JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

In this article I will evaluate Intel’s (NASDAQ:INTC) near-term execution, which has been unsatisfactory. While the initial momentum of the Pat Gelsinger CEO transition started promising, there have just been a few too many letdowns in 2022 that Intel needs to address quickly.

More to the point, one of Pat Gelsinger’s mantras was that Intel would do what it said it would do, and then some. Well, I will be evaluating several of the things Intel said it would do, and it turned out that Intel didn’t fulfill those promises. Since Pat Gelsinger has described himself as a very data-driven person, it should hence be fair to conclude based on the 2022 track record that Intel still has not fully earned back investor trust, as obviously these hiccups cannot be ignored.

So while Intel may look very compelling, trading at or near multi-year low prices, investors should acknowledge that the risks have not fully been resolved yet. This means that for the time being investors are still buying promises rather than actual results.

Investor Meeting scorecard

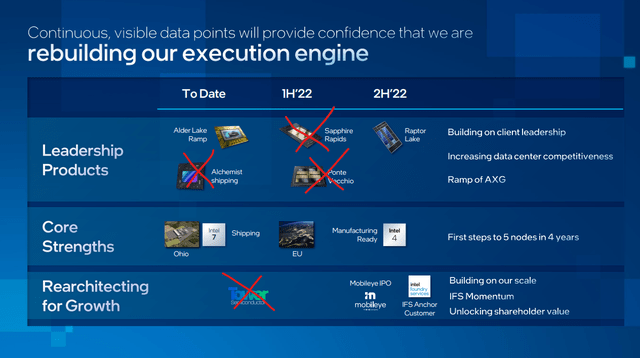

The slide below is the moneyshot of this article. It shows the data points of what Intel early this year said it would do in 2022, evaluated at the end of 2022 to see how Intel actually fared. Clearly, Intel does not have great scorecard.

Intel

1. Alchemist

Admittedly, some of these points may be up for some debate, as Alchemist was indeed shipping or close to shipping already at the time of February’s Investor Meeting. However, undeniably one must acknowledge that Alchemist has been delayed. The roadmap was laptop in Q1, desktop in Q2 and workstation in Q3. While technically there was a very limited laptop launch on literally the very last day of Q1, desktop Alchemist only launched in October, two quarters behind schedule. In addition, Intel already said in July that it wouldn’t meet its goal of shipping 4M units in 2022, along with acknowledging the driver (software) issues that prevented the cards from delivering their expected performance in-game.

2. Sapphire Rapids

Equally, one could argue that Intel indeed started shipping Sapphire Rapids in Q1 just as Intel said it would. However, again this is misleading, since it turned out the actual volume SKUs were delayed, as Intel has widely discussed on the earnings calls. Bottom line, the actual launch event for Sapphire Rapids is set for January 10, 2023, nearly a year behind schedule (and nearly two years according to even earlier roadmaps).

What this means is that a bit over a year ago, already before the latest delays, Pat Gelsinger acknowledged that regarding data center leadership it would be “nip and tuck” against AMD (AMD) for the next few years. If Sapphire Rapids had a least launched in 2022, it would still have been a leadership product for a few years, but given the delay, AMD has already launched its “tuck” product before Intel’s “nip”. This means that regarding data center leadership, which Intel lost in 2019, it will only be in 2024 that Intel will finally regain this position again for the very first time, and only then likely only for a few quarters at best before AMD’s “tuck”: AMD Vs. Intel: I Was Wrong About AMD (NASDAQ:AMD).

3. Ponte Vecchio

I was a bit surprised to see Ponte Vecchio in H1 on this slide, as I had been under the assumption that it was targeted for H2. My guess is that H1 was for shipments for the Aurora exascale supercomputer, with a general launch in H2.

In any case, it turned out Intel met neither of these schedules, as the general launch of Ponte Vecchio has been postponed to January, although Intel is currently shipping Ponte Vecchio to the Aurora supercomputer (but also six months behind schedule, never mind the original schedule which had Aurora planned for Q4’21 or Q1’22).

What this means, competitively, is that Intel’s GPU effort is enduring similar issues, against Nvidia (NVDA), as just discussed on the data center Xeon CPU side: Ponte Vecchio was supposed to be Intel’s competitor against Nvidia’s Hopper H100, but with a year earlier time to market due to the chiplet-based design. However, H100 has already started shipping, which means Intel is again running behind.

