prurigo nodularis Artfully79/iStock via Getty Images

“It’s not unpatriotic to denounce an injustice committed on our behalf, perhaps it’s the most patriotic thing we can do.”― E.A. Bucchianeri

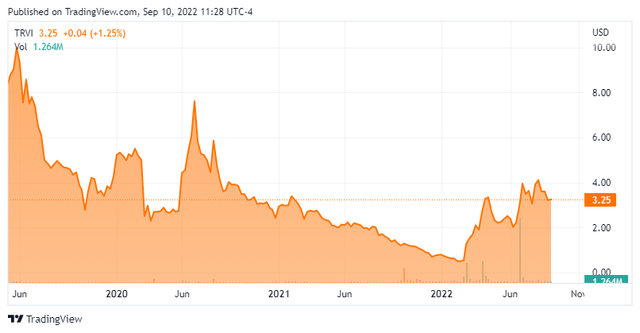

Today, we take our first look at Trevi Therapeutics Inc. (NASDAQ:TRVI). The small biopharma firm came public just over three years ago and is deep in Busted IPO territory even with a nice rebound in the shares so far in 2022. What lies ahead for Trevi Therapeutics? An analysis follows below.

Company Overview

Trevi Therapeutics is a clinical-stage biopharmaceutical company based out of New Haven, CT. The company focuses on the development of medicines to treat serious neurologically mediated conditions. Its primary asset in development is Haduvio which is an oral extended-release formulation of nalbuphine. Nalbuphine is a mixed ĸ-opioid receptor agonist and µ-opioid receptor antagonist that has been approved and marketed as an injectable for pain indications for more than 20 years in the United States and Europe. Haduvio has a dual mechanism of action by acting as both an antagonist (blocker) to the body’s mu opioid receptor and as an agonist (activator) to the kappa opioid receptor.

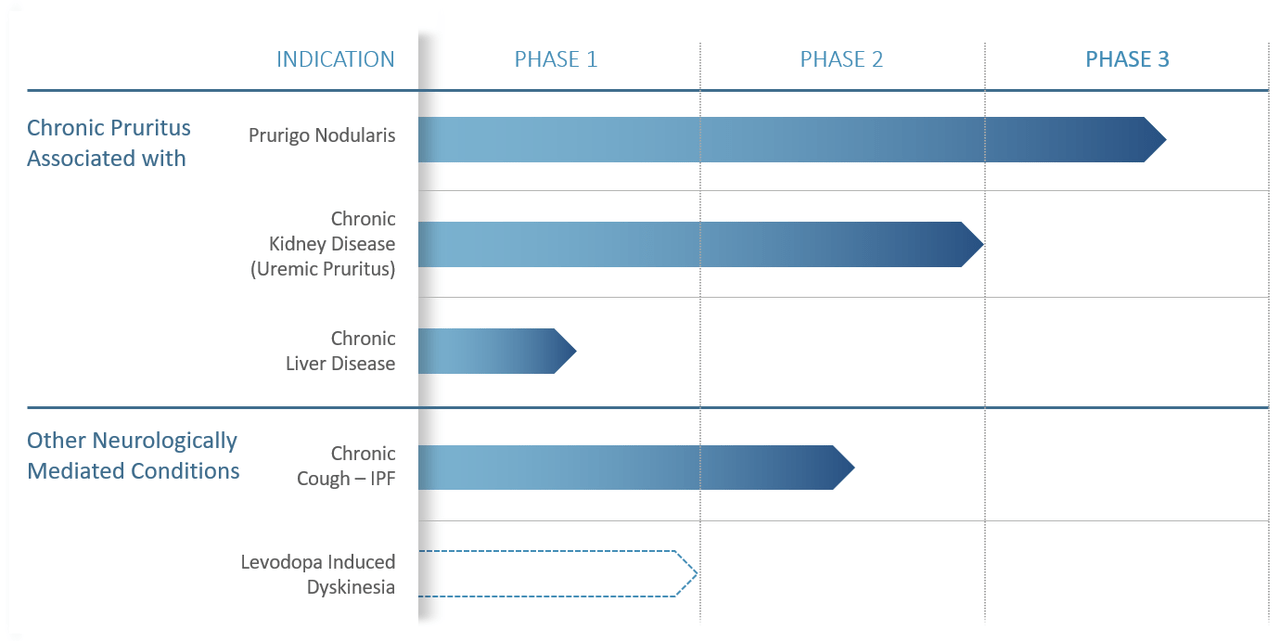

March Company Presentation

This candidate is currently being evaluating for the treatment of prurigo nodularis or PN and chronic cough in adults with idiopathic pulmonary fibrosis or IPF. Chronic cough represents a significant unmet need for IPF patients, as the majority of these patients report this cough as one of their most bothersome aspects of their disease.

March Company Presentation

Haduvio or Nalbuphine Extended Release [ER] has also been granted Fast Track designation by the FDA for the treatment of itch in patients with prurigo nodularis. In 2011, Endo Pharmaceuticals partnered with Trevi to develop and market compounds incorporating nalbuphine hydrochloride. The stock currently trades just over three bucks a share and sports an approximate market capitalization of $140 million.

Pipeline Developments

Company Website

The stock got a bump in late June 29th when the company disclosed that Haduvio had met key goals in a Phase 2b/3 ‘PRISM’ study for patients with prurigo nodularis. 25% met the primary efficacy endpoint, a clinical measure called 4-point reduction in the Worst Itch – Numerical Rating Scale compared to just 14% of the placebo group.

March Company Presentation

Patients are currently completing the one-year open-label extension study, which should be over in January. The company is in the process of having an end of Phase 2 meeting with the FDA to discuss the data, next steps and the design for a registrational study that could lead to approval dependent on results. The company would like to do a six-month study with three treatment groups.

March Company Presentation

Four months before, interim data from a Phase 2 trial evaluating Haduvio to treat IPF suffering from chronic cough found a 52% placebo-adjusted reduction in daytime cough events and the compound was well tolerated. Full results should be out by the end of this quarter. A meeting with the FDA should happen to soon to move this effort to the next stage of development. The company believes this will begin in the first half of 2023. Haduvio could have other potential indications in this category (see above) for other indications.

March Company Presentation

Analyst Commentary & Balance Sheet

Aegis Capital, Oppenheimer and Needham have all reiterated Buy ratings on TRVI over the past four months. All have identical $10 price targets on the stock.

Less than one percent of the outstanding shares are currently held short. Since late April, one beneficial owner has sold approximately $2.8 million worth of his stake in TRVI. The company ended the second quarter with just under $80 million worth of cash and marketable securities on its balance sheet after posting a net loss of $8.1 million in the quarter. Most of which came from a $55 million private placement that was executed in April of this year. Leadership has stated this is enough funding to execute all planned activities into the fourth quarter of next year. In addition, the company also has approximately 11 million pre-funded warrants still outstanding, which can provide Trevi up to $15 million in proceeds if they are exercised.

Verdict

March Company Presentation

The company has some opportunities here with Haduvio with chronic cough for IPF patients with probably the best chance to get across the finish line first. PN development probably takes longer as the PRISM trial started in September of 2018 and leadership gave less clarity on their earnings call about the timeline when the next phase of development may start pending a meeting with the FDA.

In addition, Sanofi (SNY) and Regeneron (REGN) recently showed that Dupixent significantly reduced itch and skin lesions at 24 weeks in adults with uncontrolled PN and are in the process of moving through the approval process.

Finally, it is very likely, based on the company’s projections, that Trevi will have to do another capital raise before any commercialization of Haduvio can begin. Based on perusing their website, it looks like management is actively looking for partners in this effort. Whether that results in a collaboration deal in the near future is hard to tell.

Therefore, I am ‘on the fence‘ whether TRVI deserves a small ‘watch item‘ position right here. Given my current negative view on the overall market, I am going to pass on any investment recommendation on the stock for now. However, it is likely I will circle back on this story in the first half of 2023 to see how the company is progressing.

“Politics: “Poli” a Latin word meaning “many” and “tics” meaning “bloodsucking creatures“.― Robin Williams

Be the first to comment