PM Images

Investment Thesis

IDT Corporation (NYSE:IDT) has four separate business segments: Traditional Communication, National Retail Solutions (“NRS”), BOSS Money Transfer, and Net2phone. Each of these high-growth and higher-margin businesses is exhibiting strong growth and they are already profitable or are turning profitable due to asset-light business models and favorable competitive advantages. However, these businesses are being obscured by the lower margin, shrinking traditional communication business. Unlike other companies, IDT Corporation has a history of spin-offs, which makes SOTP valuation likely to materialize.

According to the most recent 1Q23 results, many of the higher-margin businesses have reported really impressive growth rates and improved profitability. Net2Phone, in particular, has attained profitability earlier than anticipated, and BOSS Money is also nearing positive EBITDA. I attempt to dive into earnings results and provide readers with an overall analysis of the quarter.

National Retail Solution (NRS)

IDT 10-Q & 8-K IDT 10-Q & 8-K IDT 10-Q & 8-K IDT 10-Q & 8-K

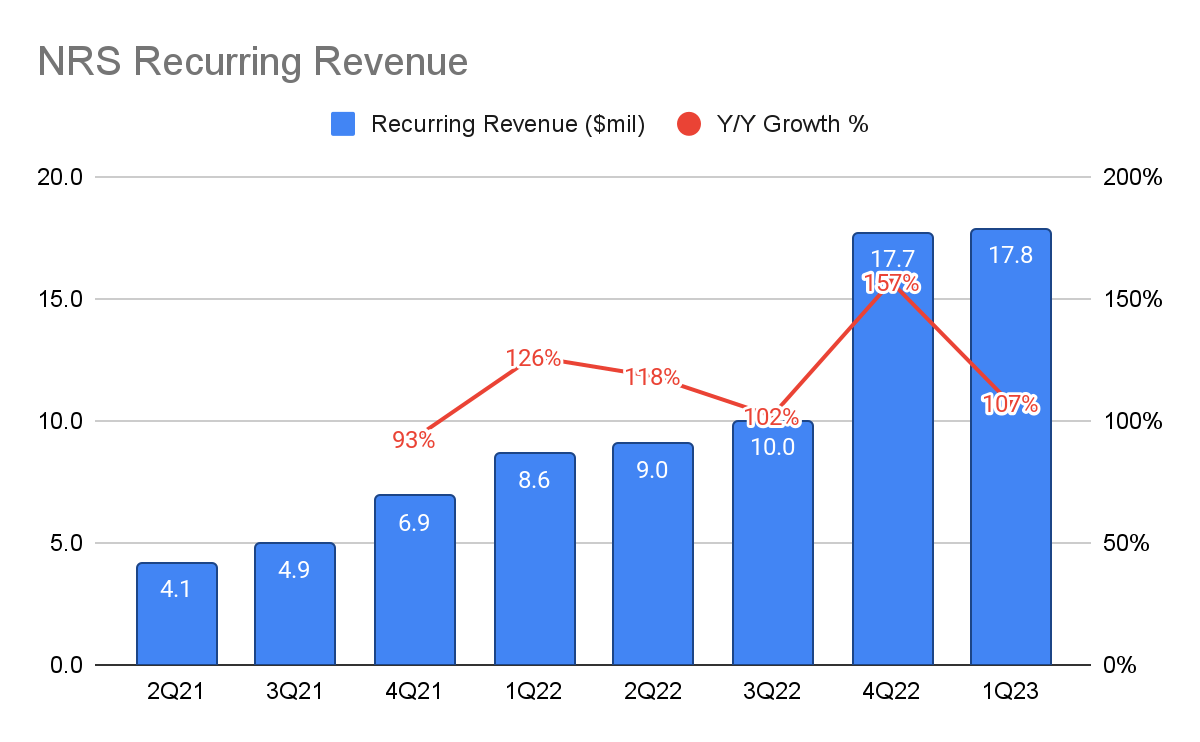

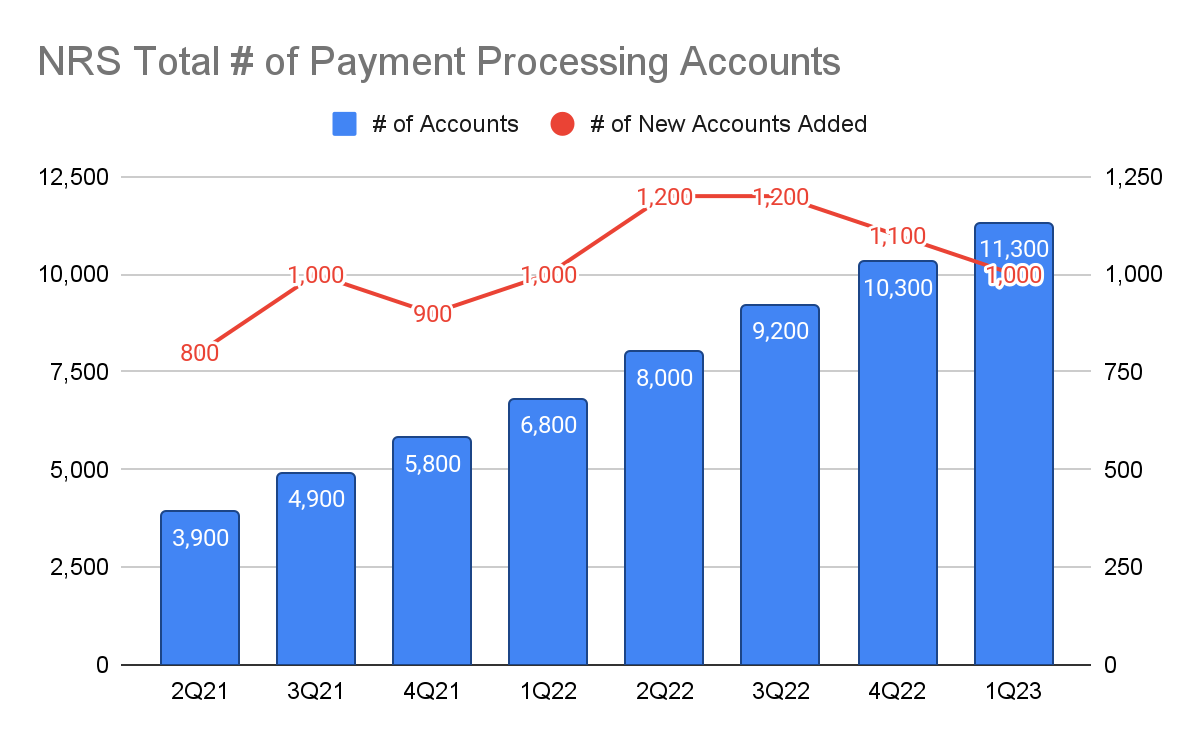

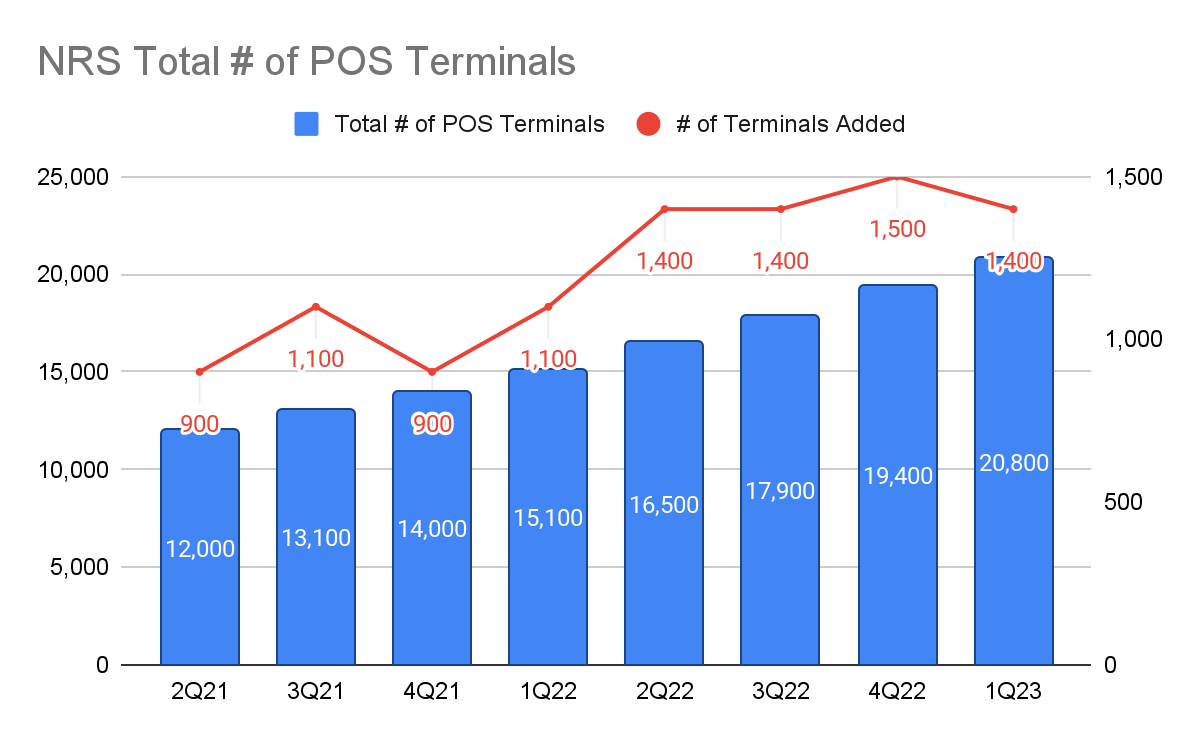

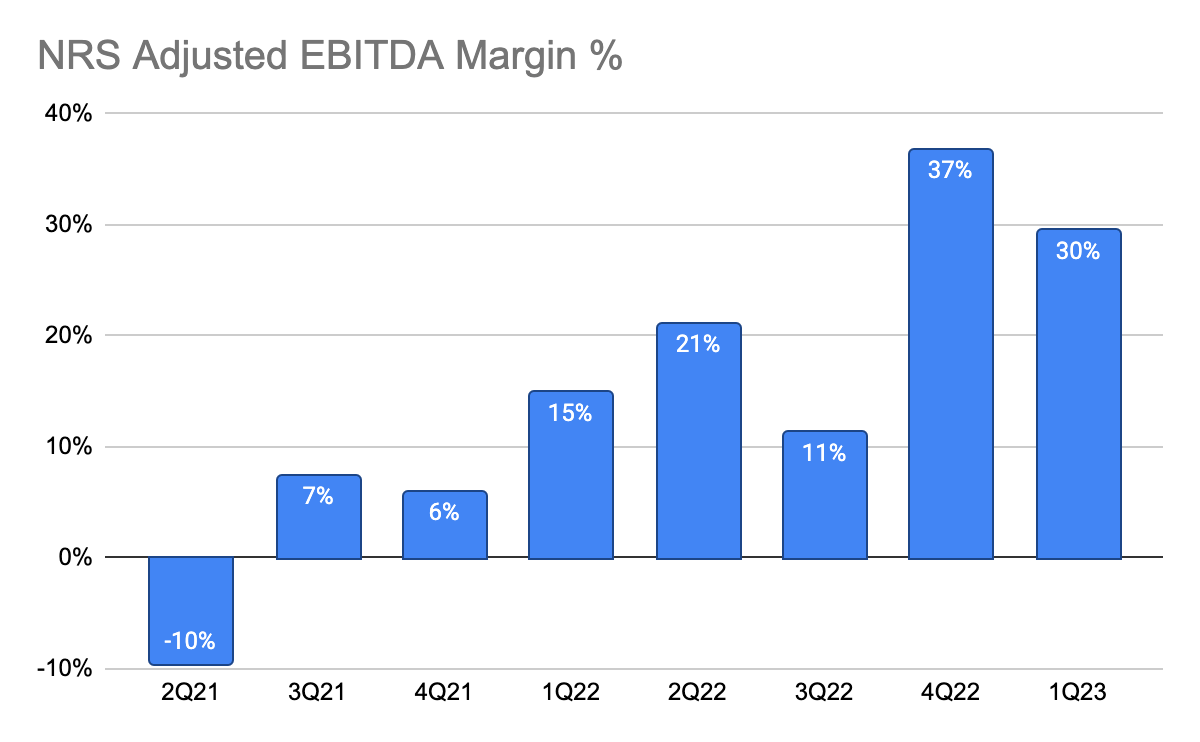

