Oselote

Introduction

In August 2022, I wrote a bullish article on SA about Avino Silver & Gold Mines (NYSE: ASM) in which I said that the purchase of the La Preciosa property was a good deal and that the market seemed to be ignoring the good progress the company was making on the ramp-up of operations.

Well, Avino recently announced that silver equivalent production increased by 20% quarter on quarter in Q3 2022 to 778,008 ounces. Both EBITDA and operating cash flows were in positive territory once again despite low metal prices. In addition, drill results from the Elena Tolosa area have been showing that mineralization extends below current mine workings. Overall, I think the future is looking bright for the company. Let’s review.

Overview of the recent developments

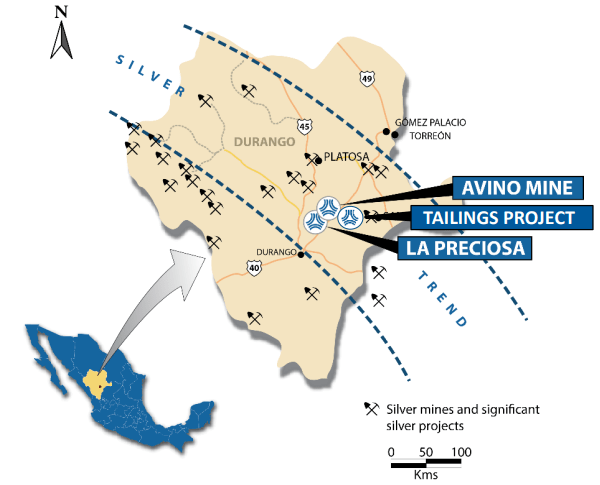

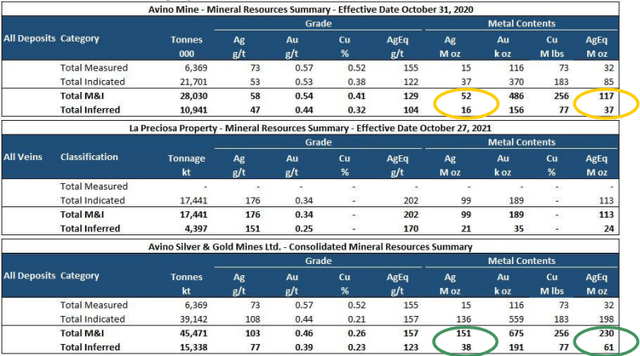

In case you haven’t read my previous article about Avino, here’s a quick description of the business. The company has a polymetallic mine under the same in the state of Durango in north-central Mexico which has been in production for almost four decades now. This is an unusually high life of mine for a precious metals project and a lot more silver and copper remain in the ground as measured and indicated resources stood at 117 million ounces of silver equivalent as of October 2020. In October 2021, Avino announced the purchase of the La Preciosa project, which has measured and indicated resources of 113 million ounces of silver equivalent.

Avino Silver & Gold Mines Avino Silver & Gold Mines

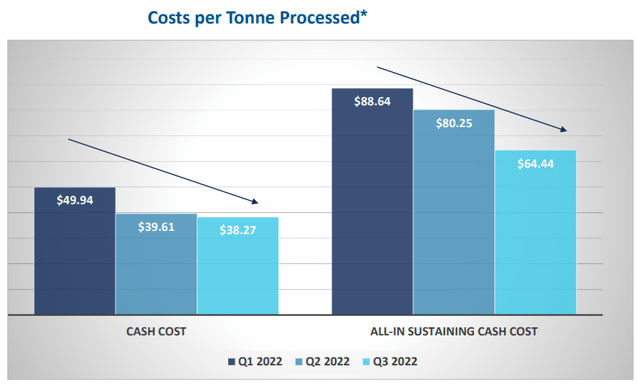

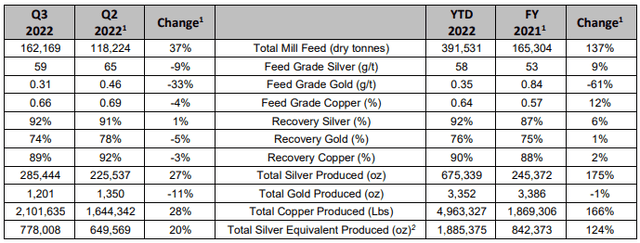

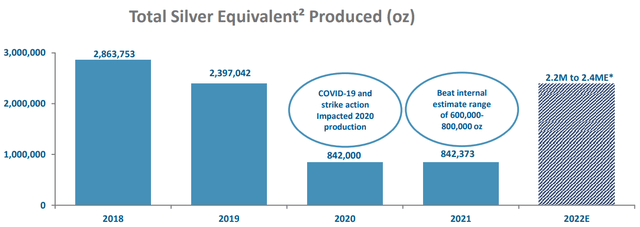

In 2020, Avino shut down its mine due to COVID-19 lockdowns, and operations restarted in August 2021. Since then, the mine has been ramping up and Q3 2022 was the strongest quarter in its recent history, both from a production and a financial standpoint. Mill throughput soared by 37% quarter on quarter to over 160,000 tonnes while silver equivalent production rose by 20% as feed grades and recovery rates fell slightly.

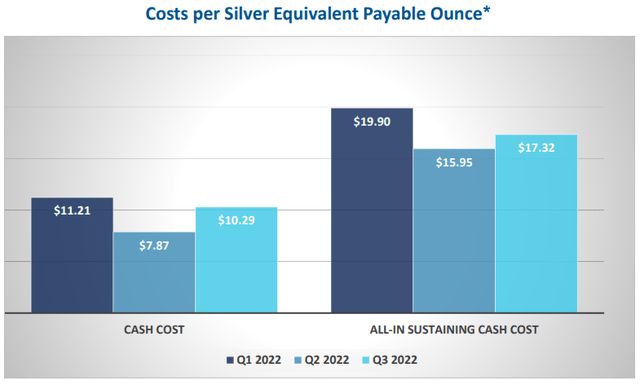

The cost per tonne processed declined thanks to the higher throughput but the lower grades and recoveries led to an increase in cash costs to $10.29 per silver equivalent payable ounce. All-in sustaining costs (AISC), in turn, rose to $17.32 per silver equivalent payable ounce. Moving forward, I expect costs to stabilize at these levels the mine has pretty much completed the ramp-up phase.

Avino Silver & Gold Mines Avino Silver & Gold Mines

In my view, Avino is likely to exceed the upper end of its 2.2 to 2.4 million ounces of silver equivalent production guidance for the full year. The company is now close to the quarterly production rates from before the COVID-19 pandemic.

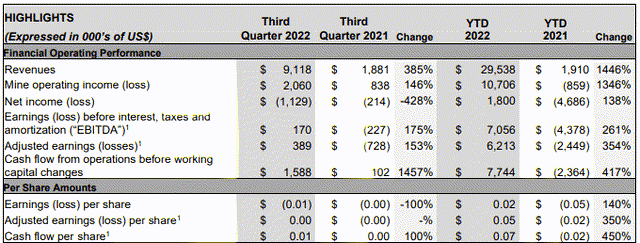

Turning our attention to the financial results, revenues declined by 2.7% quarter on quarter due to lower metal prices and this led to a 47.2% slide in the mine operating income to $2.06 million. EBITDA and operating cash flows are still in the black but net income slipped into the red. Still, most key financial metrics look much better compared to Q3 2021.

In my view, Avino is a high-cost mine, and silver and copper prices thus have a strong influence on its financial performance. At the moment, global recession fears and a strong U.S. dollar are putting pressure on commodity prices and silver and copper are no exception. I think that the short-term outlook for both metals looks bearish.

Trading Economics Trading Economics

Nevertheless, silver inventories are low, and this could lead to a spike in prices in the near future. Inventories at New York’s COMEX have declined by 70% over the last 18 months to just over 1 million tonnes, while inventories at the London Bullion Market Association are at a record-low 27,100 tonnes. Global copper stocks are also at record lows, with current inventories enough to supply world consumption for only 4.9 days. Overall, I find it impossible to predict where silver and copper prices will go over the coming months.

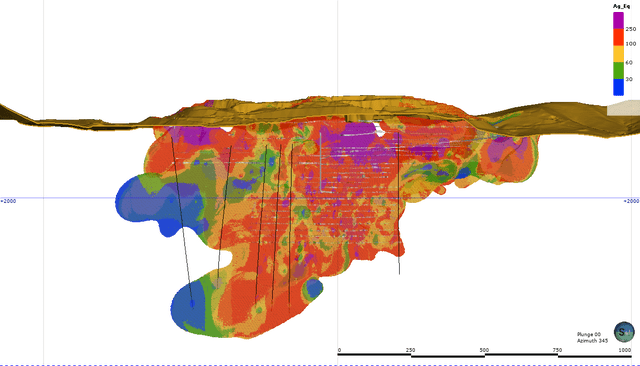

Moving on to the exploration front, Avino completed 11,253 meters of drilling in the first nine months of 2022 and the most recent results continued to confirm that the Avino vein could extend to a depth of at least 290 meters down dip below the deepest levels of development. It also seems that there’s significantly higher copper mineralization in the Elena Tolosa area. The highlights from the drill results announced in October included 150 AgEq g/t over 26.77 meters including 1,800 AgEq g/t over 0.28 meters. Here’s the block model in silver equivalent terms.

Avino has budgeted 15,000 meters of drilling for the full year, and I think there could be a significant improvement in measured and indicated resources in the next update of the resource estimate. This is crucial as Avino has major growth plans in the works. The company wants to start the development of La Preciosa in 2023 with the aim of boosting annual production to 7.5 million to 9 million silver equivalent ounces by 2028.

In my view, Avino has the potential to become a major silver and copper producer and the higher output is likely to decrease costs. That being said, I rate the stock as a speculative buy as there are several things that can go wrong over the coming months and years. Looking at the major risks for the bull case, the first one is funding. As of September, Avino had a cash balance of $10.9 million which means that stock dilution risk is low for the time being. The company expects to make $7 million to $9 in million capital expenditures for 2022, and they stood at $6.1 million for the first nine months of the year. However, the projected CAPEX for 2025 alone is $28.8 million and there could be significant stock dilution if silver and copper prices stay low until then. Metal prices are another major risk here and I think their movements are hard to predict. Recession fears are sapping demand, but inventories are at a record low so there could be high volatility ahead.

Investor takeaway

Avino just booked the strongest quarter in its recent history in terms of production, although the financial results were a bit soft due to lower silver and copper prices. I think that the company is on the right track to become a much larger producer which will bring economies of scale. However, this is still a high-cost miner and building up cash reserves over the coming 2 years is crucial to execute the growth plans without significant stock dilution. Considering silver and copper prices are close to impossible to forecast, I view Avino as a speculative buy.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment