Kevin Dietsch/Getty Images News

Warner Bros. Discovery (NASDAQ:WBD) reported its much anticipated second-quarter results last week and has done so for the first time as an independent streaming and entertainment giant. Management came out with numbers that disappointed investors and analysts alike, missing estimates and downgrading guidance across the board in what can be described as a terrible quarter for the newly merged entity.

The company appears to be starting off from a much less favorable position than initially anticipated as legacy Warner Media projections failed to properly materialize, amid a clearly more challenging macroeconomic environment and ongoing broader industry headwinds. As a result of the horrible quarter, the stock was beaten down heavily during Friday’s trading, losing 16% of its value and ending the day trading at $14.60, which made it the largest decliner in the S&P500. The disastrous results ended weeks of positive stock movement and practically erased all of the stock’s July gains. Shareholders brace for what might end up being weeks and months of uncertainty on the trading floor as the Monday opening bell approached.

Disappointments across the board

Earnings reported on Thursday last week by Warner Bros. Discovery were a disappointment across the board, with the company missing on top and bottom line expectations and significantly downgrading guidance at the same time.

The streaming and media giant reported quarterly revenue of $9.83 billion and a net loss of $3.42 billion ($1.50 per share), both falling below analyst expectations. The loss notably also included $1.0 billion in restructuring charges and $983 million in expenses related to the transaction and integration of the companies. Furthermore, EBITDA generated for the quarter was $1.74 billion, while free cash flow remained at $789 million.

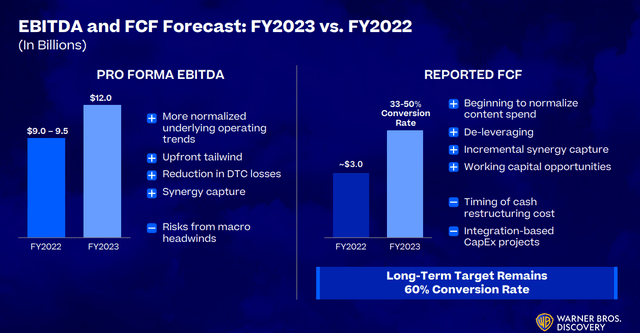

The most problematic part of the earnings was related to the downgraded EBITDA and FCF projections for 2022 and 2023. As disclosed in the May merger presentation from last year, the newly formed company was initially expected to generate roughly $12.0 billion in EBITDA for 2022 and $14.0 billion in EBITDA for 2023, while at the same time managing an EBITDA to free cash flow conversion rate of somewhere in the range of 60%.

EBITDA and FCF Forecast (WBD Q2 Earnings Presentation)

With the company down-shifting its full-year estimates, Warner Bros. Discovery now expects an adjusted EBITDA of $9.0 billion to $9.5 billion in the “transition year”. Looking to 2023, the company cut its full-year EBITDA guidance from $14.0 billion to “at least $12.0 billion.” The new forecast now sees the company generating roughly $3 billion in FCF for 2022 and $4.0-$6.0 billion in FCF for 2023, which represents a significant downgrade from initial projections, especially given the $53 billion in gross debt the company has to aggressively pay down.

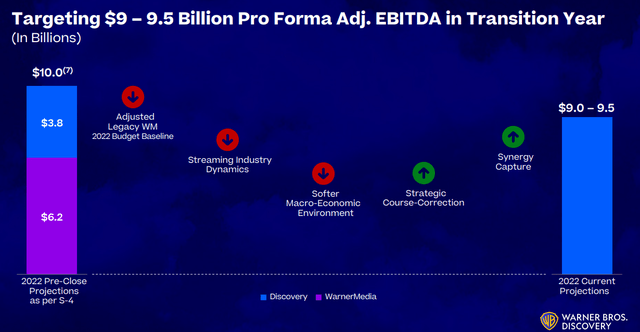

In other words, the second quarter results have left much to be desired as management shifted the blame for the lackluster performance to three distinct factors:

- Inadequate legacy WM projections from the days of AT&T’s management.

- Streaming industry dynamics and broader headwinds

- A degrading macroeconomic situation

Guidance Adjustments (WBD Q2 Earnings Presentation)

Having concluded this process, we determined that certain legacy WarnerMedia budget projections that were made available to us prior to closing, varied from what we now view as legacy WarnerMedia’s budget baseline post-closing. On taking a deep dive in pressure testing, what we found, our assessment has resulted in lower EBITDA projections. Specifically, we identified a number of approved investments and foregone revenue in various parts of the business that, when taken together, impacted full year 2022 EBITDA by roughly $2 billion. Some examples of these business decisions include: number one, significant reductions in external content sales. As part of a corporate initiative to prioritize HBO Max growth globally, new content licensing deals to third parties were largely halted and content was, in general, made exclusive to HBO Max. This is, of course, an upside opportunity over time as we ramp initiatives back to a balanced level of monetization depending on relative value contributions.

Gunnar Wiedenfels, CFO – Q2 2022 Earnings Call

While the results remain overall disappointing across the board, management’s early execution in capturing synergies and limiting the damage caused by the three factors brings back a lot of confidence. Over the past couple of months, the headlines have been full of groundbreaking and sometimes borderline unpopular news resulting from the newest shakeups within the organizational structure and changes in WBD’s business philosophies. The decision to shut down CNN+, a $300 million project just weeks after its launch, has been one of the early signs that the new management truly means business. Strategically shifting from the “political advocacy” approach and positioning CNN as a “news first” organization has been a difficult and politically sensitive decision.

More recently, in the upcoming days before the earnings release, management decided not to release the upcoming Batgirl movie, which was initially planned to be streamed on HBOMax. After a test screening that by no means went well, management opted to shelve the $90 million budget movie and take the tax write-off. A similar fate has been bestowed upon The Wonder Twins, another costly direct-to-streaming movie that ended up getting shelved in May. This is a part of a broader strategy of management moving away from the direct-to-streaming model and focusing more on theatrical, as management considers the former a subpar business approach.

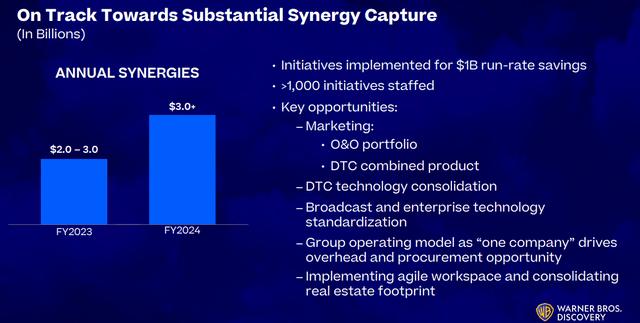

Another straightforward positive from the earnings was the management’s reassurance of being able to capture “at least” $3 billion in synergies over the course of the next two years. While initiatives already implemented brought forward more than $1 billion of run-rate savings, management expects the majority of the $2.0-3.0 billion synergy realization to occur next year but also left the door open to achieving more than $3.0 billion in synergies afterward.

Synergy Capture (WBD Q2 Earnings Presentation)

We have already implemented initiatives totaling more than $1 billion of run rate impact. This will grow from this point, the opportunity to implement transformational change across the global organization is enormous, and we’re being thoughtful about its prioritization and cadence. Individual initiatives range from direct merger-related opportunities such as consolidating our real estate footprint against hybrid and agile work environments to opportunities tied to David’s operating philosophy as one integrated company. The latter opens up tremendous transformation potential along systems integration, process harmonization and importantly, optimize utilization of our O&O promotion and advertising potential. I am very pleased with how well the program has progressed so far and based on the savings potential in our initiative funnel, I have full confidence that we will expect at least $3 billion of synergies overall, with $2 billion to $3 billion of synergy realization in 2023. Naturally, we will update the market regularly as certainty on value and timing increases.

Gunnar Wiedenfels, CFO – Q2 2022 Earnings Call

The Streaming Segment

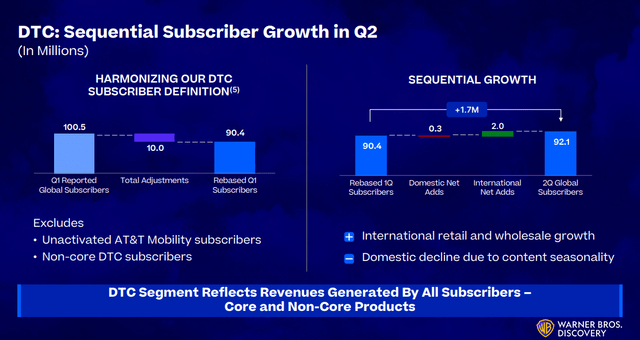

The combined company managed to grow its subscriber base to 92.1 million subscribers at the end of the quarter. This quarter they have managed to add 1.7 million additional subscribers, as compared to the 90.4 million subscribers the company reported in the first quarter. The big elephant in the room here is that the numbers are not really adding up.

As many might recall, the reported first-quarter results were limited only to the Discovery side of the business, due to the transaction still not being fully finalized. As a result, we haven’t had any real combined subscriber numbers to go after, however, management did point out during the last quarter’s earnings calls that the two streaming services added 5.4 million net subscribers and were henceforth successful in passing the milestone of 100 million combined subscribers.

