Anton Vierietin/iStock via Getty Images

Everything that could go wrong with Alibaba Group Holding Limited (NYSE:BABA) over the past couple of years did go wrong. Regulatory crackdowns, record fines, higher taxes, bad economy, you name it. I initially opened a position at $220 in March, 2021, when the company was still expected to make about $15 per ADR, and have been averaging down ever since. My average cost basis is $120 now, so I’m down by roughly 50%. The stock is down by over 80% from its 2020 record of $319 and I’ve lost every shred of confidence in my ability to correctly anticipate the bottom.

But bottom it will, eventually. All investors need is a cool head and patience.

U.S. Banks in 2009 vs. Chinese Companies in 2022 – A Historical Parallel

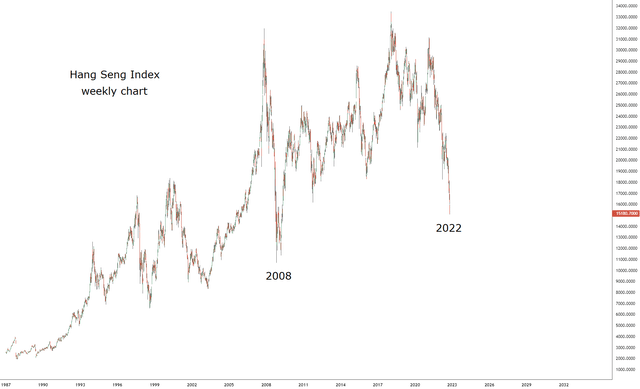

Judging from the Hang Seng index chart below, the economic crisis China is facing right now is of similar magnitude to the one in 2008. It also has the same culprit, namely, a construction and property bubble fueled by a lack of meaningful regulation and plenty of debt, dragging the entire economy down with it when it burst. Nothing new under the sun.

This brings an interesting comparison to mind. In 2008, 2009 and even up until about 2013, the big banks on Wall Street were still reeling from their mortgage losses during the Great Recession. Many of them nearly went bankrupt. Some of them actually did. The U.S. government started regulating them more strictly in order to make sure such a crisis would never happen again. Their stocks were in the doldrums, down 70-90% from their 2007 peaks.

Pessimism was so strong that the majority of investors wouldn’t touch Bank of America (BAC), Citigroup (C), Goldman Sachs (GS), Morgan Stanley (MS) or Wells Fargo (WFC) with a 10-foot stick. The banks would be paying huge fines for years to come. It felt as if they would never make a dime of profit ever again. Laymen and “experts” alike called Warren Buffett crazy for buying BAC warrants and Goldman preferred stock. For the vast majority, no price was low enough.

Sounds familiar? It does to me.

Today, China’s property market is imploding and the economy is in tatters. Regulations and fines have diminished the earnings power and near-term growth potential of many Chinese companies. The stocks of even the best and biggest of them are down by 80-90%, not to mention the smaller ones. Investors are running away in panic, no price is low enough, and Charlie Munger is being called crazy for holding 300,000 Alibaba ADRs.

Some Personal Experience

Similar comparisons could be made about oil stocks, when Big Oil CEOs were forced to admit they knew about the climate damage they were doing. Or about Big Tobacco, or gambling, or CFD trading in Europe in 2019. But guess what? Those who managed to stay rational and focus on the fundamentals and valuation of the companies instead of on abstract doom and gloom narratives did pretty well in a few years’ time.

And while I was only 19 and not smart enough to buy banks in 2009, I’ve had my fair share of experience holding large paper losses in recent years. For example, in 2018, new regulations on CFD trading were introduced in the European Union. It was a bad year for companies in the sector, who saw their stocks falling by ~80% in a matter of months. I remember reading a comment on SA saying that the regulators have killed them all for good.

On the other hand, I thought Plus500 (OTCPK:PLSQF), a leading CFD trading provider, was strong enough to survive and adapt. At 900 pence a share, it looked ridiculously cheap at a trailing P/E of 3, so I jumped in. As it turned out, I was right about the first idea, but very wrong about the second. Plus500 didn’t bottom until it pierced 400 pence a share, which means my initial position was down by over 50%. It felt bad to the point where I started wondering whether I was stupid.

There was no new fundamental developments, just the pure fear that the big bad regulators would push the industry and every company in it out of business. Fear is a bad investment strategy, though, so I kept averaging down. Fast-forward to today, Plus500 is alive and well and the stock is hovering above 1750 pence a share. My total return is in the vicinity of 200% in under four years.

Another relevant example is Danish jewelry-maker Pandora (OTCPK:PNDZF), whose stock I started buying at DKK 590 a share in early-2018, only to suffer through a 70% decline to DKK 180 by March, 2020. Covid-19 seemed like the final nail in my investment’s coffin. Again, it felt as if I had made a huge blunder, even though the company’s financial statements looked good. But I kept averaging down until I brought my cost basis down to DKK 450. In November, 2021, I sold the position at DKK 930, doubling my money in under four years.

I’ve had the same kind of experiences with investments in Hibbett (HIBB), Home Capital (HCG:CA), Cameco (CCJ), and many others. All eventually led to very satisfactory returns despite feeling awful at first. There is no such thing as catching the bottom. It only exists in the minds of the inexperienced.

Alibaba Feels Terrible And That’s OK

You may be wondering, what does all this have to do with China? What do Pandora, Plus500, tobacco and oil have to do with Alibaba? I am aware these are very different companies operating in very different environments. The thing they all have in common is the fear driving their stocks ever lower.

When the market is ruled by fear, fundamentals and valuation don’t matter. But eventually they always do.

SA abounds with articles, whose authors basically say the same thing: “I told you so.” The way I see it, they sound sensible now merely because the price is, indeed, falling. It justifies their long-held pessimism. The question is, is the price falling because Alibaba, Tencent (OTCPK:TCEHY) and the others are doomed, or do they seem doomed because the price is falling?

Even though Nouriel Roubini was right in 2008 and early-2009, he’s been wrong ever since. People call him Dr. Doom these days, and hardly anyone takes him seriously. You don’t want to be that guy, correct only twice a day like a stopped clock. It works if your aim is sensational headlines, but not if your goal is good investment results.

It always amazes me how people want a bargain and certainty at the same time. The two are mutually exclusive. When an asset’s price is down substantially, there is always an obvious reason why. On the other hand, when the price is up by a lot, there seems to be nothing but blue skies ahead. However, the first rule of investing is that the higher the price paid is, the lower the return on investment will be. So, in order to achieve a high return, one must pay a low price. Unfortunately, low prices for quality assets are never available when things are fine and dandy. We must invest at the throes of a bear market, precisely when all hope is lost. I think that is where Alibaba, Tencent, Baidu (BIDU), and the other China majors are today.

The Bear Thesis: Xi Is Scary

With the delisting issue now largely resolved, the justifications for not buying Alibaba turned to the economy at large and Xi Jinping’s persona. He just secured an unprecedented third term at the helm of China’s Communist Party and surrounded himself with loyalists, virtually guaranteeing that he’ll rule for life. I agree that Xi is scary. In fact, I think he is just as terrifying as Vladimir Putin. Maybe even more so, especially if he acts on his plans to seize Taiwan.

While having a ruthless dictator for life is far from an ideal situation, the truth is there haven’t been any significant new crackdowns from China’s regulators for a year now. In fact, the government is expressing willingness to support the economy. Xi wants China to become a “medium-developed country” by 2035, which implies a doubling of the size of the economy from its 2020 level. That won’t happen unless he lets businesses do business. Alibaba, Tencent and Baidu are the backbone of his economy, and he knows it. Xi cannot achieve his GDP growth targets without them. So I seriously doubt that the goal of regulators is to destroy these giant companies.

The biggest fear of the bears right now is that Xi is going to nationalize Alibaba and leave investors with nothing. I don’t care even if you are the biggest expert of China, Xi and the Party, no-one knows what Xi is going to do. Maybe he’s not sure what to do, either. So, to avoid Alibaba or any other Chinese company because of this fear is inconsistent with rationality. It is like not boarding a perfectly safe plane, just because you’ve seen a plane crash on TV. Yes, there’s gravity and the plane weighs hundreds of tons, so it is possible. But given the odds, does that make it a rational concern?

It is a pure speculation by people pretending to know the future to justify the paralysis they’ve fallen into after seeing the stock’s dramatic crash. Every bearish Alibaba argument can be summed up in the following three words: “Xi is scary.” Nothing more. And while correct, it is not a thesis-invalidating observation.

Suppose Xi really nationalizes Alibaba, he’ll have to nationalize the whole economy, as well. Even if there is a 5-10% chance of this actually happening, aren’t the other 95-90% worth the risk at these prices, really? Besides, why would China allow American auditors to access its companies’ books, something it’s been avoiding for over a decade, if it is going to nationalize them anyway? It makes no sense.

Valuation and Final Words

If the pressure a falling stock price is exerting on your psyche is limiting your capacity for rational thinking to the point where you start making up explanations and reasons for it, instead of sticking to the cold facts and taking advantage of it, maybe you’re not cut out for investing.

After Monday’s selloff, Alibaba trades at nine times this year’s depressed earnings. Subtract its significant net cash position and you arrive at a P/E of about 6. If you cannot muster the courage to buy Asia’s arguably best company at a P/E of 6, no matter how bleak things may look, you should think about quitting investing outright.

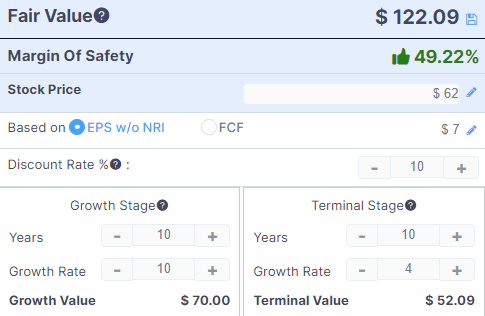

Given its importance and dominant market position, by 2035 Alibaba could’ve easily grown its earnings at twice the growth rate of China’s GDP. Assuming a 10% discount rate, a 10% annual EPS growth rate for next ten years and only 4% for the ten after that, we arrive at a fair value above $120 per ADR. That’s a 50% margin of safety based on depressed earnings. Alibaba can easily be worth two or three times more in a normal year.

Alibaba Fair Value Calculation (GuruFocus)

Scrolling through the comments section on literally every article about Alibaba and China, I once again get the feeling that I am either crazy or stupid, or both. After Plus500, Pandora, Home Capital, Hibbett, Cameco and many more, however, I’m now used to it. It is the psychological price one has to pay for superior long-term investment returns.

Value investing only works if you can keep singing and dancing to its song while the panicked majority yells “SELL!” in the background.

“And those who were seen dancing were thought to be insane by those who couldn’t hear the music.” – Friedrich Nietzsche

Be the first to comment