Anna Gorbacheva/iStock via Getty Images

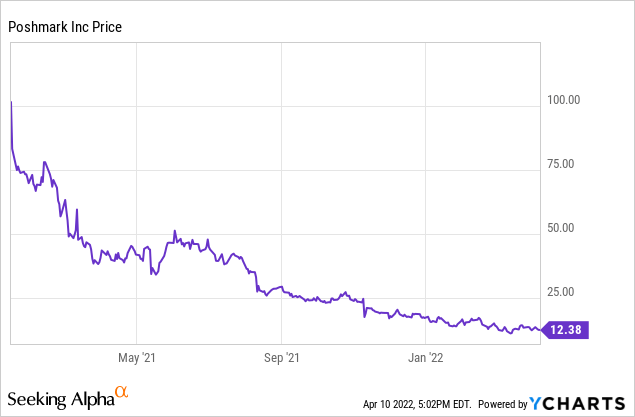

Online reseller Poshmarket (NASDAQ:POSH) continues to report weak results and the future looks even worse. Their ineffective marketing model was hit hard by Apple’s (AAPL) new privacy policy in 2021 and a new 2022 IRS Form 1099-K reporting requirement could have a very negative impact on sellers. While POSH stock price has plunged from a high of $101.50 in 2021, it is still too relative to their expected future results. The stock price has dropped 53% since my sell recommendation last October. POSH remains a sell.

Some Positives

While most of this article will focus on a long list of negative issues impacting Poshmark, the online retailer does have some positives going for it. First, with inflation squeezing many consumers, some may decide the best way to get more cash to spend on necessities is to sell assets. The items in their closets that they rarely or no longer use could be a source for cash. It is easy and does not cost anything to list an item to sell on Poshmark. So sellers can just take pictures of items in their closets they want to get rid of and wait for a buyer.

Second, also because of inflation, people are trying to save money and might be more willing to buy used items online or try to get bargains on new items. Poshmark also has the feature to “Reposh” or resale an item bought via Poshmark’’s website, which is a very convenient way to buy and then sell an item.

Third, Poshmark has a strong balance sheet with no long-term debt. They raised $296.5 million via an IPO in January 2021 and have a large cash position partially due to their business model for payments. A buyer pays Poshmark, not directly to the seller. Items are sent by the seller after the buyer pays Poshmark and the seller receives a mailing label directly from Poshmark. Three days after an item is received, Poshmark credits the seller’s account. The cash remains in the seller’s website account and in Poshmark’s bank account until the seller actually requests payment. Many sellers leave the cash in their account because they expect to use those funds to pay for some future purchase. The result is that Poshmark has a lot of cash ($581.5 million) but also a large funds payable to customers liability ($145.3 million).

New 1099-K Tax Reporting Problem

A serious problem facing Poshmark is the IRS. Starting in 2022, the IRS requires 1099-K (copy of Form 1099-K) reporting for sellers that have $600 or more sales on Poshmark in any calendar year. Prior to 2022 the threshold was a much higher $20,000. The reality is that in the past many sellers operated a nice small part-time operations that were not included in the seller’s income tax filing.

It is not completely clear, but it appears that Poshmark waits to get the various needed information, such as a social security number or other tax id number, until a seller actually reaches $600 in sales for a calendar year.

There are three events that could negatively impact Poshmark. First, when there is more media coverage of this 1099-K issue, will sellers re-think about selling on-line? Second, when sellers are actually asked for the needed information by Poshmark, will sellers decide to use other non-reporting methods of selling, such as garage sales. Third, in early 2023 when they finally get their Form 1099-K and realize the actual income taxes owed, what will be their reaction?

I don’t think any of the reactions will be positive for Poshmark and I am surprised there has not been much coverage of this issue by analysts covering Poshmark. I think it could be a major negative just because of the complexity of sellers trying to file their taxes in the future, especially trying to determine what items sold are subject to federal income tax and which items are not. In addition, some sellers could be subject to backup withholding, including those residents without social security numbers.

This new IRS issue could have a dramatic negative impact, in my opinion, comparable to the June 2018 SCOTUS decision of South Dakota v Wayfair that allowed states to collect sales tax on website transactions. Some sellers are using websites to avoid paying income tax on their profits, but this 1099-K reporting requirement will change the “non-tax” part of their business model, which could reduce the number of sellers.

Apple’s Privacy Policy

Unlike the 1099-K issue, there has been a lot of coverage of Apple’s privacy policy adopted in April 2021. An update allowed users to “allow” or “ask the app not to track your activity across other companies’ apps and websites”. This data is usually used to measure advertising efficiency, which is critical for Poshmark’s advertising/marketing. These metrics are more effective and much cheaper than the old fashion surveys of potential consumers to see the impact of their advertising, which I doubt Poshmark ever had to do. Poshmark was significantly impacted in 2021 by this change and so were many other tech companies.

Marketing Model Continues To Be A Disaster

Poshmark’s marketing model has been extremely ineffective. Of course, part of the marketing problem is that their actual website is mediocre. It is difficult to get buyers/sellers to increase the number of their transactions when there is nothing innovative about their buying/selling features. It is just basic and boring, in my opinion. Instead of pouring millions into marketing, more money should have been spent on the actual website’s operating features.

In my B-School decades ago, one of my marketing classes used case studies of very successful marketing campaigns and also disasters. Poshmark is a case study in a marketing disaster, but because insiders control 82.3% of the voting power via B shares with 10x voting power, it is impossible to get new competent management.

