Klaus Vedfelt/DigitalVision via Getty Images

Thesis

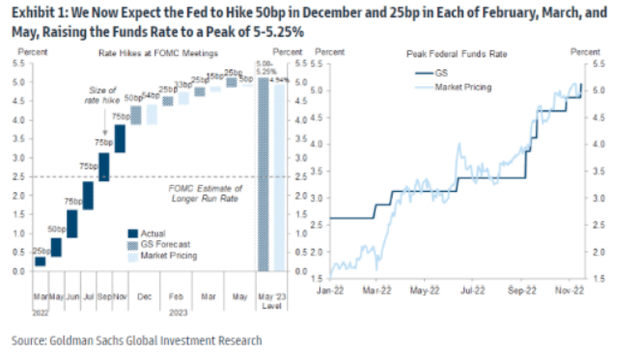

The Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV) is a fund which invests its cash in long-dated Treasury STRIP securities. With a massive 24.2 years duration, the fund’s performance is driven by the long end of the treasuries curve. There has been substantial speculation regarding the ultimate path for long rates, with unclear answers. What has firmed up in the past months though is the predicted path for Fed Funds, which are priced to peak at 5.25% per Goldman:

Fed Funds (Goldman)

In this article we are going to explore the historic relationship between 30-year rates and Fed Funds, and try to draw conclusions regarding peak 30-year levels for this cycle. While history does not repeat itself like-for-like, it often rhymes, thus we feel we can use historical blueprints to identify an appropriate range for peak long end rates.

Historic relationship between Fed Funds and 30-year treasury yields

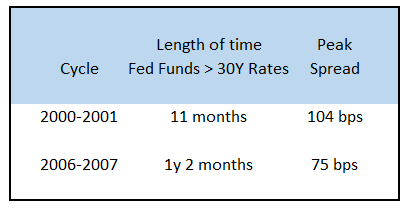

Let us have a look at the historic relationship between Fed Funds and long rates:

Fed Funds vs 30Y Rates (The Fed)

The above graph plots the Fed Funds rate in blue, and the 30-year constant maturity market yield for treasuries. There are a number of interesting facts to notice:

1) Fed Funds can actually exceed 30-year treasuries yields.

- while it would seem counterintuitive given the concept of term premium, history has shown us that Fed Funds can occasionally exceed long rates

- looking back almost 20 years we can see this dislocation occurring just twice, both at the end of monetary tightening cycles

2) The average duration of the time frames with Fed Funds higher than long rates is 1 year, and the maximum observed spread is around 100 bps

- when looking at this historic relationship it is important to quantify the period of time for which the dislocation occurred and the maximum spread observed

- if Fed Funds exceeded long dated treasuries for just a couple of days, then the occurrence would not really matter in inferring a top long rate for this cycle

- the correlation between time-frame and spread for the two occurrences is important in inferring a similarity with the current tightening cycle

Fed Funds / 30Y Treasuries Spread (Author)

- so the two historic occurrences are fairly well correlated, with time-frames for the inverse term premium clocking in around 1 year, with a maximum spread between 75 to 104 bps

3) The 2006-2007 tightening cycle also peaked with Fed Funds at 5.25%

- history often rhymes, and the Goldman call on peak Fed Funds in this cycle matches the top rate seen in the 2006-2007 tightening cycle

- the Fed would thus just revisit what it had done before in the not so distant past

If history is any guide then we should expect a similar development in this cycle. Working off the historical table above and the Goldman prediction would give us a terminal 30-year rate of 4.25% to 4.5% during this cycle. We have already seen long rates touch that level before retracing:

30-Year Rates (Investing.com)

Long rates peaked at 4.38% before retracing below 4%. As we have seen with our historical graph the relationship does not max out until the Fed is done raising rates. Expect long rates to go back in the 4.25% to 4.5% “box” as economic data does not come in soft and the GS path is priced in.

What does this mean for EDV?

Granted the vehicle has only a 24.2 years duration, but the price correlation to long rates is fairly close since it straddles the 20 year / 30 year term structure. We saw peak long rates during this cycle on October 24, and the associated price for EDV was roughly $75/share. Do expect this to be re-visited but to act as a soft bottom for the fund. EDV’s price is driven entirely by long rates, and as we have seen from the above analysis we expect those to peak in the 4.25% to 4.5% “box.

The fund is down -38% year to date given the violent rise in rates and long duration, and it approaches a “generational buy” level. Do we believe the Fed will go much higher than what GS is predicting? No.

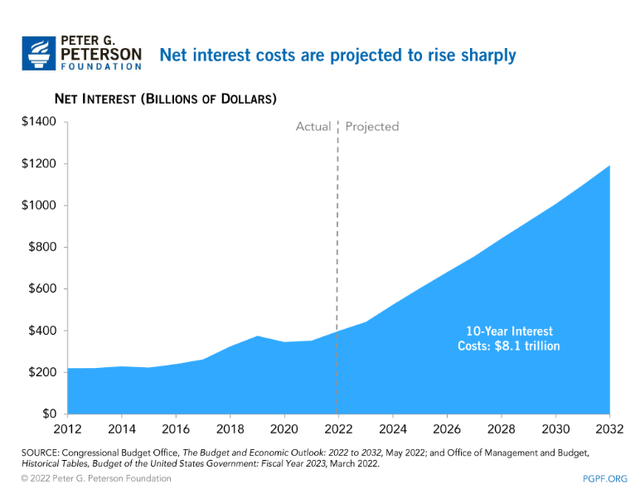

As interest rates on U.S. Treasury securities rise, so too will the federal government’s borrowing costs. The United States was able to borrow cheaply to respond to the pandemic because interest rates were historically low. However, as the Federal Reserve increases the federal funds rate, short-term rates on Treasury securities will rise as well — making some federal borrowing more expensive. In late May, the Congressional Budget Office projected that annual net interest costs would total $399 billion in 2022 and nearly triple over the upcoming decade, soaring from $442 billion to $1.2 trillion:

Net Interest Cost (CBO)

The sudden rise in net interest costs is not sustainable long term, and rates will need to come down. That is another reason for the Fed to move so quickly – it needs to move rates up and then down in the shortest time-frame to minimize both inflation and net interest costs.

Conclusion

EDV is a long duration Treasuries fund. With a 24.2 years duration, the fund’s performance is entirely driven by the long end of the yield curve. Despite the concept of term premium, history has shown us that Fed Funds can be higher than long rates. In the past twenty years we have witnessed two historic instances where Fed Funds have been higher than 30-year rates, both occurring during past monetary tightening cycles. The average duration for the inversion has been 1 year, with the spread peaking at 100 bps. One of the two occurrences is the 2006-2007 tightening cycle when Fed Funds peaked at 5.25%. With Goldman now anticipating the Fed to move to a peak level of 5.25% in Fed Funds next year, past historic correlations would indicate 30-year rates to peak in the 4.25% to 4.5% “box”. This yield range implies a “soft bottom” in the EDV pricing at roughly $75/share.

Be the first to comment