NRS recurring revenue grew 107% Y/Y to $17.8 million despite the slowing growth in advertising revenue. This came off from the strong merchant acquisitions as they added 1,000 new NRSPay accounts and 1,400 new POS terminals during the quarter. As high-margin ad revenue slowed and this is a seasonally weaker quarter for NRS, its EBITDA margin fell from 37% in 4Q22 to 30% in 1Q23.

As merchants continue to cut back on ad spending, we will likely see a further impact on the bottom line, although, the 2Q23 is likely to be a stronger quarter:

“In the first quarter, we benefited from sales of political advertising and we expect to see a significant amount of holiday and year-end spending in the second quarter. However, January is usually a slower sales month and we have begun to see the impact of macroeconomic headwinds that are buffeting the advertising market.”

IDT 10-Q & 8-K

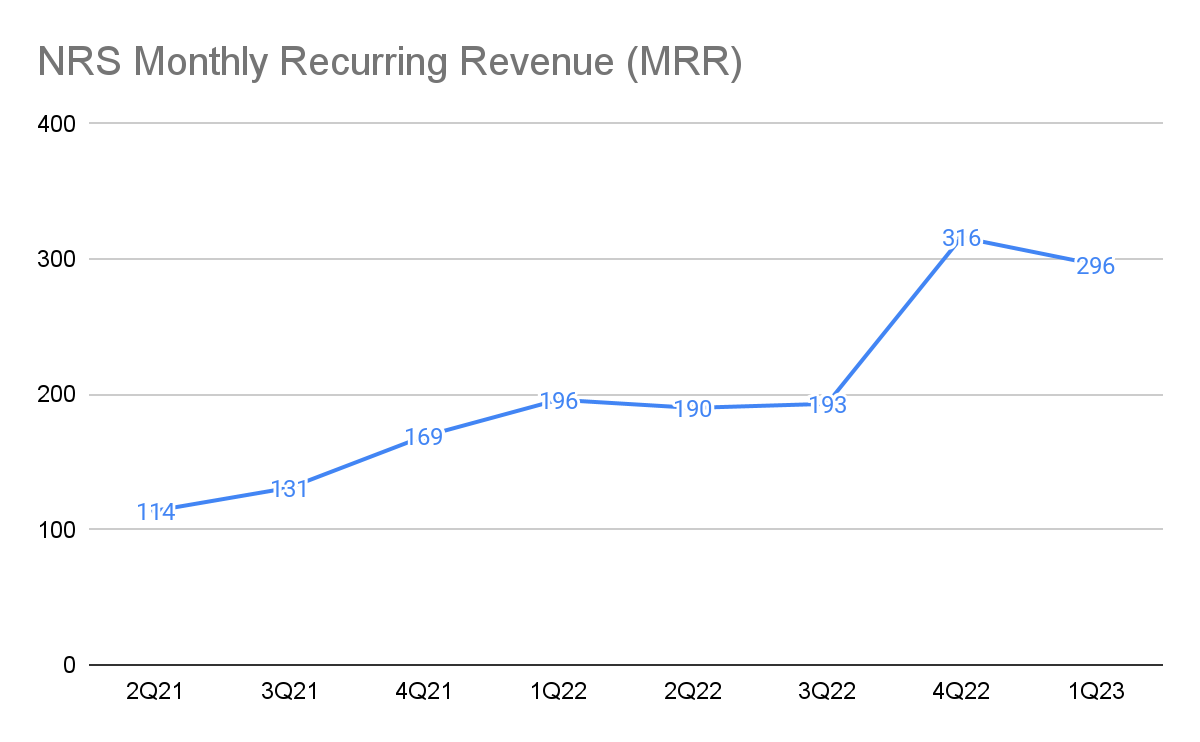

Despite the slowdown in ad revenue though, MRR has remained relatively stable at $297 from $316 last quarter. The MRR has definitely held on better than I expected as I did anticipate a lower MRR. However, I will not rule out a lower MRR, and thus, a lower margin, due to the uncertainty surrounding the advertising market.

