Traitov/iStock via Getty Images

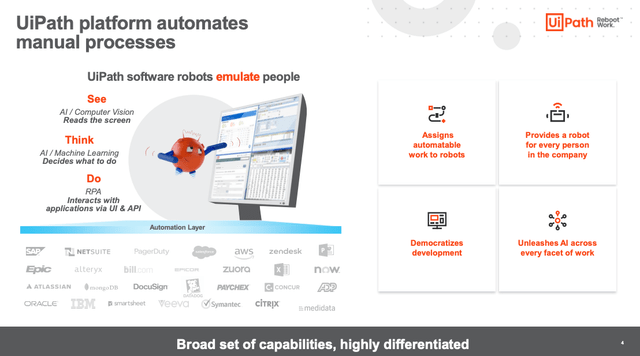

UiPath (NYSE:PATH) is a leader in enterprise automation software. It provides an end-to-end platform that helps organizations efficiently automate business processes.

The platform combines the leading RPA solution (robotic process automation) with a full suite of capabilities that enable every organization to transform its business digitally.

If a manual task is automatable, UiPath wants its software robots to do it for you. Approvals, journal entries, payment processing, data entry, customer support, etc. In short, UiPath enables its customers to:

- Save time and effort.

- Improve workforce productivity.

- Ensure compliance with documentation and reporting.

UiPath Investor Presentation

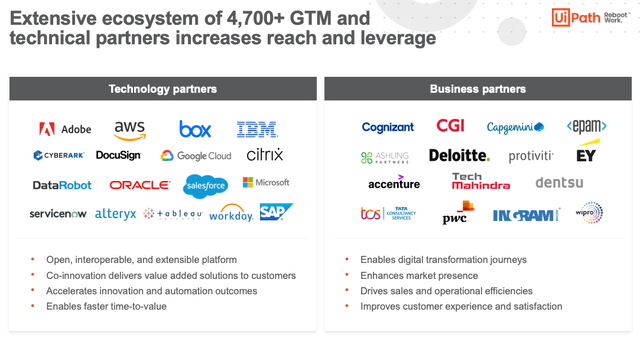

A critical aspect of UiPath’s success is its extensive ecosystem of partners:

- Technology partners: Over time, the platform has gained new use-cases. In a way reminiscent of Twilio (TWLO), UiPath has expanded an impressive library of out-of-the-box native integration with a wide range of apps and tools, such as Adobe (ADBE), Amazon Web Services (AMZN), Salesforce (CRM), DocuSign (DOCU), Oracle (ORCL) and more.

- Business partners: Some of the largest consulting companies in the world have partnered with UiPath (PwC, EY, Deloitte, Accenture (ACN), etc.). These firms provide an efficient sales funnel for UiPath. In turn, their customers enjoy the business efficiencies from the RPA solutions. Everybody wins. These partnerships have likely helped UiPath be recognized as the absolute leader in the RPA space (more on that later).

UiPath Investor Presentation

With more than 40 offices worldwide, UiPath is an international behemoth celebrated as part of the CNBC Disruptor 50, the only RPA provider named to Forbes AI 50, and #3 on the Forbes 2020 Cloud 100 list.

Forbes Cloud 100 List

Additionally, UiPath has been celebrated for its culture and leadership. The company was on the list of Comparably’s Best Company Culture 2021, and founder-CEO Daniel Dines has a 93% approval rating on Glassdoor.

UiPath Reviews on Glassdoor

UiPath is a subscription model, with primarily one-year contracts billed annually. Its pricing depends on the number of robots and users. As the usage of the platform increases, so does the size of the annual bill. As a result, UiPath makes more money from its existing customers over time as they expand their usage.

The company can deliver its product through the cloud, on-premises, or hybrid. While the cloud should make most of its revenue over time, some government agencies might favor the on-prem option for security reasons.

UiPath’s Website

UiPath Automation Cloud launched at the end of 2019. At the end of Q4 FY22, 38% of customers were cloud customers (+4pp Q/Q). In Q4 FY22, 55% of new customers have adopted cloud products. So we already have a cloud transition well on its way and executed at record speed. This transition to the cloud is reminiscent of MongoDB (MDB), with Atlas steadily increasing in percentage of overall revenue. The cloud solution allows for immediate onboarding of new customers and more flexibility to scale.

UiPath’s existing list of customers illustrates that the platform has found success across all industries, from Uber (UBER) to Bank of America (BAC), to GE (GE), to CrowdStrike (CRWD) or Adobe (ADBE). As more high-profile companies embrace UiPath’s solutions, it could become easier to acquire new customers, given its track record and leading position.

Historically, once UiPath is deployed, a customer will significantly expand its platform use. The graph below illustrates this expansion by showing the ARR (annual recurring revenue) from each customer cohort over the years. For example, the cohort of January 2016 customers had increased its spending by 57x by January 2021.

