krblokhin

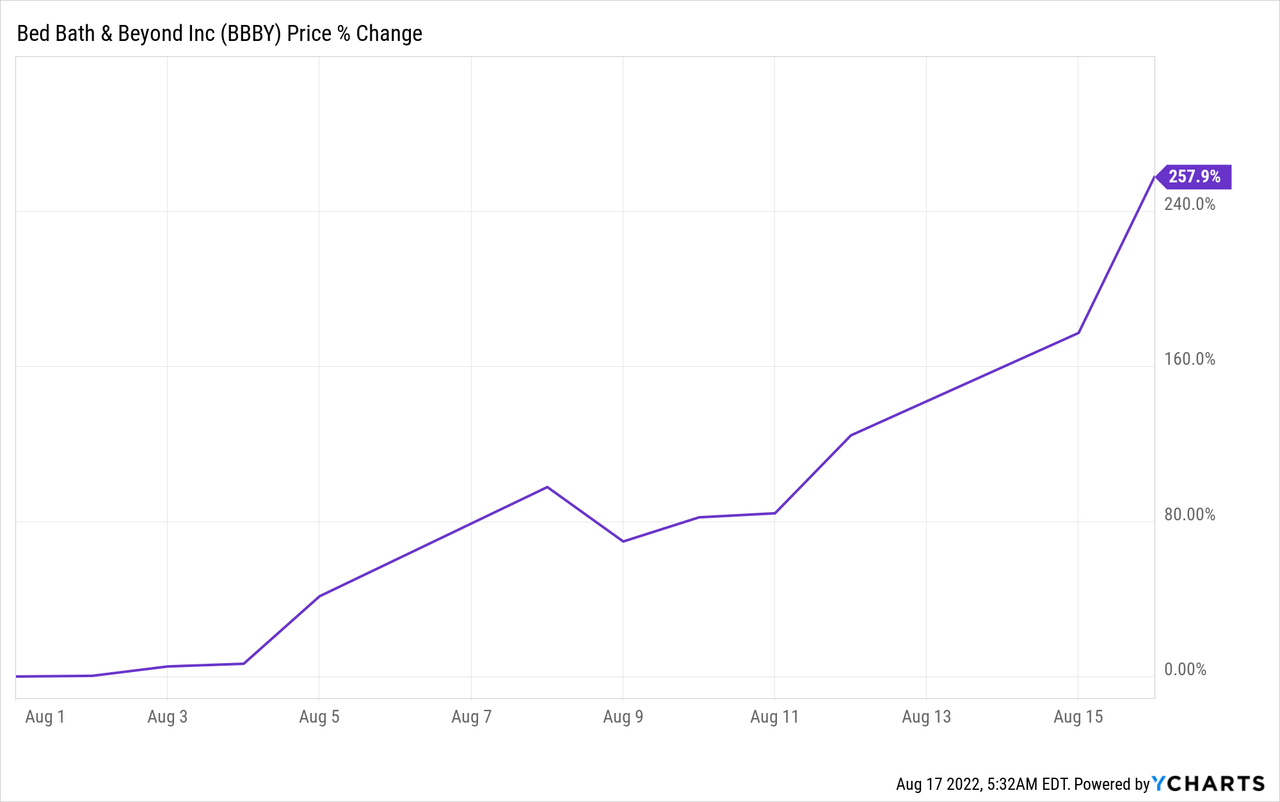

Bed Bath & Beyond Inc.’s (NASDAQ:BBBY) shares soared 70% yesterday after a major venture capital firm disclosed the purchase of call options on the retail chain. With panic buying still driving the retailer’s shares 29% higher by the end of the day, investors are possibly well advised to sell into the current sentiment and count their blessings they can secure a big profit. I expect the bubble to burst since the retailer’s fundamentals remain challenged and there is no objective justification for Bed Bath & Beyond’s 258% return this month.

Meme traders target their next short squeeze company: BBBY

WallStreetBets is an investment forum on Reddit where mostly younger people trade stock tips and egg each other on to buy a stock, sometimes in a bid to take on large hedge funds which have taken short position in struggling companies. The idea is to aggressively buy up heavily shorted stocks in an attempt to ignite a short squeeze. GameStop (GME) was the original meme stock, and Reddit-minded investors had some success in creating circumstances for a short squeeze.

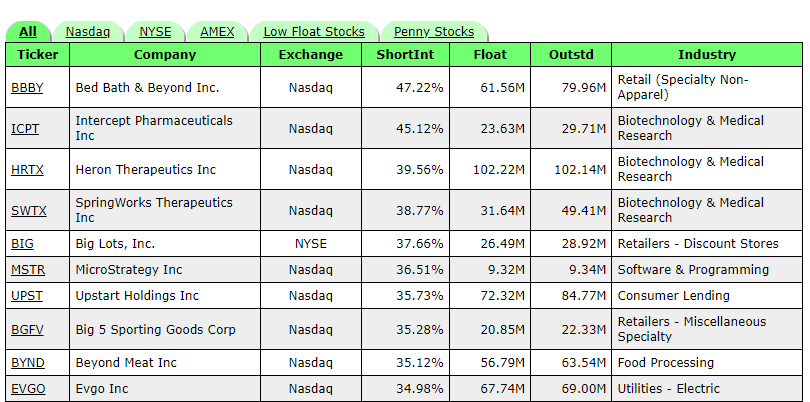

Since Bed Bath & Beyond is one of the most shorted stocks in the market with a short interest ratio of 47%, the retail chain is a natural target for WallStreetBets’ audience.

Source: High Short Interest

Yesterday’s surge in pricing was chiefly related to a disclosure made by Bed Bath & Beyond and RC Ventures LLC, a venture capital firm owned by GameStop Corp.’s chairman Ryan Cohen who is a large investor in the home decor retail chain. The company bought 1.67M call options on BBBY with an expiration date of January 2023. The disclosure of the option purchase has been the key driver behind BBBY’s soaring stock price yesterday, in large part because Cohen also played a key role during last year’s unfolding GameStop saga. Since the beginning of August, shares of BBBY have surged 750% and investors should think about taking profits here.

Bed Bath & Beyond: A struggling business

A key feature of a meme stock is that the business is struggling. Video game retailer GameStop shuttered hundreds of store locations even before the pandemic due to growing margin pressure from large e-Commerce retailers like Amazon (AMZN) and changing consumer behavior. While Bed Bath & Beyond is no longer struggling because of the pandemic, a massive deterioration in the macro environment has now resulted in massive risks to its revenue base.

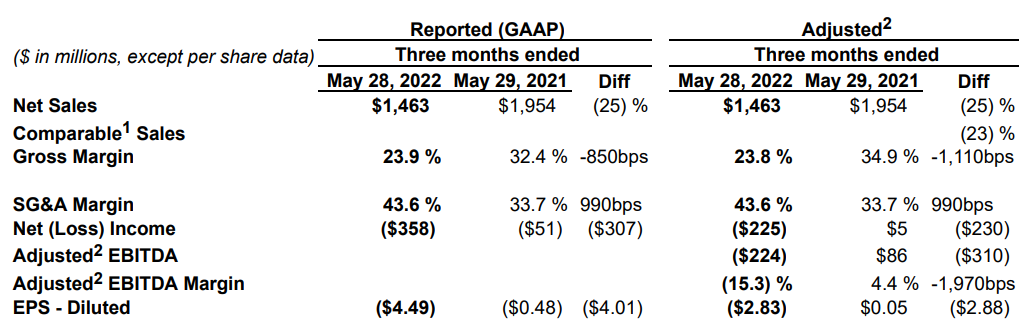

Bed Bath & Beyond’s FQ1’22 net sales crashed 25% to $1.46B due to changing consumer behavior in a high-inflation, low-growth market that is weighing heavily on consumer spending. Bed Bath & Beyond’s comparable sales dropped 23% year-over-year.

Bed Bath & Beyond: FQ1’22 Key Metrics

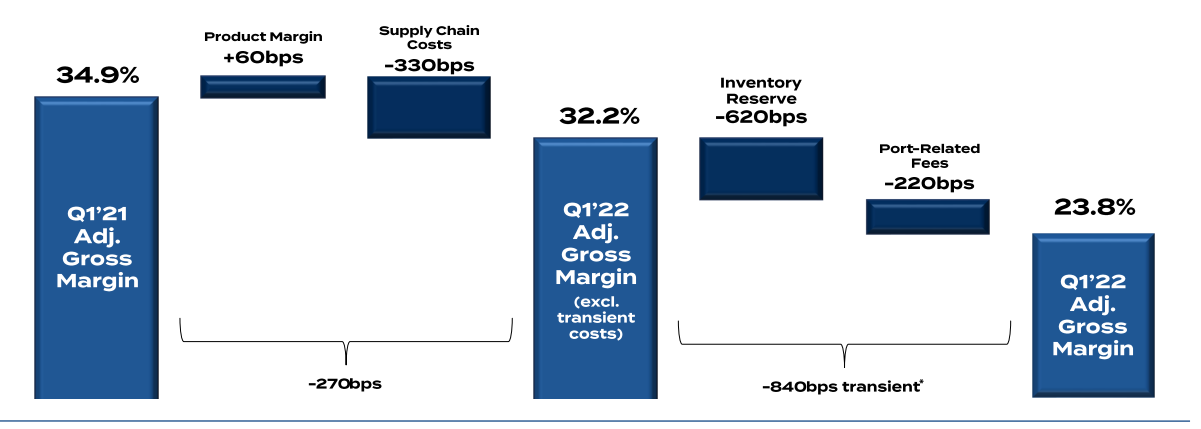

Besides dealing with a rapidly declining top line in a very challenging retail environment, the company was forced into making aggressive mark-downs in the last quarter which not only lead to declining margins, but also a large loss of $358M. Bed Bath & Beyond’s adjusted gross margins declined 11 PP in FQ1’22 to 23.8% due aggressive price actions to get slow-moving inventory off the shelves.

Bed Bath & Beyond: FQ1’22 Gross Margins

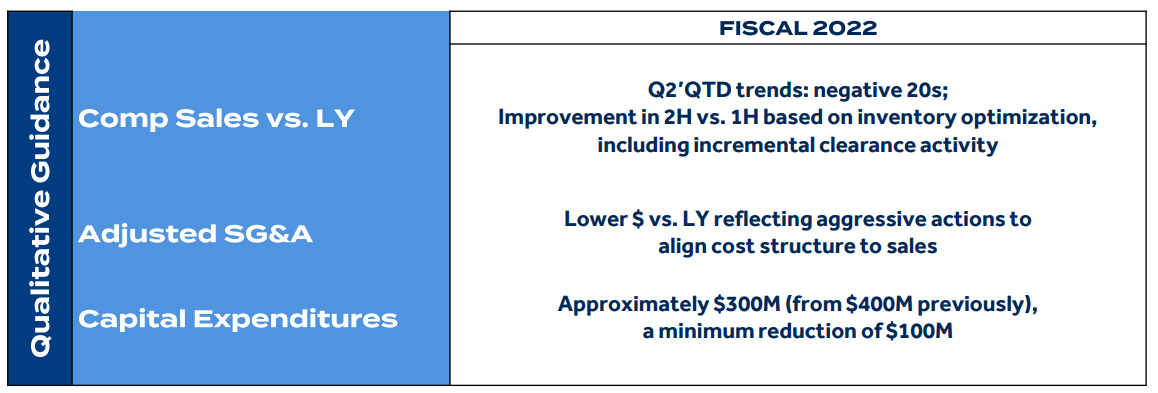

The retailer also issued a very gloomy outlook for FY 2022 that projects continual pressure on comparable sales and margins. While cost-savings programs may result in some margin relief in the second-half of the year, FY 2022 is far from being a great year for Bed Bath & Beyond.