Boss Money

IDT 10-Q & 8-K IDT 10-Q & 8-K IDT 10-Q & 8-K

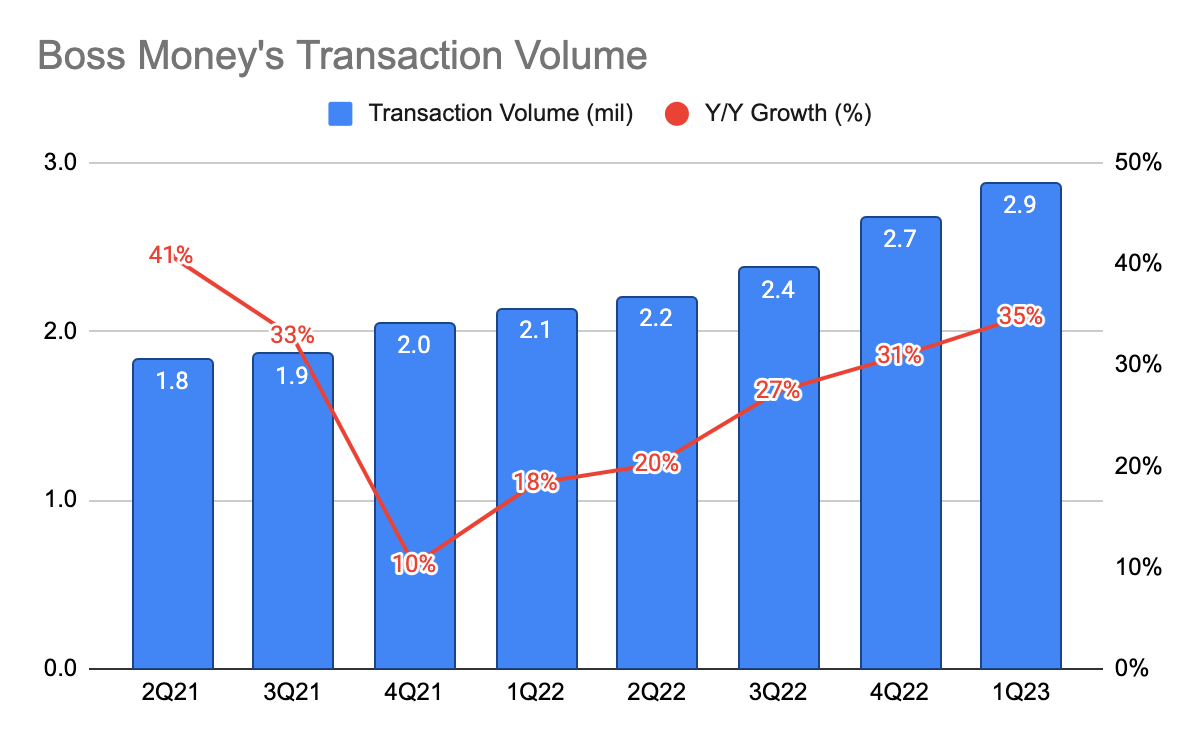

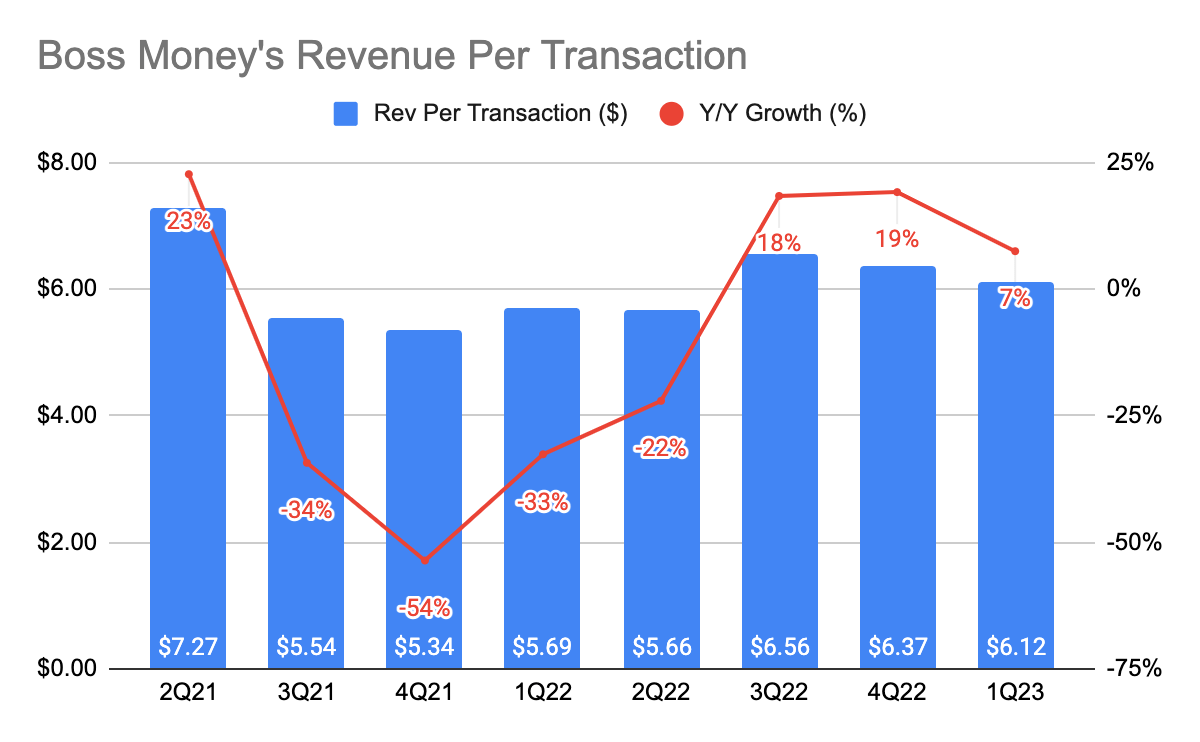

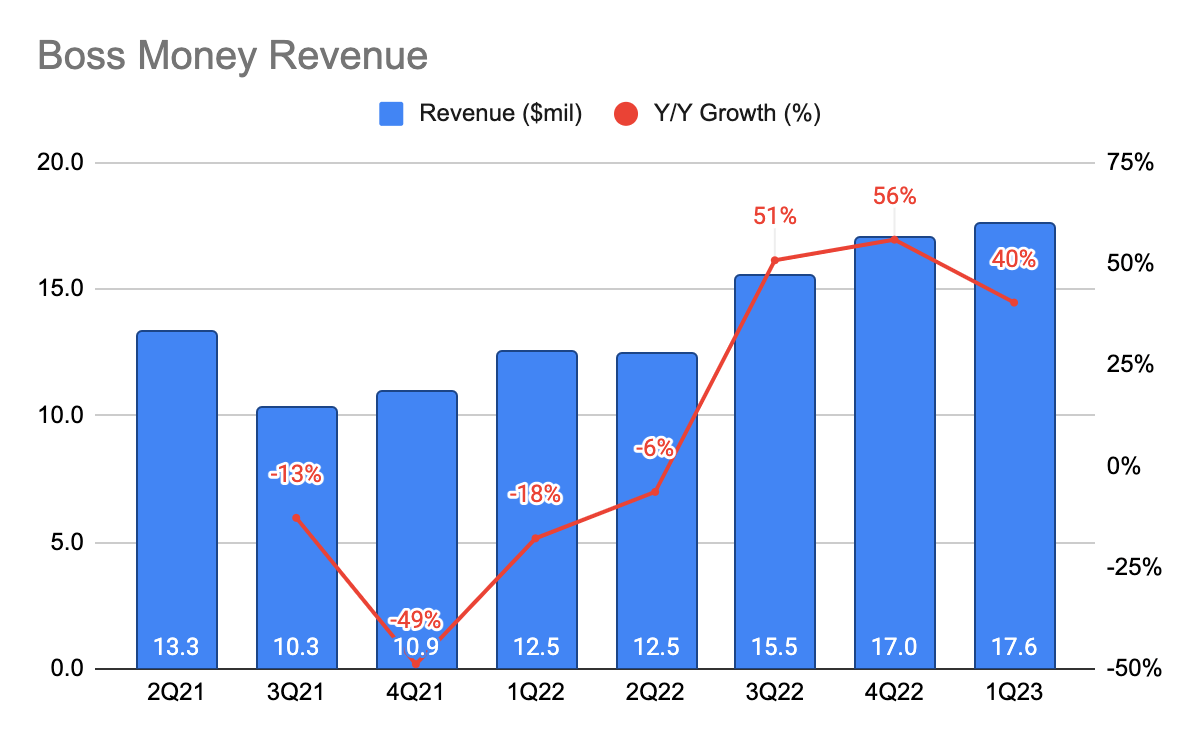

BOSS Money had a really great quarter as transaction volume grew 35% Y/Y to $2.9 billion, and revenue per transaction grew 7% Y/Y. This is a step up in growth rates from the previous quarters. While BOSS Money does not have recurring revenue like NRS and N2P, I do think its revenues exhibit similar characteristics. For instance, during good or bad times, users still going to transfer money overseas to their families. Hence, BOSS Money has a really strong and predictable revenue stream.

