FangXiaNuo/iStock Unreleased via Getty Images

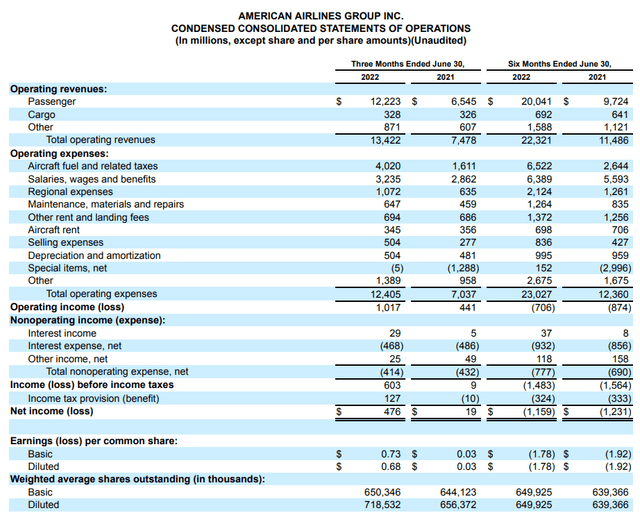

American Airlines Group Inc. (NASDAQ:AAL) reported its second quarter 2022 financial results on July 21. In its report, AAL reported net income of $476 million or 73 cents/share which translated into a 4% adjusted net income margin. American was the last of the Big 3 U.S. global airlines to report and it was the only one of the three that beat on earnings; Delta (DAL) reported first and registered a 7.5% adjusted NI margin while United (UAL) chalked up a 3.9% margin. The rest of the industry will announce over the next few weeks but an analysis of what AAL reported and its execs said will help investors understand not just if AAL is a worthy investment, but also how well AAL is performing relative to the U.S. airline industry.

AAL income statement 2Q2022 (American Airlines Group, Inc.)

Revenue, Capacity and Network

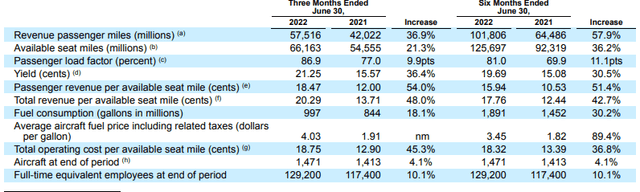

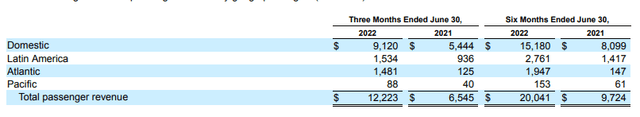

American reported $13.4 billion in second quarter 2022 revenue, an all-time high for the company, even though they flew 8.5% less capacity. Their domestic system accounted for 75% of their total passenger revenues, those flights were nearly 90% full, and their passenger revenue per available seat mile (PRASM, the unit measure of airline revenue generating efficiency) improved 56% from the prior year. American’s Latin America and transatlantic route systems each contributed about 12% of AAL’s passenger revenues, but the star of the show was its transatlantic system which saw load factors (percent of seats filled with paying passengers) triple from a year ago which translated into a nearly quadrupling of transatlantic RASM – boosted not just by more passengers but by higher fares. Throughout the pandemic, the thesis from many analysts was that global carriers would be at a disadvantage because of their longhaul international routes which were heavily closed due to Covid restrictions; in actuality, the increase in international revenue for each of the Big 3 – particularly across the Atlantic – has translated into profits while many low cost carriers have not yet found profitability.

American Airlines Operating Stats 2Q2022 (American Airlines Group, Inc.)

American’s philosophy during the pandemic has been to return capacity to its system as quickly as possible, especially on its domestic and near international system to Latin America and the Caribbean which largely remained open to American tourists. Part of American’s capacity philosophy has been a result of its realization that it could not get costs out of its system near as well as it could stimulate leisure traffic. In fact, AAL’s financial results indicate that its aggressive capacity strategy paid off based on very strong domestic leisure demand and a continued return of business travel. American continued its belief that domestic business demand is approximately 80% returned while transatlantic and Latin America business demand continues to grow but is not at the level of the domestic system. American’s transpacific system shrank to its smallest in decades, both as a percentage of total revenue but also in absolute dollars.

