Luke Chan/E+ via Getty Images

First Commonwealth Financial (NYSE:FCF) recently entered into a definitive all-stock agreement to acquire Centric Financial Corporation (OTCPK:CFCX). Overall, I view the merger announcement as a step in the right direction – not only does the move add significant scale benefits to the FCF franchise but crossing the $10bn mark also removes a key overhang on the stock. From a strategic standpoint, the addition of Centric also offers FCF a foothold in attractive new markets via a commercial-oriented, branch-light model. Long-term, FCF gains an increased breadth of product set and capabilities as well, helping to facilitate the expansion of the consumer bank.

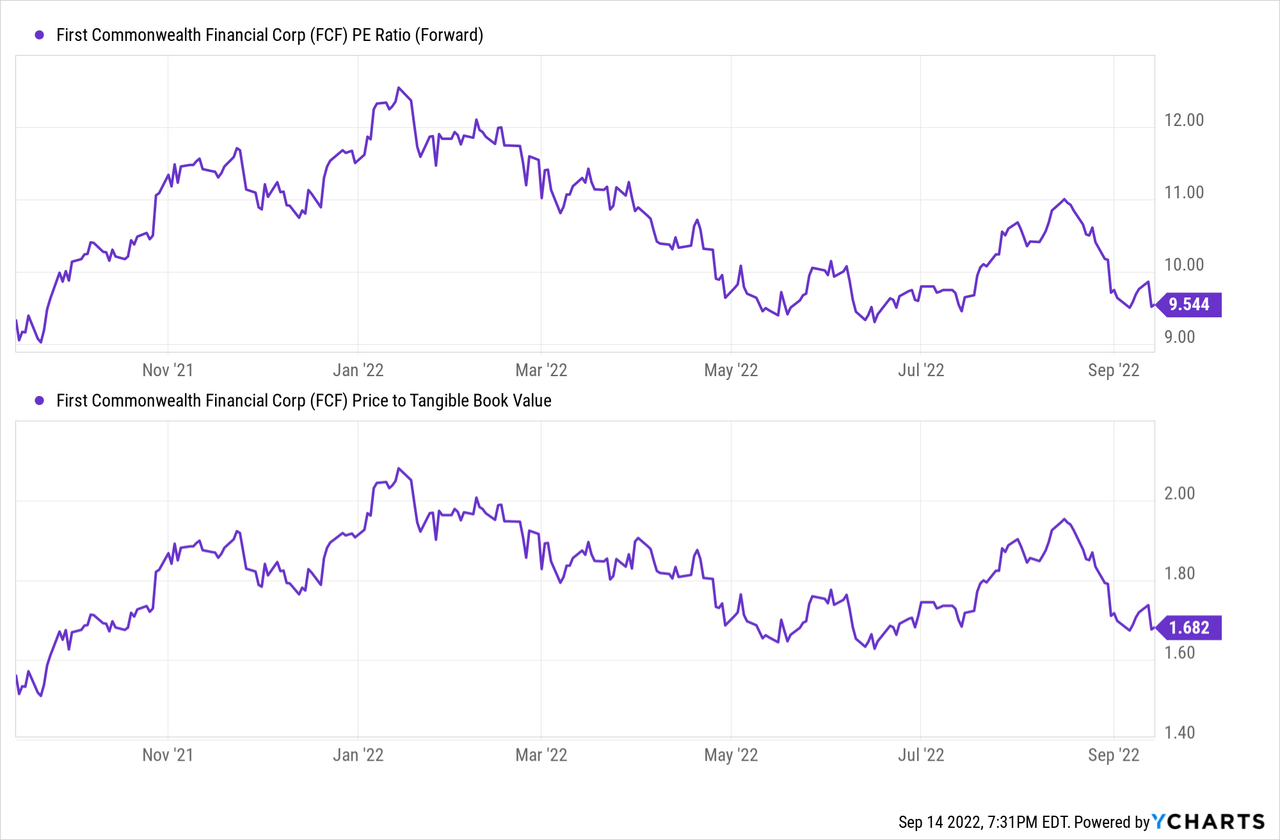

The stock has lagged on the M&A news, likely due to the limited cross of the ~$10bn asset threshold, offering investors an attractive entry point into the FCF story. Given FCF’s rate sensitivity, expect further Fed hikes to drive above-par returns and growth numbers in the coming quarters.

Centric Acquired in All-Stock Deal

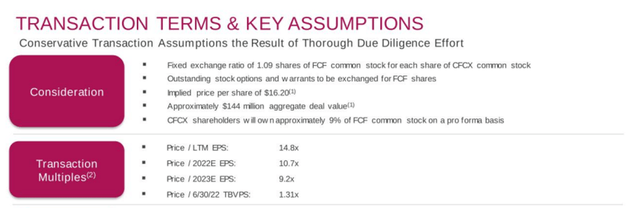

First Commonwealth’s recently announced ~$144m all-stock acquisition of Centric Financial (expected to close in Q1 2023) was a long time coming. Management has not closed a whole-bank deal in years, despite commentary consistently indicating their openness to M&A and ongoing conversations on potential deals. Yet, this deal is different in that it adds Philadelphia-focused bank assets – in contrast to prior expansion through M&A, which had largely been focused in Ohio, where FCF also generates most of its organic growth. While the transaction is sizeable, adding ~$900m in loans and deposits to FCF’s existing base, there remains ample room for more accretive deals within and adjacent to its markets ahead of the planned Q1 2023 closing.

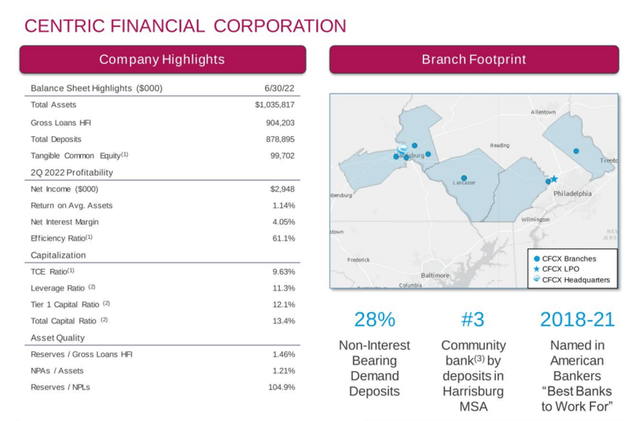

For context, Centric is a commercially-oriented bank founded in 2007 and looks to have a well-run set of operations through the years. Of note, recent returns have been impressive at a ROA of 1.15% and an ROTCE of 12%. A key part of its success has been its prime central locations centered around the Philadelphia capital, while more recently, growth has come from Centric’s expansion into suburban areas. As of its latest quarter, Centric Financial had ~$1bn in assets, ~$904m in loans, and ~$879m in deposits across its branch network. Its deposit base is particularly attractive, with an ~30% non-interest-bearing contribution driving a solid ~48bps funding cost (albeit ~15bps above FCFs). Finally, Centric’s loan/deposit ratio has also consistently stayed at ~100%, while its minimal net charge-offs highlight the underlying asset quality.

Reasonable Deal Pricing Supports Accretion Outlook

Valuation-wise, the transaction seems reasonably priced at a valuation of ~1.3x tangible book or ~9.2x fwd P/E. The all-stock nature of the deal (100% stock consideration of ~$144m at a fixed 1.09x exchange ratio) also allows FCF to leverage its stock as currency, given the ~1.8x P/TBV pre-announcement valuation. The transaction also includes an expected ~9.7m of new share issuance, implying an additional ~10% potential dilution to the current shareholder base.

On the flip side, cost savings opportunities are guided to be significant at ~35% of Centric expenses. Approximately 75% of cost synergies are guided to be unlocked in 2023, so the ~5% EPS accretion target in 2023 seems within reach, in my view. As the full extent of the cost synergies is fully phased-in, EPS accretion is set to reach ~7% by 2024. An important caveat – the realized EPS accretion could fall slightly short, as headwinds from the Durbin offset will total $6.5m in lost revenue in 2024 (and $13m in 2025). Overall, though, the assumptions seem reasonable, and given management’s track record of post-acquisition integration, I feel confident underwriting the current accretion targets.

A Strategic Addition to the Overall Footprint

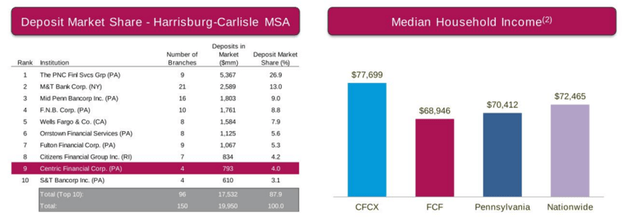

Strategically, the deal has clear advantages, including getting FCF into attractive growth markets in eastern Philadelphia. While investors might have been hoping for more consolidation in the Ohio region (vs. extending east), I would note the adjacencies of Centric’s markets to FCF’s existing footprint. Centric’s branches in East Philadelphia are particularly attractive additions, giving FCF exposure to faster-growth geographies such as Harrisburg and Lancaster. Plus, management commentary indicates opportunities in Ohio remain a focus, even if this deal builds FCF’s presence on the eastern front.

The other key strategic benefit here is that the addition accelerates FCF’s asset growth to the >$10bn threshold (the merged entity will have pro-forma assets of ~$11bn). Relative to organically growing past $10bn or doing a larger deal, pursuing an accretive deal with Centric makes a lot of sense, in my view. For one, no material incremental expense will be required. Additionally, the ~$1bn of assets in the Harrisburg/Southeastern Philadelphia markets could pave the way for additional deals to further offset lost Durbin income. In the meantime, Durbin is unlikely to be an issue until 2024, as the near-term impact of Durbin (pegged at ~$13m through 2025) will be offset by ~$24m of contribution from the target (after cost saves), as well as equipment finance lending.

M&A Strategy Continues with Centric Acquisition

With the latest acquisition of Harrisburg, PA-based Centric Financial Corporation, FCF has signaled its intent to opportunistically expand into faster-growing markets, adding a significant loan and deposit base, as well as a strong return profile. Strategically, Centric provides FCF with an efficient way to cross the Durbin threshold while also expanding the footprint into new markets with favorable demographics. In total, the deal consideration represents a >40% premium over Centric’s pre-announcement closing price (based on a 1.09x fixed exchange ratio), although the P/TBV multiple is reasonable at ~1.3x (per disclosed financials).

Coupled with management’s disciplined track record (six transactions out of sixty M&A opportunities over the last seven years), I see more acquisitions beyond Centric as a major long-term positive for the growth trajectory. Net, FCF’s strong fundamentals and its leverage to future rate hikes keep me positive on the organic outlook for the company, while more attractive acquisition opportunities offer incremental upside from here.

Be the first to comment