andresr

The technology sector is among the worst performers in the past year, losing over 30% of its value. While many stocks may have been excessively hyped during the massive rebound out of the pandemic-lows, others have been under pressure because of rising inflation, a higher cost of capital, bottlenecks among the supply chains, as well as headwinds caused by pandemic-related restrictions, geo-political tensions, and the ongoing war in Ukraine. Companies in the Information technology services industry could perform better from a yearly perspective but lately have been struggling to rebound, while others, such as the semiconductor and the solar industries, have recently been leading the sector.

The two selected companies are two global giants in their industry, with Alphabet (NASDAQ:NASDAQ:GOOG) (NASDAQ:GOOGL) having nearly a monopoly in the online search field, as Google processes over 92% of online search volume worldwide, and Meta Platforms (NASDAQ:NASDAQ:META) counting 3.71B monthly users in Q3 2022, among the company’s core products, Facebook, WhatsApp, Instagram, or Messenger, up 4% Year-over-Year [YoY].

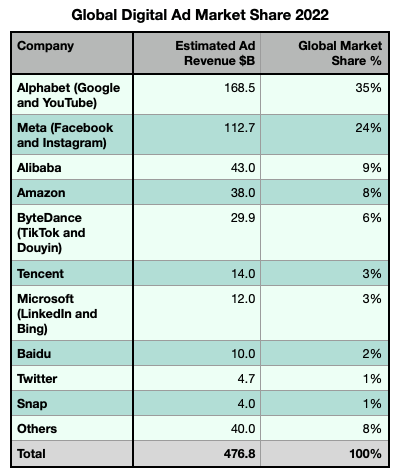

While the two companies once were identified as a digital duopoly, because of their massive market share in global online advertising, more recently, companies such as Amazon.com (NASDAQ:AMZN), Alibaba (NYSE:BABA), Tencent (OTCX:OTCPK:TCEHY), or ByteDance through their social media TikTok, have penetrated the market and contributed to the erosion of this duopoly.

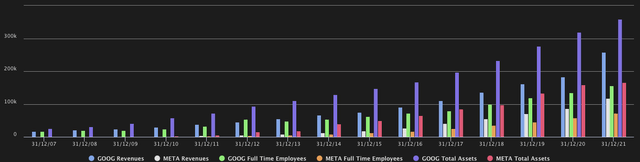

Author, using data from Insider Intelligence, Research and Markets, Company filings

The global IT Services market is projected to grow at a 9.5% Compound Annual Growth Rate [CAGR] through 2031, while the global digital advertising market is forecasted to grow even faster at a 13.9% CAGR, reaching a size of $1.79T through 2031. The sustained market growth is driven by the broader penetration of internet users, technological advancement, rising spending in digital advertising, and the expanding popularity of mobile phones and digital media across the world, while platforms such as in-app, mobile ads, connected TV or social media advertising are increasingly important vectors in the industry.

An in-depth company comparison

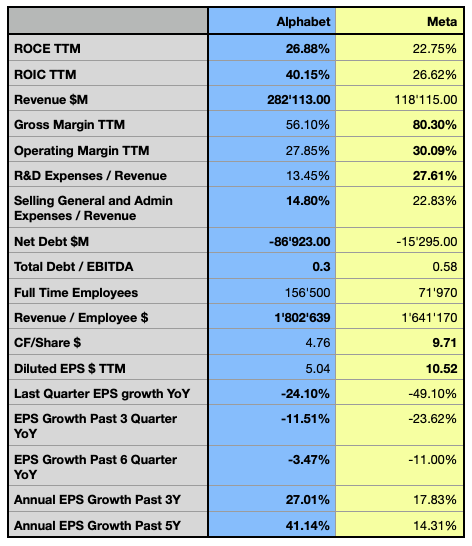

Author, using data from S&P Capital IQ

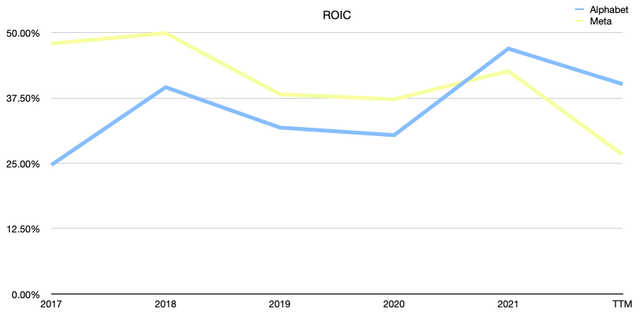

The financial comparison highlights the major relative strengths and weaknesses of the two giants. In terms of their Return on Invested Capital [ROIC], a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment, Alphabet seems to gradually increase its capital allocation efficiency over the past few years. Although Meta has been more efficient in the past, the metric has progressively dropped, until recently significantly falling under Alphabet’s level. The latter seems to have a more efficient core business, but Meta has seemingly more efficient cash management, observed in the relatively narrow spread between their ROIC and the Return on Capital Employed [ROCE], while Alphabet could significantly increase its capital allocation efficiency as the company reported a massive cash position of over $116B.

Author, using data from S&P Capital IQ

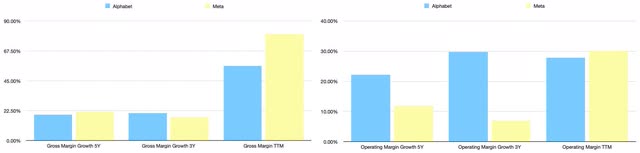

Although Meta reports by far the higher gross margin, this metric’s growth is seemingly dropping from 21.94% CAGR in the past 5 years to 17.88% CAGR in the past 3 years. While Alphabet reported a lower actual value, the company saw this metric slightly increase from 19.38% CAGR to 20.72% CAGR, over the same time window. Meta’s main source of revenue began faltering as the widely popular video app TikTok massively increased its audience, and other companies increased their market share in the online advertising space, while Apple’s (NASDAQ:AAPL) shift to a strict app tracking transparency privacy policy, requiring the user’s approval for apps to be able to track their data, had an estimated two-digit billion impact on Meta’s revenue. On the operational side, the companies have an even more divergent profile, as Alphabet demonstrated being capable of significantly increasing its operational profitability from 22.13% CAGR in the past 5 years, to 29.80% CAGR over the past 3 years, while Meta’s operating margin growth is decelerating from 11.96% CAGR to 7.03% CAGR over the same period. Meta is massively investing in the development of the Metaverse while rising doubts emerge concerning the company’s ability to reach its ambitious goals in a concept that only a few people understand, while at the same time the company struggles with a weakening advertising business.

Author, using data from S&P Capital IQ

Meta reportedly has a more cash-rich business than the analyzed peer, while none of them is paying a dividend, both companies spend billions in share-repurchase programs. Alphabet announced its biggest share-buyback program of over $70B earlier this year, a major increase after the authorized buyback of $50B in 2021 and $25B in 2019. Meta has reportedly spent $91B to repurchase 377M stocks at an average price of $242, between 2017 and September 2022, a price that seems steep, considering that the actual share price is valued at -53% of that price. Meta also reports significantly higher EPS, while in those terms, Alphabet has had a less negative development over the most recent quarters and reported significantly higher growth over the past few years. Both companies are relying on debt for sustaining their business, increasing significantly their debt reliance since 2019, as the historically low-interest rates pushed many companies to consider more debt in their financing strategy. That said, both companies could repay the entirety of their debt exposure as shown in their net debt position and low leverage ratio.

