Wendy Gunderson

Back in 2020, the pandemic took the travel and hospitality industries right to death’s door. Burdened with too much debt and vanishing cash flows, Hotel REITs looked doomed. Effective vaccinations and boosters, however, have enabled a resurgence in leisure travel and breathed new life into some hotel operators. Today, we revisit an old favorite that is demonstrating some new vitality, Hersha Hospitality Trust (NYSE:HT).

Beginning in the early 2000’s we were really enamored with investing in Hotel REITs. It was exciting to stay at the Essex House on Central Park South and then join Bill Gates as a shareholder in Strategic Hotels, the property’s owner.

Though investing in hotel REITs was exciting, we ultimately came to understand that REITs were not the surest way to make money in the lodging industry. We learned that before the REIT got any cash flow, Hilton Worldwide (HLT) or Marriott International (MAR), as franchisers, took a big slice off the top. Even before the franchiser’s cut, the OTAs (online travel agencies) like Expedia Group (EXPE) or trivago N.V. (TRVG) clipped off double digit percentage fees for booking the rooms. The REITs had to capitalize the purchase of the property, pay for all operating expenses, and hope there was money left over to pay dividends. Then, in February of 2020, COVID arrived and washed all hope away.

The hotel industry had just ten years earlier emerged from the dire straits of the great financial crisis. Going into the 2008-2010 recession, many REITs carried too much debt and the slowing economy dried up revenues and forced operational austerity and the suspension of dividends. As the economy recovered, REITs were able to recapitalize and reduce debt, but the costs associated with the franchisers and OTAs still limited profitability. The pandemic’s shuttering of the entire travel industry proved even more daunting than the Great Recession. Hersha Hospitality felt the pressure as much as everyone else.

When new bookings cease overnight, any operational forecasts and budgeting flies out the window. In a March 19, 2020 press release, HT suspended payment of dividends on its common and preferred shares. Simultaneously, they announced the first round of initiatives to conserve cash, including:

- Comprehensive containment of operating expenses through deep cost cuts, restructuring, and select closing of hotels

- Reducing floor operations and closing restaurants and bars to “shrink” hotels to more efficiently serve our limited guest count and curb expenses

- Suspending planned capital expenditures for the balance of the year, resulting in $10 million to $15 million of estimated savings

- CEO & COO reducing salary by 50% and the Board of Trustees electing to take all payments in stock for the remainder of 2020, resulting in cash preservation and additional liquidity

On April 6, 2020 they disclosed further measures taken to shore up operations and fight for survival:

- Amending the existing Bank Credit Facility and Borrowing Base of Assets to access an additional $100 million on the Company’s $250 million Senior Revolving Line of Credit

- Successfully amending our Bank Credit Facility to obtain waivers on all financial covenants through March 31, 2021 yielding additional operational and financial flexibility

- No changes to the interest rate on the amended credit facility

- Corporate level cost containment resulting in more than 25% savings in SG&A expenses

- Working closely with our hotel operating partners to significantly reduce operating expenses over the immediate period through on-site expense cuts

- Implementing asset management initiatives at all properties to eliminate contract services, vendor and outsource contracts, utility usage, and purchasing expenses resulting in near-term and long-term cash savings

- Where feasible, seeking alternative sources of hotel revenue through government agencies, law enforcement and military personnel, emergency first responders and medical personnel, and universities

- Exploring the potential to recoup losses through insurance claims

- Submitting loan applications for each portfolio hotel for grants and low-cost unsecured financing from the Paycheck Protection Program under the recently passed CARES Act

Hersha announced that they had suspended operations at 19 of the company’s 48 hotels. The 29 hotels that remained open were operating with minimal staff onsite, resulting in a reduction of on-property labor approximating 80%. Most important of these measures were the obtaining of waivers on their credit facilities and access to an additional $100MM on their credit line; this would potentially buy them the time to dig their way out of the travel industry’s collapse.

