blewisphotography/iStock via Getty Images

“Hopium” is back again

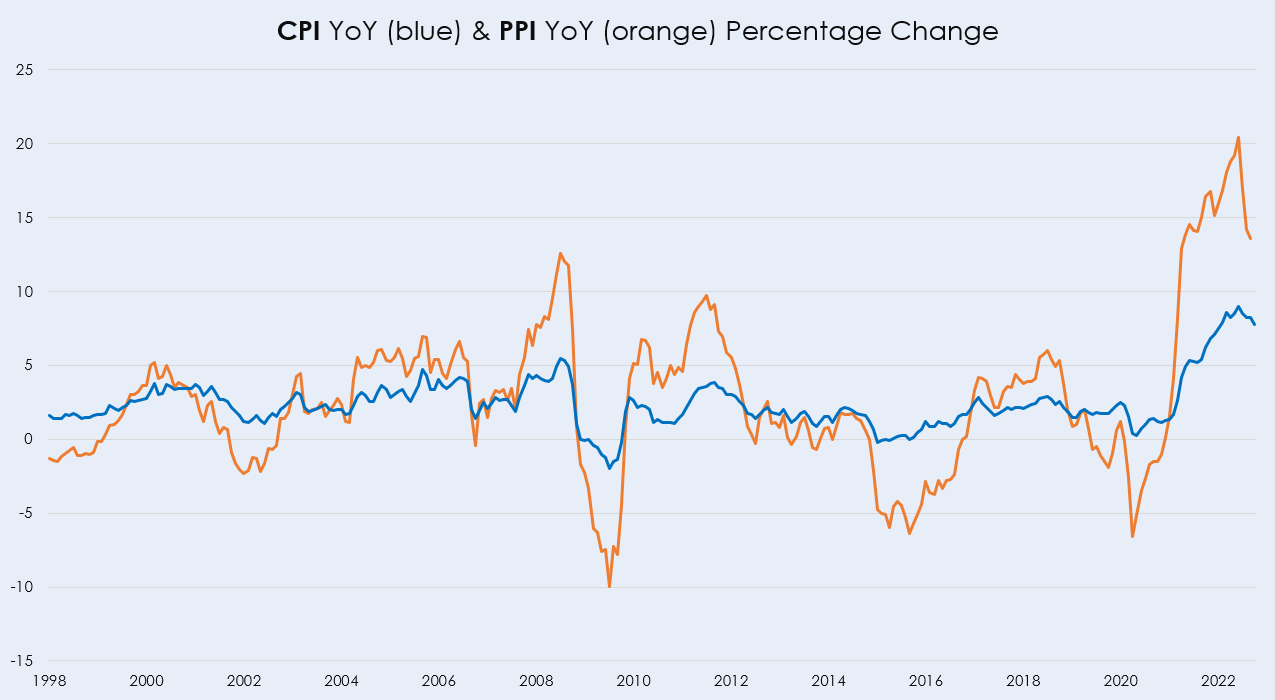

It doesn’t take much for investors to be optimistic about the markets again. Last week the S&P 500 (SPX) rallied ~6%, and the Nasdaq ~8% after the inflation print came in lower than expected at 7.7% YoY or 0.4% MoM. The PPI data should come in lower too, reflecting the symptoms of a slowing economy and weakening consumer spending.

CPI & PPI YoY Percentage Change (Author Excel with Data from fred.stlouisfed.org)

So far, so unsurprising – not for the market, though. The S&P 500 and the Nasdaq made the bulk of their gains last week right after the CPI report was published. Markets played the pivot book: The Dollar (DXY) withdrew sharply as Yields collapsed, and assets appreciated. The market priced in a higher probability of relative monetary easing of the Federal Reserve due to lower-than-expected inflation. Naturally, the most interest-rate sensitive assets appreciated the most, hence the outperformance of the Nasdaq. Bitcoin (BTC-USD) rose over 10% on that day. Although that gain has to be taken with a caveat because the CPI print followed the day that FTX went bankrupt and Crypto assets collapsed. Therefore, a rebound seemed natural.