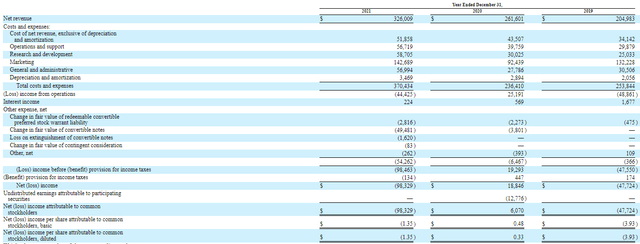

For example, net revenue increased $64.4million in 2021 to $326.0 million from $261.6 million in 2020. Marketing expenses increased $50.3 million to $142.7 million from $92.4 million. Using increased revenue/increased marketing expenses ($64.4 million/$50.3 million) we get 1.28. That implies for every additional $1.00 spent in 2021 on marketing there was only a $1.28 increase in revenue (revenue-not profit). The company spent 43.8% of their 2021 revenue on marketing. This is a complete disaster, in my opinion, because Poshmark is not some new start-up. It has been in operation since 2011.

Poshmark claims to be some social media retailer. You would think that satisfied customers would be their best salespeople and would post on social media, which costs Poshmark nothing. The company is spending a lot of money advertising on various social media platforms, but the ads do not result in action by the targeted consumer. They do not need to spend more on marketing-they need more effective marketing/advertising.

Operating Model’s Achilles’ Heel

I covered their operating model’s Achilles’ Heel in my prior article, but basically they are just spending a lot of money to get new customers, but those customers do not steadily increase their transactions over time. There has been very limited growth in transactions per customer; therefore, in order to have growth they just depend on getting new users.

Using some metrics contained in their January 2021 S-1, those who became buyers on Poshmark’s website in 2016 collectively bought $134 million of merchandise in 2017, $143 million in 2017, and $147 million in 2018. These numbers show very low growth. It is even worse for those who became buyers in 2017 when they collectively bought $179 million, $193 million in 2018, and then only $181 million in 2019-an actual decline from the prior year. The new 2018 buyers bought $255 million, but only increased their purchases to $260 million in 2019.

Selling Stolen Items

With soaring crime rates, especially for shoplifting, I am expecting new attention on how these stolen items are monetized. Many people, including myself, suspect that some of these items are sold online, including on Poshmark’s website. Currently, they do have a policy against selling stolen items, but there really is almost no direct enforcement or policing of selling these items. Their website states: “If you have good reason to suspect that someone is selling stolen merchandise on Poshmark: Please contact your local law enforcement to report the suspected crime. Once a case has been filed, please have the officer contact us by emailing lawenforcement@poshmark.com.”

I do not see any direct reporting by a customer to the company of potential questionable items posted for sale. Their policy requires the customer to contact their local law enforcement departments. Depending where they live, this could be a major problem because of the effort needed to file a complaint and many police departments can do absolutely nothing.

It may take aggressive new federal regulations to get the online sellers, such as Poshmark, to take direct action. If future federal regulations require that online websites take the initial complaint by a customer, this most likely will cause a very large increase in operating expenses. Right now, much of these expenses are borne by the local police departments.

Quick Review of Operating Model

A seller posts an item to sell on Poshmark’s website. A buyer agrees to buy the item and pays Poshmark the price of the item, a fixed $7.67 postage amount for items up to 5 pounds, and any local/state sales tax. After the buyer pays Poshmark, a shipping label is sent to the seller to use. After the buyer receives the item, the selling amount, less selling fees of 20% for items over $15 or $2.95 for items less than $15, is credited to the seller’s account. The seller can leave the money in their account or request payment be sent to them.

Historic Results and Future Guidance

Income Statement

Income Statement (sec.gov)

Poshmark’s annual EBITDA has been a roller coaster. They reported $7.3 million EBITDA for 2021, $36.0 million for 2020, and a negative EBITDA of $36.1 million in 2019. Management’s guidance during their latest conference call was 1Q revenue of $86 million-$88 million, which is a growth rate of 7%-9%, with negative EBITDA of $7 million to $9 million. These are terrible numbers for a “growth” company.

I am waiting for management to give the excuse in conference calls later this year that the new 1099-K reporting caused weaker sales, as some sellers left Poshmark’s website. With management planning to continue to spend over 40% of future revenue on marketing, I am expecting future losses, but because of the long list of future negatives, it is impossible to give specific revenue and EBITDA estimates for 2022 and 2023.

Conclusion

Poshmark perfectly timed their IPO in January 2021, when meme traders mistakenly thought they ruled Wall St. and bought this poor quality online retailer’s stock. While the company is not financially leveraged, it has no real growth model. Their website is just some basic functional website selling used and new items-nothing special at all. Management trying to assert it is somehow a social media company is questionable, in my opinion.

Their massive spending on an ineffective marketing model is hurting their bottom line. With potential negative impact from 1099-K reporting of sellers with annual sales of $600 compared to the $20,000 threshold before 2022 and potential for much stricter scrutiny by law enforcement of items sold via Poshmark’s website, this company could be in for a difficult 2022 and 2023.

I would not recommend selling short POSH because of potential future meme trading. The stock is still too high and most likely has a floor of about $5.65, which is total cash minus funds payable to customers divided by shares outstanding. I still consider POSH a sell.

Be the first to comment