pandemin/iStock via Getty Images

Every Monday, members of Margin of Safety Investing, get several option selling ideas. We write covered calls when stocks in our portfolios are overbought and sell cash-secured puts when stocks we want in our portfolio are oversold.

Currently, much of the oil and gas complex is priced to perfection, however, there are pockets of value and growth that continue to be investable in energy. We have identified opportunities in oil & gas, biofuels, carbon capture and clean energy.

Last week we sold cash-secured puts on 6 energy investments that offered annualized yields up to 50%. Here are those trades and thoughts on what might be available in the coming week or two.

The Energy Short Story

My summarized thesis on energy is this:

- We are in the 2nd or 3rd inning of the end of the oil age which I first identified on MarketWatch back in 2015. It could be an extra innings game or rained out early, anyone offering a perfect time line is a huckster.

- OPEC, mainly Saudi Arabia, and Russia are dramatically impacting global oil and gas supplies and prices, much of their actions are for deliberate geopolitical and international monetary system reasons.

- Oil demand will be robust until about 2026-7 which is when EVs will start to take significant new car sales market share due to regulation and a major shift in manufacturing that is already underway.

- With the significant use of the Strategic Petroleum Reserves, there is now a price floor under oil in the $60-$70/barrel that will last for several years, likely until about 2026-7 coinciding with broader EV adoption.

- There is still the potential for a spike in oil and gas prices due to geopolitical events, i.e. war or other disruptions to supply.

- Several years from now, something I am calling “panic pumping” is likely to occur as oil producers, particularly from countries with significant oil assets, will increase production to avoid leaving stranded assets as the end of the oil age progresses into later innings.

- Carbon capture and low carbon impact biofuels are gaining traction due to investment by big oil and the Inflation Protection Act which incentivizes such solutions to climate change.

- In the short run, several oil and gas companies appear to be low risk ways to profit via investment and cash-secured put selling.

- In the long run, clean energy solutions will dominate growth, however, volatility will be wicked and should be used to find low buy in prices.

I plan to discuss each of those points in more complete articles soon.

In a recent article for subscribers to my service I said this:

Energy thoughts on MBS & President Biden (Margin of Safety Investing by Kirk Spano)

I think it is important to realize, that regardless of your particular views on climate change, most governments of the world believe it is happening and that burning fossil fuels is the main culprit. They are adjusting policy to reduce carbon emissions via policy in energy, transportation, building, industry, agriculture and finance.

President Biden is an ardent believer in climate change and it should be considered that he sees higher oil and gas prices as a means to an end.

Here’s my 3 to 5 year view. Energy will be higher through next summer, but by autumn 2023 we will see several things:

- a new record in U.S. oil and gas production.

- deals with Canada and U.S. oil to refill the SPR.

- even more EV adoption.

-

another record year of solar installations.

So, if we see an oil and gas price spike, similar to after Russia’s invasion of Ukraine, I think it most likely by next year. And, from whatever the high price set next year is, we are likely to see a slow choppy drift down in oil and gas prices to 2026-7, after which, we could see deeper declines, especially in the 2030s.

Here are my 6 of my energy ETFs and stocks for the above viewpoint.

Oil & Gas

As subscribers know, I rarely release my top investment ideas to the public. However, these are ideas that are six months to a year old now and no longer need to be embargoed.

Consider that each idea is based upon my “energy short story” thesis as laid out above. If you do not largely agree with that thesis, these ideas might not be for you.

I have taken a lot of time to analyze these companies, including interviewing executives, touring facilities, looking for value that the market does not yet assign to prices and considering as a potential owner or executive.

Occidental Petroleum (OXY)

I have no doubt in my mind that Berkshire Hathaway (BRK.B) is buying this company in whole sometime next year. We have been discussing this since spring.

The Berkshire thesis is largely misunderstood by most who are talking about Occidental. While the oil and gas component is obvious, the real meat here is their carbon flooding expertise and carbon capture abilities of the company. I will have an article on this coming takeover in coming weeks.

Berkshire recently received government approval to buy half the shares of Occidental. Their warrants are priced at $59.62, which acts as a floor on share prices, making Occidental among the safest oil and gas stocks in my opinion.

We were buyers of the stock until is firmly crossed $60 per share. We have also sold previous cash-secured puts. I am recommending selling another tranche of cash-secured puts to generate income and if we see a dip in price, then we are fine owning more shares. This was last week’s recommendation and if there is a dip big enough, do it in my opinion:

- Sell OXY $60 January puts for $4+

At the moment, that trade is not available since the stock rose a lot the past week. Occidental won’t likely fall below $60 again unless something very unexpected happens. So, I think you can raise strike price to $65 with a GTC for $5 in premium. You’re using the GTC order to potentially let the volatility get you an execution.

Permian Resources (PR)

Permian Resources has a very cheap asset base in the Permian and merger synergies from the tie up of Colgate and Centennial. As a new and largely under covered company, this stock can run higher on firm oil and gas prices.

As we have discussed with TotalEnergies (TTE), Permian Resources has been a bargain hunter for their assets. Many of their assets were bought out of bankruptcies and distressed strategic transactions.

When the market comes to realize their great “rock” position and excellent low leverage balance sheet, I think the shares can run significantly. I am recommending a starter position and selling cash-secured puts.

- Sell PR $8 January puts for $1+

Like Occidental, Permian Resources price jumped last week after our bullish recommendations. You will need to use a GTC limit order and let volatility work for you to get this put sold. Another choice is to raise your strike price to $9 and seek the dollar premium. I prefer trying to get the $8 strike.

New Fortress Energy (NFE)

New Fortress has a unique technology in liquified natural gas that retail investors are not fully aware of. Their F.A.S.T. technology allows them to load LNG at the wellhead on the water. FAST LNG is growing fast.

New Fortress Energy is perfectly positioned to keep growing on European and global demand. Their recent sale of a Brazilian joint venture further deleveraged their balance sheet and puts them on a path to an investment grade rating. I see a price north of $100/share as revenues continue to climb and the balance sheet moves towards investment grade. I will be releasing a full analysis on New Fortress in coming weeks.

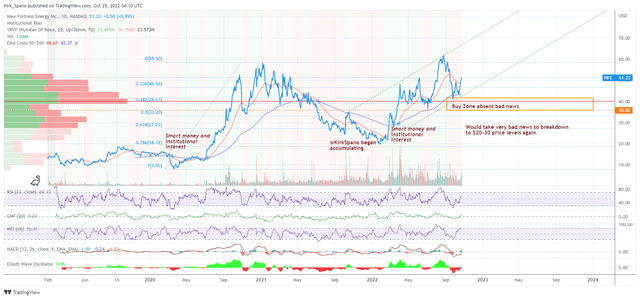

Technically the stock is strengthening after a minor correction from a new high. It looks like it could be setting up for a breakout in coming month. Notice the oscillators turning up and the golden cross of the 50 day EMA over the 200 day EMA in April that hasn’t broken even on pullbacks within the channel I have marked in parallel green dotted rays.

NFE Basic Technicals (Kirk Spano)

For the record, I love this company for the fundamental story, but the technicals paint a nice picture to work within. I am recommending taking a starter position in New Fortress Energy on any dips and selling this cash-secured put.

- Sell NFE $45 December puts for $4.50+

ETF breakout candidate: SPDR Select Energy (XLE)

President Biden has essentially put an upper $60s price floor under oil by saying he would refill the SPR around those prices. That’s a big deal. I have been talking about a government backstop on oil since spring because they would have to commit to refilling the SPR. That’s exactly what is happening.

Exxon Mobil (XOM) and Chevron (CVX) are most likely to cut deals with the U.S. government to refill the SPR. But, even if there is no formal deal, as major producers they will benefit from a floor under prices. They are about 40% of XLE holdings.

Other large oil companies, midstream and services are other big holdings. In short, I think the whole complex is solid, though not without risk. If the Fed damages the economy, then these can slide. I think it is more likely we see these stocks lead a rally, along with tech and clean energy stocks, in 2023-4.

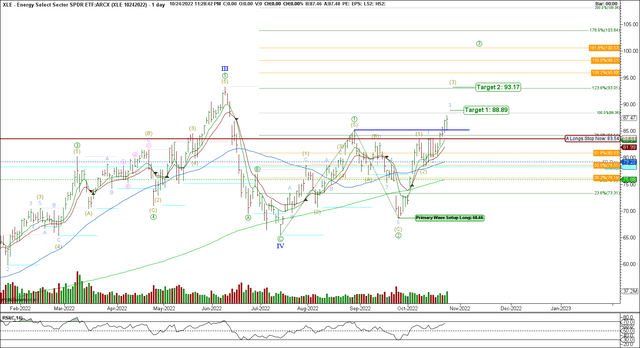

From a technical standpoint, my technical analyst both see XLE breaking out using different methodology. Here’s our Elliott Wave analysis:

XLE Elliott Waves (Scott “Shooter” Henderson)

You see his targets extend all the way to a shade over $100/share. A pullback to below $83 would likely signal a new primary upward wave set-up.