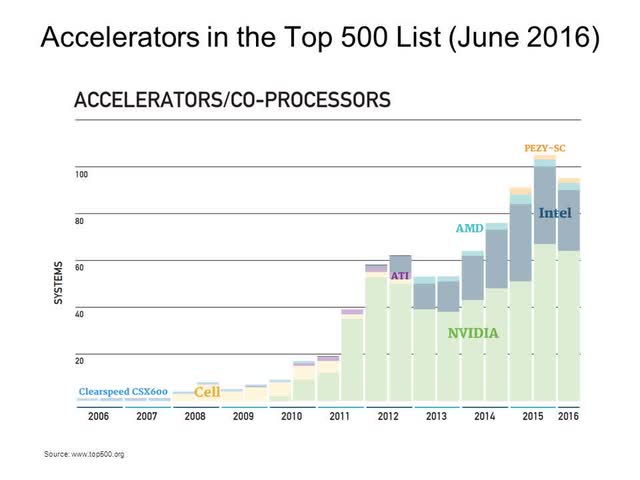

One difference is that Intel is starting from 0% market share (although it once had a decently successful Xeon Phi supercomputing business. Also important for investors, Intel has long touted its open oneAPI initiative against the closed CUDA ecosystem, and Intel has developed a code migration tool, so in principle software shouldn’t be a too major issue for its adoption. It is likely that the $10B revenue plan for AXG (by 2026) includes quite a bit of revenue from this product line, but obviously Nvidia bulls in particular would likely argue that Nvidia’s stronghold won’t be taken over that easily (although as noted in the HPC space Intel once had a decent competitor with Xeon Phi).

TOP500

4. Tower acquisition

The acquisition is currently scheduled to close in Q1 2023, more or less on schedule, but technically it shouldn’t have been on the 2022 “bingo card” since Tower is currently still an independent company.

Nevertheless, I remain reasonably excited about acquisition given that it catapults Intel into a full portfolio foundry business. Although a GlobalFoundries (GF) acquisition might have been more compelling given its existing scale, it will be interesting to see if Intel can transform the Tower business from a low-margin and relatively small player in this space, to a more substantial competitor. On the other hand, as Intel said Tower is adding thousands of foundry employees to the nascent IFS business.

5. Robotaxi

This is another major item given its potential to become a multi-billion dollar business. In April, Pat Gelsinger said: “Mobileye expects to launch its commercial robotaxi services in Munich and Tel Aviv by the end of 2022.” About a year ago, and since around 2018 or so, the timeline had been to launch the robotaxi business in early 2022 and then scale this to many global locations through 2022 and 2023 (and beyond).

Clearly, the robotaxi business is also having some hiccups. Nevertheless, in the comments early this year it seemed that the robotaxi was actually ready for launch, only waiting for regulatory approval to remove the driver. However, since then, Intel hasn’t said literally anything about these plans, so it is unknown what the status currently is. In that sense, the recent Mobileye IPO, while more or less on schedule (it was actually delayed from mid-2022), might be seen as mostly smoke and mirrors to distract from the real value generator.

Highlights

One should nevertheless acknowledge that a few targets were met.

First, both Alder Lake and Raptor Lake have launched as intended. Although for Raptor Lake Intel had previously said it would also launch the laptop CPUs in 2022, at the time of writing there being no indication that this will still happen.

Secondly, on the manufacturing side Intel started working on the Ohio fab, announced the E.U. location, the CHIPS Act was passed and Intel announced the Brookfield SCIP program. In addition, Intel is spending, per its guidance, some $25B GAAP net capex in 2022 (although down a few billion from the initial guide), of which an impressive nearly $7.5B is geared towards Technology Development (as opposed to fab space or tools). As a side note, as discussed extensively before, these costs will come down significantly starting next year, which is one the levers for Intel to manage the FCF.

Thirdly, on the process technology side, Intel 4 indeed seems to be ready in H2’22 (even if it is late Q4), although Intel may have been a bit misleading since the Intel 4 volume product, Meteor Lake, now seems scheduled for the second (instead of first) half of 2023, which means the volume ramp will really happen only through 2023 (with higher volume obviously weighted towards the second half and into 2024). In addition, Intel has taped-in and taped-out Granite Rapids (and likely Sierra Forest as well) on Intel 3, which is running multiple OSes in the lab, purportedly with healthy yield. Lastly, on Intel 20A and 18A, Intel has started to run its own and internal test chips in the fabs, also seemingly on schedule.

Lastly, while it is not sure if this is the announcement Intel intended on the slide, Intel did announce Nvidia (NVDA) as a new member of the RAMP-C program, which may be a step towards its use of IFS.

Genoa launch

As discussed above, Intel has been doing too little and too late in at least several of its major businesses in 2022. The most important one being the data center.

The Genoa launch reminds me of Rome back in 2019. Intel had just 28 cores, and then AMD used its process advantage to offer 64 cores, more than twice as much. Currently, Intel has only 40 cores while AMD just plowed forward with its new 96-core Epyc, again over twice as much.

I have been reading some of the coverage, and it seems as if people have a short memory. Some data center review sites noted about how this was one of the biggest jumps they’ve seen in a very long time, even though it was “only” a bit over three years ago that AMD launched Rome with 2x the core count and 4x the vector throughput of its predecessor Naples. By contrast, Genoa “only” has 1.5x the core count of Milan, although the performance is further improved due to the Zen 4 architecture (+14%) as well as the N5 process to improve frequencies, although to some extent at the expense of higher power as well. Still, note that in 2019 the jump from N16 to N7 was actually much bigger: over 3x the transistor density vs. the ~1.5x that N5 brings.

That point aside, there is a more tangible difference this time around. While it took Intel an obscene nearly two years to at least partly respond to Rome (Ice Lake-SP with 40 cores), this time it will be just two months, as Sapphire Rapids is launching in January. Of course, this is ignoring the fact that Sapphire Rapids was actually intended to compete against Rome and Milan.

Still, overall this means that the status quo actually isn’t changing too much: Intel has continued to lose market share because Ice Lake-SP is unable to compete on performance (it actually does fare a bit better on price), and both AMD and Intel are increasing the core count by 1.5x with their latest launches (although Intel isn’t moving to a completely new process node, Intel 7 is significant improvement from the original 10nm+ in Ice Lake, as this encompasses the jump from 10nm+ to 10nm SuperFin and then to Intel 7, both of which delivered significant improvements in performance and performance per watt).

In fact, since AMD has raised its prices with Genoa (the price per core for Genoa is unchanged from Milan), this does give Intel a bit of breathing room to compete on pricing, especially in the more mainstream/volume segments, although Intel did suggest it would also seek to improve its pricing with Sapphire Rapids (although as underdog Intel will obviously remain limited in its pricing power, as it risks alienating its still quite loyal customer, given the still over 80% share in Q3).

Admittedly, though, some of the benchmarks that have come out have shown how the 32-core Genoa is competitive with, if not faster than, a dual-socket Ice Lake-SP (2x40C). Obviously, this means Intel will need all the tricks that it put into Sapphire Rapids: the many dedicated accelerators (for things like crypto, AI, etc.), as well as the jump from 10nm+ to Intel 7 just mentioned. In any case, based on pure stats Sapphire Rapids delivers a 50% increase in core count, about a full node worth of performance per watt, and a bigger jump in architecture (+14% for AMD vs. +20-35% for Intel, with the 35% being Intel’s disclosure for microservices).

Nevertheless, I have been reading Seeking Alpha coverage of an analyst note which claimed that Genoa is cementing AMD’s leadership for “years to come”. However, this is undeniably false.

Per Intel’s roadmap, Granite Rapids remains on track for 2024 (Intel praised its execution in the Q3 call, although it provided little details besides that the CPU has been running in the lab), and one could make an educated guess that this CPU should have no trouble dealing with Genoa, so this limits AMD’s leadership to “just”the next two years, although admittedly a few quarters later (at the latest) AMD will have its own next-gen Turin ready.

As a reminder, Granite Rapids is rumored to have been upgraded from 120 to 128 cores as part of its redefinition from Intel 4 to Intel 3. In addition, Intel disclosed that Granite Rapid has also received a new core microarchitecture with about 10% increase in IPC (instructions per cycle) over Redwood Cove. Redwood Cove for its part is rumored to increase IPC by 15-25% over Raptor/Golden Cove, which from testing we know has about the same IPC as Zen 4. Hence, this means that, assuming Genoa and Granite Rapids run at the same frequency, Granite Rapids should be approx. 76% faster than Genoa.

Now, for completeness, some people will now point towards the upcoming Bergamo, which will also have 128 cores. However, Bergamo uses a downgraded Zen 4c core, so it will all but likely still lose in performance against Granite Rapids, and secondly, Intel’s competitor against Bergamo isn’t Granite Rapids, but Sierra Forest, which leverages Intel’s E-core roadmap. Intel’s E-cores are much smaller, allowing Intel to significantly increase the core count, and also feature higher performance per watt. There are no recent rumors about its core count, but it would be surprising if it isn’t at least twice as much as Granite Rapids (256 cores). This means it should be able to compete even against the next-gen Turin, whose Zen 5c version will have 256 cores.

Overall, what this means is that in 2024, there will be two options. First, customers who want the highest possible single-threaded performance, and customers who can make use of one or more of its many powerful accelerators, will find an absolute leadership product with Granite Rapids. On the other hand, for customers who simply want the highest regular CPU throughput and performance per watt, Intel will have another unmatched leadership product with Sierra Forest. So although recently someone one Twitter warned me Sierra Forest might not have the core count I would have expected, Intel should finally have a decent portfolio again within two years. But not today.

The final point of discussion is regarding market share. As mentioned above, even in the last quarter, over five years after the introduction of Epyc, AMD still had less than 20% x86 market share. This is despite that for over two years it had over twice the core count to offer. So on one hand, this means Intel still has 80% it could lose, while on the other hand, it could also serve as indication that Intel’s demise has been overstated, which may continue. (Intel called this its incumbency position.)

Annus Horribilis

We can sum up everything that went wrong for Intel this year:

- The lack of 7nm (Intel 4) ramp (Granite Rapids in H1, Meteor Lake in H2) as was the plan in 2019 and early 2020.

- The gazillionth Sapphire Rapids delay, to early 2023, missing the window to take data center leadership for the next two years (given the Granite Rapids “redefinition” to 2024).

- The gazillionth Ponte Vecchio delay, to early 2023, missing the window to take GP-GPU and AI training leadership from Nvidia for the next two or three years (given the meager Rialto Bridge upgrade with just 25% more cores in 2024, likely putting Falcon Shores back from 2024 to 2025).

- The many Arc consumer GPU woes that have put a big dent into the once widely anticipated Intel GPU ramp (which ideally should have happened during the GPU shortages in 2021).

- The absence of the robotaxi ramp, which is a product and new business that seems poised to transform civilization and likely Intel’s financials, but (given the delay) not in 2022.

- Earlier in the year, Pat Gelsinger was joking about he had given Technology Development an “unlimited” budget (referring to his own time when the CEO had given him an unlimited budget, and then came back to tell him he had still gone over budget), which captures the general Intel sentiment about spending and investing significantly to deal with the issues described above, but given how the macro environment started to significantly deteriorate in mid-Q2, leading to a collapse in earning, Intel is now forced to (at least partly) revise its spending plans. Many have already speculated about the sustainability of the dividend (despite Intel’s commitment).

Investor Takeaway

It was exciting that Pat Gelsinger wanted to bring back a culture where the company would do what it said it would do. However, the scorecard for 2022 unfortunately does not stack up. Combined with the worsening financial as well as stock performance, it has been a true annus horribilis for Intel.

It gets even bleaker when realizing that the plan under former CEO Bob Swan had been for 2022 to become Intel’s annus mirabilis instead (7nm ramp to at least temporarily regain process leadership, Granite Rapids to regain unquestioned data center leadership, Meteor Lake groundbreaking disaggregated design, Ponte Vecchio to dethrone Nvidia in graphics and AI, and the launch of robotaxi).

Of course, it had been known for quite some already that none of those original 2022 plans would materialize, so Pat Gelginger was timely brought in almost two years ago to set a new course for the ship, which as we’ve seen includes the two full process nodes in just two years (Intel 4 in 2023, Intel 20A in 2024) as well the start of a first-class foundry business.

Fortunately for investors, they can find some solace in knowing that the items most impacted by the delays were already well in-flight when Pat Gelsinger joined. Intel added around 20k net new employees over the last two years (the impact of the reorganization remains unknown currently), and those new teams that have been assembled or increased in size are likely working on brand-new projects that will materialize no earlier than 2025.

It are these projects that do not seem to be impacted by any issues (yet), most notably the plan to recapture process leadership in 2025 with 18A, and use this to build a big foundry business. So while 2022 has been an annus horribilis for Intel, given that some of the newer projects have already been underway for a years now, we can already see some initial progress of Intel’s recovery plan, with the process roadmap still on track, as evidenced by the first internal and foundry test chips being in the fabs currently.

Put differently, earlier this year I argued 2022 would mark the technological, financial and stock bottom. Although in recent coverage I have cautioned that it could perhaps be a two-year bottom, it likely cannot get much worse than it currently is, especially given the really promising products and technology on the horizon over the next few years.

Ultimately, this means that 2022/2023 remain on track to be the bottom, and not just the first few years in a long road to irrelevancy. Investors who can see the difference between both scenarios could make compelling alpha with the stock.

Be the first to comment