Oleksandr Pirko/iStock via Getty Images

Else Nutrition Holdings (OTCQX:BABYF) [TSX: BABY] is a plant-based, non-dairy, non-soy food and nutrition company that began commercial sales of its products in the U.S. in the second half of 2020. Management’s goal is to provide a full line of food and nutritional products for newborns, infants, toddlers, and adults lactose or soy intolerant or hypersensitive or interested in a healthy plant-based diet.

Previous articles

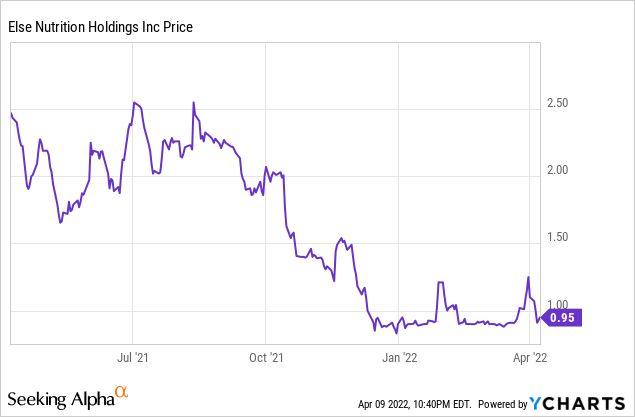

The stock has not performed very well since my introductory article published in Dec. 2020, titled Else Nutrition Is As Good As Mother’s Milk As You Can Get and a July 2021 article discussing the initial commercial rollout, titled Else Nutrition’s Fast Growth Formula. Unfortunately, Else is a few months behind in its forecasted commercial rollout due to Covid related disruptions that it is overcoming and small-cap growth stocks have generally been out of favor due to rising interest rates.

The company recently reported a year over year 219% increase in revenues and plans to expand sales in Canada, Europe, Australia, and China and more good stuff, which I discuss in this article. The positive news has not affected the stock price, hovering near 52-week lows.

I recently spoke with CEO Hamutal Yitzhak and asked her to comment on her company’s stock price. She replied, “The stock price does not matter as it is early in what we are trying to accomplish.” Her statement reminded me that every startup hits bumps in the road and that managing these obstacles is crucial for evaluating a company’s chances for success.

A few days after speaking with CEO Yitzhak, I visited the company’s main sales office near Columbus, Ohio. I talked to G.M. and VP Mike Glick to better understand the company strategy. Mr. Glick, a former executive at Abbott Laboratories (ABT) with similar roles in healthcare-related startups, was hired by Else nine months ago to lead its U.S. sales efforts.

Investment thesis

My investment outlook remains bullish despite the slumping stock price because Ms. Yitzhak and her team have Else functioning at full speed ahead, which should escalate revenue growth this year and into the foreseeable future.

Else is currently building on its initial sales platform that it established during its first year of commercial activity by:

- Introducing new products, including a likely game-changer, later this month.

- Expanding U.S. sales and production.

- Expanding product sales internationally.

- Developing a healthcare education program.

- Gaining eligibility in government assistance programs

- Establishing product value for specific targeted markets through clinical trials.

- Conducting clinical trials expected to lead to regulatory approval for another game-changing product; infant formula.

New products

Else remains the only company that offers organic, non-dairy, non-soy, clean label, plant-based nutrition and continues to add to its product offerings. On April 18th, the company will introduce “Super Cereal,” the first commercially available cereal with Clean Label certification, meaning that the product does not contain heavy metals or other contaminants.

Else has been adding new products to compliment the first commercial products, aimed at the toddler market (ages 1-3 years old), such as the recently introduced kid’s shakes (ages 3+) available in four flavors. At the request of pediatricians, the company will soon be introducing a new toddler product that includes Omega 3 and Omega 6, which are considered essential ingredients in recommended proportions for children’s brain development. Else will also be offering, for budget-conscious families, a less expensive product, eliminating the organic certification but maintaining all of the other nutritional qualities and product certifications.

U.S. sales and production expansion

The company’s initial commercial efforts in the U.S. were aimed at establishing sales through all of the significant online food retailers such as Amazon, Kroger, and Walmart. Else has been adding brick-and-mortar sales with distribution agreements with UNFI and KeHE, which cover most of the smaller retail stores, and partnerships with smaller national chains such as Sprout’s Farmers Market and regional supermarket chains as Big Y in the Northeast.