UiPath’s S-1

This level of expansion involves a gigantic runway ahead. It shows the product’s stickiness, customer satisfaction, and the power of UiPath’s platform.

UiPath is a sticky platform, but acquiring and onboarding new customers is no easy feat in the enterprise category. As you’ll see in the financials below, UiPath is spending most of its gross profit on sales and marketing. However, it’s a worthwhile investment based on its CAC payback period. The company can recoup these costs in less than two years. And once customers are onboarded, the return on investment looks exceptional over time.

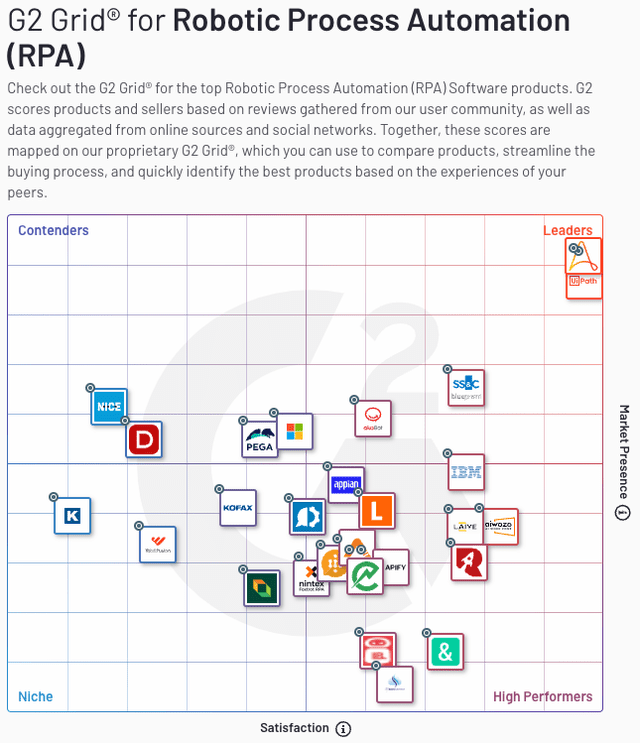

How Big Is UiPath’s Lead On Competitors?

When I invest in a category, my preference generally goes to the top performers. And evidence shows UiPath is the clear leader for RPA across all competitive benchmarks.

Below is the G2 Grid for RPA. You can find UiPath in the top right of the chart. As you can see, the company is well ahead of the pack.

Automation Anywhere, which may go public in the coming months, is the closest competitor. The company has an estimated annual revenue of approximately $400M (compared to $892M for UiPath).

G2 Grid for RPA

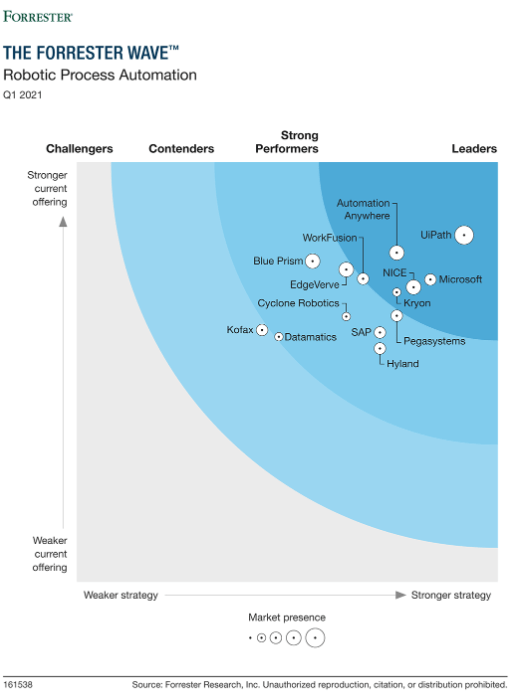

UiPath also appears as a clear leader in the Forrester Wave for RPA (see below). Other leaders in the field highlighted by Forrester are Automation Anywhere, Nice, Kryon, and Microsoft (MSFT).

