1joe

This article was co-produced with Cappuccino Finance.

Today, we’re discussing Boston Properties (NYSE:BXP). I’ve written about it more than once, but for those who don’t know…

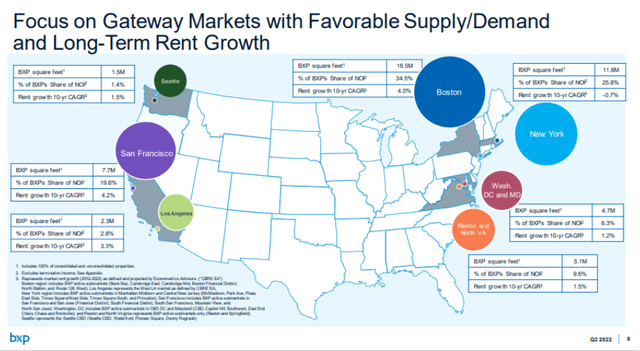

BXP is a real estate investment trust (REIT) that develops, owns, and manages Class A office properties concentrated in six premier markets: Boston, L.A., New York City, San Francisco, Seattle, and D.C.

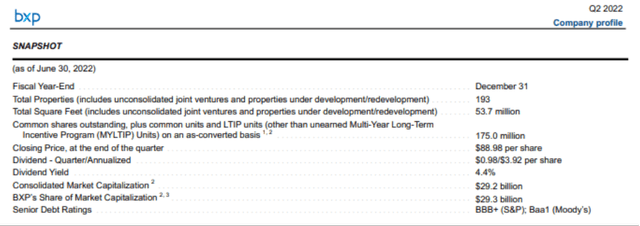

Its portfolio includes over 190 properties with 53.7 million square feet… making it one of the largest publicly traded office REITs around. These assets are professionally managed and well-located, and are either modern structures or have been modernized to stay competitive.

Boston Properties is a full-service real estate company. Acquisitions, development, financing, construction, property management, marketing: It’s got the capacity for all that and more.

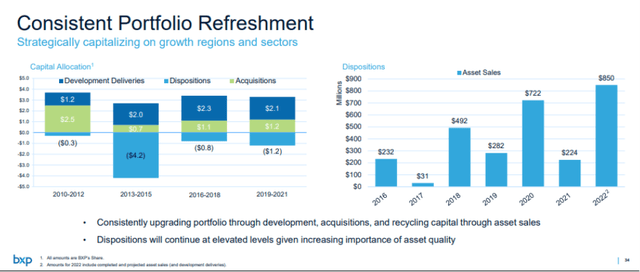

As such, it shouldn’t surprise you that its business has been consistently growing (3% per year revenue growth, 5-year CAGR). That’s built on a cycle of acquiring desirable new properties, strategically disposing of certain assets, and redeveloping others.

And since the company has a solid pipeline of acquisitions and development projects in the works… I expect the trend to continue.

Boston Properties maximizes its return on investment (ROI) by acquiring the highest-quality buildings with unique amenities and desirable locations. This allows it to maintain high occupancy at premium rental rates.

Moreover, by focusing on only six premier markets, it’s better able to achieve economies of scale within each… all of which provide a great long-term growth trajectory.

Solid Development Pipeline

Anybody in the real estate business understands the importance of building a solid pipeline to maintain growth. Continuous flows of deals are essential.

In this respect, Boston Properties is doing a great job to keep its expansion engine running.

