Nikada/iStock Unreleased via Getty Images

This story was originally written on July 25 for subscribers of Reading The Markets, an SA Marketplace service. The story has been updated on the morning of July 26 where italicized.

Apple’s (NASDAQ:AAPL) shares have rallied sharply since the June lows, by nearly 20%. The stock has been trading as if all is well, and nothing can go wrong when the company reports results. It will put extra pressure on the company when it reports fiscal third-quarter results on Thursday, July 28, after the trading session to meet investors’ expectations.

Adding importance to these results and any guidance the company may give are reports from Bloomberg indicating that Apple will offer discounts on its iPhone 13 Pro series between July 29 and August 1 in China. Apple rarely does this.

What Analysts Expect From Apple’s Q3 Earnings

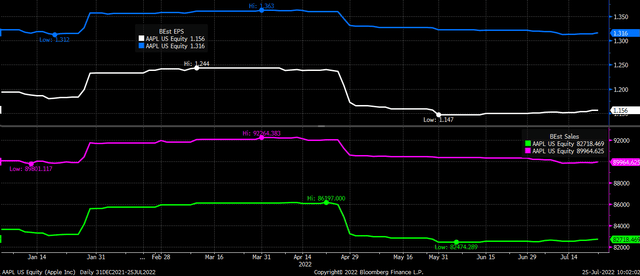

Analysts estimate that earnings fell by 11% to $1.16 per share in the fiscal third quarter, while revenue rose by 1.6% to $82.7 billion. Meanwhile, gross margins are expected to have decreased to 42.8%, while operating margins dropped to 27.3%.

More importantly, service revenue growth is seen decelerating sharply to 12.8% this quarter, with revenue climbing to $19.3 billion, while wearable growth is forecast to be flat at $8.7 billion. iPhones sales are expected to have dropped by 2.3% to $38.9 billion, as iPad sales slipped by 6% and the Mac unit grew by 2.6%.

Guidance Is Key

The company doesn’t typically provide guidance but gives some vague color for revenue. For example, in the first quarter, the company noted:

“We expect to achieve solid year-over-year revenue growth and set a March quarter revenue record despite significant supply constraints…”

This type of language makes it essential to know for this quarter’s conference call that in the fiscal fourth quarter of 2021, the company had total revenue of $83.4 billion. It is also necessary to know that analysts expect the fiscal fourth quarter of 2022 revenue to grow 7.9% to $89.9 billion.

Dollar Impacts

The big issue that will impact Apple this quarter will be the dollar. Analysts expect just $38.6 billion of Apple’s total revenue of $82.7 billion from the Americas. More than 50% of Apple’s fiscal third quarter revenue will come from outside the Americas. While the company does not break its revenue out by country, we can probably assume that the bulk of that revenue from the Americas comes from the US. Still, we know that the dollar may play an essential role in how strong Apple’s results will be this quarter.

Analysts have adjusted their earnings and sales estimates lower after the company reported results in April for the third quarter. However, sales and earnings for the fiscal fourth quarter may need to adjust if supply chain constraints are still a factor for Apple and for a dollar index that has risen nearly 8% since the end of March.

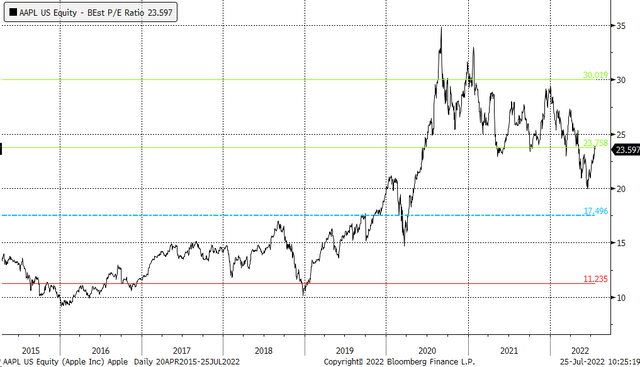

The stock isn’t as expensive as it used to be, but it isn’t cheap either. At 23.5 times next-year earnings estimates. Historically, since 2015, the average PE ratio has been around 17.5. At this point, there is the potential for the PE ratio to fall even further.

Bearish Betting

A trader is betting that Apple will trade lower following results. On July 25, the open interest for the July 29, $140 puts rose by around 16,600 contracts. The data shows the puts were bought on the ASK for roughly $0.45 to $0.55 per contract. The trades were broken up into multiple lots of 1,000 contracts, which is why there is a range of execution prices. It would imply that the stock will be trading below $139.55 by the expiration date at the end of this week. Given this trade’s short time frame, this is a reasonably large wager, with the trader paying around $800,000 in premiums to make the bearish bet. It is the type of bet that will lose value very quickly if it doesn’t work.

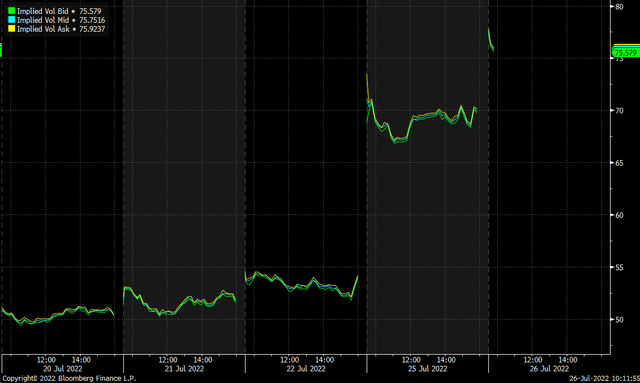

This trade could be a hedge position for someone who is long the stock or is looking for a cheap way to finance a short on Apple. The only problem is that these options have a very high implied volatility at near 75% on July 26 due to event risk from the FOMC meeting and Apple’s earnings. So once Apple’s earnings past IV will drop, the value of the puts will fall. So the options owner needs to see the stock drop sharply to monetize these puts.

Additionally, on July 26, another bearish bet was placed for the August 5, $152.5 puts. The data shows the puts were bought on the ASK for between $4.40 and $4.50 per contract. It would indicate that the trader expects the stock to trade below $148 by the expiration date. The trader paid a significant premium, more than $11 million, to create the bearish bet.

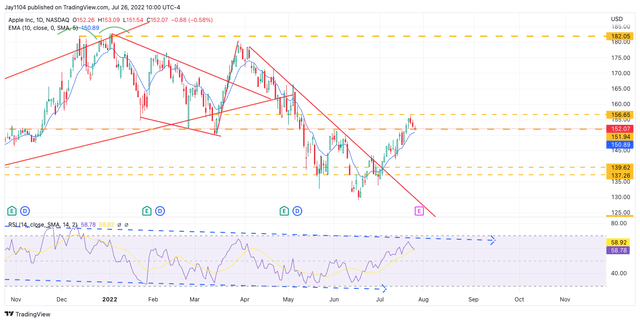

Technical Downtrend In AAPL Stock

Apple’s technical chart does suggest the shares can fall after hitting technical resistance at $156.65. The RSI has been trending lower for some time, making a series of lower highs and lower lows. It would suggest that momentum is very bearish. If the stock should fall below support at $152, then there is a chance the stock could fall back to $139.60.

The stock rose above a downtrend on July 5, so if Apple is trying to re-establish a new uptrend, which I doubt at this point, then a retest of that breakout and a decline back to that trend line looks possible.

Apple’s earnings are critical not only for the company but also for the market’s health. Apple is the largest company within the NASDAQ and S&P 500, so disappointing results from the company would do more than push the stock lower; it takes the whole market with it.

Be the first to comment