American made the decision during the pandemic to begin to focus less on flying, which it had deemed strategically necessary even though it was not profitable, to instead operating a leaner, less global network on its own aircraft and more focused on cooperation with its partners. Data from the U.S. Dept. of Transportation has long shown that American’s transpacific system lost hundreds of millions of dollars per year even though American has been the smallest of the Big 3 in the region. American also reduced its flights to continental Europe where it has traditionally not generated revenues as strong as Delta or United or as well as American generates in the United Kingdom, home of its primary joint venture partner, British Airways.

AAL revenue by region 2Q2022 (American Airlines Group, Inc.)

Domestically, American says that its partnerships with JetBlue (JBLU) in the Northeast – New York City and Boston – and Alaska Airlines (ALK) on the west coast have helped those hubs generate above system average profits, undoubtedly because American has suspended a number of underperforming routes and is now relying on partners to operate flights. While American does not have the size of network on its own aircraft that it once had and, in some cases comparable to competitors, they are seeing improved margins which is a positive sign for the company.

Analysts expressed concern after AAL’s earnings report that they may not be able to scale the airline to the cost base which they say matches the airline. In fact, AAL said that it has scores of aircraft that it is not flying – predominantly regional jets – because it cannot hire enough pilots to operate those aircraft. American’s margin performance relative to its previous guidance looked the best of the Big 3 primarily because it was able to better match the size of its operation to its costs better than Delta and United. Still, concerns about the amount of capacity that each of the Big 3 need to be able to deploy is concerning given that the peak summer travel season is winding down, business travel is not back to levels necessary to sustain previous levels of profitability, and a potential recession will make it much harder to add capacity. While those concerns are legitimate, I believe American can reshape its capacity profile to match potentially reduced capacity; I am less confident that American can get costs out if they are forced to downsize from their present size targets since American has typically struggled more in cost control than it has in revenue generation compared to its most direct competitors.

Threats to American’s increase in profitability also involve its partnership with JetBlue which the two call their Northeast Alliance – NEA. The Dept. of Justice sued both airlines saying it contains elements that domestic airlines are not allowed to use as the basis of cooperation except in a pure merger. The case will go to trial in September unless a settlement is reached. JBLU’s participation in the NEA is complicated by its pursuit of Spirit Airlines (SAVE); JBLU believes it can maintain the NEA and also acquire SAVE and has suggested asset divestitures which it believes would alleviate any concerns. The concern for American, which continues to be supportive of the NEA, is that AAL has made a number of changes to its own route system based on the ability to transfer slots to JBLU and by having JBLU serve routes which AAL has not been able to profitably serve. If the NEA has to be altered, AAL might not receive all of the benefit it is receiving, especially if JBLU is forced to choose between the NEA and an acquisition of SAVE. It is noteworthy that AAL’s relationship with ALK is fully acceptable to regulators and AAL says that it is benefitting from that relationship.

Fuel and labor costs

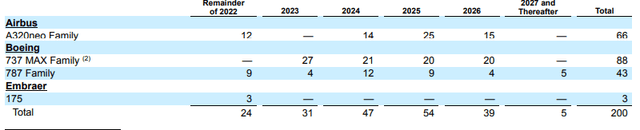

Airlines are facing many of the same cost pressures that other businesses in the United States are facing – including higher labor and fuel costs. American burned just under one billion gallons of jet fuel in the second quarter at a cost of just over $4/gallon making its total fuel expense the largest expense for the company, surpassing labor costs. While American has invested heavily in new aircraft over the past 10 years, its fuel efficiency among U.S. airlines is tied for last place with United because of the heavy dependence both have on regional jets – which are less fuel efficient than larger aircraft – and because a majority of its international widebody capacity is still flown by the Boeing 777 which is less fuel efficient in both of its versions which American operates than other new technology aircraft including the B787s which American operates. American has a very modest number of new aircraft due for delivery in the next few years compared to most other airlines which means the percentage of its fleet that have new technology engines will fall. While other airlines, especially those with larger operations in the Northeast – including AAL’s partner JBLU – are experiencing much higher fuel prices right now, AAL could find itself with a fuel efficiency disadvantage compared to its peers.

AAL aircraft commitments 2Q2022 (American Airlines Group, Inc.)

AAL’s labor costs increased a modest 13% on a year over year basis, indicating that the company was carrying a high percentage of the labor costs necessary to operate a much larger airline for months before that size was needed. AAL execs noted that pilot costs are expected to continue to increase especially for regional airline pilots; still, American is committed to retaining its regional airline operation which could include over 600 aircraft if the operation is fully staffed. American’s hubs heavily rely on regional jets to help connect smaller cities and the company says that the thousands of additional origin and destination markets that are created by the use of regional jets give it a strategic advantage in the marketplace. AAL has several wholly owned regional airlines that have been very aggressive in offering healthy six digit pilot bonuses, hoping to recruit from other regional airlines; anecdotal evidence indicates that American is succeeding in building its regional jet staffing at the expense of other airlines. While it isn’t clear how long or how sustainable high regional jet pilot salaries will be, American appears to be the most committed to retaining a large regional jet operation. Thus, American could conceivably create a significant niche by serving many more small communities with regional jets than what other airlines can serve with mainline jets and a smaller regional jet fleet.

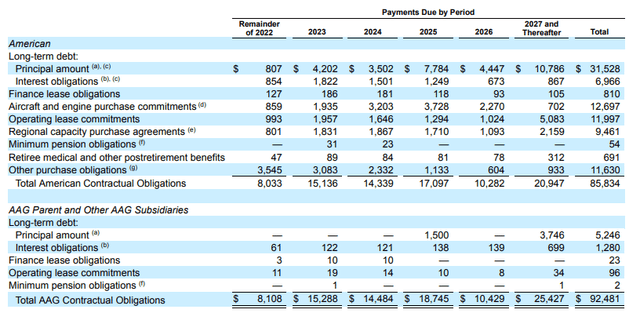

AAL contractual obligations 2Q2022 (American Airlines Group, Inc.)

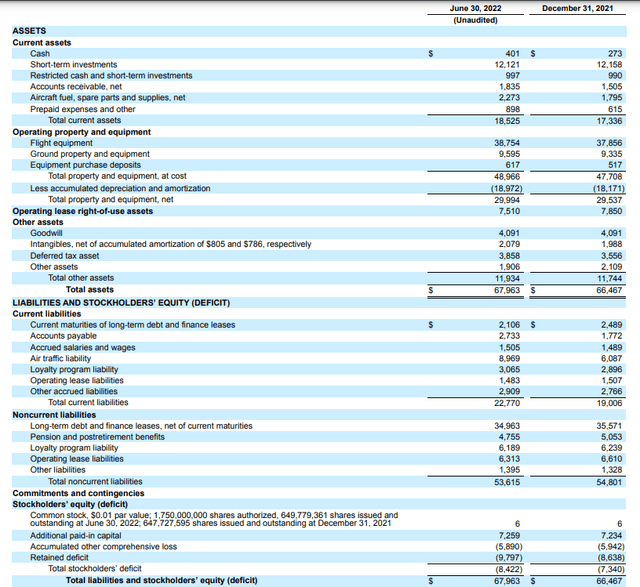

Balance Sheet

American’s balance sheet has long been one of the biggest detractors to investors in the company. With $35 billion in long-term debt, AAL is by far the most indebted U.S. airline although it frequently notes that its fleet, the youngest of the Big 4 U.S. airlines, is much more valuable. Still, American has committed to slowing its capex and its fleet spending in order to reduce its debt by $15 billion over the next four years; it says it has reduced its debt by $5 billion from pandemic highs and paid off another $1 billion in debt in the most recent quarter. AAL’s debt repayment plans are aggressive but will remove a huge amount of investor angst if they succeed at not only reducing their debt but also the interest expense on that debt which sapped $1 billion dollars per year pre-pandemic and is pushing two billion dollars per year based on current debt levels; it should be noted that American and most airlines are still carrying higher debt levels than they did pre-pandemic.

AAL balance sheet 2Q2022 (American Airlines Group, Inc.)

AAL Stock Key Metrics

In looking at the performance of AAL stock on a year to date basis, a few key comparisons highlight that AAL has not performed remarkably out of line. On YTD basis, AAL stock is down 26%, nearly in line with the NASDAQ on which AAL trades. AAL is down slightly more than the JETS ETF which includes a basket of airlines, with proportional weight to the largest U.S. airlines. Other AAL metrics are less favorable to AAL. Its market cap of just under $9 billion is the smallest of the Big 4 at just 37% of the market cap of Southwest, 44% of the market cap of DAL and 75% of the market cap of UAL.

AAL chart YTD 25Jul2022 (Seeking Alpha)

AAL’s short interest at nearly 13% is the also the highest of the Big 4, multiples higher than DAL and LUV but not as Frontier Airlines which is currently involved in a merger proposal with Spirit Airlines. AAL is not expected to be profitable for 2022 as a whole driven by its 1Q2022 loss but is expected to be profitable in 2023. AAL did not pay a dividend per Covid and U.S. airlines cannot pay dividends as a result of the federal aid the industry received, meaning AAL will not be at a disadvantage to those few airlines that might pay a dividend in the future.

Of the airlines that have reported second quarter financials and based on the guidance of those that will report, American’s financial performance is about middle of the pack for the U.S. airline industry, its highest relative position in years. AAL’s margins were slightly above UAL but a number of low cost carriers including JBLU, SAVE, and ULCC are expected to either be unprofitable or report lower margins in the near future. Legacy/global carriers are expected to be able to handle the higher cost environment and the pilot shortage better than low cost carriers whose business models do not permit recovery of high costs as well as carriers with higher fare structures. In addition, United’s aggressive expansion is proving to strain its ability to generate profits that have historically been superior to American. Given that the two have long been engaged in intensive competition not just across their networks, but also operationally and financially, the pendulum could be swinging in American’s favor as it moves into a stabilization and refinement of its strategies in contrast to UAL’s more aggressive expansion and spending.

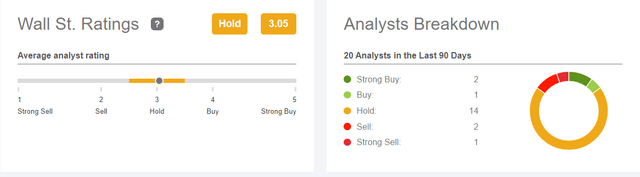

AAL Wall Street Ratings 25Jul2022 (Seeking Alpha)

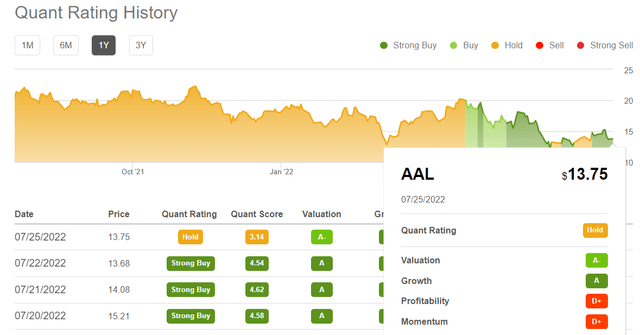

AAL’s Quant Rating ended a streak of Strong Buy with its earnings report, driven by its profitability expectations and its potentially slowing momentum. Given that AAL’s ability to increase profitability is dependent on its ability to manage its operations, something that AAL demonstrated it did better than its peers. AAL is rated relatively similarly as a hold by SA contributors and Wall Street analysts. AAL’s price target is $17.66 based on an average of 20 Wall Street analysts.

AAL Quant Ratings 25Jul2022 (Seeking Alpha)

AAL is an undervalued, consistent performer

On the basis of data, AAL is stuck in the same mediocre position it has been in for years. However, AAL has evolved its business model to be unique enough with a robust domestic network that will likely translate into some advantages in the coming years. In addition, AAL is addressing some of the biggest detriments to the stock from the past – high debt and low profit margins because of too much “strategic flying.” Most significantly, AAL is executing on its strategies better than its peers and especially compared to a number of low cost and ultra low cost carriers that are struggling to be profitable at all.

American Airlines may not become the most profitable or highest valued airline, but its low valuation and its improved relative financial performance in the airline industry coupled with its above average execution of its strategies in the most recent quarter make it a buy in an industry which investors frequently bypass.

Be the first to comment