silvestra/iStock via Getty Images

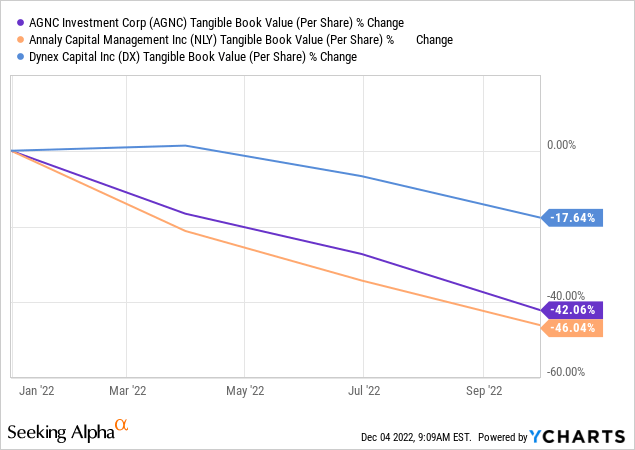

We have covered Dynex Capital Inc. (NYSE:DX) previously and our general impression was that the REIT was one of the better bets in a volatile sector. The story has developed in a more volatile manner with interest rate spreads blowing out, pushing all mortgage REITs on the defensive. Dynex has been no different and despite trying to hedge multiple different risks, we have seen a rather substantial erosion of book value during the year.

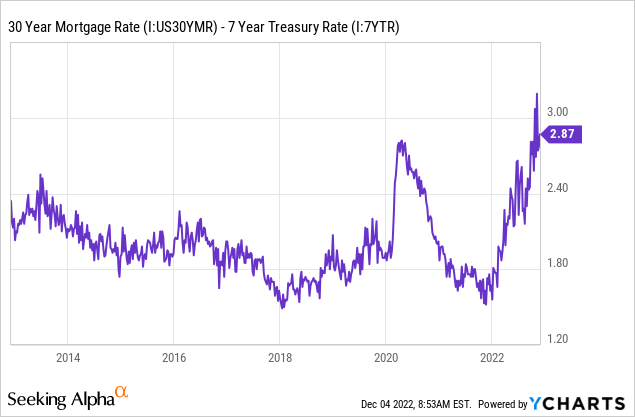

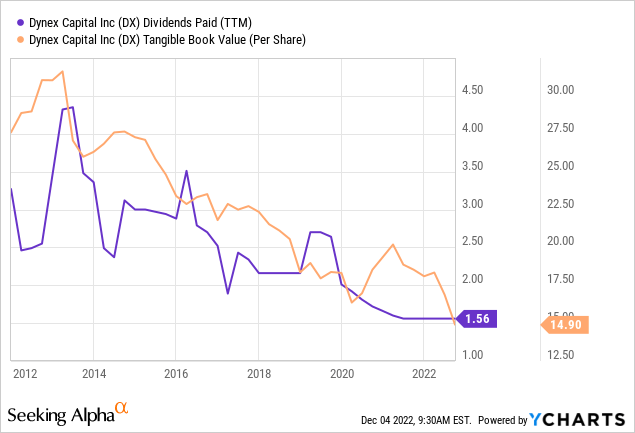

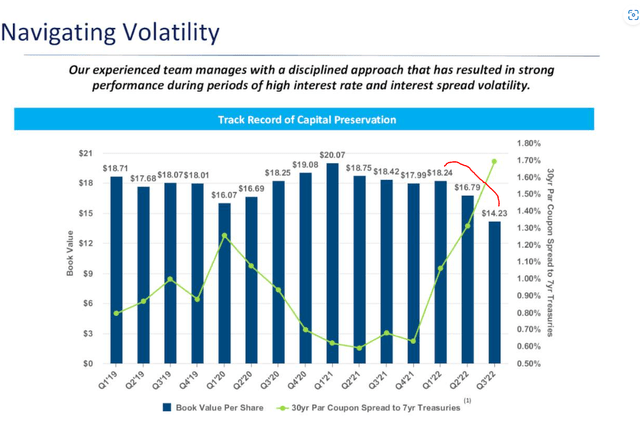

The chart from Dynex does drive home an important point though. Book value tends to run counter to the spread between 30-year mortgage rate coupons and 7-year treasuries. So, what is the outlook for this spread and if the spread normalizes, should be expect big dividends from Dynex?

Q3-2022

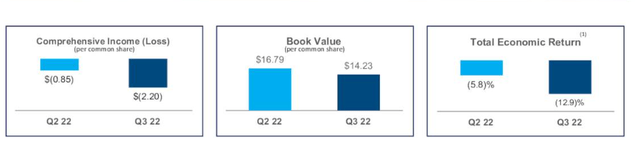

Before we get to those questions, here is a brief look at what happened in Q3-2022. As shown above (and below), book value dropped sharply. Total economic return was solidly in the red.