The Forrester Wave for RPA

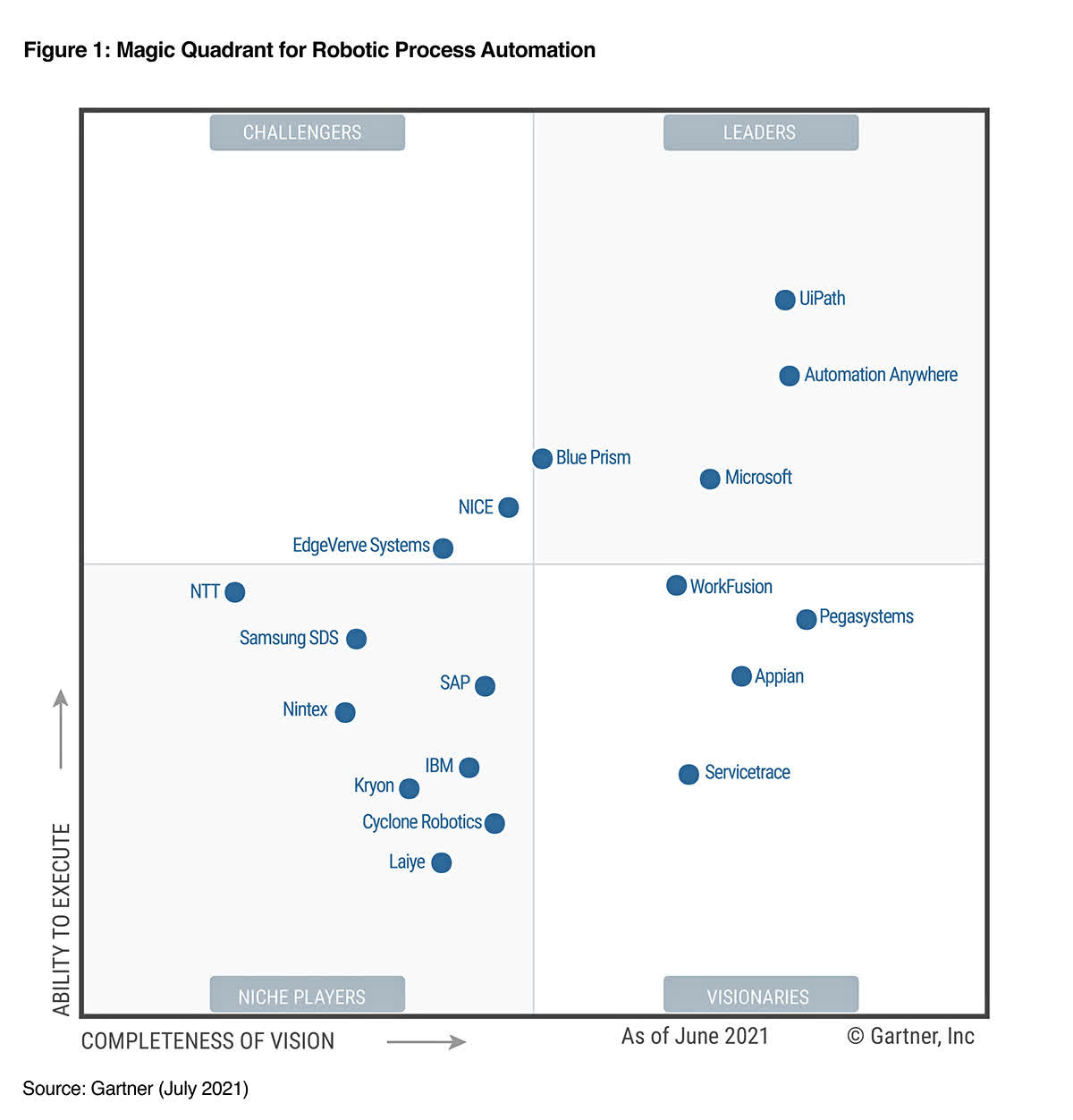

The Gartner Magic Quadrant for Robotic Process Automation Software also shows UiPath as the clear leader in RPA, ahead of Blue Prism, Automation Anywhere, and Microsoft.

Gartner Magic Quadrant for RPA

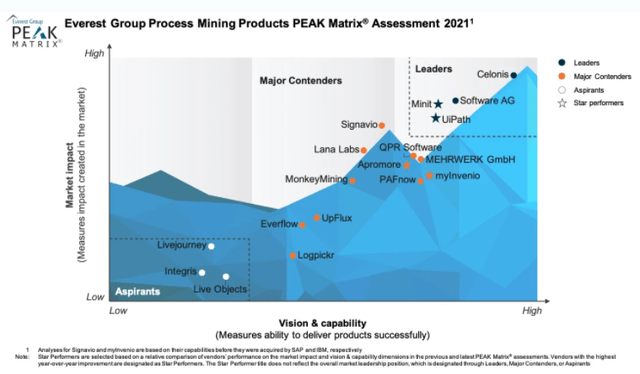

Finally, the PEAK Matrix Assessment for Process Mining Products shows UiPath as a leader and “star performer” alongside Minit (private).

Everest Group Peak Matrix Assessment for Process Mining Products

To fend off competition, UiPath benefits from switching costs, an essential economic moat. As customers embrace automation, the success of their operations becomes increasingly intertwined with UiPath’s platform. Over time, it becomes unlikely a customer would want to waste days, weeks, or months transitioning to another automation system.

What Is The Long-Term Potential for UiPath?

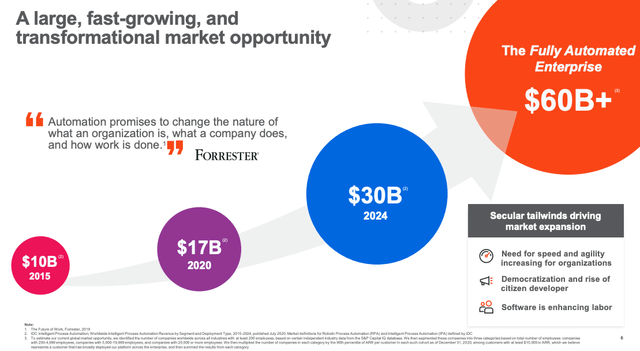

IDC estimated the market for Intelligent Process Automation had a value of $17 billion by the end of 2020 and is expected to grow at a four-year compound annual growth rate of approximately 16% to $30 billion by the end of 2024. This estimate alone shows the large runway ahead for UiPath, given its position as a leader and its current annualized run rate below $1B.

However, UiPath’s management sees even more potential ahead. They believe the fully automated enterprise represents a $60 billion global market opportunity.

UiPath Investor Presentation

This market assessment assumes a broad automation adoption across companies with more than 200 employees. This number is consistent with an estimate by Bain & Company, explaining in a recent report that the expansion of automation platforms has increased the size of the addressable market for automation software to approximately $65 billion.

PATH Stock Key Metrics

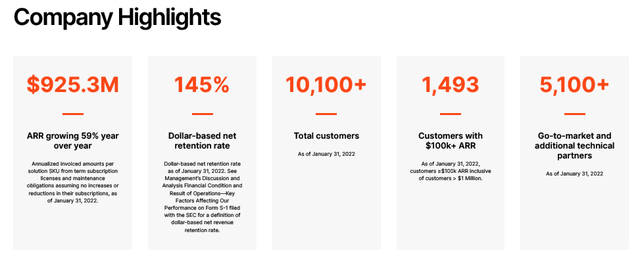

UiPath’s most recent key metrics are stunning:

- 10,100 customers (+5% Q/Q, and +27% Y/Y).

- ARR (Annual Recurring Revenue) of $925M (+59% Y/Y).

- An average ARR of $92K per customer (+8% Q/Q, +26% Y/Y)

- Dollar-based net retention of 145% (unchanged Y/Y).

UiPath’s Website

The dollar-based net retention at 145% indicates that existing customers spend a lot more over time. Therefore, it could lead to sustainable and predictable revenue growth.

