hapabapa

Sysco Corporation (NYSE:NYSE:SYY) finished its Q4 2022 beating the consensus estimate for both its top line and its earnings per share, and they generated their highest-ever revenue of $68.63 billion. Unfortunately, the stock price is still lower than it was on the date of the company’s earnings report (August 9, 2022). The market continues to exercise extreme caution due to the ongoing inflation concerns. The company has successfully navigated its path towards recovery from the pandemic and is strongly positioned to thrive in today’s post-pandemic era.

The company tackled its ongoing labor shortage with the launch of its Sysco Driver Academy and successfully expanded its employee base this FY2022. Operating margin remains elevated compared to its pre-pandemic levels. Profitability remains pressured due to today’s rising fuel costs. However, it remains attractive with its management’s positive EPS guidance in FY2023. With these catalysts in place, I believe SYY remains a buy after a strong runup from 2020’s low.

Company Overview

Sysco Corporation is one of the global leaders in the foodservice distribution industry. It is also a Fortune 500 company that has a wide range of products and services that are used by restaurants, healthcare facilities, schools, and other institutions. FY2022 reveals that restaurants contribute the majority of their revenue; in fact, restaurants account for 63% of its total revenue, which grew 33.80% year-over-year.

According to the National Restaurant Association, the industry is expected to grow to $898 billion this year, up from $799 billion in 2021. With the ongoing phase of recovery from the pandemic, I believe the restaurant industry will remain strong despite today’s potential recession. Furthermore, 16% of the company’s income comes from serving the healthcare (8%) and education/government (8%) sectors. Those are the two sectors that management believes will be less affected by the expected recession.

Hence, the majority of its top line remains safe for the meantime, setting up a positive momentum towards its better FY2023, as quoted below.

All in, we are growing our adjusted EPS with both volume growth and profit improvements contributing to our substantial increases in earnings per share. We are guiding adjusted EPS for fiscal year ’23 of $4.09 to $4.39. The midpoint of this range equals a 30% increase in adjusted EPS over fiscal year 2022. It also represents a 20% increase in our adjusted EPS from our previous high point, fiscal ’19. Source: Q4 2022 Earnings Call Transcript.

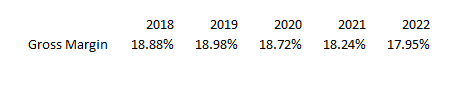

Looking forward at the company’s gross margin trend, we can clearly see that SYY is facing difficulties with today’s inflationary pressures.

SYY: Gross Margin 5-year trend (Source: Data from SeekingAlpha, Prepared by InvestOhTrader)

However, upon further investigation on top of the inflationary pressure, the decline in its gross margin is because of the write-down of Covid-19-related personal protection equipment inventory. Looking at its adjusted gross margin of 18.06%, we can see that the decline is not that massive compared to its GAAP gross margin of 17.95%.

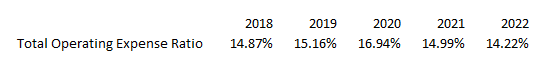

Additionally, its operating margin produced a figure of 3.73% this FY22, better than its 3.25% in FY21 and 1.78% in FY20, but it still remains below its FY19 and FY18 levels of 3.82% and 4.00%, respectively. This is thanks to its improving operational efficiency, where the company produced an improving total operating expense ratio of 14.22%, better than its 15.46% 5-year average and beating its pre pandemic levels, as shown in the image below.

SYY: Improving Total Operating Expense Ratio Relative to Total Sales (Source: Data from SeekingAlpha, Prepared by InvestOhTrader)

This is thanks to its successful implementation of its “Recipe for Growth” strategy; in fact, according to the management, they already exceeded their cumulative cost-out savings goal of $750 million. This positively offsets pressures from incremental labor costs and continuous investment in productivity. Here are some of SYY’s investments in technology that drive operational efficiency, as quoted below.

The technology for the distributed order management system goes live this quarter and what it will enable us to do is decouple the front-end sales from the back-end operations. And by doing that, we can ensure that we decrease miles driven, meaning serve the customer from the closest possible warehouse.

That sounds basic and obvious, but it is a meaningful unlock technologically, but it also is going to help us with our strategic stocking of product, what product is where. Think about slow-moving SKUs and fewer warehouses that then get cross-docked through the last mile delivery location and really being strategic and optimized of increasing the ability of our inventory, but actually doing it with overall over time, less inventory, less working capital. Source: Q4 2022 Earnings Call Transcript.

Other points of investment are their Sysco Driver Academy and loyalty program, Sysco Perks, which are expected to improve both the company’s productivity and customer retention rate.

Getting Bigger and Better

In FY2022, SYY acquired leading companies such as Greco and Sons, Paragon Foods, and a leading fresh produce distributor, Coastal Companies. SYY remains very aggressive in expanding through acquisitions despite today’s macro headwinds and still returned $1.5 billion to shareholders, as quoted below.

…we returned $1.5 billion to shareholders through 500 million of share repurchases completed in the fourth quarter and $959 million of dividends. Source: Q4 2022 Earnings Call Transcript

In fact, according to the management, regardless of the market condition, they expect to outpace Foodservice Market by 1.35x and provide a positive ~10% year over year increase in revenue in FY2023.

As a result of their confidence, they have increased their annual dividend to $1.96 per share, up from $1.88 per share in FY2022. Furthermore, as of this writing, this provides a dividend yield of 2.34%, which may improve further with its potential correction in the coming trading weeks, as discussed later.

Lastly, the company has a market cap of $42,458 million as of this writing, and another value adding catalyst to mention is their approval of a $5.0 billion share repurchase program as part of its Recipe for Growth strategy, with $4.5 billion worth of share buyback authorization still remaining.

Remains Fundamentally Undervalued

SYY has an improving profitability as shown by its all-time ROE of 92.59%, which is way better compared to its sector median of 12.21%. This somehow explains why it is trading at a higher multiple than its sector. So, looking at its trailing EV/EBITDA ratio of 15.91x compared to its sector’s median of 12.87x may turn off some investors. However, looking at its forward EV/EBITDA of 12.97x and its 5-year average of 17.12x, I believe SYY remains fundamentally undervalued, especially considering its $4.5B remaining share repurchase program. Using Wall Street’s high target price of $100 as our conservative target price provides a decent ~20% upside as of this writing.

Some risks to consider: despite today’s inflationary pressure, SYY successfully managed to control their margin as mentioned earlier. However, a prolonged and continued increase in fuel prices and other necessary goods may affect the company’s overall demand.

On The Verge of Challenging Its $91 Mark

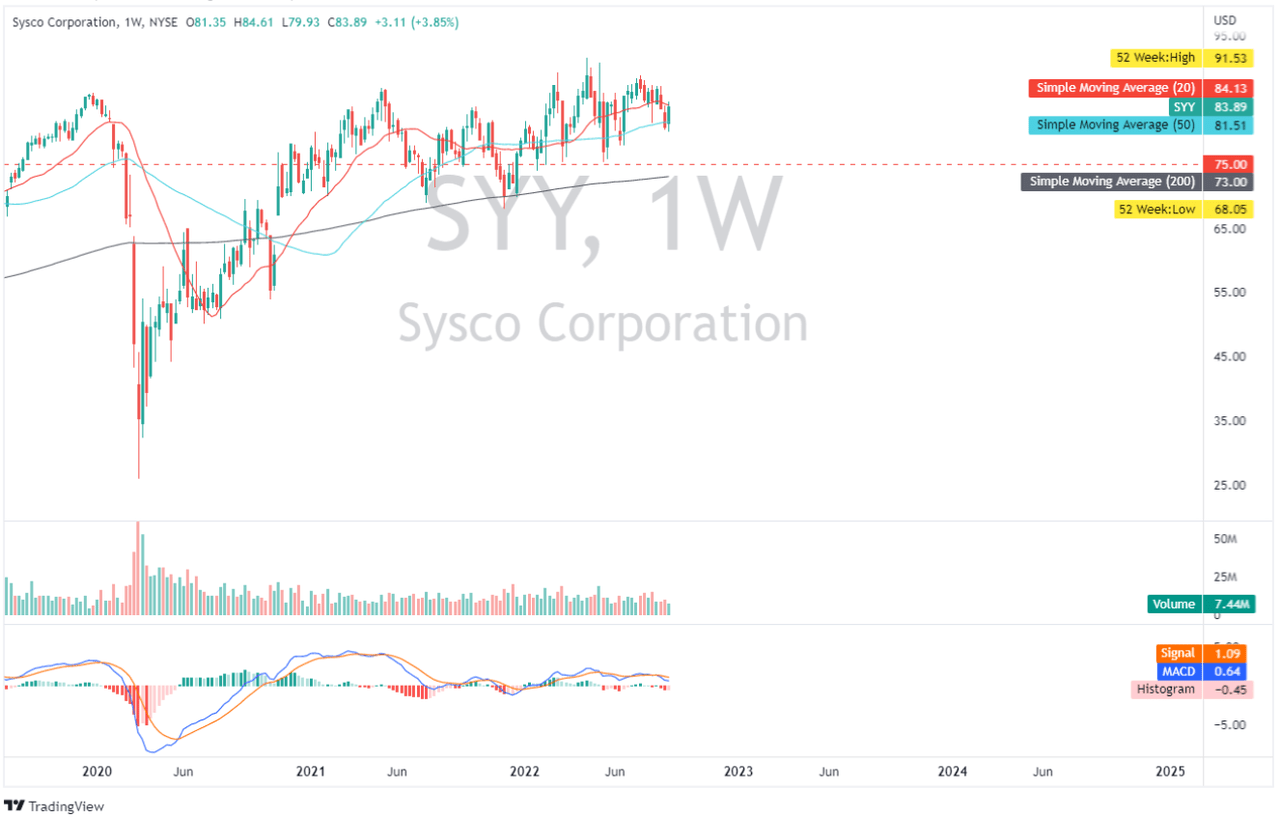

SYY: Weekly Chart (Source: TradingView.com)

The 50-day simple moving average is currently acting as a support on the weekly chart. Furthermore, based on its price action, SYY appears to be having difficulty breaking through the $86 level, which has already been attempted three times this year – in February, May, and July – but has been unsuccessful. As shown on the chart above, its MACD indicator already indicated weakness. If there is a correction, I believe $70 to $75 will be a strong support zone to keep an eye on.

Final Key Takeaways

In today’s inflationary environment, SYY demonstrates resilience with its outstanding growth and can successfully control its margin. In addition to this catalyst, SYY has a liquid balance sheet, and Moody’s has reaffirmed its investment-grade credit rating. Its current ratio remains lower than its 3-year average of 1.54x, owing primarily to cash acquisitions. With a net debt to adjusted EBITDA ratio of 2.9x in FY22, it provided a better figure than ~4.0x in FY21 and ~5.9x in FY20. This implies improved long-term liquidity. Another value-added catalyst is management’s expectation of a range of 2.5x to 2.75x in FY23. To conclude, SYY remains fundamentally strong and is an attractive long candidate.

Thank you for reading!

Be the first to comment