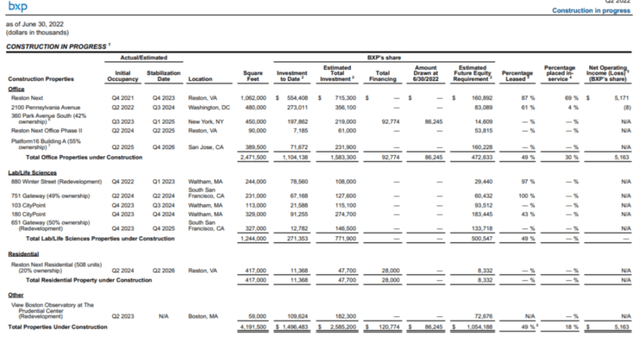

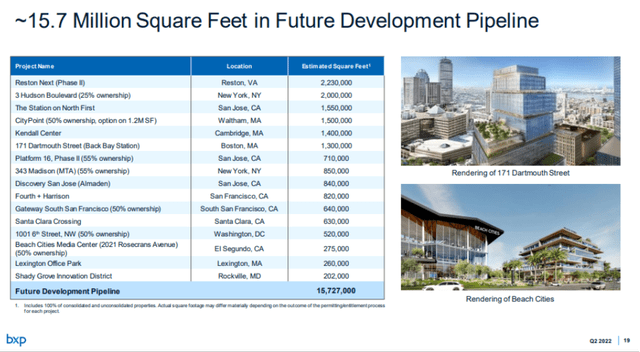

Based on its last quarterly report, the REIT has $2.6 billion of assets under active construction. And 15.7 million square feet worth is ready for future development.

These projects will keep its revenue, cash flow, and dividend moving in the right direction.

BXP Investor Relations BXP Investor Relations

Let’s also look at its capital allocation and transaction history. Boston Properties is clearly doing a great job at consistently upgrading its portfolio and recycling capital.

Once again, with this great deal flow, we have little doubt the company will keep producing impressive portfolio growth and quality upticks.

Strong Post-Pandemic Performance Amid Recessionary Pressure

Here’s some news nobody needs to hear, mainly because it’s so exhaustingly obvious…

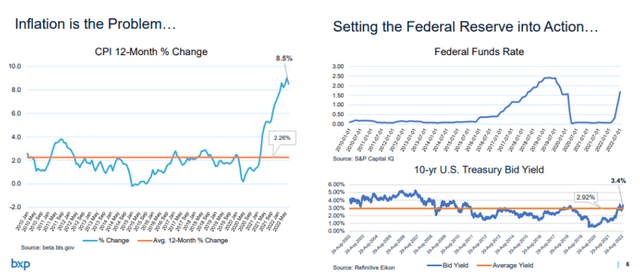

Inflation has been creating headaches across the board. On the consumer side, it impacts our day-to-day life through high food and consumer goods prices. On the business side, companies are struggling to control costs.

At the same time, the Federal Reserve’s higher interest rate is tightening the economy. Fears of a recession have been growing throughout the year, and many (if not most) already believe we’re in one.

Yet Boston Properties continued its strong post-pandemic performance in Q2-22. Its financial results reflect the strong reopening trends in its major markets.

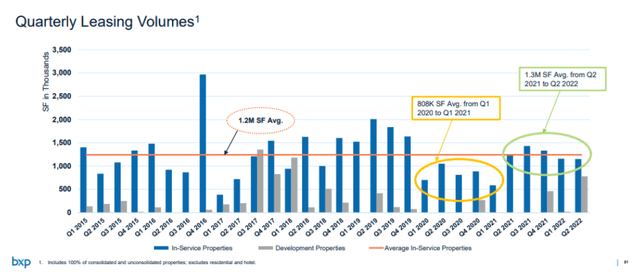

The office REIT’s clients have increasingly needed to secure high-quality space. That allowed the apt and able Boston Properties to complete 1.9 million square feet of leasing during the quarter…

Which was more than 160% of its Q1 volume and 140% of what it achieved a year ago.

One major trend driving this growth is how so many companies increased their workforce during the pandemic. And they did it without increasing office space.

Why would they when everyone was working from home.

But now a shortage of office space will only add to Boston Properties’ already established impressive performance. Overall, its Q2 revenue and funds from operations (FFO) increased by 10% and 13%, respectively.

It recorded $1.94 per share of FFO, which was $0.09 higher than the midpoint of its previous guidance.