Additionally, I’ve also touched on the importance of the partnership with TerraPay as it will enable BOSS Money to accelerate its footprint and market share, leading to much more durable growth over time. As a result, its revenue grew 40% Y/Y to $17.6 million.

IDT 10-Q & 8-K

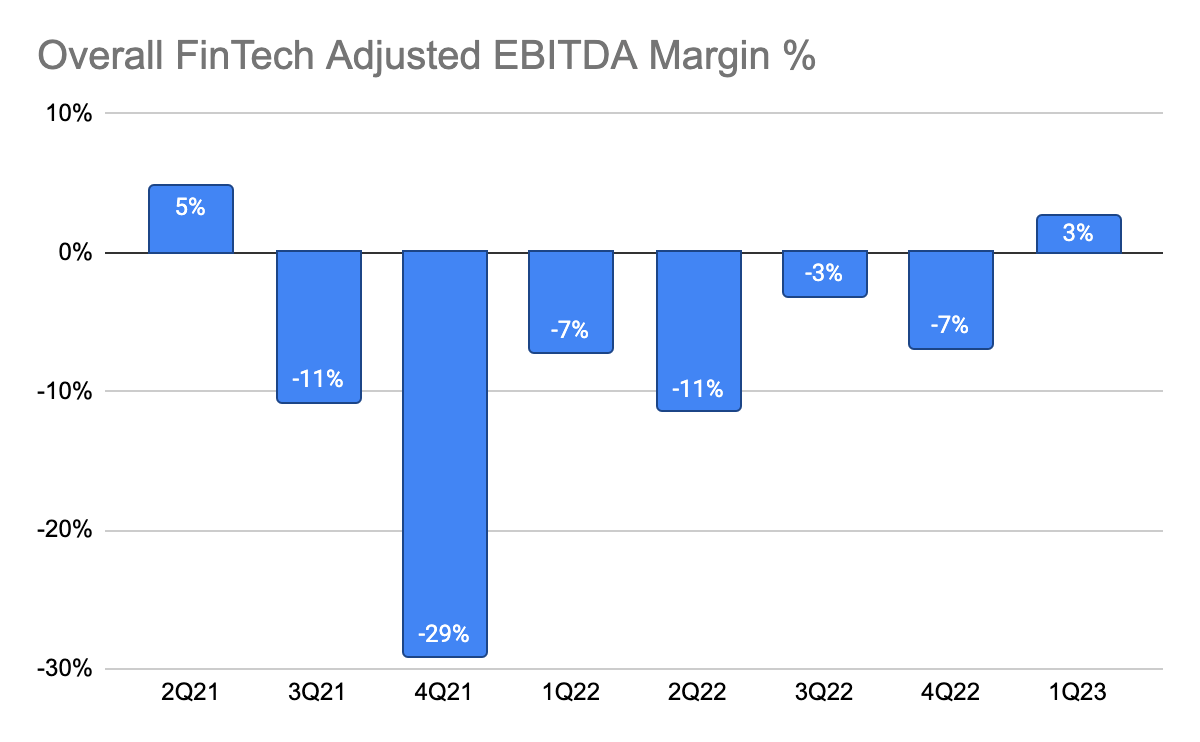

Due to some readjustments, the management reported the new FinTech segment, consisting of revenue streams from BOSS Money and other several digital finance offerings. As BOSS Money makes up the bulk of its FinTech revenue (88% revenue mix), this serves as a proxy for BOSS Money’s profitability. Although, I do think BOSS Money is still unprofitable, and likely to hit a positive EBITDA margin in 2H23.