Bed Bath & Beyond: FY’22 Outlook

Bed Bath & Beyond is hopelessly overvalued

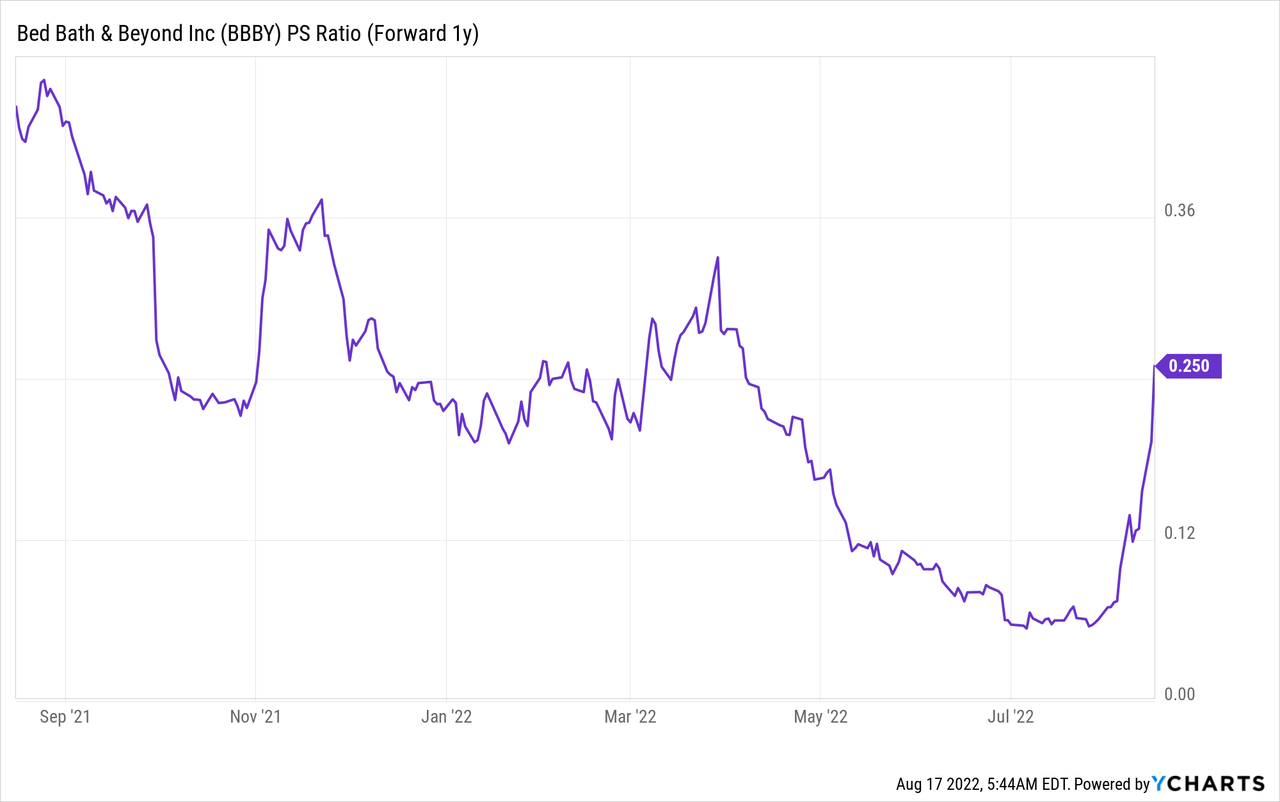

Given Bed Bath & Beyond’s devastating top line decline in FQ1’22, there is now huge uncertainty about the actual levels of sales the retailer can achieve in FY 2022. The expectations is for Bed Bath & Beyond to see a 17% revenue decline just year, but it could get a lot worse for the retailer if the macro environment further deteriorates. Shares of the retailer are currently trading at 0.25 X sales.

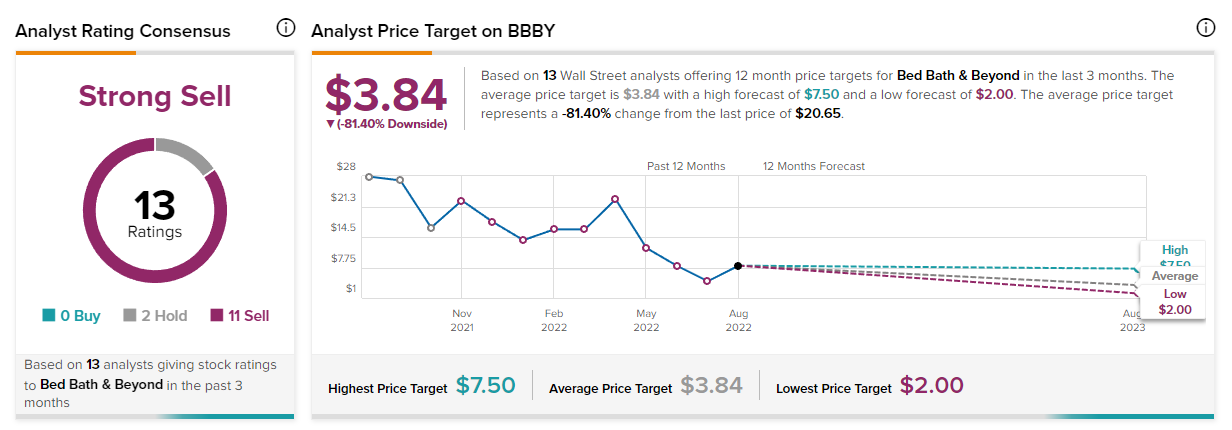

The average stock price target for Bed Bath & Beyond on TipRanks is $3.84. Since BBBY closed at $20.65 yesterday, the price target calculates to a potential downside of 81%. While TipRanks should not alone be used to determine the value of the retail chain, the huge gap between estimated fair price and actual stock price suggests that BBBY is in a bubble… especially considering that nothing fundamentally changed about the retailer this week.

TipRanks

Risks with Bed Bath & Beyond

The biggest risk is that the meme hype fades… which it will. Chasing a meme stock after a 260% run is extremely dangerous and considering that BBBY trades well above the consensus estimated fair price target, investors are exposing themselves to unwarranted risk here chasing the stock price. From a commercial perspective, the retailer is likely to see further revenue declines if high inflation keeps weighing down consumer spending. The drop in gross margins is also concerning and with consumers cutting back on spending, Bed Bath & Beyond is set to enter a long and painful restructuring.

Final thoughts

Investors in Bed Bath & Beyond may want to consider selling into the strength before the bubble bursts. Neither Bed Bath & Beyond’s business constitution — crashing comps, weakening margins, unpredictable sales outlook — nor valuation justify buying the stock. While Bed Bath & Beyond is the latest meme stock that excites investors, the meme saga will likely end the way it always does: with a lot of investors losing their life savings.

Be the first to comment