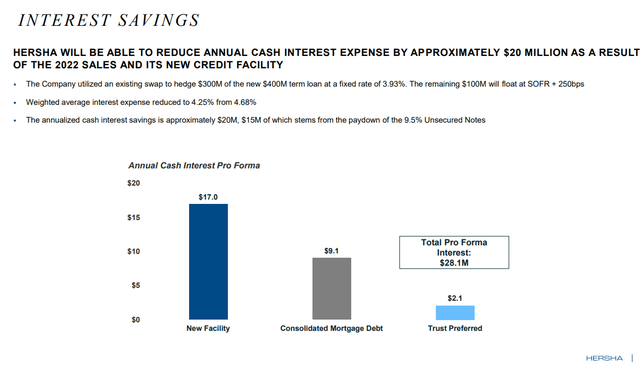

On January 4, 2021, Hersha announced the $64.5MM sale of the 245-room Courtyard San Diego. This would be the first of a long series of dispositions, beginning with the $505MM sale of 7 non-core, urban select service hotels and today’s announced sale of two West Coast luxury hotels for $125MM. This slimmed down HT was in August able to refinance their entire credit facility, saving millions in interest expense annually.

In just under 30 months, Hersha has emerged from the pandemic and they want you to know that their stock is cheap.

So many rooms sold, but the really good stuff remains

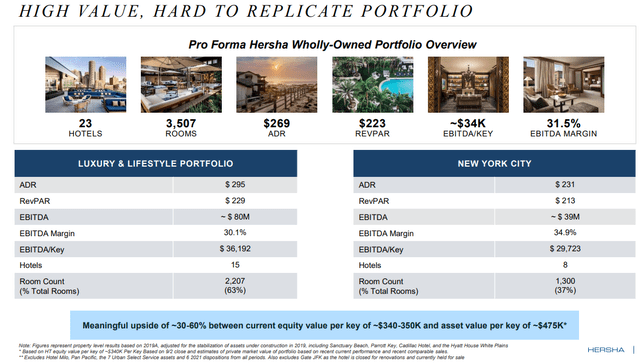

While the hotel dispositions described above may sound like a fire sale, HT management would likely consider it more of a culling. They sold non-core assets to shore up their balance sheet and now own a portfolio of high-margin trophy properties.

What Hersha wants us to understand is that their equity prices the assets at $345K/room and analyst consensus values the assets at $475K/room.

We haven’t toured every Hersha property, but we’ve stayed at the oceanfront Cadillac Hotel and Beach Club in Miami Beach.

HT

When I again go back to Miami, that’s where I’ll stay.

In 2015 we did a property tour of every REIT owned hotel on Key West. Among them was Hersha’s Parrot Key and Villas.

HT

I regret my choice to have stayed at The Reach by Waldorf Astoria, instead.

Hersha’s Portfolio is impressive.

Are HT Shares Cheap?

Analysts’ consensus puts a median $13.86 net asset value on Hersha’s common shares. That NAV is defined by a median cap rate of 6.8% and is likely still on the older, unculled portfolio. In today’s investor presentation, Hersha points out that the West Coast properties sold at 2.9% cap rate and that the remaining assets are more valuable than the stock market perceives.

Every REIT claims to have the best portfolio and that their shares are undervalued in the market. When you consider how on the earnings call Neil Shah, Hersha’s president and COO, described the 2Q22 operating results of the two hotels I referenced above, their asset value claims might have real merit.

Our properties in Miami and Key West once again benefited from the unique market dynamics we are witnessing in South Florida. The Parrot Key’s 74% occupancy and $497 average daily rate resulted in a $368 RevPAR, which surpassed the second quarter’s 2019 RevPAR by 59%. Parrot Key generated $2.9 million in EBITDA for the quarter, a 127% increase to the same period in 2019. While the late summer and early fall are typically slow season than Key West, we have seen continued strength at the Parrot Key and expect continued outperformance throughout 2022, especially to close out the year.

The Miami Beach market turned in another outstanding quarter as the Cadillac recorded 80% occupancy at a $283 ADR, resulting in a RevPAR of $226 for the quarter, a 66% increase to 2019. The hotel generated $3.3 million of EBITDA, a 158% increase from the second quarter 2019. The Ritz-Carlton, Coconut Grove drove nearly 50% ADR growth and over $1 million in EBITDA, a 148% increase to the second quarter of 2019.