Net2Phone

IDT 10-Q & 8-K IDT 10-Q & 8-K IDT 10-Q & 8-K

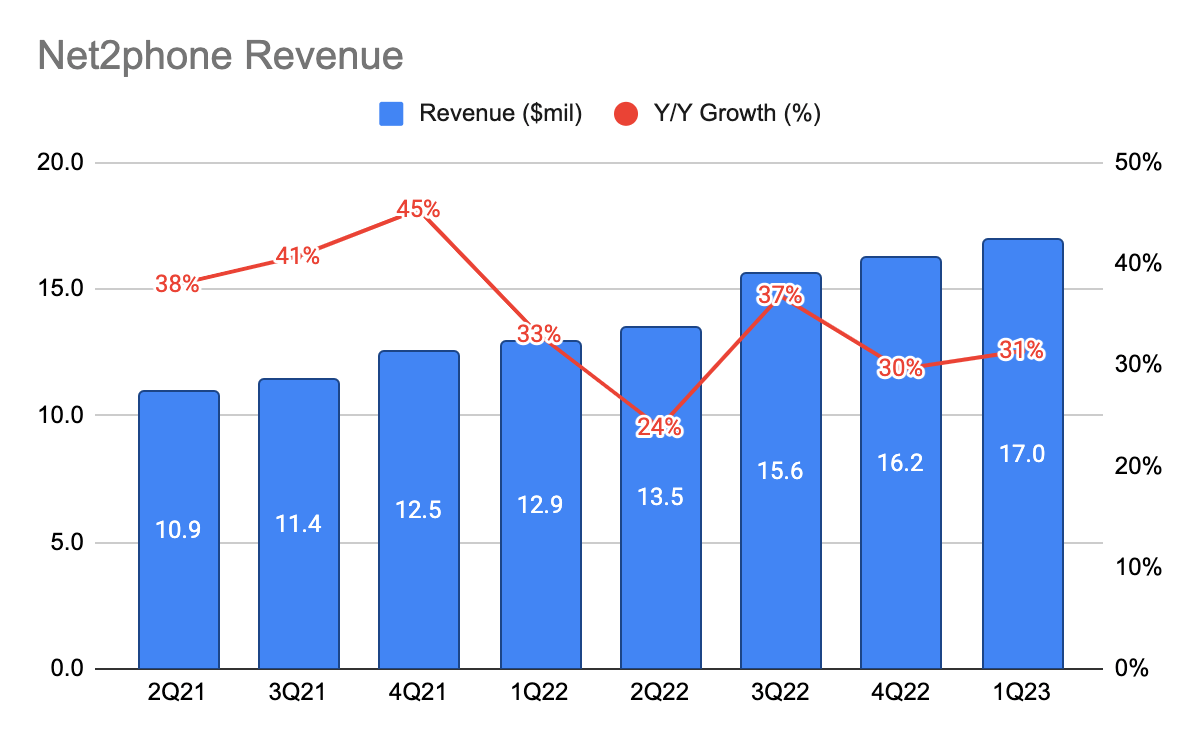

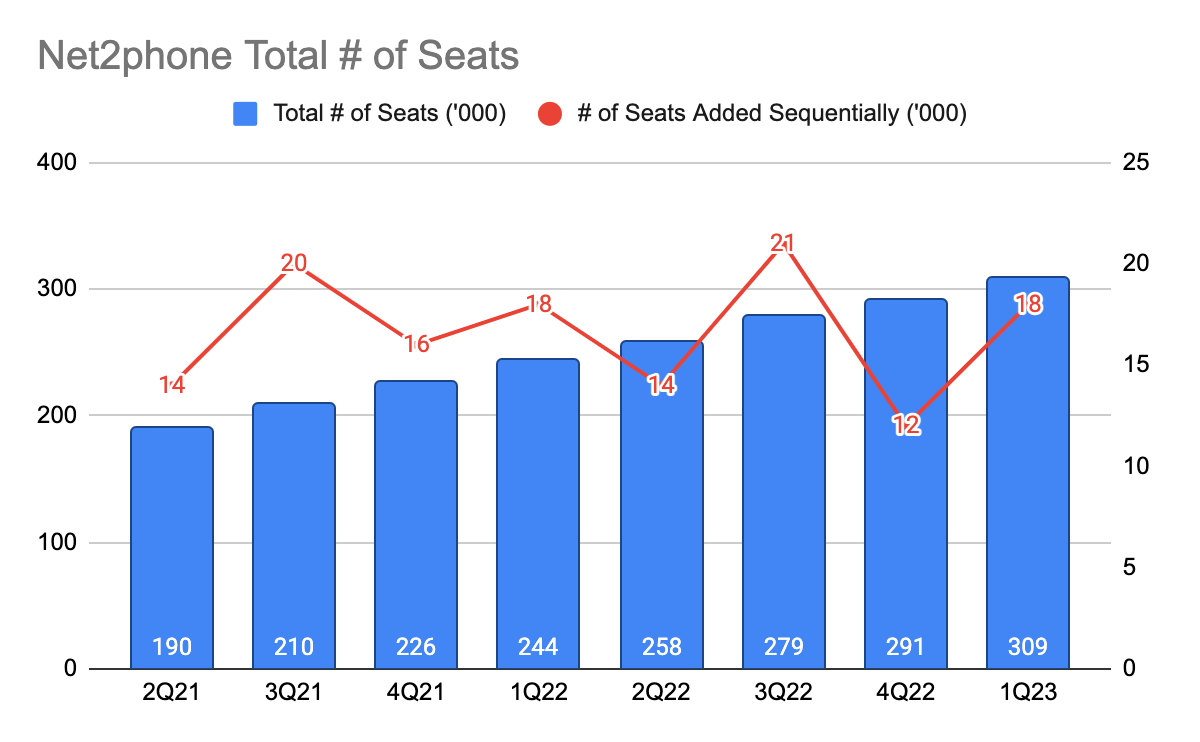

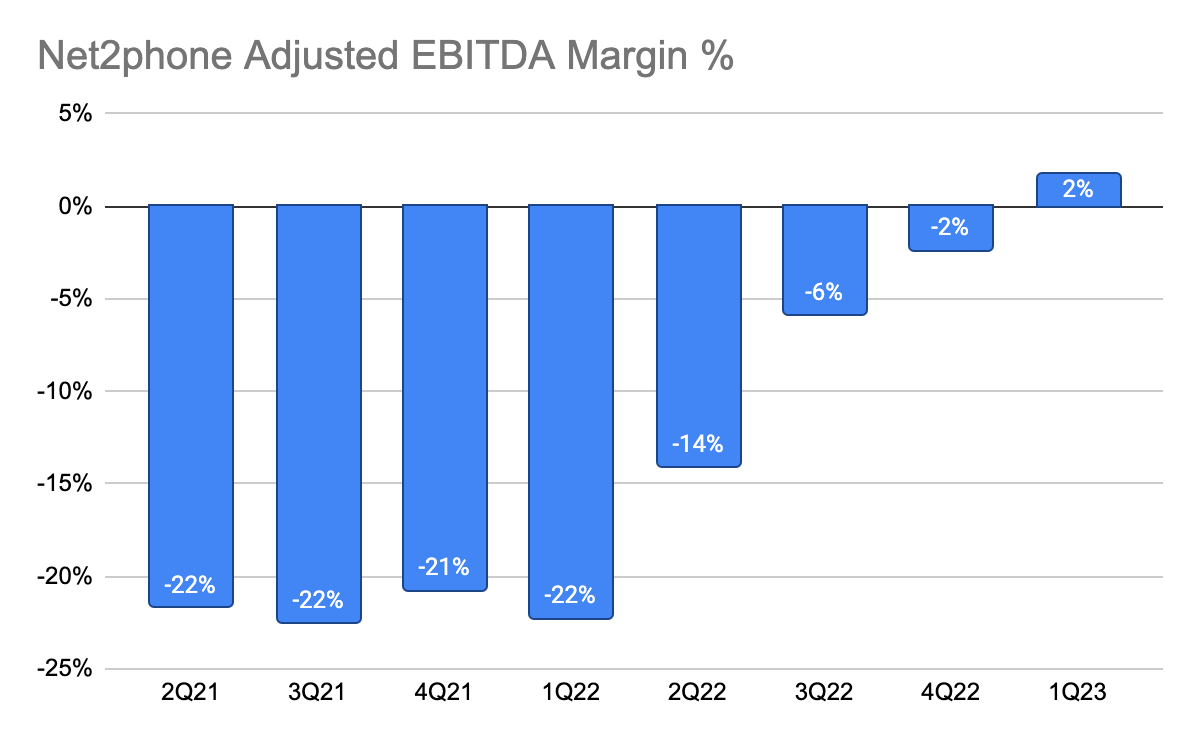

Net2Phone had a strong topline growth as its revenue grew 31% Y/Y and it added 18,000 seats during the quarter. More impressively, it managed to turn profitable earlier than anticipated, with an adjusted EBITDA margin of 2%. I would have imagined them to break even in 2H23, so this is definitely a plus point for me.

This is primarily due to the management’s focus on cost reduction and efficiency, and they were still able to report strong growth in seat counts. The management believes this profitability is sustainable and there should be further improvements in EBITDA margin, and ultimately, hitting free cash flow positive:

“…beauty of the net2phone business is it has very, very low churn – and its revenue is pretty predictable. So, the more lines you sign, the more revenue you have and the more profit. And as long as you manage your costs well…you are going to see continued improvement in the bottom line…I am happy that we own more of it for longer, although that was not the plan…hopefully…we will be able to be coming back to calls later this year and start saying when we are going to become actually free cash flow positive…at the rate are going we might be talking already in fiscal ‘24 about becoming free cash flow positive.”