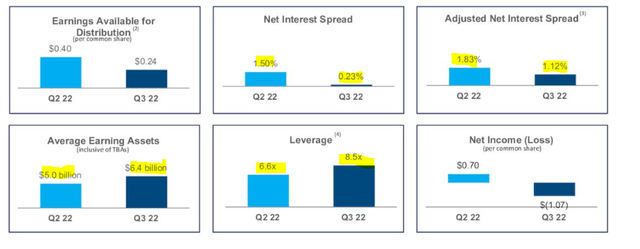

Dynex realizes that there is no real return if book value undergoes erosion and rightly presents total economic return rather than telling investors to focus on monthly dividends. What caught our eye though, was the stunning increase in leverage through Q3-2022 as Dynex increased total assets from $5 billion to $6.4 billion.

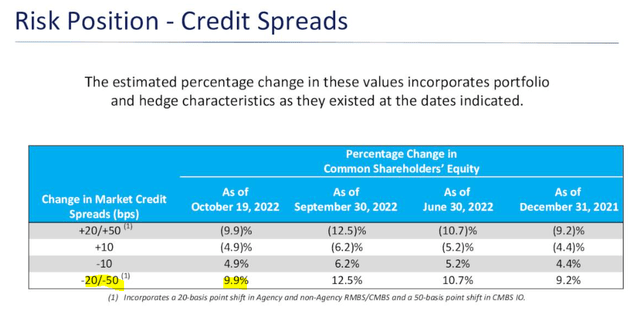

The company is obviously making the bet that things normalize rapidly but it does dial up risk for this relatively (and we stress the relatively part) conservative mortgage REIT. Leverage at the end of Q3-2022 was a stunning 8.5X. This follows a similar trend that we have seen among other mortgage REITs, which decided to bet on normalization by raising their leverage. Also, notable here was the collapse in interest spreads with net interest spread absolutely flatlining and adjusted interest rate spread dropping by 71 basis points. These are all big warning signs and running up 8.5X leverage with margins collapsing likely creates problems ahead.

The Big Question

Mortgage Rate spreads to Treasuries remain extremely high and have not improved materially since Dynex released those results.

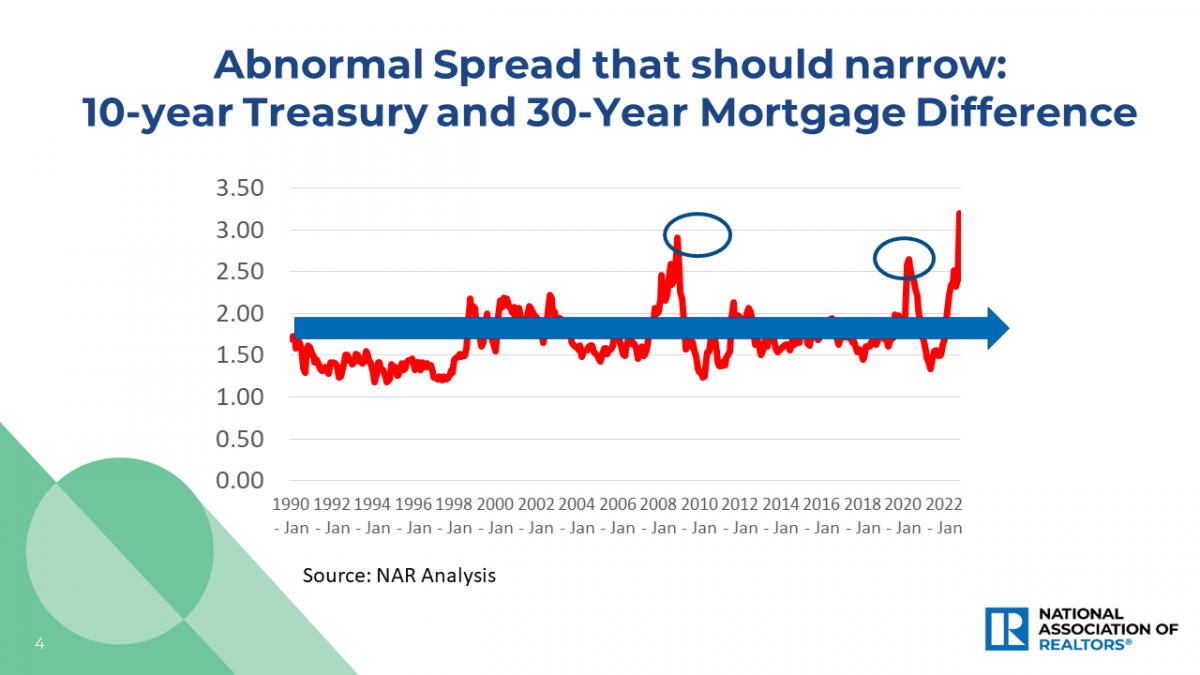

There is nothing magical about benchmarking the mortgage rates vs 7-year Treasuries. We only used it because Dynex has used a similar metric (note that Dynex is using par coupon rates, not actual mortgage rates). Here is a look at the spread vs 10-year Treasury rates.