And while REITs still have the poor cash flow structure under agreements with franchisers and OTAs, Hersha has managed to realize this triple digit EBITDA growth over pre-pandemic rates.

Hersha is operationally impressive.

What about the Dividend?

REIT investors are understandably dividend focused. While the preferred dividends have been reinstated and are current, HT has not paid a dividend on the common since 4Q2019. The dividend was also discussed on the earnings call.

Neil H. Shah

…And I think in terms of capital allocation, whether we look at acquisition opportunities, it’s — again, it’s kind of — the market is a little bit uncertain right now. I think before we consider acquisitions, we’re probably going to be discussing with our Board returning some capital to shareholders. And so I think the next big capital allocation decision really centers around the size and regularity of the dividend.

Management went on to say that based on the gains from property dispositions, they would anticipate a special dividend later this year in the range of $0.25 to $0.50/shares. With the West Coast sales announced on September 12th, that dividend could be materially larger.

William Andrew Crow

Three quick questions for you. First of all, can you just remind us just the prospective size of the special dividend?

Ashish R. Parikh

Bill, right now, I mean, look, we haven’t discussed this with the Board. We still need to work through it. But I mean as a proxy, I think that we would look at — just looking at our gains from these transactions about $200 million, we have NOLs we can utilize. But I think that the thing it should be at least the special should be somewhere in the range of probably $0.25 to $0.50 is not our balance at this point.

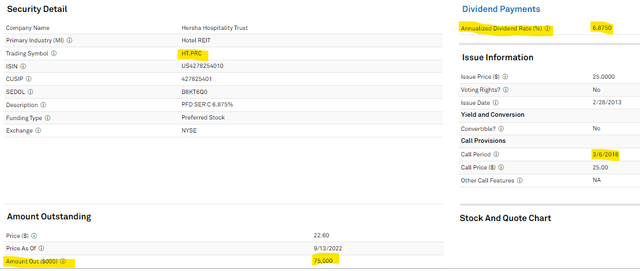

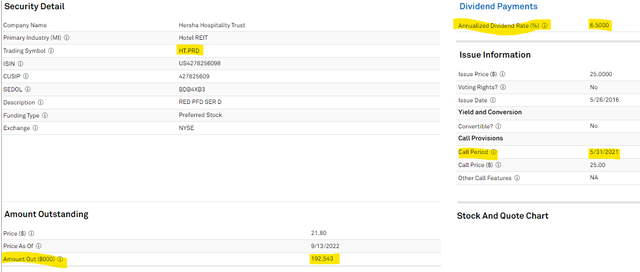

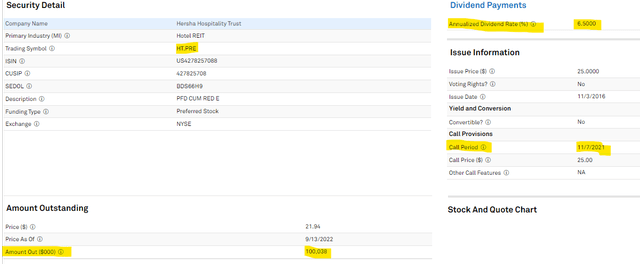

An alternative to waiting for resumption of a regular common dividend, the preferred shares are attractive at current market prices. HT has 3 preferred series, they are all presently callable, and, priced at ~10% below par, offer going in yields of 7%+.

HT.PC

HT.PD

HT.PE

Bought at discounts, the HT preferreds have upside potential if called. Though interest rates are now on the ascent, if Hersha can find a lower cost of capital that improves their balance sheet, redeeming the preferreds is certainly an option.

The Verdict

The leisure and hospitality industries have risen from the pandemic’s ashes and are looking vibrant again but remain vulnerable to shocks. Hotel REITs may not be the clearest path to investment profits in the lodging industry, but many companies have surmounted the obstacles and returned to their prior earnings capacity.

We’ve been in and out of Hersha Hospitality equities for more than twenty years. Management has skillfully navigated the economic carnage of the last two and a half years and emerged stronger. We are again long the common and even longer the preferred shares.

Be the first to comment