Traditional Communication

IDT 10-Q & 8-K

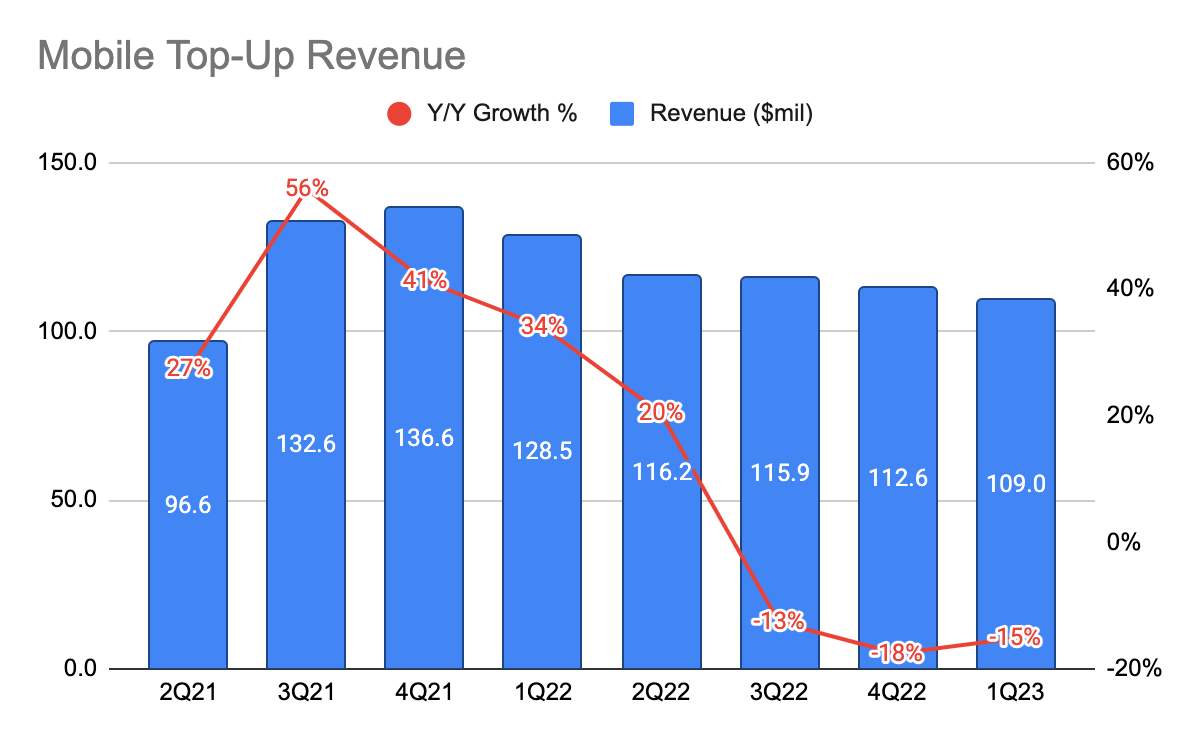

I’m going to focus on its mobile top-up business as the rest of the business segments under its traditional communication business are shrinking, low-margin businesses. During the quarter, its mobile top-up revenue fell 15% Y/Y. According to the management in the 1Q23 8-K:

“The decrease reflected the industry-wide deterioration in a key corridor that was particularly impactful in the wholesale and retail channels. Excluding this corridor, MTU revenue would have increased 4.7% year-over-year.”

IDT 10-Q & 8-K

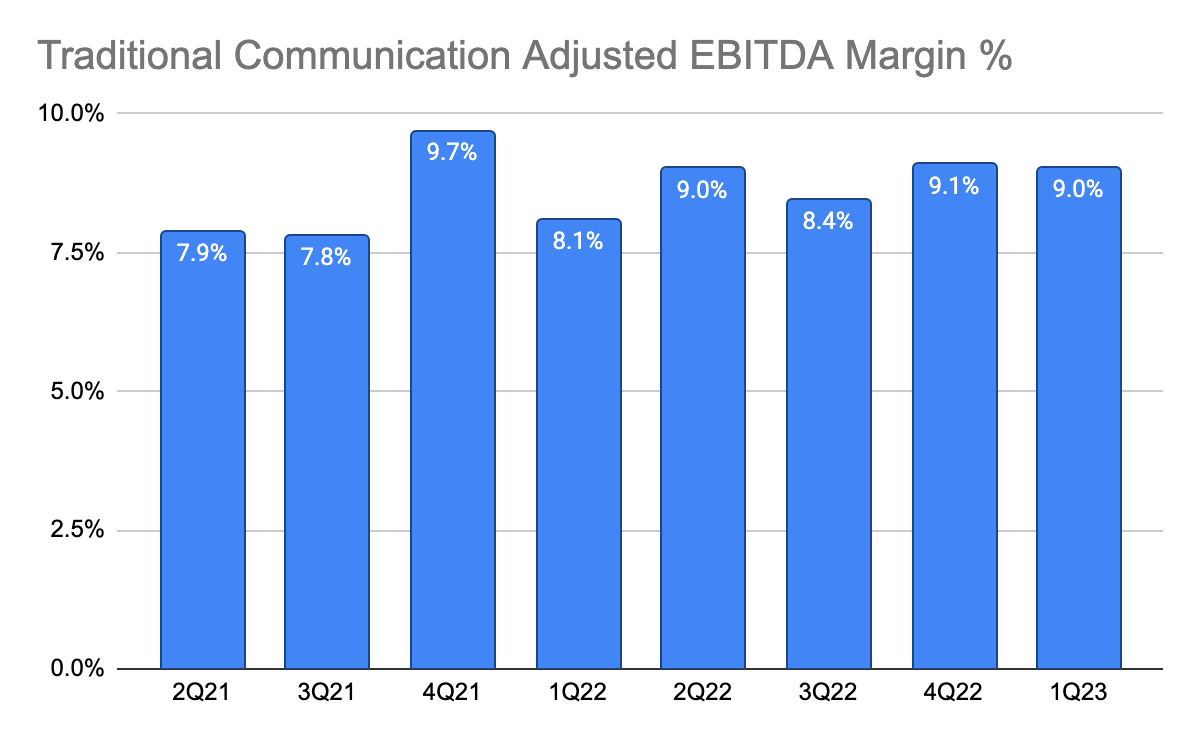

Its overall adjusted EBITDA margin has also been rather stable at 9%.

Consolidated Financials

IDT 10-Q & 8-K IDT 10-Q & 8-K

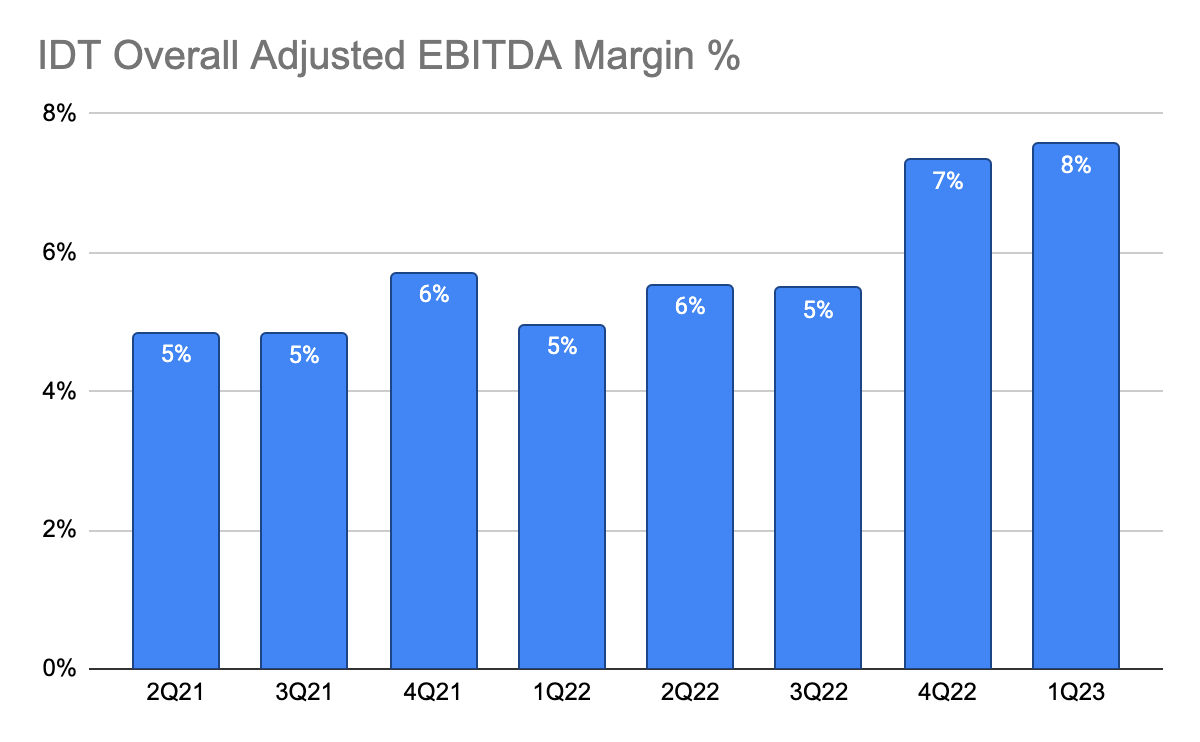

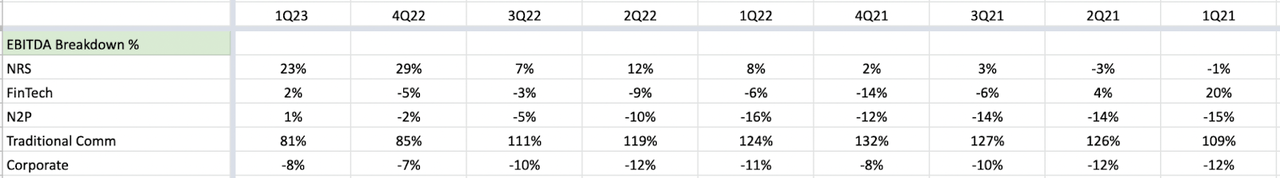

The improved profitability of its FinTech segment, NRS, and N2P led to an improvement in the consolidated adjusted EBITDA margin from 7% in 4Q22 to 8% in 1Q23. Breaking down its EBITDA, we can see that while traditional communication makes up the bulk of profits, its other faster-growing and higher-margin businesses are making up a larger proportion.

Valuation

I will be doing some changes to my previous valuation

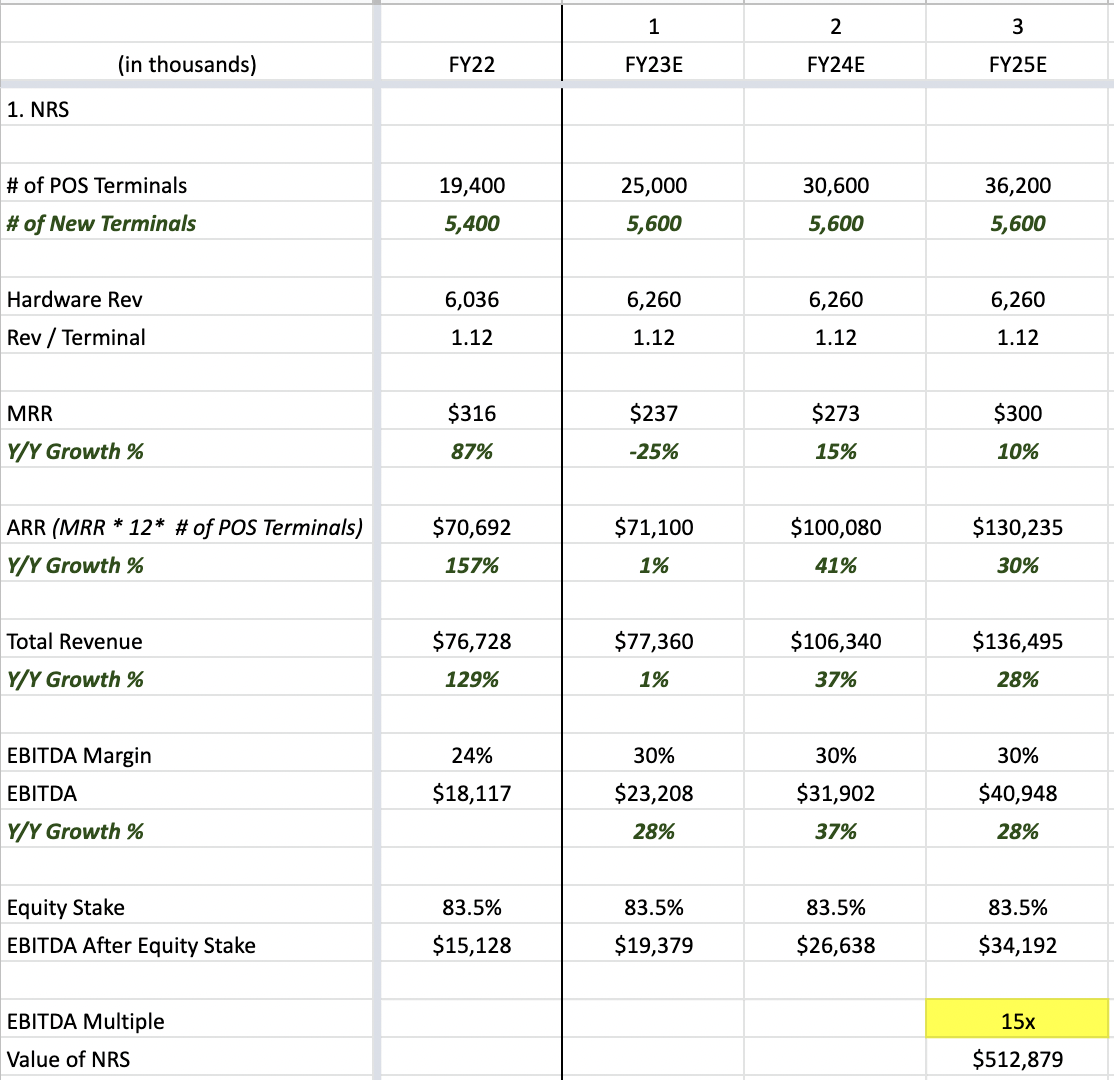

NRS

Authors’ Estimates of NRS

Instead of doing 1,500 new terminals per quarter, my new estimate is 1,400, which translates to 5,600 new terminals annually. For the EBITDA margin, instead of a 37% EBITDA margin, I will be using a 30% EBITDA margin instead. With a 15x multiple, this gives me an enterprise value (“EV”) of $512 million by FY23.

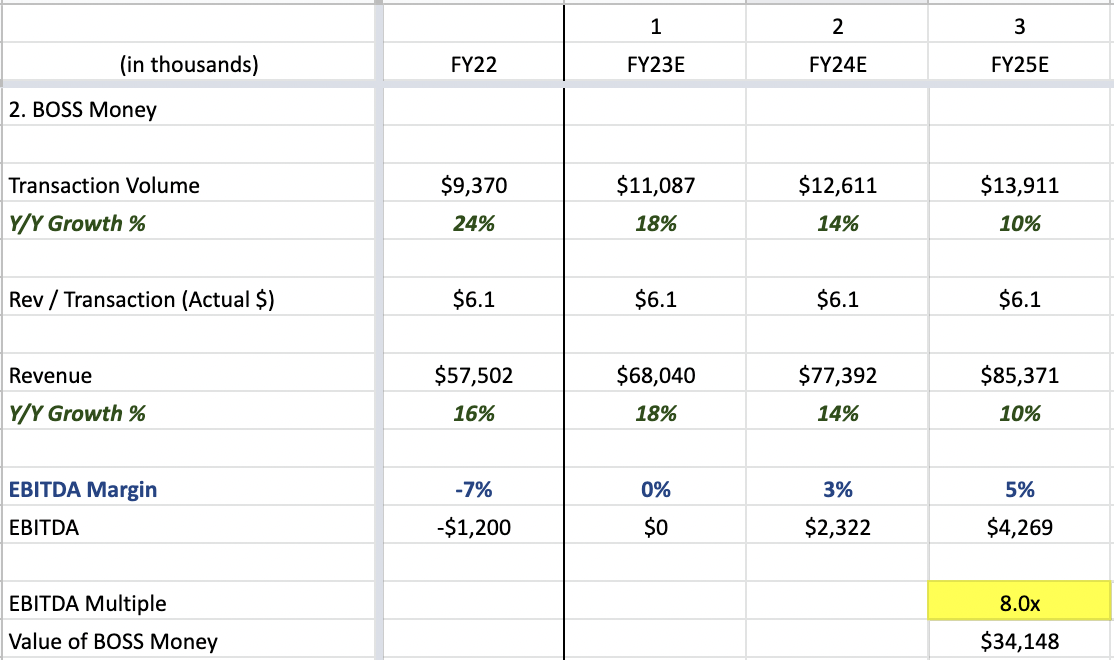

Net2Phone

Author’s Estimates for Net2Phone

Instead of a 0% EBITDA margin for year 1, I will be increasing it to 3%, and subsequently, 7% by FY25. This is largely due to the earlier-than-expected profitability. With a 10x multiple, this gives me an EV of $48 million.

