KenWiedemann/iStock Unreleased via Getty Images

Introduction

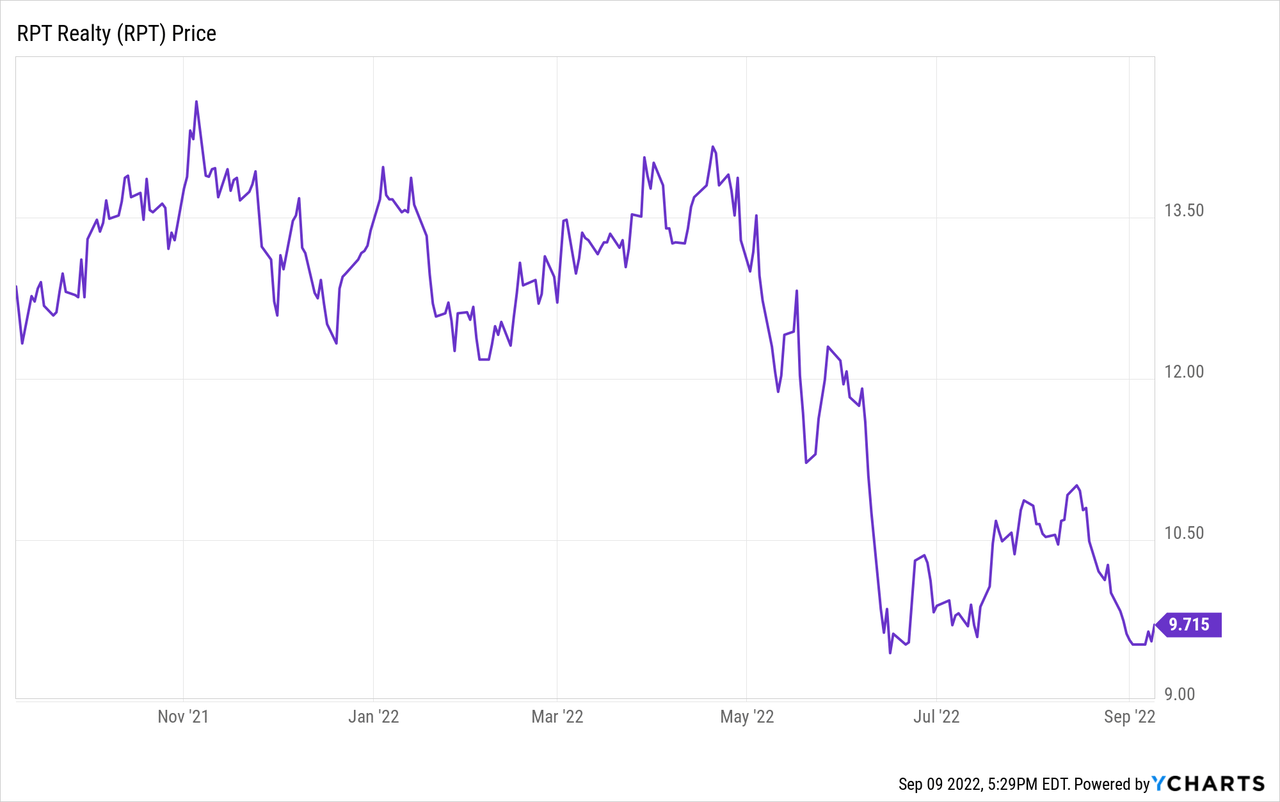

It’s been over a year since I last discussed RPT Realty’s (NYSE:RPT) preferred shares, which are trading as NYSE:RPT.PD. These preferred shares cannot be called by the REIT (and can only converted into common shares which would unlock an immediate 34% capital gain) and as the REIT is performing pretty well, I think the preferred dividend is quite safe. As the interest rates have continued to increase, the share price of these preferred shares has decreased to less than $49. That’s a 15% decrease and this has boosted the preferred dividend yield to just under 7.5%.

A look at RPT’s Q2 results

To figure out how interesting the preferred shares are, we first need to have a look at the performance of the REIT. The income statement provides us with ‘some’ information as for instance the Q2 EPS was just $0.06 given the $5.12M net income which includes the almost $1.7M in preferred dividend payments.

RPT Realty Investor Relations

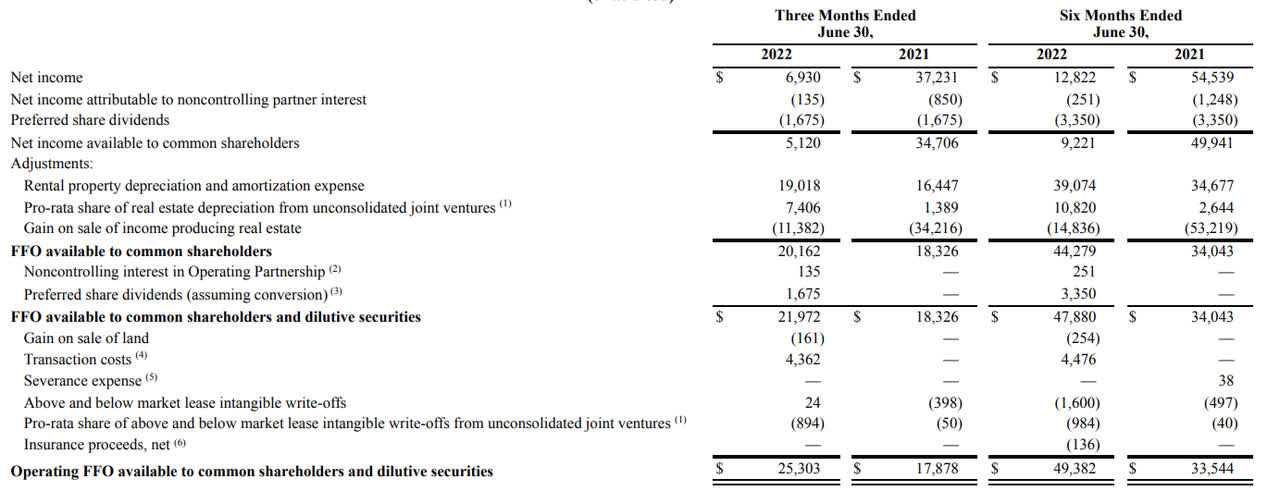

Good to know, but I’m obviously more interested in the REIT’s FFO calculation as the depreciation and amortization expenses are obviously weighing on the income statement but have no impact on the FFO.

RPT Realty Investor Relations

We see the FFO reported by RPT Realty in the second quarter was approximately $25.3M which is an improvement over the $24.1M in the first quarter of the year. The total FFO generated in the first semester came in at $49.4M. Keep in mind this does NOT include the preferred dividends yet. Because the preferred shares have a conversion feature (see later), RPT Realty has added the preferred dividends back to the FFO calculation. So the FFO per common unit was approximately $0.55 per share if I would exclude the pro-forma conversion (as there’s no reason why anyone would convert the preferred shares into common units right now.

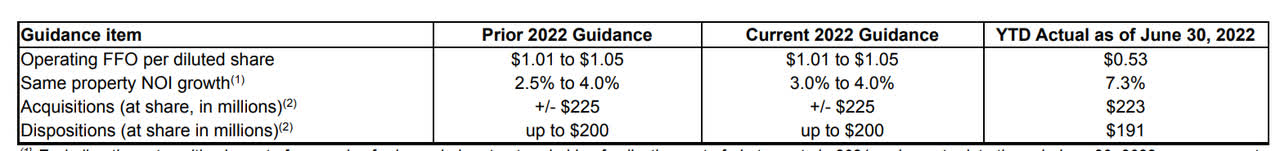

For the entire financial year, the REIT is guiding for a full-year operating FFO per diluted share of $1.01-1.05.

RPT Realty Investor Relations

However, I don’t think we should use the diluted share count exactly because the preferred shares (which account for the lion’s share between outstanding shares and diluted shares) are nowhere being attractive enough to be converted and even further away from the mandatory conversion. Excluding the impact from the potential but unlikely dilution due to the preferred shares, RPT’s FFO per common share will likely exceed the $1.05.

The terms of the preferred share and its coverage ratios

As a quick reminder, preferred shares have a 7.25% preferred dividend yield, resulting in a quarterly preferred dividend of $0.90625.

And as explained in my previous article:

An interesting feature is that there’s no call provision included in these preferred shares: RPT Realty cannot call these securities, but owners of preferred shares are able and allowed to convert them into common units at a conversion price of $14.41/share (each preferred share entitles the owner to convert it into 3.7962 common units).

This means that preferred shareholders can benefit from a run-up in the share price of the underlying units without running the same risks. The sole caveat is that RPT may force the conversion into common units, but can only do so after its common shares have been trading at in excess of 130% of the conversion price for 20 of any 30 consecutive trading days.

Using the $50 principal amount and the conversion rate of 3.7962, the conversion price is now approximately $13.17 which means RPT needs to trade at 1.30 * $13.17 = $17.12 before the REIT can call these preferred shares.

That means that if that would happen at exactly that price, preferred shareholders will receive 3.7962 shares valued at $17.12 each, putting the value of the preferred share at $65. This creates a no-lose scenario as long as the REIT doesn’t go bankrupt. Investors happily collect the 7.5% preferred dividends and could potentially get a 34% capital gain if the securities get called (which I don’t think will happen anytime soon).

We know from the FFO calculation that the FFO excluding the preferred dividends came in at $49.4M in the first half of the year. Including the $3.35M in preferred dividends, the FFO attributable to the common unit holders was approximately $46M and the preferred dividend coverage ratio was just under 1,500%. In other words, less than 7% of the FFO was needed to cover the preferred dividends. A very healthy low percentage.

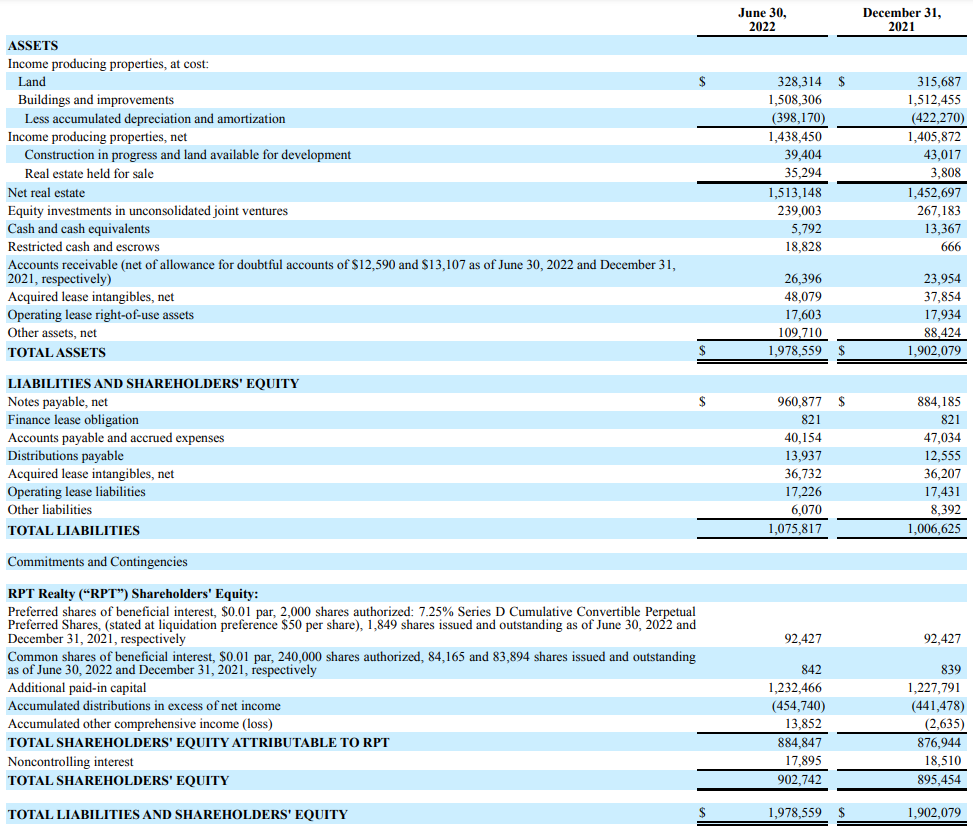

And looking at the balance sheet (see below), the preferred shares represent about $92.5M of the total equity value which stood at $885M. This means there is almost $800M in equity ranked junior to the preferred shares which also is a very healthy ratio.

RPT Realty Investor Relations

And we shouldn’t be too worried about the balance sheet in general. The almost $2B in assets are covered by $1.08B in liabilities and about $900M in equity. The gross debt level was approximately $961M as of the end of June but as the company had about $24M in cash and restricted cash, the net debt was just under $940M. While that sounds relatively high compared to the $1.75B in real estate and JV investments (this indicates an LTV ratio of almost 54%), keep in mind the $1.51B held in real estate already includes almost $400M in accumulated depreciation.

So I’m not worried at all about the REIT’s balance sheet and the relatively low amount of preferred equity outstanding means the preferred dividends and preferred equity value are very well covered.

RPT Realty Investor Relations

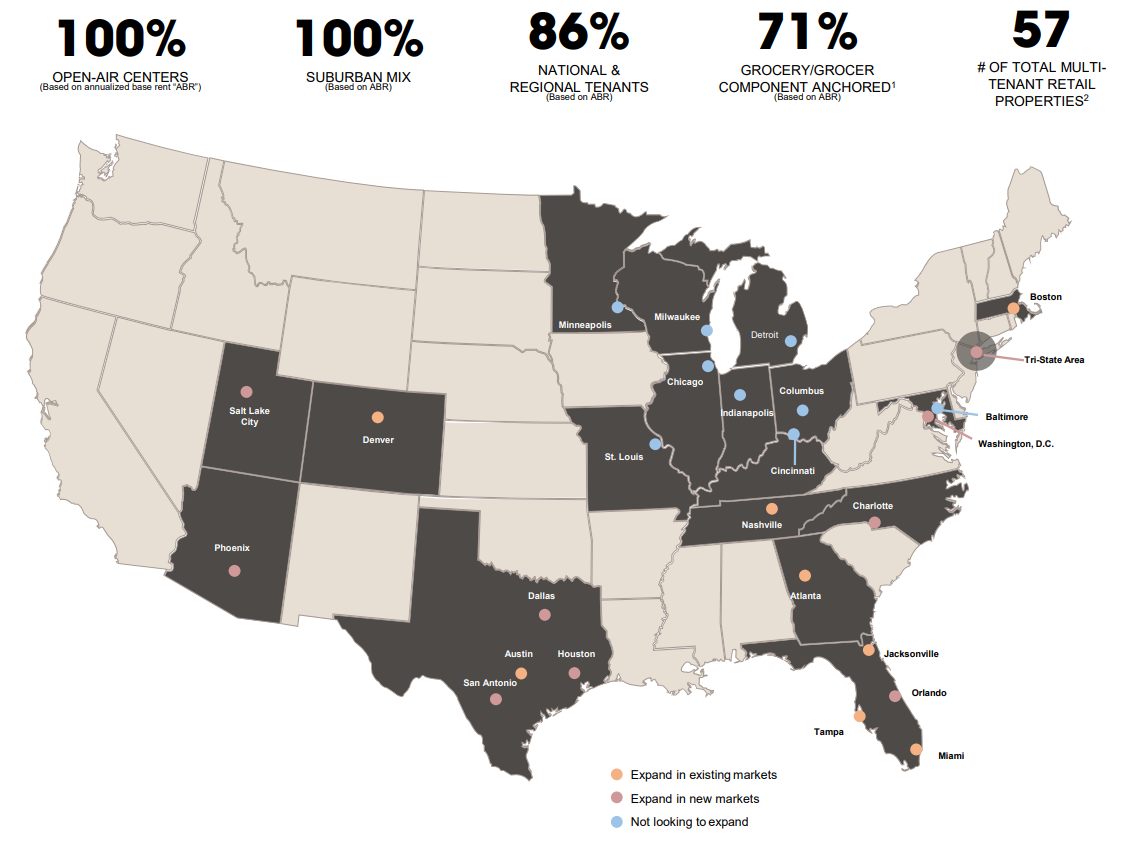

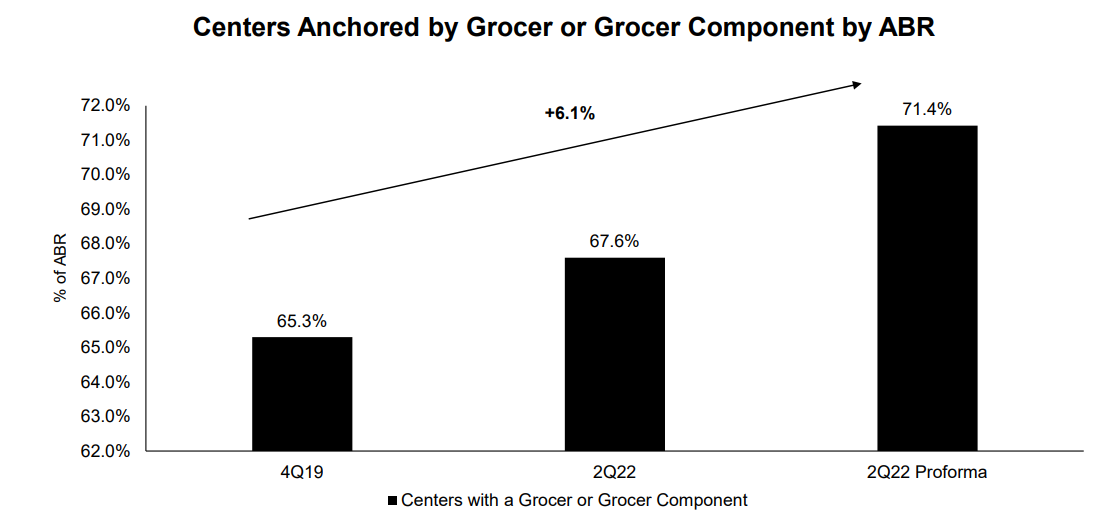

RPT Realty remains very active and subsequent to the end of the second quarter, RPT’s joint venture platform which focuses on grocery-anchored commercial real estate acquired the Mary Brickell Village property for $216M (of which $111M is payable by RPT for its pro rata stake in the asset). This acquisition will partly be funded by the proceeds from the sale of two assets to the same joint venture. RPT continues to invest in assets with a grocery-focused anchor tenant.

RPT Realty Investor Relations

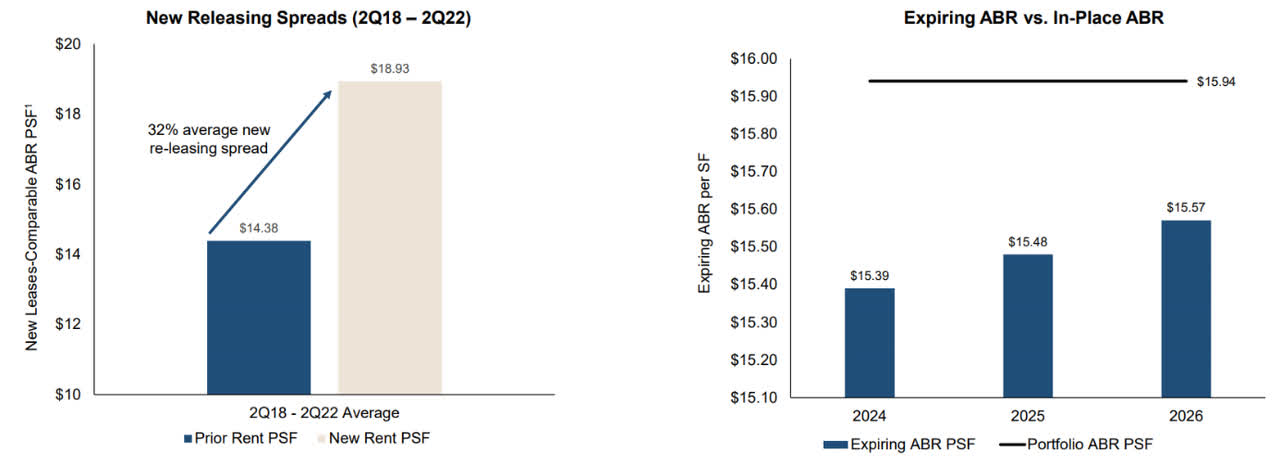

Additionally, leasing spreads are still healthy and I wouldn’t be surprised to see a further improvement in the rental income.

RPT Realty Investor Relations

Investment thesis

While RPT was recently highlighted by Mizuho when it cut its advice from ‘buy’ to ‘neutral’ because RPT has a higher exposure to a ‘discretionary’ tenant base, this doesn’t really matter for preferred shareholders. Even if RPT would have to take a 40% haircut on the value of its assets, the preferred shares would still be made whole.

I’m also getting quite charmed by the common units which are now trading below $10 for a P/FFO of approximately 9.5 which is on the lower end of the spectrum for grocery-anchored REITs. While I’m getting interested in the commons, the preferred shares are now a part of my (income-focused) portfolio as the almost 7.5% preferred yield now appears to be too good to ignore from a risk/reward perspective.

Be the first to comment