Melpomenem

SoFi (NASDAQ:SOFI) and LendingClub (NYSE:LC) are similar as both are FinTechs that have recently become banks. I have been an investor in LendingClub since 2020 and have been tracking its progress very closely and now it is a large position in my portfolio. I have also recently initiated a position in SoFi.

In this article, I will compare and contrast both firms. There are many similarities (personal lending) but also some stark differences in strategy, business operations, and financial aspects. Ultimately, I am hopeful that this will assist investors in making a more informed decision on which is the better stock to own now.

Overview

LendingClub

LC is a digital marketplace bank. It became a nationally licensed bank through the acquisition of Radius bank completed in early 2021. The engine of its business is the origination of personal loans through its marketplace. The main use case for LC personal loans is the refinancing of credit cards and debt consolidation. The benefits for customers are lower interest rates and a better credit score. LC typically retains ~25% of the assets it generates from the marketplace and the rest is sold to investors (banks, asset managers, hedge funds etc). LC holds other loan assets such as mortgages, auto loans as well as some commercial loans (inherited as part of the acquisition of Radius bank) but in the whole scheme of things, these loan assets are somewhat immaterial, LC is very much a personal lender and a marketplace. Currently, ~60 percent of revenue is generated from the marketplace and the remaining 40 percent is interest income from loans held on the balance sheet.

SoFi

SoFi’s origins are as a student loans refinancers. Currently has three business segments Lending, Technology Platform, and Financial Services. It is a much more diversified FinTech/digital bank compared to LC.

On the Lending side, SoFi has expanded its lending strategy to offer home loans, personal loans, and credit cards. On the non-lending financial products side, it offers products such as money management and investment product offerings.

In the technology division, SoFi is operating as a platform-as-a-service for a variety of financial service providers, providing the infrastructure to facilitate core client-facing and backend capabilities, such as account setup, account funding, direct deposit, authorizations and processing, payments functionality, and check account balance features through the acquisition of Galileo. More recently, SoFi expanded its platform to include a cloud-native digital and core banking platform with customers in Latin America through its acquisition of Technisys S.A., allowing the Company to expand its technology platform services to a broader international market.

Importantly in 2022, the Company became a bank holding company and began operating as SoFi Bank through its acquisition of Golden Pacific Bancorp, Inc.

SoFi versus LendingClub

On the surface, the similarities and differences are plainly obvious. Both firms are digitally-led and originate, retain and distribute loan assets. Both firms are also deposit-taking institutions and nationally regulated banks.

The differences are also readily apparent. LC is much more narrowly focused on the personal lending market opportunity set. Whereas SoFi’s scope is much more of a multi-product or a “super-app” approach. It is also operating as a banking-as-a-service for other financial firms which is already material and growing part of its business.

But to make an informed decision as to which is the better investment, we need to delve into the detail.

Selected key metrics

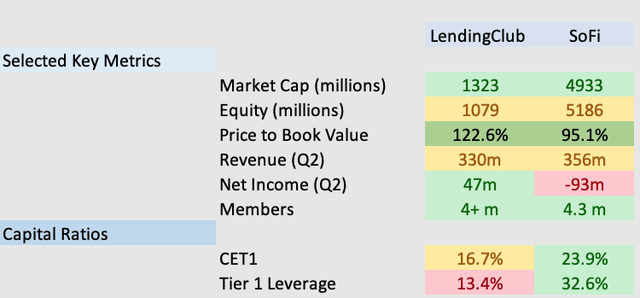

The below table provides a comparison summary of key metrics for both SoFi and LC:

Author based on companies’ filings

I will draw out a few key observations for now:

- Both firms have similar quarterly revenues and members; however, LC is profitable on a GAAP basis whereas SoFi is loss-making.

- SoFi’s market cap is ~3.5x LC but this is also proportionate to the relative equity base.

- LC’s capital ratios are substantially lower and near its minimum requirement of 11% for Tier 1 Leverage which means that is much more capital constrained compared to SoFi.

What is driving profitability?

Let us start with SoFi with Q2’2022 earnings.

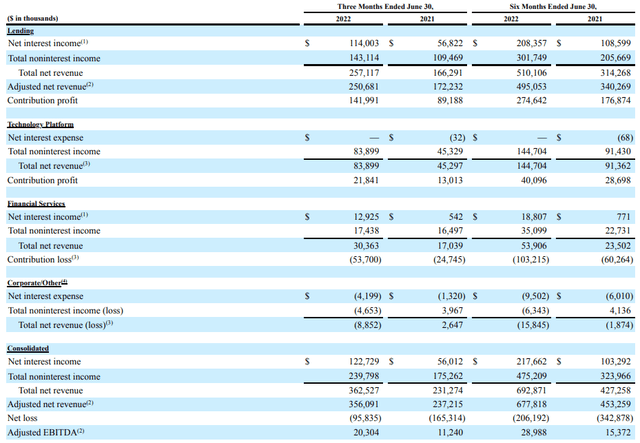

SoFi Investor relations

As can see above, the majority of the revenue and adjusted EBITDA is derived from its Lending segment. The Financial Services EBITDA is contributing to ~54m of losses and the Technology segment is contributing ~22m.

The Lending segment is also directly comparable to LC’s main business, so I will focus on this segment and compare it to LC. Note the above figures are adjusted EBITDA and it currently generates an overall net loss of $93 million in Q2’2022 (mostly due to share-based compensation and depreciation costs).

SoFi and LC Lending segment comparison

The digitally-led originations are the blood life of both businesses.

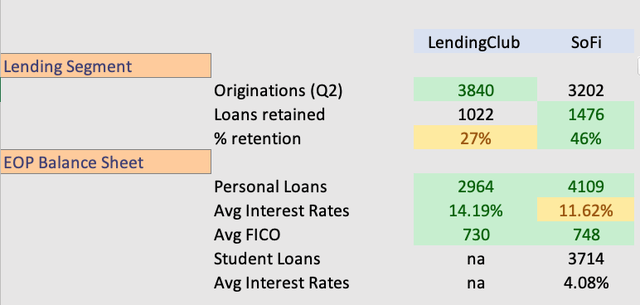

I have summarised below, some of the key metrics for both SoFi and LC:

Author – companies’ filing

I will make several observations on the above table:

- LC originations are higher than SoFi but the latter retains more assets on the balance sheet. This is not surprising given that SoFi has plenty of surplus capital to deploy for asset generation. LC is capital-constrained.

- Note that LC’s originations are almost all Personal Loans. Whereas for SoFi the figure is ~2.5b out of 3.2b.

- SoFi’s originations are impacted by the suspension of repayments for student loans. It is likely to rise substantially in 2023 as the moratorium expires.

- LC’s gross yield on personal loans is substantially higher than SoFi. Although the average FICO score for SoFi is marginally higher. This suggests the risk-adjusted returns for LC loans are materially higher than SoFi’s.

- The average gross yield on SoFi’s student loans is a modest 4.08% currently. The student loan business is nowhere as profitable as the personal lending space.

A qualitative assessment of the relative investment case in SoFi and LC

Fundamentally, LC and SoFi are pursuing different strategic paths even though the final destination may be similar.

LC is almost singularly focused on the unsecured lending product currently. There are two key reasons for this. This product is generating exceptional financial returns for LC as reflected by its increased GAAP profitability. The greatest returns are generated by retaining the loan assets on LC’s balance sheet (as much 3x the returns of selling it to investors). However, LC is also constrained by its relatively small equity capital buffer. As such, LC’s management team has elected to prioritize growing the unsecured lending book currently. In order to grow the book, LC has to grow earnings and redeploy capital back into the business. This forces the management team to be very disciplined financially as well as slow down the pace of investments in a multi-product roadmap. I believe this is a conscious decision the management team in LC has taken. However, in the medium term, it is clear that LC’s strategy is a multi-product comprising lending products, deposits, insurance, and savings/wealth management. The anchor product, however, will remain the unsecured lending product.

SoFi, on the other hand, has gone down the path of the super-app with substantial investments in multi-product development and inorganic acquisitions. GAAP profitability is not a priority currently, rather it focuses on contribution margins and adjusted EBITDA metrics which are pointing in the right direction. SoFi’s true profitability potential is somewhat masked by a number of aspects. Firstly, it only recently became a bank which would allow it to retain more assets on the balance sheet as well as improve its funding cost. Currently, it is utilizing expensive warehouse lines which should be replaced by cheaper deposits.

Secondly, it is somewhat handicapped by the student loans moratorium, originations of student loans should rebound strongly in 2023 and beyond. Having said that, SoFi continues to invest heavily as well as a very high rate of share-based compensation. Whilst I expect it to improve its GAAP financials over time, there is yet no clarity on the trajectory. Still, it has substantial excess capital to deploy for retention on the balance sheet, this should enable it to drive scale and profitability in the medium term.

Clearly, though, the most profitable business line for both firms is the Personal Lending segment. In my view, LC has a distinct advantage in this space. It originates in larger volumes, leading to marketing efficiency and much better gross yield whereas FICO scores are only marginally lower. LC also proved during the recent pandemic, that its credit risk models are super efficient as they delivered 30% better loan losses than the industry. I suspect the risk-adjusted returns for LC are industry leading and it keeps on pressing its advantage.

Final thoughts

I recently initiated a position in SoFi. The valuation is undemanding and there is a (quasi-free) call option in its Technology division (banking as a service of BaaS). SoFi is building scale rapidly and this should get it to profitability in a reasonable timeframe especially as some of the headwinds subside and it capitalizes on its bank status. Having said that, I am cognizant of the lack of apparent financial discipline and especially the high dilutive cost of share-based compensation.

My larger position is in LendingClub and I have written several articles on it. The key attraction is the exceptional returns it generates from its marketplace and loans that it retains on the balance sheet. There are pros and cons to the almost singular focus on the unsecured lending product. The returns are exceptionally high but since it is constrained by a thin capital buffer, it is delaying the further monetization of customers’ lifecycle. The risk is that the likes of SoFi will cement a first mover advantage as a convenient, customer-friendly financial super-app. I believe this is a conscious decision by LC’s management team. At this time, they are determined to prioritize the growth of the balance sheet and earnings, and by that create capacity for additional investments.

In my view, both stocks are exceptionally good value at current prices. I do have a preference for LC given the clear trajectory on GAAP profitability and its competitive advantage in the lucrative personal loans space.

Be the first to comment