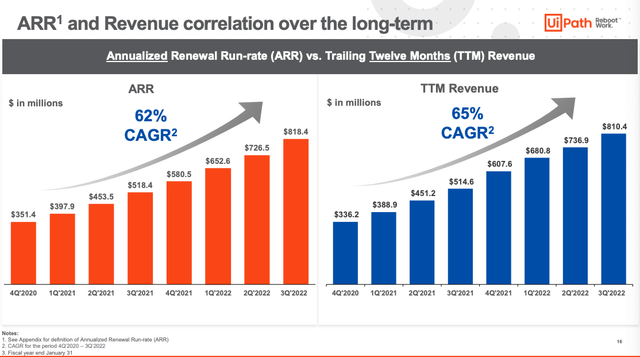

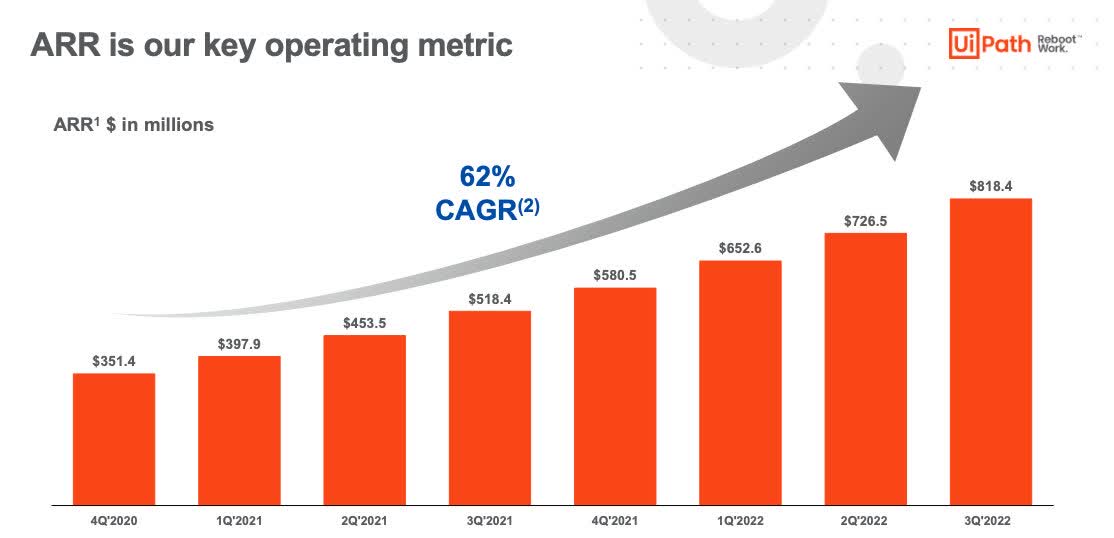

ARR is the best representation of its success because it shows the customer wins on an annualized basis, without revenue recognition rules getting in the way. ARR has grown 2.6x in the past two years.

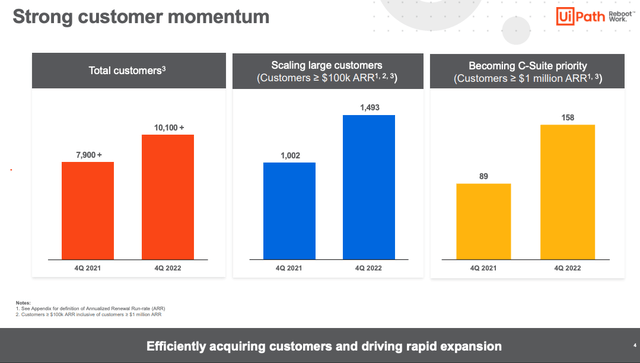

The company showed strong customer wins in the most recent quarter:

- Overall customer count grew +27% Y/Y to 10,100 (accelerating).

- Customers > $100K ARR grew +49% Y/Y to 1,493.

- Customers > $1M ARR grew +78% Y/Y to 158.

These numbers illustrate an increasing and accelerating product adoption. Moreover, given the net retention, there is a large untapped growth potential from the existing customer base alone.

UiPath Q4 FY22 Presentation

Revenue growth is not the best way to evaluate the company’s growth profile. Revenue can lag ARR additions due to revenue recognition rules under US GAAP, depending on how fast some customers are deployed. Ultimately, revenue should follow ARR closely. Hence, ARR is the best indicator of future revenue growth.

UiPath Q3 FY22 Presentation

Q4 FY22 Top-line trends:

- ARR grew +59% to $925M (vs. +58% Y/Y in Q3), vs. guidance +56% Y/Y.

- Net new ARR grew +72% Y/Y to $107M (vs. +42% Y/Y in Q3).

- Revenue grew +39% Y/Y to $290M vs. guidance of +36% Y/Y.

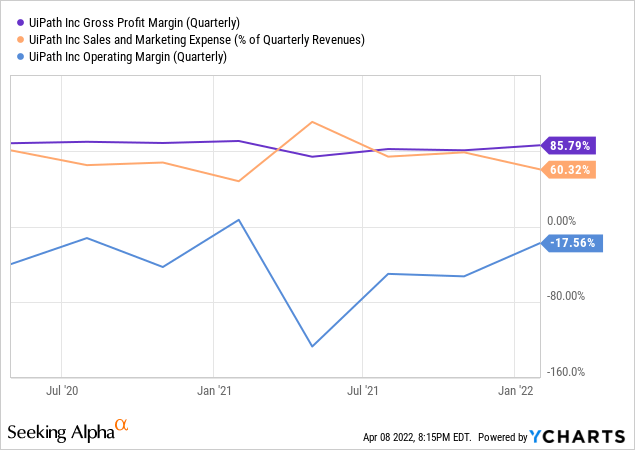

Q4 FY22 Margin trends:

- GAAP gross margin was 86% (-4pp Y/Y).

- Non-GAAP gross margin was 88% (-3pp Y/Y).

- GAAP operating loss margin was -18% (+35pp sequentially).

- Non-GAAP operating margin of 14% (-3pp Y/Y).

- Net cash used in operations was $(6)M (vs. $18M generated in Q4 FY21).

- Non-GAAP adjusted free cash flow was $10M (vs. ($8)M used in Q3 FY22).

SBC (stock-based compensation) is the main difference between GAAP and Non-GAAP. It spiked during the quarter of the IPO ($251M in Q1 FY22), but it has leveled off since then ($77M in Q4 FY22), hence the significant margin improvement.

- Gross margin is very high, at 86%. It fluctuates depending on the size of maintenance costs in a given quarter.

- Sales & marketing costs are very high, at 60% of revenue (high cost to onboard new customers), but going down.

- Operating margin is significantly improving but still in the red, at -18%.

UiPath is spending the vast majority of its gross profit on sales and marketing. These costs can be recouped in less than two years. Over time, they should represent a smaller portion of the income statement as existing customers spend more on the platform.

The cash flow margins are close to breakeven, illustrating that the company has been capital-efficient even through its recent exceptional growth phase.

The balance sheet is clean with $1.9B in cash and marketable securities and less than $0.1B in long-term debt.

We can summarize the recent results as follows:

- Accelerating ARR growth at +59% Y/Y – showing strength.

- Very high gross margin at 86% – showing long-term potential.

- Huge sales & marketing costs, at 60% – showing the elevated cost to onboard new customers.

- Improving operating margin – showing operating leverage.

- Significant net cash position on the balance sheet and cash flow from operations close to breakeven – showing sustainability.

Overall, UiPath’s quarter was nothing short of spectacular. ARR and customer growth accelerated while the company remained capital efficient with mostly breakeven cash flow margins. There was a slight margin compression due to the revenue mix favoring professional services costs.

Based on all of the above, the long-term thesis is on track. Yet, the stock sold off by more than 30% in the aftermath of this report. Why? The guidance for FY23 caused this strong market reaction. Let’s review.

Why Is UiPath Stock Going Down?

UiPath was founded in Romania and generated almost a third of its business in Europe in Q4 FY22. Unfortunately, the Russian invasion of Ukraine has created more uncertainty for the company in the short term.

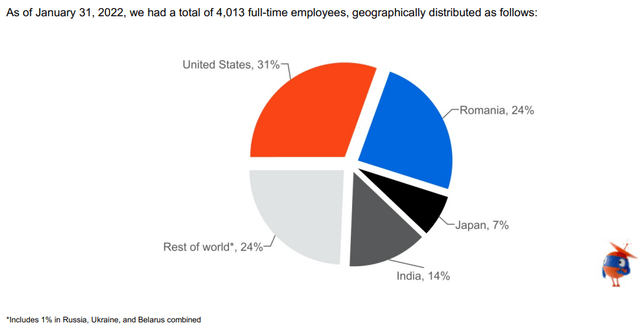

From an operational standpoint, UiPath has 24% of its workforce in Romania (a country that shares a border with Ukraine) and 1% in Russia, Ukraine and Belarus combined.

UiPath 10-K

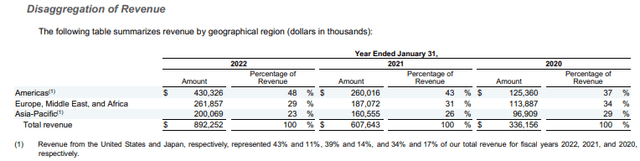

EMEA (Europe, Middle East, and Africa) represented 29% of revenue in FY22 (-2pp Y/Y and -5pp Y/2Y). So while UiPath exposure has diminished over time, it remains very high.

UiPath 10-K

FY23 Guidance:

Q1 FY23

- ARR of ~$965M (+48% Y/Y).

- Non-GAAP operating loss ~$27M or ~12%.

Full Year FY23

- ARR of ~$1,210M (+31% Y/Y).

- Non-GAAP operating income ~$5M or ~0%.

The ARR guidance implies a steep decline in the company’s growth profile, from the high 50s to the low 30s in the year ahead. Such a steep decline has caused investors to re-rate the company’s valuation multiple, essentially pinning UiPath’s growth profile in the low 30s moving forward. Margins are expected to worsen in the short term.

Management is cautious, and the guidance reflects the current macro environment instead of any trouble for UiPath’s core business.

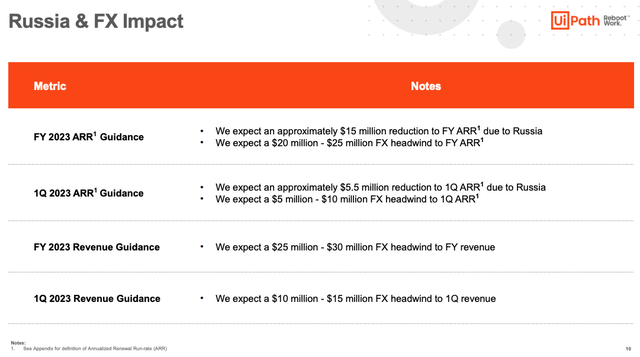

During the earnings call, management broke down how it factored short-term headwinds in the guidance:

- Russian invasion impact: $15M for FY23 and $5.5M for Q1 alone.

- FX impact: up to $25M for FY23 and up to $10M for Q1 alone.

UiPath Earnings Presentation

These headwinds are temporary by nature and pollute what would otherwise be an impressive business momentum. Excluding these impacts, the ARR guidance would have been:

- Q1 FY23 ARR of ~$980M (+50% Y/Y).

- FY23: ARR of ~$1,250M (+35% Y/Y).

For context, in June 2021, management provided an ARR guidance of $855M for FY22. They ended up beating their guidance by $70M. So it wouldn’t be surprising to see more sandbagging in the current context. And I certainly don’t blame management for being conservative, given the uncertainty of the macro environment.

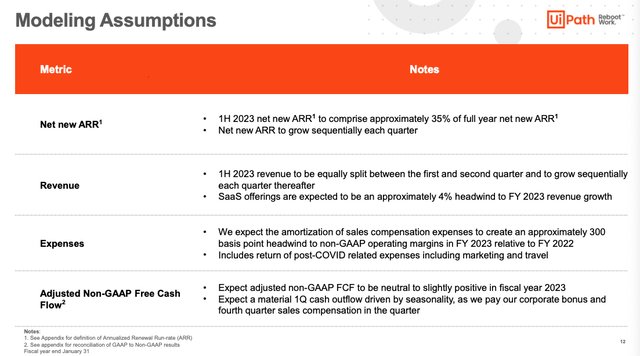

Management shared their modeling assumptions, and it gets interesting:

- 1H 2023 net new ARR is expected to be 35% of the Full Year, and net new ARR is expected to grow each quarter sequentially. It implies a significant slowdown in Q1 and a gradual re-acceleration in Q2, Q3, and Q4.

- The Russian invasion of Ukraine started on February 24. UiPath’s fiscal Q1 is February through April. So management expects the most significant impact to be in the aftermath of the invasion (March and April) and to gradually recover from there.

- Chris Weber (former Corporate VP at Microsoft who led Digital Sales across the commercial business) is joining UiPath as Chief Business Officer. Meanwhile, Chief Revenue Officer Thomas Hansen will leave the company to pursue other opportunities (he was also a former Microsoft executive). This transition adds uncertainty.

UiPath Q4 FY22 Earnings Presentation

Here are a few critical quotes on the call to contextualize the guidance:

Founder-CEO Daniel Dines:

I can tell you firsthand, this war is having a profound impact on the sense of physical and economic security across the continent and in the UK.

We are also starting to hear customers in the US express reservations about both political uncertainty and rising interest rates. As we start the fiscal year, we believe it is prudent to guide assuming the uncertainty we are seeing in the first quarter will continue. It also takes into account our decision to transition our go-to-market leader, which can create short-term disruption. Our financial model is powerful, and we believe there is considerable opportunity to continue to drive durable growth and improve profitability as we scale the business.

This commentary indicated that the current uncertainty could impact the business beyond the EMEA zone. It’s also a warning sign for many other SaaS companies relying on Enterprise spending to thrive.

CFO Ashim Gupta:

Let me now turn to first quarter and full year fiscal 2023 guidance, which we believe encapsulates a realistic view of what we are seeing in our business today. Our roots are in Romania and the European market, which was a major focus from the beginning and is an important part of our growth profile. Approximately 30% of our business is in Europe, and we serve customers across the eastern part of the region and in Russia.

We also price in local currency, which has created FX headwinds, given the recent strengthening of the US dollar. Both have a direct impact on our growth profile and guidance. […] We have also made prudent assumptions around the profile of large deals in our pipeline, given the current environment and factored in the risks that exist with any sales leadership transition.

Overall, the soft guidance came as a shock given the consistent and growing ARR addition in the past few quarters:

- Q1 FY21: +$47M

- Q2 FY21: +$55M

- Q3 FY21: +$65M

- Q4 FY21: +$62M

- Q1 FY22: +$73M

- Q2 FY22: +$73M

- Q3 FY22: +$92M

- Q4 FY22: +$107M (beating guidance of $84M)

- Q1 FY23: +$40M (guidance)

Now let’s look at ARR addition on a fiscal year basis:

- FY21: +$229M (or +65% Y/Y)

- FY22: +$345M (or +59% Y/Y)

- FY23: +$285M (or +31% Y/Y) (guidance)

While the FY23 guidance is a disappointment (particularly Q1), the headwinds causing the slowdown appear temporary. As a result, investors with a time horizon beyond the next two years may be looking at an opportunity to buy shares at what will look like an attractive valuation in retrospect.

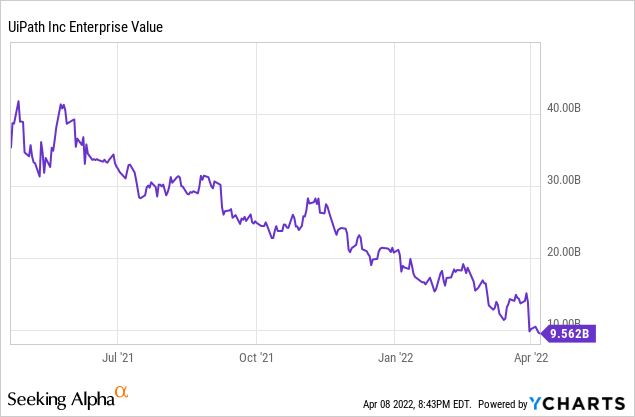

Is PATH Fairly Valued?