The stocks’ performance

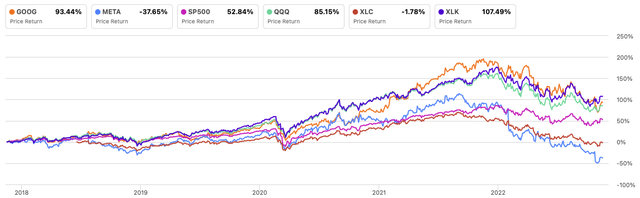

Considering both stocks’ performance in the past 5 years, GOOG reported a solid performance of 93.44%, while META performed significantly worse, losing 37.65% over the analyzed period. The most significant references show a mixed picture, with the S&P 500 (SP500) returning approximately 53%, and the Nasdaq technology index, tracked by the Invesco QQQ ETF (QQQ) marked over 85% performance, while more industry-focused references, such as the Communication Services Select Sector SPDR Fund (XLC) performed flat, while the Technology Select Sector SPDR ETF (XLK) is the strongest outperformer of the analyzed references.

Author, using SeekingAlpha.com

While both stocks display periods of relative strength, GOOG reported massive resilience after every major drop, while META has significantly suffered after its All-Time-High [ATH] in September 2021, leading to massive value destruction for its investors, being priced at levels not seen since 2016. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer an interesting opportunity, while also assessing the possible risks in different scenarios.