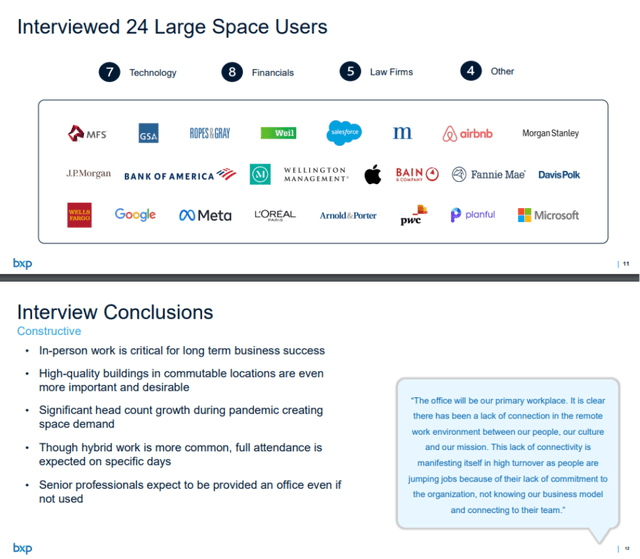

Boston Properties interviewed 24 of its large space users, who acknowledged that in-person work is still a critical part of a business’ long-term success. Again, this means that high-quality buildings in commutable locations are becoming even more desirable and necessary for business success.

Solid Balance Sheet

To achieve solid growth, a real estate company needs a strong balance sheet and some available liquidity. Properly maintaining leverage properly is key for a REIT’s success.

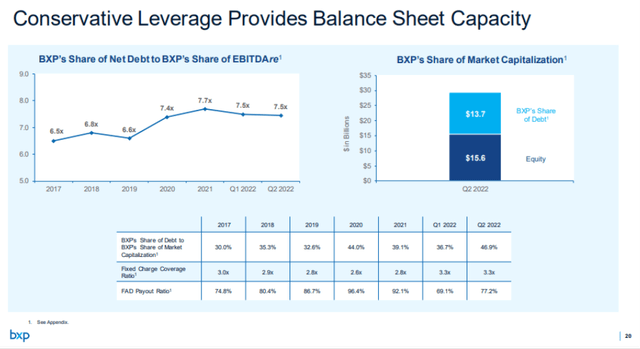

Sure enough, Boston Properties manages its debt conservatively and effectively. As such, it’s built a very good strong balance sheet to support its plans from here.

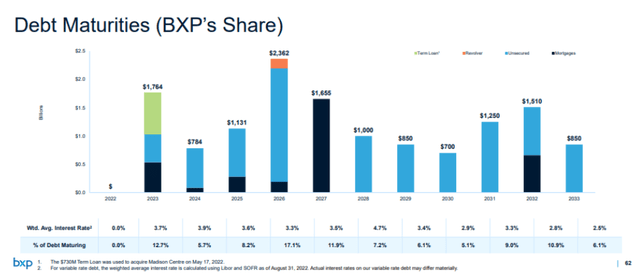

Its interest payments are well-covered at 4.3x, and its net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) stands around 7.5x. And no debt matures until September 2023 outside of unconsolidated joint ventures.

In fact, its debt maturity schedule is nicely spread across the next several years. BXP’s finance team truly does an excellent job at managing such things, so it’s not surprising to see the REIT rated highly by both Moody’s and S&P.

BXP Investor Relations BXP Investor Relations BXP Investor Relations

Growth Opportunities in Life Science

With so many news stories out there for so long about people not returning to the office, Boston Properties’ growth might make many skeptical at first glance.

But here’s the thing…

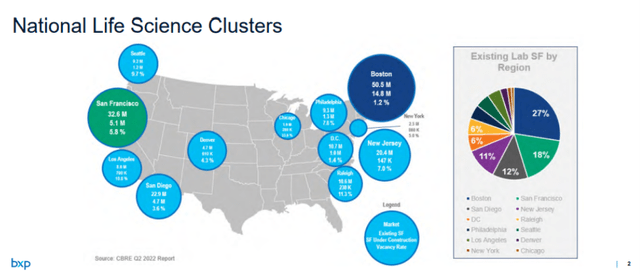

The life sciences field is booming, and it’s creating great opportunities for commercial construction businesses. Drug research and innovation as a business has been growing at a rapid pace, and that’s not set to slow down.