Else has been relying on brokers to develop its sales channel. Mr. Glick believes that the timing is right to expand into distribution at the larger big-box brick and mortar chains across the U.S. He explained that Else’s sales at locations such as Sprout’s have validated its products as marketable and satisfying a market need. Large retail enterprises offer a short annual window period in which companies are offered an opportunity to compete for available shelf space. Mr. Glick is hiring a Sales Director who will be dedicated to implementing a strategy for capturing opportunities to partner with the large brick and mortar retailers.

Else has been utilizing third parties for production and packaging. The company is altering its business model to improve profit margins. Last year Else began production of buckwheat at its facility in Oregon. Management plans to purchase equipment and own a production facility and contract a partner to manage the everyday manufacturing operations.

Establishing product eligibility in government programs

Else’s products are eligible for purchase by the 11% of Americans enrolled in the Supplemental Nutrition Assistance Program (“SNAP”), formerly known as the Food Stamp Program. The products are also Health Savings Account (“HSA”) eligible.

Else is attempting to establish product eligibility in the Women With Infant Children program (“WIC”) sometime this year. About two-thirds of American infants are eligible for WIC assistance. Establishing eligibility is a lengthy process as each state determines eligibility separately and on a product-to-product basis, but it will be a big win should Else succeed.

International expansion

Else needs to meet regulatory requirements and appetites for each country it pursues sales in. Else hired Simeon Saunders as V.P. of Global Medical Marketing and Scientific Affairs nine months ago. Mr. Saunders has vast experience in international sales overseeing operations in Europe, the Middle East, and Africa as a V.P. at Abbot Labs and a self-employed consultant.

Production for international sales will initially come from the U.S. facility until sales grow sufficiently to justify building local production facilities. Initial product sales for Canada, Europe, and Australia are beginning through online sources such as Amazon, similar to the U.S. product rollout model.

Else supported its entry into Canada by presenting at a Canadian scientific convention last month pre-clinical data validating Else’s success in promoting healthy growth in children. Else is s presenting the same material at a European scientific convention in June.

Sales in China, the world’s most significant market opportunity for Else, will initially be through a soon-to-be-announced marketing partner. The partner is a large publicly traded conglomerate.

Developing a healthcare education program

I like to think that I had something to do with Else’s decision to develop an education outreach program for pediatricians and health care providers. The idea came to me when I mentioned Else’s products to my daughter-in-law and my son as nutrition for my toddler granddaughter. They had just learned about the presence of heavy metals and other contaminants in baby food.

I asked a pediatrician friend to look at Else and give me her opinion. Her review was that Else looked great but that she couldn’t recommend it because there were no clinical trials to support the claims made and because nobody from Else had provided her office with information. She also informed me that generally, a pediatrician’s education consists of about six hours of nutritional education but that, nevertheless, parents consistently ask for their advice. My daughter-in-law and son received the same no answer from their pediatrician.

It is probable that my experience was similar to what many other parents and grandparents were experiencing when evaluating Else and that despite my ego, I had nothing to do with Else’s decision to develop a website as a reference tool on nutrition for health care professionals. Else then went on to mail out information packets to pediatrician practices in the U.S. My pediatrician friend confirmed receiving the packet and is now confident in recommending Else as a result of this information, as well as information from clinical trials discussed later in this article.

Else now has a full outreach and education program for health care providers. Mr. Glick informed me that Else has a team of medical sales reps in California and a phone team in Chicago dedicated to communicating and providing information to pediatricians and healthcare providers. I also learned that Else will be mailing Super Cereal samples for display and distribution in pediatrician offices.

Else maintains a warehouse near Columbus, Ohio, that the company uses to ship out product samples to requesting medical providers. The sales office that I visited will be combined with the warehouse operation in a new location as both of the current spaces are not meeting the space required by Else’s growth.

Clinical trials

Else first validated its products through an independent study last year. The company recently completed a pre-clinical trial involving animals as the first step in pursuing FDA and European regulatory approval of its infant formula, which the company claims to offer the nutritional equivalence of mother’s milk. The trial results demonstrated that growth was equal for the Else group as to the mother’s milk group and is ready to begin human clinical trials, which are expected to be completed by the end of the year and receive regulatory decisions sometime in 2023.

Else is conducting other trials to demonstrate how its product is effective in not only solving dairy and soy intolerance but also dairy hypoallergenic problems.

Ingredients

All plant-based food is not necessarily a better health alternative. Let’s consider plant-based beef, for example. You won’t find any plant-based beef product accompanied by any claim other than it is a plant-based alternative to real beef. You will, on the other hand, find that many information and opinion sources consider plant-based beef as just hype.

Else has a hurdle to overcome in educating consumers that Else is not equivalent to the likes of Beyond Meat. The health value of Beyond Meat has been questioned by nutritionists. Beyond Meat contains 18 ingredients, including something called methylcellulose. Else food is mostly three simple ingredients; almonds, tapioca, and buckwheat.

The three ingredients are gluten-free and are packed with energy boosters. Almonds are also sodium and cholesterol-free and provide essential healthy fats, fiber, and vitamin E. Tapioca is a nutrient source for vitamin C and iron.

Certifications

All of Else’s products except one new product to be introduced are certified organic. To market a product in the U.S. as organic, the product must meet strict USDA requirements. Falsely labeling a product as organic is illegal and punishable by heavy fines.

An independent review has certified all of Else’s products as Clean Label. The Clean Label Project is a non-profit group that monitors the food industry and created a stir in 2017. It reported that 80% of infant formula and food in the U.S. contained arsenic, with over a third also containing lead. The news drove N.Y. Attorney General Leticia James to demand FDA standards for regulating heavy metals in all baby foods. The FDA has been conducting a multi-year study on the effects of heavy metals in baby foods and is expected to initiate new requirements.

Else’s products have been certified and registered as non-GMO and gluten-free, plant-based nutrition by the NSF International division of the Plant-Based Food Association and as Soy-free by Beyond Soy. While soy is an excellent source of protein, most soy is GMO and has been a factor in causing asthma, acne and eczema, and other medical issues.

Share and financial information

Insiders own about 30% of the 104 million shares outstanding. The market cap is $99 million. The company last reported about $20 million in cash and no debt resulting in an E.V. of $79 million. Revenues for fiscal 2021 were $3.7 million. The company has not provided forward revenue guidance other than an expectation that revenues will exceed $10 million for fiscal 2022.

Going with the minimum revenue expectation results in an EV/S ratio of 8x, which is expensive but typical for a fast-growing early commercial-stage company. Else’s revenue growth rate appears ready to accelerate for all of the reasons discussed above. Regulatory approval for the infant formula could boost revenue to $50 million in 2023, resulting in a modes EV/S ratio of about 1.5 X. It breaks down to the stock selling at a cheap multiple when considering that potential regulatory approvals are about a year away.

Please note that although this is an Israeli company based in Canada all figures are in U.S. dollars.

Risks and concerns

Early market acceptance has been favorable, however, there isn’t any guarantee that the market enthusiasm will continue as the product becomes available in mass. There is no guarantee that Else will be successful in its international expansion or that it will gain regulatory approval for its infant formula.

Many plant-based products in the marketplace appear to be healthy alternatives and are available at a lower price. An Amazon search for an organic, non-dairy, non-soy, Clear Label plant-based toddler food turns up many other nutritionally inferior products that do not fulfill all of the qualities entered into the search line. Consumers aren’t provided with sufficient information to determine that all plant-based food isn’t necessarily a healthy alternative. This is an obstacle that Else will have to overcome.

Management is focused on growth and isn’t opposed to funding growth by raising capital by issuing shares that would cause dilution to earnings.

Conclusion

Else was slowed down in completing its commercial rollout, but it is not behind due to any errors of its own making and is accomplishing its goals despite the setback. There are several potential share price catalysts expected in the next few weeks to the next 12 months ranging from the introduction of Super Cereal, a distribution partnership in China, product eligibility for WIC, and exploding revenue growth from new sales channels, new products, and international expansion. The expected regulatory approval for the infant formula sometime next year would establish Else as a major global food and nutrition company.

Be the first to comment