Valuation

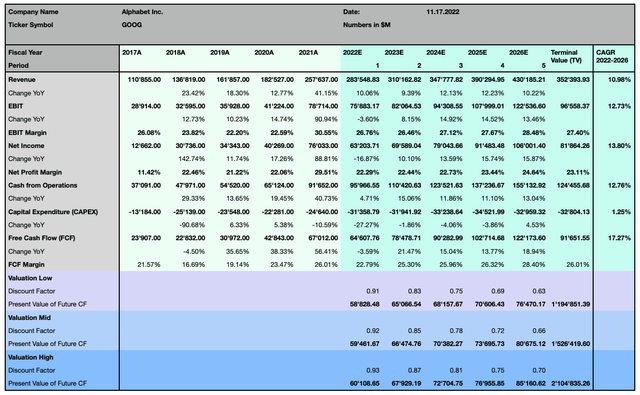

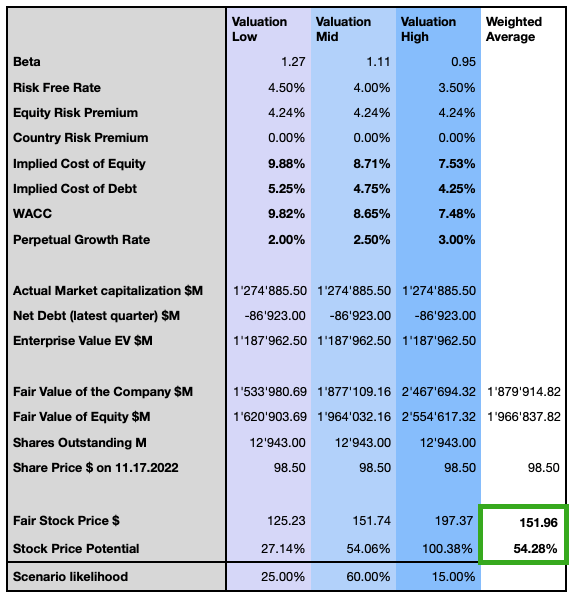

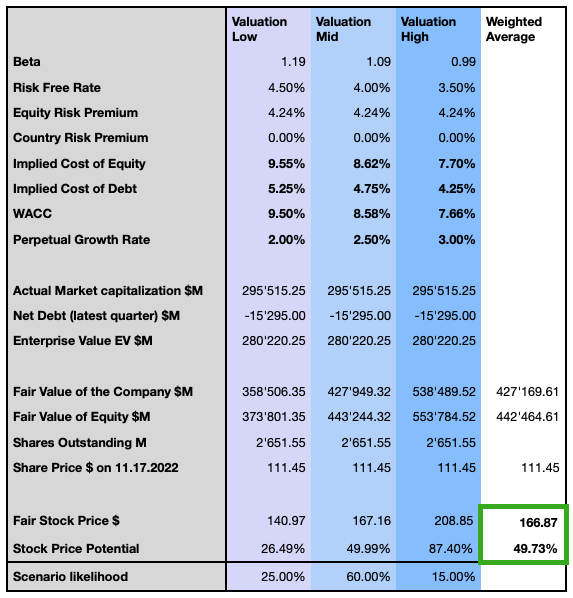

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow [DCF] model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the WACC and the terminal value. As forecasted by the street consensus, Alphabet is anticipated to generate a massive 17.27% Free Cash Flow [FCF] CAGR over the coming 5 years, with its operating and net profitability increasing at respectively 12.73% and 13.80% CAGR, while its revenue is projected to expand at solid 10.98%, above the expected growth in the relevant industries.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be significantly undervalued with a weighted average price target with about 54% upside potential at $152.

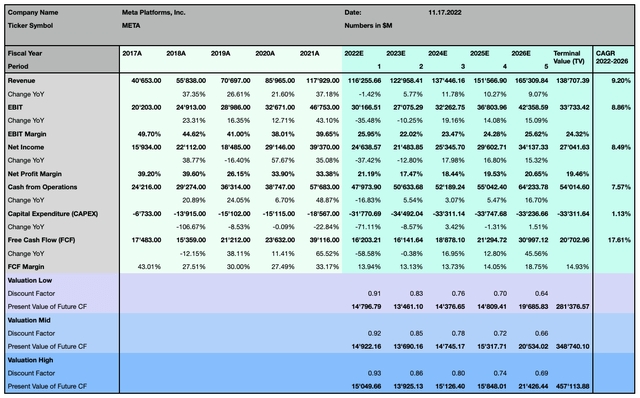

Meta is forecasted to expand slower, with its sales growing at 9.20% CAGR over the next 5 years, and its operating and net profit margins are expected to grow between 8.5% and 8.9%, in terms of FCF the company is anticipated to substantially increase its metric, with 17.61% CAGR through 2026.

Author, using data from S&P Capital IQ

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

Author

Despite both stocks seemingly being undervalued, when considering the weighted average price target, the two modelizations suggest that GOOG may offer a higher expected return, while META’s expected performance is seen 50% higher than the latest closing price, or at about $167. Both modelizations emphasize the still substantial expected return, also in the less optimistic scenario.

Investors should consider that those forecasts are based on a relatively conservative assumption in terms of perpetual growth rates, higher discount rates, and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and Risk discussion

With both companies having tremendous possibilities to expand their powerful product ecosystem, it’s quite difficult to estimate their relevant total addressable market [TAM], as both peers have shown to be able to significantly grow their business either organically or through strategic acquisitions. Alphabet and Meta own strong brands with Google ranked in the fourth position in Interbrand‘s Best Global Brands, while Facebook is ranked 17th. Google’s essentially monopolistic position in search engines, its gigantic database with no equal data-harvesting worldwide, and the dominant position in the smartphone industry with Android estimated to hold a share of 72% in the mobile operating systems’ market, while Apple is progressively gaining market shares, are only some of the company’s major strengths. Despite this, with approximately 80% of its revenue originating from income related to advertising, the company’s revenue model is highly exposed to demand fluctuations, and with a recession likely seen coming in major global economies, dropping consumer spending and cuts in expenses on advertising, will likely have a tangible negative effect on the company’s results. Privacy concerns and regulatory pressure, as well as data security, are also possible future threats to Alphabet, Meta, and their peers, as the biggest strength for the companies, the massive data collection, is the most damaging weakness for their users. Among Alphabet’s most promising opportunities I do like to underscore the company’s positioning in terms of Artificial Intelligence [AI], Machine Learning [ML], and cloud-based business, as well as its expansion into the wearable OS market, and the great diversification opportunities the company could access or create through its colossal financial strength.

Meta is building a strong product portfolio including WhatsApp, Instagram, Messenger, Oculus, Workplace, Portal, and Calibra to diversify from Facebook and create expanded opportunities in strong secular trends. With over 45% of the world’s population using Facebook or its family products, the company holds an extremely powerful and irreplaceable position. But with approximately 98% of revenue originating from advertising, Meta is even more exposed to demand-driven fluctuations than Alphabet, and since the company is massively investing and focusing its resources on developing its visionary Metaverse, the diversification opportunities are, at least for the moment, seemingly more limited than Alphabet’s. Facebook has been losing popularity after facing backlash over its negligence in protecting the user’s privacy, while negative publicity, allegations of racial basis, or the platform’s inability to control the spread of fake and misleading information, may have cast a shadow on the company’s once brighter outlook. Despite this, Meta faces many opportunities in terms of possible monetization of its platforms through paid services such as news subscriptions, peer-to-peer marketplaces, online dating apps, e-wallets, or the development of other hardware devices, while its existing technologies could also be integrated or connected with a variety of other applications, such as e-commerce, gaming, or expanded into the digital creators’ space, or by offering remote-work solutions. In terms of future-oriented secular growth vectors, Meta has extensive expertise in AI and ML, which the company could use to penetrate markets such as the technologies used for autonomous vehicles, where other competitors like Google, Amazon, and Apple are already massively investing.

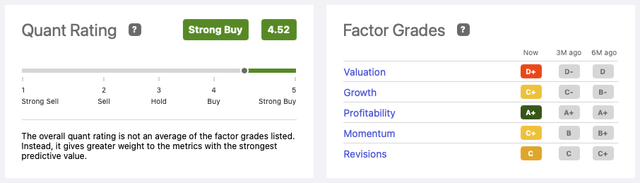

Alphabet is rated with a Strong Buy rating from Seeking Alpha’s Quant Rating since August 25, 2022, and holds the first two positions in the Interactive Media and Services industry through its two share classes.

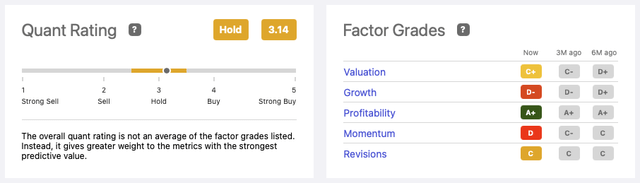

Meta has instead been qualified as a Hold position since the end of 2021 and is ranked 22 out of 62 in the relevant industry. Both companies are without seen excelling in terms of profitability, while growth and valuation seem to be less favorable factors in the actual uncertain market environment, with Meta also significantly suffering from the negative momentum in its more recent price action.

The Verdict: Which stock is the better buy?

The two analyzed companies are two global leaders in the technology services industry, with their respective strengths and weaknesses, but also offering inherent opportunities with their correlated risks. From an investor’s point of view, it’s important to consider the company’s ability to create value for its shareholders, while minimizing the risks. Past performance is not a guarantee for future results, and despite GOOG overall performing significantly better than META in the past few years, the latter is seemingly offering great opportunities ahead, and my rather conservative modelization hints at the significant undervaluation of both stocks. Both companies have strong financials and report high profitability, but Alphabet is seemingly on a better path, as the company reported an overall better trend and is expected to optimize its profitability even further, while also owning a massive idling cash position that offers incredibly many options, and could even further increase the company’s already superior capital allocation efficiency. Meta’s huge bet on the Metaverse may lead to great success, but it also bears a major risk, in times when the company’s great dependency on advertising spending is under pressure. While both companies’ Achilles heel is seemingly their dependency on spending in digital advertising, Meta is more reliant on it than Alphabet, and may also have shown less intention to diversify its revenue streams, when compared to its colossal peers. I consider both companies as being a buy position for long-term oriented investors, but overall in this comparative analysis, I chose Alphabet as my favorite stock pick, for its preeminent opportunities and lower risk profile, while seemingly also offering the greater potential in its stock performance, when considering all three forecasted scenarios.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment