnings report is that the two main segments reported significant declines, with printing down 6.3% (5.3% in constant currency), and personal systems down 3% (0.3% in constant currency).

Balance Sheet

If HP could just keep buying shares aggressively as it has been doing maybe earnings could keep rising even with lower revenues. The problem is that the aggressive buybacks have weakened the balance sheet, which will likely force the company into moderating the pace of the share repurchases. Net debt has gone from $3.7 billion in Q3 of 2021 to $5.8 billion in Q3 of 2022. This is still very manageable, but with interest rates rising and the business weakening, HP will have to be more prudent going forward.

Shareholder Returns

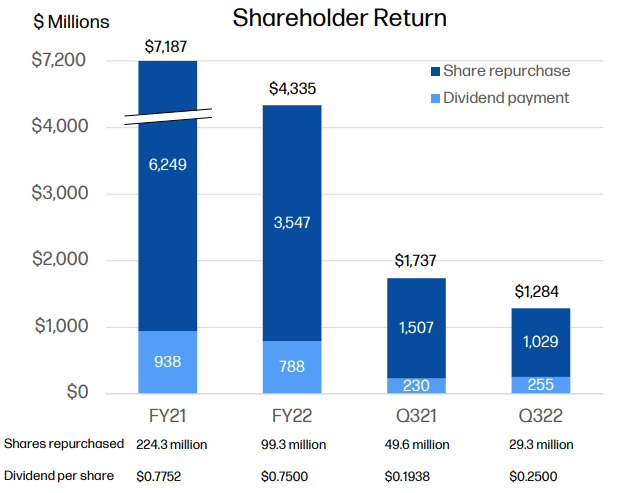

We are already seeing signs of this slow down in share repurchases, with total shareholder returns decreasing from ~$1.7 billion in Q3 2021 to ~$1.2 billion in Q3 2022.

HP Inc. Investor Presentation

Valuation

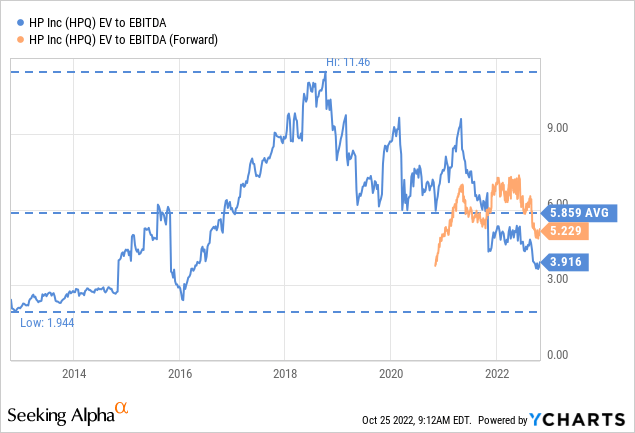

At first glance shares look extremely cheap with an EV/EBITDA ratio of only ~3.9x. The forward EV/EBITDA is meaningfully higher at ~5.2x, as analysts are expecting earnings to decline next year.

We think estimating the net present value of its future earnings is a better way to value the shares. Using analyst estimates for the next three years, and then assuming a 5% annual decline in earnings, and discounting everything at 10%, we get a net present value estimate of $28 per share. Very close to the current share price, and making us believe that the market is already pricing some degree of terminal earnings decline. Given how close our estimate of intrinsic value is to the share price, we rate shares a ‘hold’. Since Warren Buffett bought shares in the $30’s, we do believe he somewhat overpaid for his position, and we don’t think this will be a particularly successful investment for him.

| EPS | Discounted @ 10% | |

| FY 22E | 4.07 | 3.70 |

| FY 23E | 3.72 | 3.07 |

| FY 24E | 4.05 | 3.04 |

| Terminal Value @ 5% terminal decline | 27.00 | 18.44 |

| NPV | $28.26 |

Risks

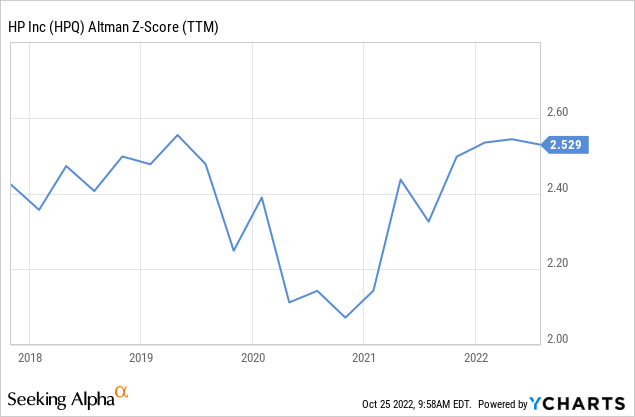

While the market appears to already be discounting a level of decline in the business, and of the future earnings, shares could still drop significantly should the rate of decline accelerate. Things could get even more complicated as HP is now carrying more debt, especially if it continues ramping up leverage to do more buybacks. At the moment, the Altman Z-score is already below the critical threshold of 3.0, so the company should start paying more attention to its balance sheet.

Conclusion

We believe Buffett overpaid for his HP Inc investment, but not by much. It is likely that he will end up making some positive return. At current prices, we believe shares can deliver ~10% returns, as long as the company manages to avoid a drastic decline in earnings. According to our analysis, the market is pricing a ~5% decline per year in earnings long-term. Despite the low embedded expectations, we believe there are better investment opportunities out there.

Be the first to comment