CBRE reported that the U.S. life sciences market has reached an all-time high in funding. And demand for lab space continues to increase.

Better yet, BXP’s focus markets are all hubs for this work, putting it in an even more prime position.

The REIT is already making moves to capture opportunities here. In September, for one, it closed on 125 Broadway in Kendall Square for $592 million. The six-story laboratory/life science property was purchased from biopharma Biogen and has been leased back to it through 2028.

And Boston Properties has another 6 million square feet of life science-focused development opportunities on hand.

Valuation

This brings us back to perception of the office market, which falls in anyone’s favor who wants to snap up shares. Reflecting recession fears and continuing negative sentiment about office leasing…

BXP shares have suffered substantial losses in the past six months. After touching $130 in April, they’ve slid below $77.

This creates a great opportunity for investors to grab them at a bargain price.

Based on iREIT’s price target of $100-$120, this company is trading 23% below the target range. We see that as a major mistake on the market’s part given everything we’ve mentioned above.

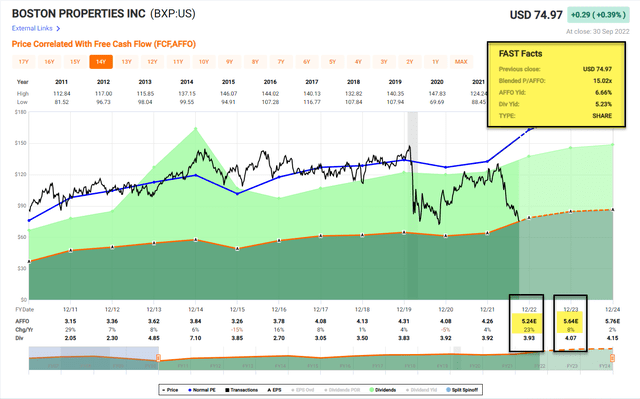

Here’s another clue it’s trading too low: BXP’s current p/FFO ratio of 11.87x and p/adjusted FFO (AFFO) ratio of 18.27x are 15% or so below their historical levels.

And here’s a bonus: The lower stock price pushes up BXP’s dividend yield above 5%, which is a huge bonus for investors.

Risk

As everyone is aware by now, economic activities are slowing down due to inflation and high interest rates. And Fed Chairman Jerome Powell’s recent speech confirms that the central bank plans to stay hawkish for the foreseeable future.

While we believe the Federal Reserve’s action is the right move at this point, it’s bad news for short-term stock market players. I don’t expect the market bull to have any traction until inflation trends downward for several months as a result.

Until then, the stock market will be volatile. And BXP will no doubt gyrate with it.

It’s also important to recognize that office space leasing activities and rates are affected by economic activity. With high inflation putting pressure on companies, some negative impacts could spill over to hurt Boston Properties’ profit and growth trajectory.

It’s already seen flattening in rent growth and leasing activity in the past couple of months.

Finally, these pressures will increase the REIT’s interest expenses. And the capital market may experience shrinkage from here, which may affect the availability of capital for Boston Properties.

With that said…

In Conclusion…

Boston Properties has been growing at a solid pace in the past several years, and I expect it to do so from here.

Its strong portfolio, solid balance sheet, and growth opportunities should serve it well. In which case, shareholders will be rewarded with stock appreciation and dividend growth.

The recent market volatility and recessionary environment may challenge BXP’s profitability and growth trajectory. However, that should be the short-term effect.

While here at iREIT, we’re focused on its promising long-term growth trajectory.

Again, we believe Boston Properties is undervalued by more than 20% at this point. Its current valuation is presenting a great opportunity for investors to grab some shares at a discounted rate.

And its high dividend yield just makes the stock that much more attractive.

Be the first to comment