DTC Q2 Subscriber Growth (WBD Q2 Earnings Presentation)

The reason behind this is that the company brought forward a new more transparent system of tracking subscribers, which dealt with some of the long-rumored “non-existing” legacy AT&T(T) subscribers, mainly representing inactive subscriptions gained from AT&T mobility deals. Furthermore, this removes subscribers of MotorTrend, Eurosport Player, and similar legacy offerings. This still notably excludes a complete breakdown of the subscriber base, but that seems unlikely to happen until a joint streaming service is launched in the future.

Given their expected rate of growth, we can conclude that the adjustments set them back by roughly a year in terms of subscriber growth. While 10 million subscriptions is a big number to be skimmed off from what many still perceive as the paramount industry metric, a more transparent approach and a clean sheet in terms of growth are much appreciated in our view. In addition to this, management also reported a subscriber overlap between the two services of 4 million, which amounts to slightly more than 4.3% of the total number of subscribers.

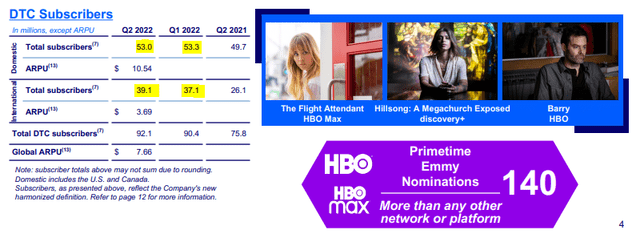

Another issue that can be viewed as a red flag is that domestic subscriber growth has stopped and the company has lost 300 thousand subscriptions in the U.S. and Canada, which is possibly a sign of households reigning down discretionary spending in the ever increasingly difficult economic situation we find ourselves in. International growth on the other hand still remained strong as the company added 2 million subscribers in Q2, ultimately landing an impressive 22% year-over-year growth. The growth levels in Q2 fall somewhat short of rivals such as Disney (DIS) or Paramount (PARA) but are nowhere near the struggle that Netflix (NFLX) is going through at this point.

DTC Subscribers Breakdown (WBD Q2 Earnings Presentation)

The undoubtedly good news, in our opinion, is that the final decision was made to combine the two services into one streaming option, which is supposed to be launched in the summer of next year. Until the joint service is rolled out, management has decided to introduce a content-sharing system between the two platforms, attempting to expand the appeal of individual services.

In terms of technology stacks moving forward, the decision was made to move ahead with the Discovery+ stack as the one to build the foundation for the combined streaming service. This decision seems almost like a no-brainer, with the overall consensus that lackluster technology was in fact pulling back HBOMax and was unnecessarily degrading an otherwise good service. For instance, the Discovery+ app represented a much more user-friendly experience and was as such rated 4.8/5.0 on Google Play and 4.9/5.0 on the App Store. In comparison, HBOMax has been rated 3.7/5.0 on Google Play and 2.8/5.0 on the App Store. It remains to be seen under which name the new service will become available next year, with something like “Max” possibly being the obvious choice, with the drawback of losing the recognizable HBO brand strength in that sense.

Single Global Service (WBD Q2 Earnings Presentation)

We will roll out our new combined offering under a single brand and we will have more to share closer to launch. On the product side, we recognize that both of our existing products have shortcomings. HBO Max has a competitive feature set, but has had performance and customer issues. Discovery+ has best-in-class performance and consumer ratings, but more limited features. Our combined service will focus on delivering the best of both, market-leading features with world-class performance. To deliver this, our team has developed a clear road map to migrate onto one tech stack, leveraging much of the core infrastructure of the highly rated Discovery+ service with significant and important feature enhancements from the more established HBO Max.

Jean-Briac Perrette, CEO of GS&G – Q2 2022 Earnings Call

With the way their content pipeline is set up, we can see the streaming service garnering significant traction in the last two quarters of the year, creating a situation where we comfortably expect the company to generate stable subscriber growth and surpass 10 million added subscribers added for the year. Given macroeconomic headwinds and the state in which the industry finds itself today, this remains a huge positive on our books.

Debt and deleveraging

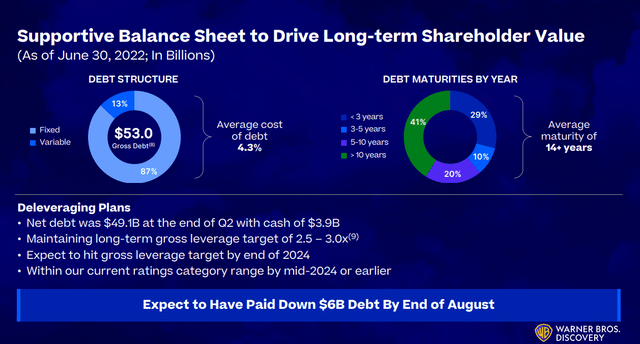

The most important issue facing Warner Bros. Discovery and the one thing everyone had their eye on during the earnings call was how well the newly formed company tackled the matter of debt. Deleveraging remains a key focus for management as the newly formed entity inherited $56 billion in debt when it went public in April.

The company ended Q2 with $3.8 million of cash on hand, and gross debt of $53.0 billion, resulting in net leverage of 5.0x. More keen observers will note that the net leverage ratio has in fact moved to the other end. Once again, this is not really directly comparable to Warner Bros. Discovery’s first quarter reported numbers, when Discovery reported net leverage of 2.7x. During the April call, Wiedenfels reported that the company was starting from a much more comfortable position of a 4.6x net leverage.

Opening leverage as a consequence of this, while still dependent on working capital adjustments that have yet to be finalized is likely to be a notch higher, now estimated around 4.6 times give or take and still well below the initially modeled 5 times.

Gunnar Wiedenfels, CFO – Q1 2022 Earnings Call

Zaslav and the rest of the leadership team initially established a long-term gross leverage target of 2.5 to 3.0x as one of the top priority goals. That goal, while described by many as overly ambitious, has been reiterated in spite of the rather problematic quarter the company faced. Management still believes it is able to hit the gross leverage target by the end of 2024 and plans to dedicate virtually all free cash flow generated to debt reduction until then.

Debt Structure (WBD Q2 Earnings Presentation)

As noted prior, the recently concluded upfront is a timely example of just that. Despite the more challenging macro environment, we’re very pleased with our performance, which proved the enormous value of our content portfolio to our advertising clients and as a differentiated means to service brands. Out of the gate as a combined company, we have been focused on debt pay-down and I am pleased to report that by the end of this month, we will have paid down $6 billion of debt since closing the transaction.

Gunnar Wiedenfels, CFO – Q2 2022 Earnings Call

Most of the $53.0 billion of total debt WBD had on its books at the end of Q2 was long-term with an average maturity of more than 14 years and a 4.3% average interest rate. Even more important, interest rates for the majority of the debt are fixed. Only 13% of the debt carries a variable interest rate. The repayment schedule remains another positive in our view, with “only” $5.3 billion of debt maturing until the end of 2024. The company has no payments due in 2022, $1.3 billion due in 2023, and $4.3 billion due in 2024.There was a very interesting quote from the CFO, Gunnar Wiedenfels during the earnings call where he revealed his expectation that net leverage should be approximately 4.8x at year-end. Considering the fact we are already aware of the $9.0-$9.5 EBITDA projection for the year, with some back-of-the-paper math, we can conclude that Wiedenfels believes WBD will be successful in further lowering net debt to roughly $44 billion by year end. The average interest rate on the $53.0 billion of total debt is 4.3%, which comes down to approximately $2.2 billion in yearly interest payments, or $550 million in interest expenses per quarter. For the quarter ended June 30th, Warner Bros. Discovery reported paying out $510 in interest expenses, a number that is only going to come down considering the aggressive deleveraging. For example, with the $6 billion of debt paid down, almost $250 million in interest payments per year are being “saved”. Overall, after having a chance to go through the numbers and tune in on the earnings call, we have become much more comfortable with the current state of the balance sheet.

Final thoughts and conclusions

Ultimately, we believe that the current financial performance of the company is not necessarily indicative of its underlying health, the strength of its assets, or its future potential. Rather it is only reflecting how management is starting from “a less favorable position” than initially expected. In spite of the obviously disappointing results, strong management focuses on capturing synergies, timely course corrections, and properly positioning the new company in a market that distrusts the streaming business model more than ever has likely saved shareholders from a lot of headaches. Furthermore, we cannot escape the conclusion that management, after realizing the difficulties they were facing, decided to hit the brakes and reset expectations to the minimum, effectively presenting us with “kitchen sink” quarter results. As a result, we expect the worse to be over and the situation to start gradually improving from this point on, especially as we get into the second part of 2023 and beyond, with the majority of the issues surrounding the merger slowly cleared up while the synergies properly materialize. The second-quarter earnings call was more than a two-hour-long exhausting affair, but it’s one that goes well beyond financials and dives into management’s long-term strategy and business philosophies. Zaslav and the rest of the team took more than a couple of both indirect and direct shots at industry-leading rival Netflix and their business model, highlighting at length the differences in the two philosophies and business approaches. This is an interesting topic we would hope to cover at length in a different article, but the essence of it is that Warner Bros. Discovery is going to position itself in the business almost as an “anti-Netflix”. Management recognizes streaming as a key driver of growth and a critical component of business, but in their view, it still remains only one part of the diversified approach and by no means an “all-in” game. In the end, it all comes down to how realistic one views management’s goals of properly bringing the two entities together and achieving $3B or more in cost synergies, as well as the question of the feasibility of the aggressive deleveraging process. If Zaslav and the rest of the team manage to execute this well enough, we can easily see a scenario in which the stock takes off in the second half of the next year.

Be the first to comment