On Thursday, the Nasdaq (NDX) had its best trading day since April 2020. I don’t believe a new bull market has started, however. Huge upswings and short squeezes are characteristic of bear market rallies. The underlying macroeconomic circumstances have not changed enough to put an end to this bear market. I believe this rally is one of the bigger ones, like the bear market rally starting in June 2022. I believe the market can feed off of big short exposure and the narrative that inflation has finally peaked.

I also believe inflation has peaked, as I cannot imagine that the economy will be able to healthily operate with the immense burden of the sharply risen cost of capital. The previously raised interest rates start to feed into the economy gradually. As Jerome Powell always reminds us: “Monetary Policy works with long and variable lags.” That counts for monetary easing and monetary tightening. Additionally, the basis effect should help keep the YoY inflation rate comparatively low.

The financial stress that the economy will have to endure during the first half of 2023 seems too high to be bullish at the current valuation level. While analysts have lowered their expectations for 2023 earnings, they are still around ~$220 for the S&P 500 (0% growth), which currently reflects a P/E FWD of 18x. Given the macroeconomic and geopolitical circumstances I believe that is still way too high.

In the event of a recession, which is my base case, earnings should fall and not only stay flat for 2023. Assuming the earnings multiple for the S&P 500 goes back to its mean of 16x and earnings depreciate by 10% in 2023 (basically guaranteed if a real recession hits), the fair value of the S&P should be around 3,200 points. Of course, the P/E FWD ratio estimate is only for constructing a framework about where the fair value should be. There are many more factors at play.

After all, the alternative to equities is an investment in basically risk-free US government bonds, which now have moved into the positive real-rate territory across the yield curve. During the last 20 years, expansive monetary policy has moved even the most risk-averse investors into the equity space. Now that risk-free rates have risen, these risk-averse players are attracted by the risk-free yield, especially when compared to equity premiums. This is why I believe that the current drawdown in equities only accounts for the yield rise and not for earnings depreciation. I make the speculation of largely not being invested while waiting until the other shoe drops, most likely in H1/2023.

Searching for historical bottoms

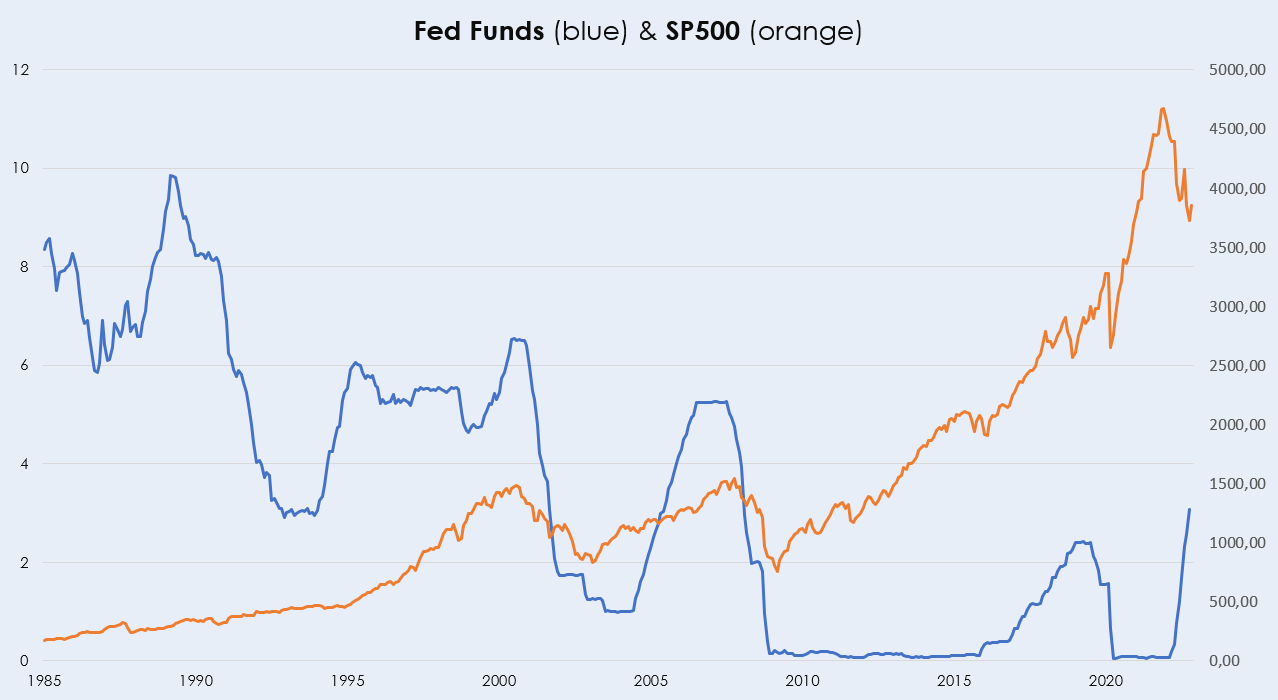

Usually, the market is forward-looking and doesn’t reflect the economy. However, historically trying to front-run the pivot didn’t work:

Fed Funds & SP500 (Excel from Author using data from fred.stlouisfed.org)

That’s because of the circumstances of the previous pivot points.

When the Federal Reserve raised rates during the 2000’s it was because the economy was overheating, and the labor market was tight. While rates were rising, the stock market appreciated because of strong fundamentals (rising GDP). After some time, the monetary tightening worked itself into the economy, and the market fundamentals started to worsen. After a period of plateauing rates, the stock market tumbled, and the Federal Reserve was quick to cut rates. While the Federal Reserve was cutting rates the stock market fell even further. Historically, the bottom of the stock market was in only after the Federal Reserve had already cut rates significantly and the liquidity cycle started to move upwards again.

In 2022, however, we have a different situation. The Federal Reserve tightened monetary policy, and the stock market depreciated because of it. That fundamental difference exists because of inflation.

During the last 40 years, the overarching trend of inflation was down. Especially in the last 20 years, global Central Banks struggled to create inflation with loose monetary policy. If the economy and the financial markets start to struggle while there is no concern about material inflation or even fear of deflation, then the playbook of Central Banks becomes very easy: stimulate the economy to raise inflation and decrease unemployment.

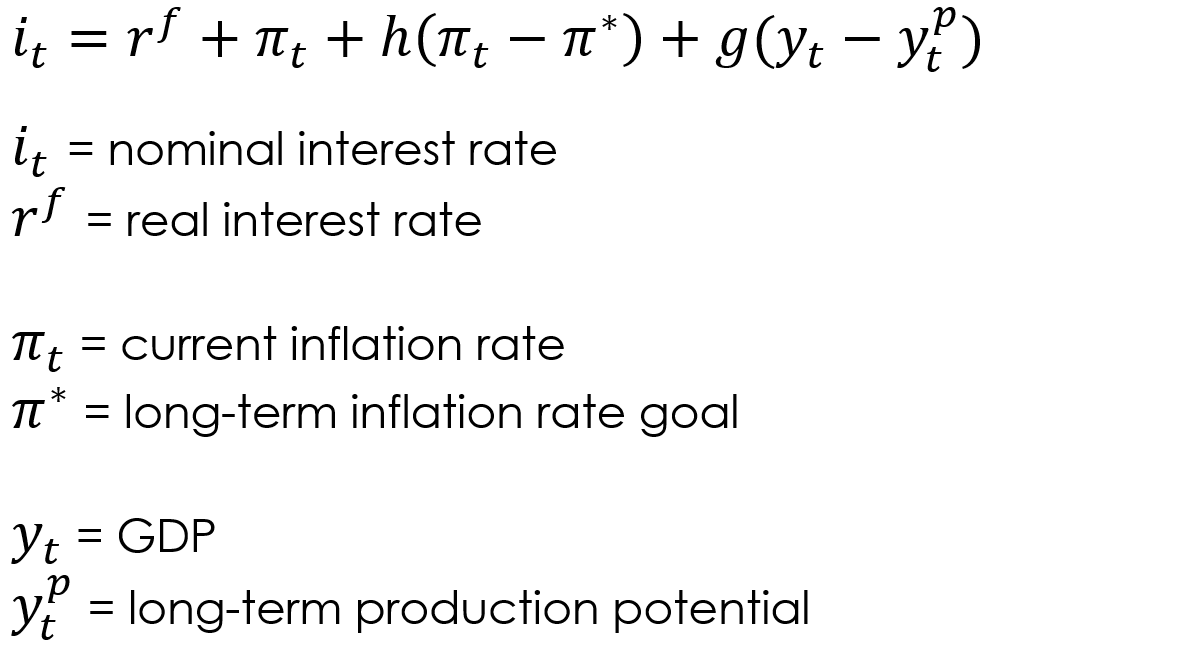

Taylor-Rule (Author)

According to the Taylor Rule, the Federal Reserve had to lower interest rates (1-h) so often in the past because inflation was below the long-term inflation rate goal, and (1-g) GDP was also below the long-term production potential. Both parts of the formula demanded monetary easing.

During 2020-2022 the macroeconomic circumstances changed 180 degrees. Because of several shortages, and most importantly massive fiscal stimulus, which was fully financed by expansive monetary policy, demand exploded while goods were scarce. After inflation came in hot quarter after quarter, the Federal Reserve had to raise rates into a falling stock market for the first time in 20+ years.

Because of the traditionally backward-looking indicators of Central Banks (i.e. unemployment), the economy appeared red hot while inflation was clearly above the 2% target. These two macroeconomic circumstances basically guaranteed monetary tightening. A falling stock market is appreciated by the Federal Reserve because it resembles tightening financial conditions. Tightening financial conditions should decrease inflation and raise unemployment – the goals of the central bank policy during times like these.

Trying to time the pivot?

We are in a different situation now, though. Inflation is still way above the 2% target. But the slowdown of the global economy is getting more and more clear by the day. And many of the bubbles fueled by monetary excesses [i.e. Meme-Tech-stocks like Peleton (PTON), Palantir (PLTR), Nikola (NKLA), or Crypto (BTC) / (ETH)] have deflated 80-90% from their highs.

Many investors ask themselves now: If inflation has peaked and the economy is materially slowing down, why not buy the dip in risk assets? Won’t the Fed Put be back after inflation comes down MoM?

That sounds like an attractive argument. Hence, I believe the current rally could sustain for the remainder of 2022. There are finally positive news for the stock market to rally. Ultimately, however, I believe the current stock price action is nothing more than a rather violent bear market rally because of the following reasons:

1. The Federal Reserve wants to make sure that inflation is dealt with

During the speculation mania that followed the March 2020 Covid crash, any doubt about valuation levels was quickly dismissed with the “don’t fight the Fed” mantra. And speculators were right back then. If the liquidity cycle makes a big upswing, you don’t want to be caught off guard shorting stocks because of their stretched valuations. Tesla (TSLA) perma bears painfully had to learn that. But the same counts for when the liquidity cycle is in a downturn and investors are recklessly holding on to their overvalued tech stocks. Fighting the Fed in 2022 means staying invested in long-duration, high-growth, high-valuation equities. Just last week, Powell reiterated the Federal Reserve’s stance to tighten policy until something breaks. Powell seemed confident that it would be easier to put the economy into recession and then rescue it after they overtighten financial conditions. After all, nothing kills inflation like a recession.

2. Unemployment is too low

Without the labor market breaking and unemployment sharply rising, there is no reason for global Central Banks to meaningfully change the direction of their policy to an accommodative level. During the FOMC meeting, Powell made it clear that rates will likely stay higher for longer than the market currently expects. The Federal Reserve has given up on its attempt of engineering a “softish landing”. Inflation becoming entrenched in the economy is their worst fear, and with the low levels of unemployment, the Central Bank doesn’t have to balance its efforts to slow down inflation. Even after the rate hikes are over, quantitative tightening will worsen financial conditions and be a great hurdle for the stock market.

Some layoffs have already started. To my belief, tech companies will be able to raise productivity by removing some unnecessary workforce from recent years, where revenue growth was highly monetarily valued, but profitability wasn’t. Facebook (FB), Amazon (AMZN), and Twitter (TWTR) have already started. Alphabet (GOOG) and Apple (AAPL) are likely to follow. If high-paid workers lose their steady income stream, they are likely to sell off some of their accumulated assets in order to have a safety cushion to rely upon. It would be typical that this selling coincides with retail capitulation and a final rise in volatility, which usually marks the low of the bear market. I don’t believe we’re at the end yet, but I don’t want to dismiss the rather orderly decline of stock prices in 2022.

3. Bad news will be bad news again

I think 2023 will be about the labor market and the effects of higher rates for the housing market and less about the Federal Reserve monetary policy. After all, the bulk of the rate hikes are done, and now it is about how long they can stay this elevated. That’s not as interesting for the stock market as hiking 50-75 basis points per month, at least in terms of forward pricing. As seen last week, the current market is still heavily focused on inflation and the resulting change of the Federal Reserve policy. That’s why bad news about an economic slowdown were bullish. Inflation expectations would decrease, and as a function of that, the Federal Reserve was expected to be less tight.

I don’t expect the Federal Reserve to immediately cut rates if the labor market eases. Because of that consistency and resilience to lower rates, I think that bad news will be bad news again in 2023. The housing market should come under pressure too, as more and more mortgages have to be refinanced. As of now, the illiquidity of the housing market makes it seem somewhat resilient. But I don’t believe that resiliency will hold in 2023 if rates stay elevated.

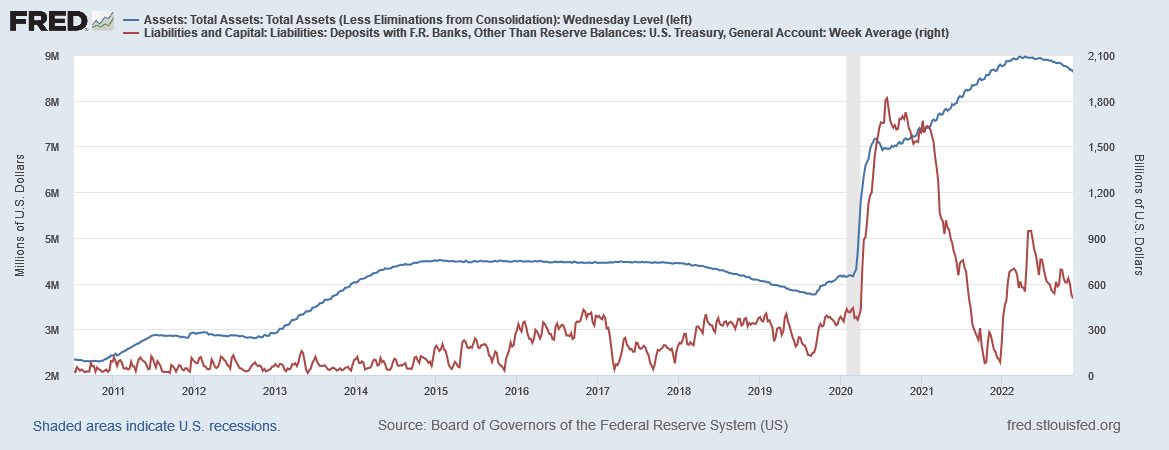

Hiking interest rates for fewer percentage points is less bearish but still not bullish, given how elevated rates already are. The liquidity cycle is still in a downturn, albeit less quickly, and Quantitative Tightening still continues linearly. Until now, much of the Quantitative Tightening got neutralized by a rundown of the US Treasury General account:

M2 & US Treasury General Account (fred.stlouisfed.org)

In 2023, the softening impact of decreasing the treasury account in line with Quantitative Easing will still be possible for some time, but not forever. The likelihood of excessive fiscal policy stimulating the economy has decreased too, given the results of the US midterm elections.

4. A stock-market rally is bearish

Something has to break for the Fed to pivot. If the market reaches previous highs, it only increases the probability that Central banks tighten monetary policy even further. That’s because financial conditions usually ease during stock market rallies. Bond yields usually fall because the market expects accommodative monetary policy, which makes it possible for the Federal Reserve to conduct more Quantitative Tightening because investors buy them, trying to front-run a pivot. To me that seems self-defeating.

Summary

I believe that in 2023, bad news will be bad news again. Plunging earnings and layoffs will ultimately be bearish for the stock market. The Federal Reserve can only pivot if something breaks. The process of “breaking” usually isn’t bullish for the stock market. Bear markets often end with capitulation, but long-only ETF DCA retail still makes their monthly investments in the S&P 500. Unemployment has to rise to turn these inflows into outflows. Bad news will be bad news, and a rallying stock market will be bearish.

Be the first to comment