Here are the most recent funding rounds of the company:

UiPath Q3 FY22 Earnings Presentation

- Series E, July 2020. UiPath raised $225M at a $10B valuation (25x ARR at the time). The round was led by Alkeon Capital and included Accel, Coatue, Dragoneer, IVP, Madrona Venture Group, Sequoia Capital, Tencent, Tiger Global, and more.

- Series F, February 2021. UiPath raised $750M at a $35B valuation. (60x ARR). The round was co-led by Alkeon Capital and Coatue and returning investors, including Altimeter, Dragoneer, IVP, Sequoia, and Tiger Global.

- IPO, April 2021. UiPath raised $1.3B at a $31B valuation (47x ARR), slightly below its Series F. Soon after, the company started trading above $40B.

- Today, the company is trading below a $10B valuation (10x ARR). So it makes the current opportunity appear timely.

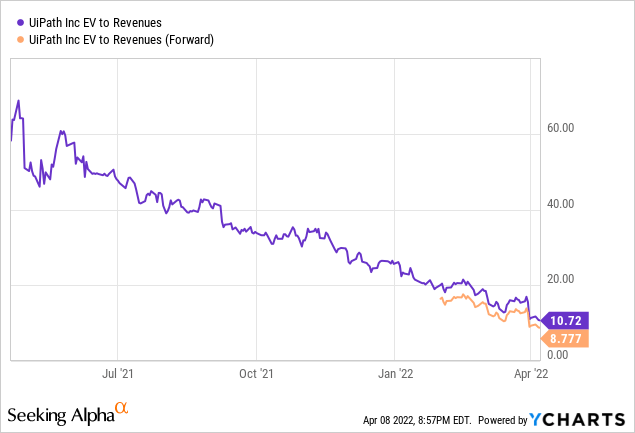

To add more context, PATH is trading at:

- ~10 times FY22 revenue (past 12 months).

- ~9 times FY23 revenue estimates.

- ~7 times FY24 revenue estimates.

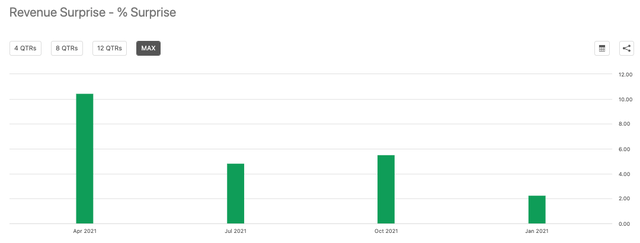

As you can see, UiPath could “growth into” its valuation very fast. Additionally, UiPath is still expected to grow revenue north of +40% Y/Y in FY25. With such a run rate, the multiple could expand on top of improving fundamentals. Let’s not forget that UiPath has beaten revenue consensus by 5% on average in the four quarters since the IPO. So the current estimates could prove to be conservative.

UiPath Revenue Surprise (Seeking Alpha)

At 10 times ARR, if the expected 2023 headwinds are genuinely temporary, I find the current valuation too attractive to pass on. Moreover, it’s a timely opportunity given that the company could sustain an ARR growth north of 30% for several years and has the balance sheet to fund the growth path ahead with its $1.9B cash pile.

Most cloud businesses are already beaten down, as illustrated by the WisdomTree Cloud Computing ETF (WCLD), down more than 40% from its previous high. However, even in the current environment, cloud businesses growing in the +40% Y/Y range tend to be valued between 15 and 25 times sales. For example, Unity (U) is a close comp due to its dollar-based retention at 140%, and ~35% revenue growth expected in FY22. Yet, it trades at 24 times trailing revenue.

For now, the market seems to be solely focused on UiPath’s growth profile in the next 12-18 months. It’s possible that the market is assuming the slowdown could go from bad to worse, as we’ve seen for COVID darlings like Zoom Video (ZM) or DocuSign (DOCU). I believe it creates a favorable entry point if you have a multi-year time horizon.

Is PATH Stock A Buy, Sell, or Hold?

I’m a buyer of PATH after the steep sell-off post-earnings. However, my position is still relatively small, less than 2% of my cost basis in the App Economy Portfolio.

The FY23 guidance reduction may be the beginning of more challenges ahead for the company, and it remains to be seen if the executive transition will go smoothly. So while I’ve been adding to my position to take advantage of the current price, I will ultimately need more evidence of the growth re-acceleration in the second half of FY23 to continue to build my position.

What about you?

- Did you buy PATH following the recent sell-off?

- Do you believe UiPath could deliver strong returns from its current price in the next five years and beyond?

Let me know in the comments!

Be the first to comment