NAR

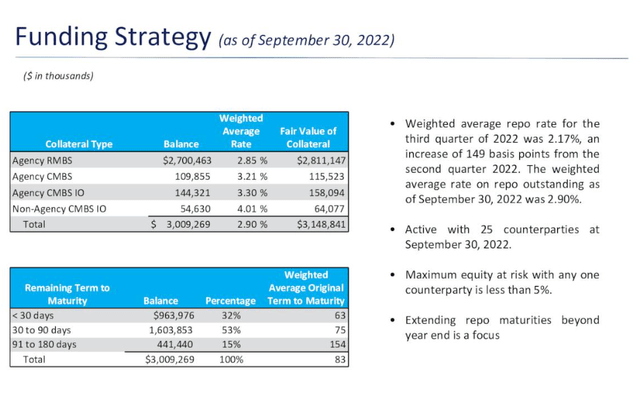

Again, the thinking is that things should normalize. While we believe that some degree of normalization is extremely probable, and Dynex’s book value does benefit from that, we think those spreads don’t exactly capture the REIT’s problems for 2023. Those problems are stated below and consist of rapidly rising funding costs alongside an 83-day weighted maturity.

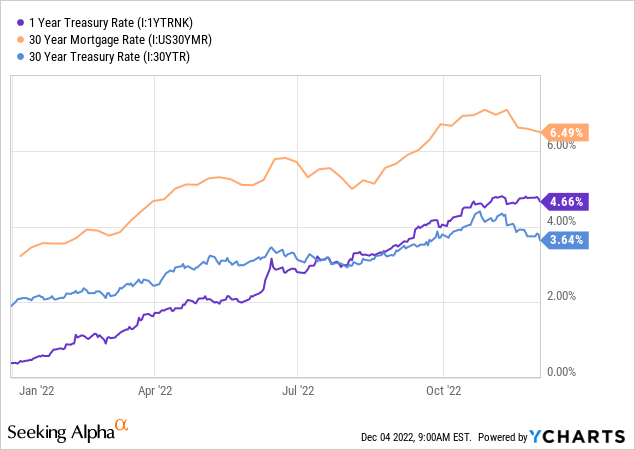

Dynex’s borrow short, lend long strategy runs into serious problems as interest curves start inverting. This is not hard to visualize. If you borrowed money at the 1-year Treasury rate and bought 30-year Treasuries, you would guarantee yourself a 1% annual loss. Of course, Dynex is not buying 30-year Treasuries, but 30-year mortgages, so on paper that looks fine.

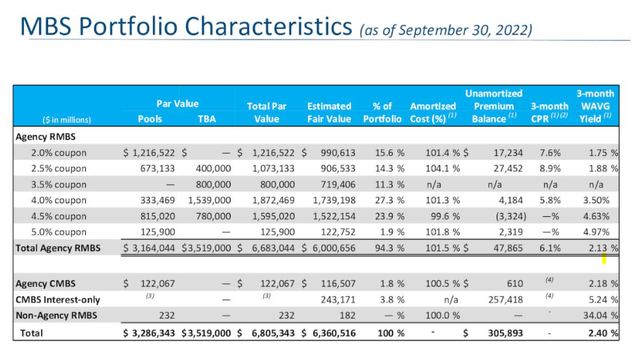

Unfortunately, that is only for new positions. Dynex’s portfolio has far lower coupons.

We wish we could tell you exactly how this plays out. But with 8.5X leverage and complex spread and hedging dynamics in play, it is impossible for us. Based on the fact that all mortgage REITs have delivered negative economic returns over the last 9 months, we are going to go out on a limb and say it is impossible for these REITs as well.

What we do know here is that we will see some massive interest rate spread compression. Dynex’s funding costs are set to rise very rapidly and this is baked in as its costs lag the Federal Fund rates. The hope here is that we see some good mortgage rate to Treasuries spread compression, which lifts tangible book value.

Even assuming that happens, we believe Dynex will come nowhere close to generating enough interest rate spread to fund the dividend. In other words, Dynex will have a higher book value and still struggle to generate income due to a pancaked curve. Management will also face interesting questions on where they hedge next. Hedging is extremely costly today versus where we were at the beginning of 2022 and overall we expect difficult times ahead.

Verdict

Tangible book value per share, our favorite benchmark for Dynex and other mortgage REITs, could move up in 2023. That won’t change the fact that Dynex will have to work hard to make money. Our forecast is for another reduction to the dividend and we are likely looking at about 10 cents on a monthly basis or $1.20 annually. This would be on the low-side, if we see the historical correlation between book values and dividends paid for the trailing 12 months.

But one that we think is highly likely in the rough environment ahead. We rate the shares a “hold” and think the preferred shares are relatively a better here.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment