Justin Sullivan

Rivian’s (NASDAQ:RIVN) mixed Q3 earnings report and production guidance reaffirmation bode well in the wake of peer Lucid’s (LCID) weak report which saw an over 8% drop in pre-orders. Although Rivian’s revenues came up slightly short of estimates, pre-order growth remained robust as deliveries look set to soar over 230% in FY23 as a second production shift can fully optimize and contribute significantly to growth. Even so, given the high likelihood for losses to continue in excess of eight quarters as gross profit remains deeply negative, shares remain a hold even as valuation inches closer to attractive levels. More visibility on the supply chain front and continual robust delivery growth over the next two to four quarters would reflect positively as other automakers still face supply chain/growth challenges.

Q3 Production Solid, Reservation Growth Robust

Rivian’s posted a 67% increase in production to 7,363 vehicles during Q3, bringing YTD production up to 14,017 vehicles as Rivian ramped its R1S and RCV lines and added a second manufacturing shift to further boost production.

Deliveries rose over 47% q/q to 6,584 units, and a transition to rail from outbound freight transport likely left about 400 to 600 vehicles in transit at the end of Q3, providing a small boost to Q4’s figures.

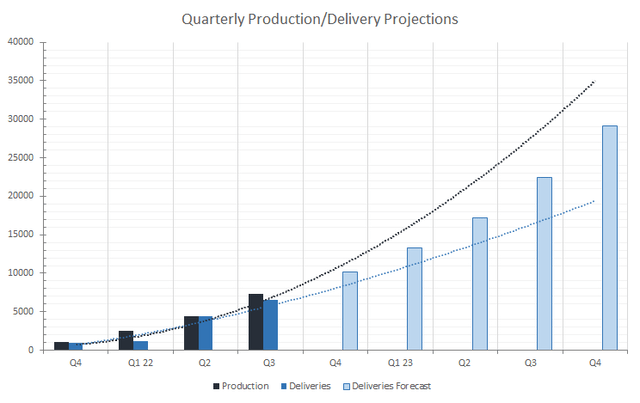

Moving forward, the addition of a second manufacturing shift along with a demonstrated ability to scale so far signal continued strength ahead in 2023 as operations can streamline and production can optimize across the two shifts to boost output. Q4 will be a more telling quarter to determine if supply chain and other adverse impacts prevent Rivian from reaching its targeted 25,000 unit production volume.

Given that Rivian already increased production by ~3,000 units sequentially in Q3, having a full quarter for the second shift to take effect is likely to take production slightly higher, to about ~11,000 vehicles in the quarter. Reaching such a volume would meet Rivian’s annual production target, a sign of strength in the luxury OEM bracket as rival Lucid has already cut production output significantly to just 6,000 to 7,000 units this year.

Initial projections for 2023 appear generally positive, with Rivian’s current ramp looking to support strong y/y growth in deliveries — currently placed at ~236% to 82,000 vehicles in a bull case scenario. While the upper bound of projected volumes does reach 35,000 by Q4 2023, it’s quite unlikely that Rivian reaches those volumes, even with the capacity to support such levels. A base case scenario (blue line) projects deliveries end the year around 20,000 per quarter, reaching about 61,500 during 2023, or +155% y/y growth. A bear case scenario projects about 48,000 vehicles, with minimal q/q growth should supply chain issues or other unexpected adverse impacts arise that would challenge production.

Supporting a rapid growth in deliveries in 2023 is a robust pre-order book. Rivian reported over 114,000 pre-orders as of Q3, compared to over 98,000 in Q2. Pre-orders grew +16.3% for Q3, a strong uptick when compared to Q2’s +8.9% sequential growth rate from Q1’s 90,000 tally. The luxury car market remained strong, reaching ~18% of new car sales in the US, up from about 17.3% in September last year; for example, BMW (OTCPK:BMWYY) reported a strong Q3 performance as US sales rose 3.2%. Sustained strength in the luxury market even as new vehicle prices rise and as vehicle loan rates surge serves as a tailwind for 2023’s performance.

ASPs Dip Slightly, But Remain Strong

Digging in to Rivian’s quarterly deliveries and revenues show that ASPs remain strong, with its pre-order book now worth about $9 billion.

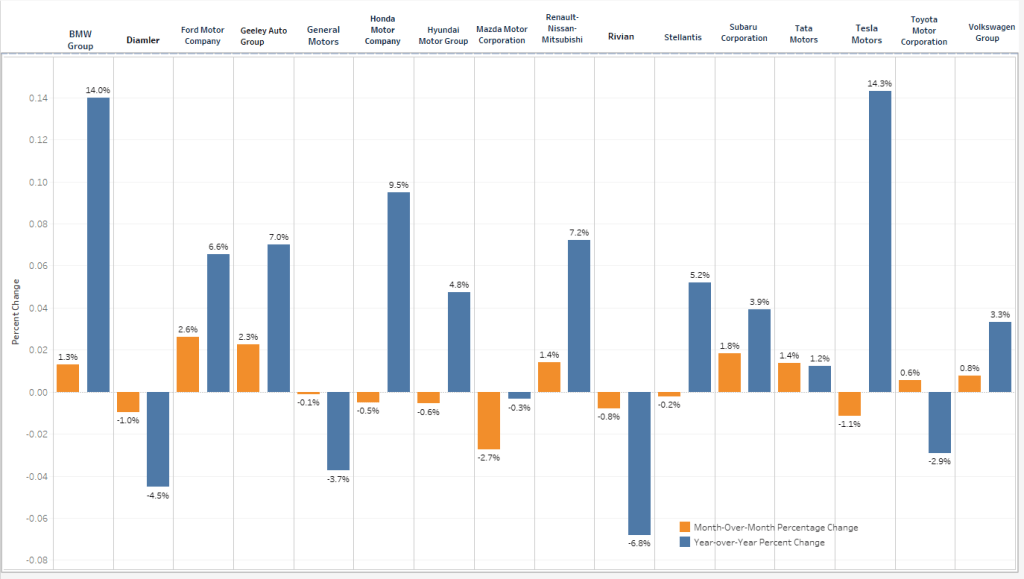

ASPs in Q1 were approximately $77,424, growing +5.2% to $81,478 in Q2. ASPs dipped slightly q/q in Q3 to approximately $81,409, but still remained elevated relative to the beginning of the year. Cox Auto is pointing to a -0.8% m/m change and a -6.9% y/y change in Rivian’s prices in October, which is a bit of a continuation in the trend in ASPs so far; however, Rivian’s pricing still remains strong, and ASPs should still remain above $80,500 in Q4.

Cox Auto

With the Adventure models of the R1S and R1T retailing for $78,000 and $73,000 respectively, Rivian’s ASP suggest that consumers are either adopting the higher trims, or selecting different customizations and add-ons, thus raising the price. Compare this to Lucid, albeit in a slightly different luxury segment with its Air sedan — Lucid is seeing pre-orders drop as ASPs also drop, suggesting new customers are selecting base models with limited additions while existing customers may be less willing to wait as production has struggled to scale.

Rivian is currently stating online that deliveries for new pre-order reservations will commence in late 2023, suggesting a ten to twelve month backlog at the moment. This correlates with both the production schedule and ramp, and also hints at a possibility for stronger-than-expected production given that upgrades and the second shift pave the way for capacity to expand from 150,000 to 200,000 vehicles by late 2023.

Not A Rich Valuation, But Risks Do Exist

In the near-term, challenging macroeconomic conditions, rate hikes and a higher terminal rate, persisting chip shortages, along with the threat for unexpected supply chain and/or logistics disruptions from a range of factors (strikes/lockdowns/weather/etc.) put major pressure on Rivian to execute. Missing production targets or guiding production lower than expected in 2023 would serve as a headwind to shares, given a richer valuation at approximately 8.5x 2022 revenues and 2.5x 2023 revenues.

Rivian trades at nearly half of battered-down Tesla’s (TSLA) 5.0x forward revenue multiple, which holds an enviable market share as a first mover in the industry along with strong margins and profitability. Rivian, on the other hand, recorded a -171% gross margin on $1.7 billion in net losses. Even with $13.8 billion in cash, Rivian is burning through billions to scale production, leading to a small risk of dilution in 2023 and 2024.

Lucid trades at over 6x 2023 EV/revenues, while Chinese EV manufacturer NIO (NIO) trades at just under 2.0x as geopolitical risks are on high alert. Rivian is not immune to downside even as shares have fallen over 70% YTD to a similar valuation to NIO and other beaten-down EV makers. Hints of declining production, slowing or reversing growth in pre-orders may result in a re-rating down to 1.6x forward revenues, or about 20% downside, especially as losses are expected to remain outsized for at least eight quarters.

Outlook

Rivian’s mixed Q3 report highlighted some strengths in production scaling as pre-orders recorded robust sequential growth. Losses continue to mount and gross margin remains deeply negative, as expected as the startup aims to scale rapidly. Initial projections for Q3 volumes, based on relatively stable chip supply and synergies stemming from starting a second production shift, place a bull case delivery forecast at ~82,000 vehicles for about $6.5 billion in revenues. Although Rivian’s valuation is not necessarily the most expensive compared to peers, execution risk remains, as rivals like NIO and Lucid have shown some difficulty over the past few months in scaling deliveries. The positive read-throughs from Q3’s report do not quite look like enough to spur a rebound in shares, leading to shares being rated at ‘hold.’

Be the first to comment