My technical analysis relies on oscillators, including the Elliott Wave oscillator. Right now, they are all pointing up and the 50 day EMA is still above the 200 day EMA. Until some of those start to breakdown, likely a shade above $100/share, XLE looks strong.

- Sell XLE $80 January puts for $6+

Decarbonization

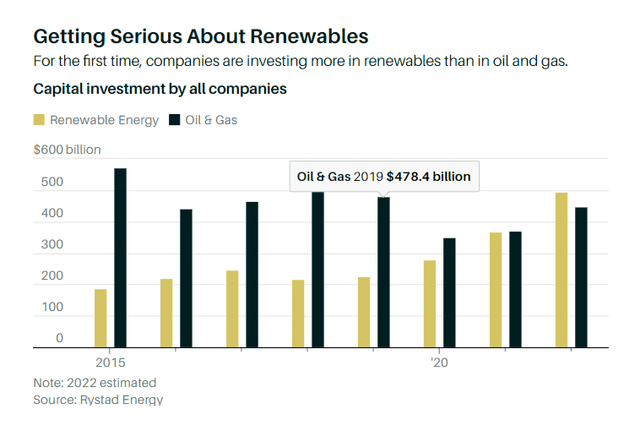

For the first time ever, more money is pouring into alternative energy than fossil fuels. This isn’t the future anymore. It’s now and the future. When I see data like this, I remember something I heard from family, family friends, bosses, landlords, mentors and other smart people: follow the money.

Biofuels & Carbon Capture stock: Aemetis (AMTX)

Aemetis is a biofuels and carbon capture stock that is the leader in California. It is early in its capex cycle yet is already on the verge of profitability.

The company continues to add contracts and future revenues as it completes its buildout. It has now finalized supply contracts to provide $7 billion worth of aviation fuel over the next decade. It also has biogas deals, feed deals and biodiesel in India. The anticipated $5 billion in revenues the CEO talked about with me in an interview with him about a year ago has been blown away.

It also has some impressive shareholders, including BlackRock (BLK), GMO (Jeremy Grantham’s company), AllianceBernstein, Encompass Capital Advisors, Vanguard and Wellington Management. We have been accumulating on the dips for about a year now.

It is only a matter of time in my opinion before investors “discover” this stock. I am planning a more full analysis for public release by year-end.

- Sell AMTX $5 January puts for .55¢+ (remember to start at the ask if it’s higher and work your way down over an hour or two).

Clean Energy ETF: Invesco Wilderhill Clean Energy ETF (PBW)

PBW is a nicely balanced global all-cap selection in clean energy space. It is a modified equal weight portfolio so that no one company dominates performance. It is a true sector play.

PBW recently corrected to about $40 per share which was near my “bottom fishing” price. I’ve adjusted the chart to include the Armageddon Zombie Apocalypse in case the Federal Reserve wrecks the economy.

As you can see on the chart below, price sits at an important support range. Because of the weak oscillators, I anticipate price will fall into the $30s somewhere. A Fed that breaks things could drive it into the $20s it looks like. We’ll see.

I think PBW is a great ETF based on diversification and strong past performance. Of course, past performance is no guarantee though of future performance, but, as I said above, follow the money.

I think selling cash-secured puts to scale in across a few purchases makes sense starting about now.

- Sell PBW $40 December puts for $3+ (this market is thin right now, so, you’ll have to set a GTC order).

Homemaking

I will be releasing more pieces of research in coming months to help people come out of this bear market. If you like this sort of analysis, more in-depth pieces and macro, please do “Follow” me below next to my name.

I will be interviewed again by Forex Analytix in December. I also offer weekly webinars. Keep an eye on my SA blog for details.

I look forward to discussing today’s ideas with you the comments below. I know there are many energy people who have followed me a long time, I value your input.

Be the first to comment