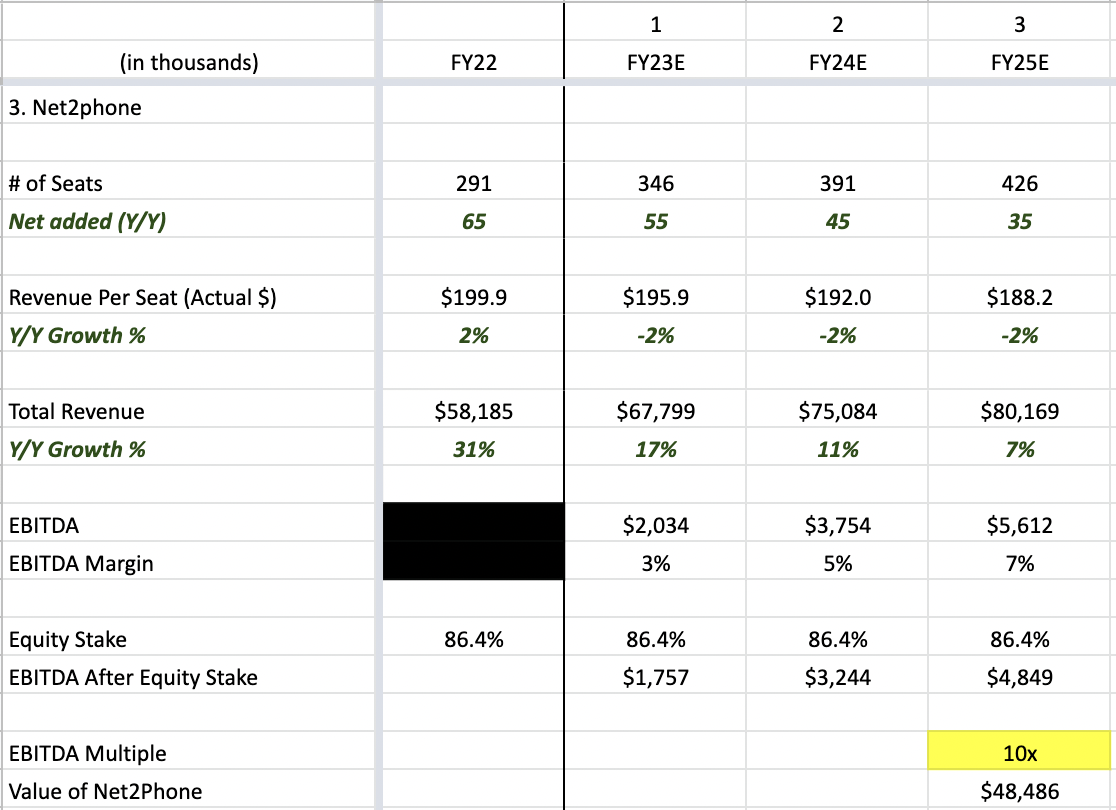

BOSS Money

Author’s Estimates for BOSS Money

For BOSS Money, I do suspect it to hit breakeven by FY23 as shown in the overall FinTech EBITDA margin during the quarter. Subsequently, its margin will improve to 5% by FY25. With an 8x multiple, this gives me an EV of $34 million.

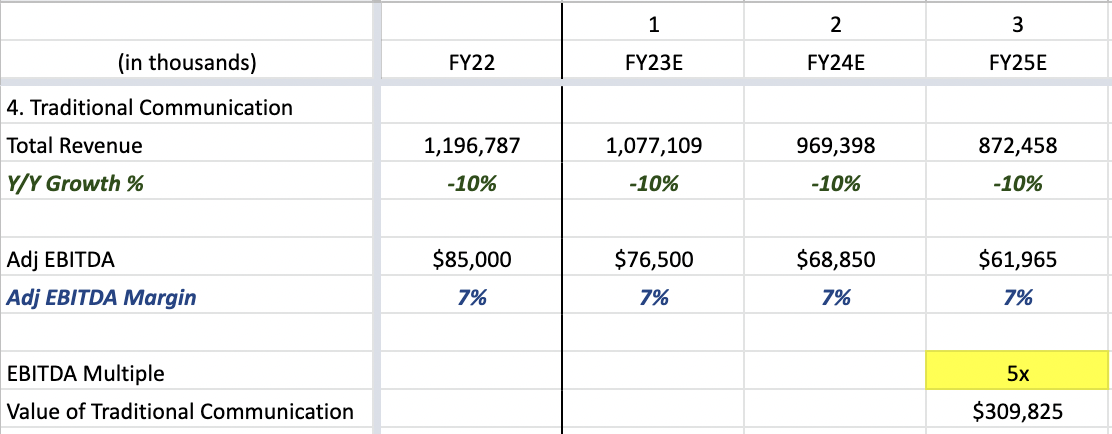

Traditional Communication

Author’s Estimate for Traditional Communication

The valuation remains unchanged with an EV of $309 million.

Combined Valuation

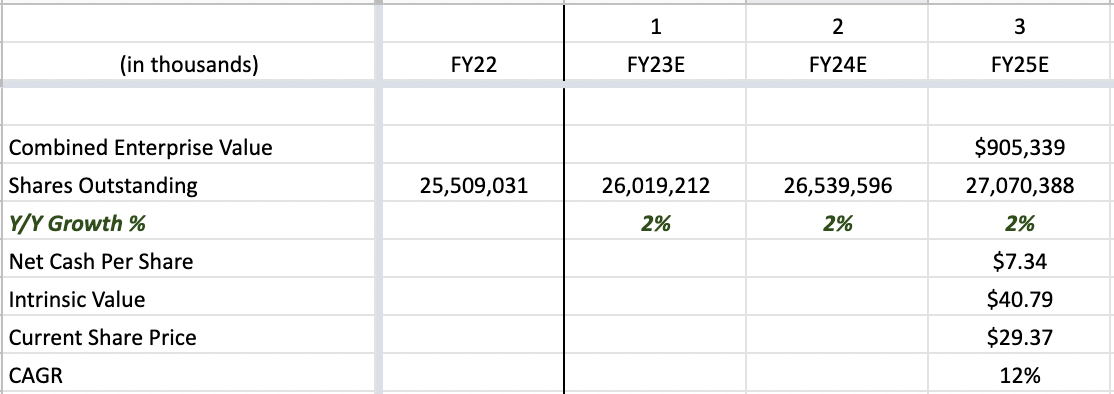

Author’s Estimate For Entire Company

Altogether, this gives us a combined EV of $905 million, and accounting for shares dilution and net cash per share, this gives me an intrinsic value of $40.79, a reasonable margin of safety from the current share price.

Do note that my assumptions may not materialize and you should also conduct your own due diligence.

Risks

NRS

Execution risk

-

Merchants cutting down on ad spending is likely to further impact its EBITDA margin, although, the impact is still uncertain as of now. This broad-based macro impact is likely to last, putting pressure on its high-margin ad revenue, and thus, impacting its profitability.

-

The key going forward also lies in its ability to maintain the growth of its POS terminals and NRSPay accounts. Weak sales execution can lead to slower growth, thus impacting its ARR and margins.

Traditional Communication

Execution risk

-

The key is management’s ability to maintain/improve its profitability as this is a shrinking, legacy business. As it still makes up the bulk of the company’s profitability, it represents an important cash cow for IDT Corporation and a significant portion of its valuation.

Net2Phone

Execution risks

-

Competing for market share is critical and weaker execution can lead to slower growth in seat counts, translating into lower revenue, and thus, lower margins.

Weaker Currency Impact On Revenue

-

FX market conditions are likely to impact its revenue as they derive most of its revenues in Latin America.

BOSS Money

Execution risks

-

Its ability to expand into a full-fledged digital financial provider is key to enhancing the value proposition of the app (and differentiating itself from its peers), encouraging more use cases and frequency of usage, and therefore, leading to stronger customer stickiness.

-

Striking partnership with more financial institutions or banks is also key to extending its Total Addressable Market and providing more durable growth

Concluding Thoughts

I was rather pleased with the result as the company’s overall profitability continues to improve as a result of the increased/improved profitability across each of its business segments, with Boss Money and Net2Phone turning EBITDA margin positive. These businesses also showed strong topline growth, including strong merchant acquisitions for NRS, strong seat growth for N2P, and transaction volumes for Boss Money, which is a testament to management’s ability to execute, high-quality revenue streams, and asset-light and strong business model.

What are your thoughts on the 1Q23 quarter? Let me know in the comment section below!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment