Bill Oxford

(This article was co-produced with Hoya Capital Real Estate)

Introduction

My regular readers know I mostly use baby bonds to build my bond ladder, but I have added a few Preferreds to the mix. That fixed income strategy was last covered in my 2021 Was A Tough Year For Investors Who Built A Bond Ladder article. With the popularity of my article on the Rithm Capital Preferred, one of which I own, MFA Financial (NYSE:MFA) appeared on my radar as a possible asset to add to the Preferred side of my fixed income ladder. As for choices, the mREIT universe provides a wide range of coupons and call dates. Here I will explore the two remaining ones offered by MFA:

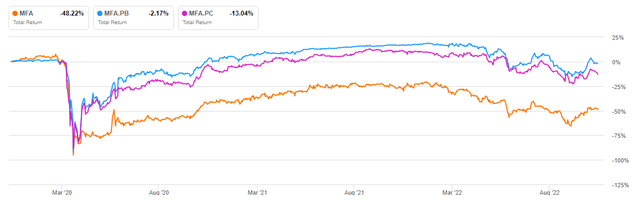

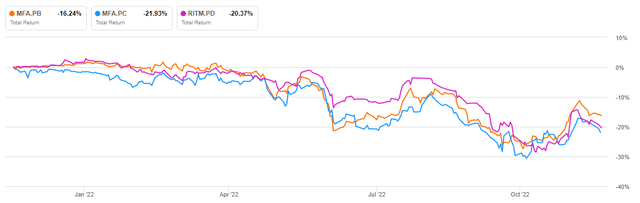

SeekingAlpha.com (Total Return)

Exploring the company: MFA Financial

mfafinancial.com/CorporateProfile

Seeking Alpha describes this mREIT as:

MFA Financial, Inc., together with its subsidiaries, operates as a real estate investment trust in the United States. The company invests in residential mortgage assets, including non-agency mortgage-backed securities (MBS), agency MBS, and credit risk transfer securities; residential whole loans, including purchased performing loans, purchased credit deteriorated, and non-performing loans; and mortgage servicing rights related assets. The company has elected to be taxed as a REIT. NFA started in 1997.

Source: seekingalpha.com MFA

This is how MFA describes their business and investment strategy:

Our principal business objective is to deliver shareholder value through the generation of distributable income and through asset performance linked to residential mortgage credit fundamentals. We selectively invest in residential mortgage assets with a focus on credit analysis, projected prepayment rates, interest rate sensitivity and expected return. We are an internally-managed real estate investment trust (or REIT).

- Residential whole loans, including Purchased Performing Loans, Purchased Credit Deteriorated and Purchased Non-performing Loans. Through certain of our subsidiaries, we also originate and service business purpose loans for real estate investors. We also own residential real estate (or REO), which is typically acquired as a result of the foreclosure or other liquidation of delinquent whole loans in connection with our loan investment activities;

- Residential mortgage securities, including CRT securities; and

- MSR-related assets, which include term notes backed directly or indirectly by MSRs.

We primarily invest, through our various subsidiaries, in residential mortgage assets. During 2021 we successfully executed on our asset acquisition strategy. Specifically, we acquired more than $4.5 billion of residential whole loans. We also completed the acquisition of the remaining 57% of the common equity interests of Lima One, the first time that we completed the acquisition of a controlling stake in a third party entity. We are particularly pleased with the results of the business combination to date, as Lima One has achieved consecutive record quarters for origination volumes since the acquisition closed on July 1, 2021. The execution of our strategy has resulted in a 49% year-over-year increase in our residential whole loans and 39% year-over-year increase in our overall investment portfolio. At the end of 2021, residential whole loan investments comprised approximately 87% of our assets and more than 75% of our allocated net equity.

Source: mfafinancial.com/overview

The recently released 3rd quarter report included the following points:

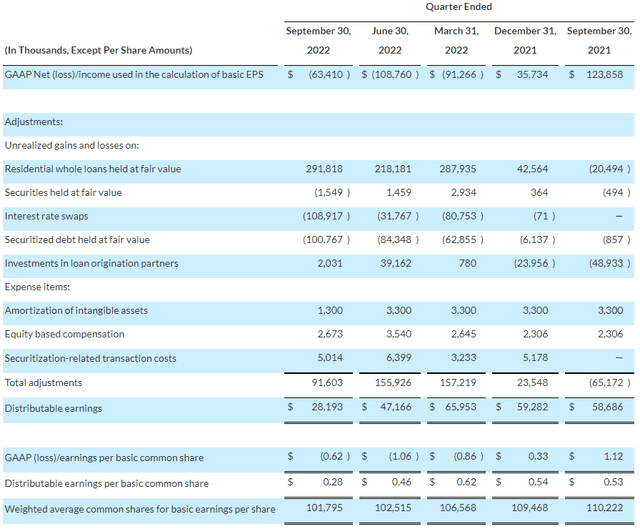

- A GAAP loss for the third quarter of ($0.62) per common share. Distributable Earnings, a non-GAAP financial measure, was $0.28.

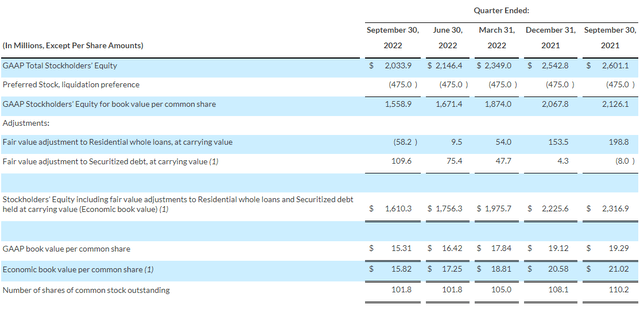

- GAAP book value at September 30, 2022 was $15.31 per common share, while Economic book value, a non-GAAP financial measure of MFA’s financial position, was $15.82.

- As of September 30, 2022, recourse leverage was 1.7x and unrestricted cash was $434 million.

-

- MFA’s seasoned $8.2 billion residential whole loan portfolio has benefited from strong home price appreciation (HPA) and loan amortization. At September 30, 2022, the portfolio has an estimated HPA adjusted loan-to-value ratio (LTV) of 57%.

- As of September 30, 2022, 99% of financing was effectively fixed-rate (in the form of either fixed-rate securitized debt or debt that has been economically hedged with swaps). Sensitivity to interest rate changes remains relatively low with net duration of 0.92 at quarter end.

- For the third quarter, the overall net interest spread generated by all of MFA’s interest-bearing assets, including the carrying cost associated with swaps used for economic hedging purposes, increased to 1.64%, an increase of 19.7% as compared to the immediately prior quarter.

It has been fifty years since I last took Cost Accounting, so I will do my best in analyzing the following reports.

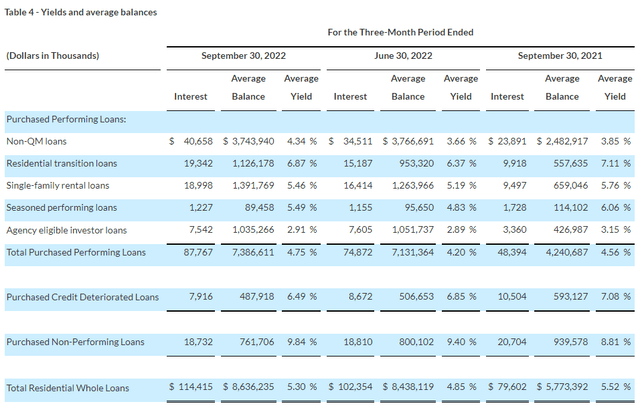

mfafinancial.com 3Q22 Balances/Yields

While the Total Residential Whole Loans amount is up over the past year, surprisingly the average yield is down 22bps. The next table shows earnings data going in the wrong direction too.

mfafinancial.com 3Q22 GAAP results

MFA has yet to have a positive GAAP earnings quarter in 2022. I believe GAAP accounting requires assets held by mREITs to be mark-to-market each quarter, which will look bad as rising interest rates reduce their book value, which is shown next. Both book values are down considerably since 2021.

mfafinancial.com 3Q22 book values

Reconciliation of GAAP Book Value per Common Share to non-GAAP Economic Book Value per Common Share

“Economic book value” is a non-GAAP financial measure of our financial position. To calculate our Economic book value, our portfolios of Residential whole loans and securitized debt held at carrying value are adjusted to their fair value, rather than the carrying value that is required to be reported under the GAAP accounting model applied to these financial instruments. Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for all of our investment activities, irrespective of the accounting model applied for GAAP reporting purposes.

Source: mfafinancial.com 3rdQ report

Even with this drop in book value and shareholders’ equity, the coverage ratio is above four, though it was above five at the start of 2022; something to keep in mind whether the preferred are yielding enough to compensate for the risk.

MFA executes 1-for-4 reverse split

Effective on April 4, 2022, MFA executed a 1-for-4 reverse split as the price was trading below $4/share. Daniel Varga expressed his opinion on this event: MFA Financial: The Reverse Stock Split Makes Investors Wary

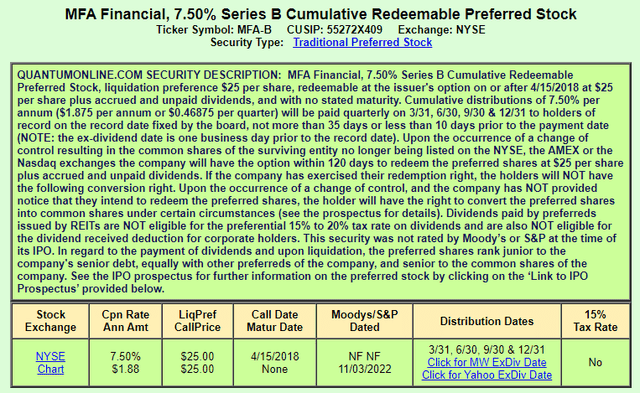

Exploring the MFA Financial, Inc. PFD SER B

While the experts on mREITs I follow on Seeking Alpha state no mREIT preferred has ever gone under, both MFA Financial preferreds did skip the payment due in March 2020, causing the MFA shareholders to miss their second quarter payout. Due to both preferred being “cumulative”, holders got a double payment that summer, allowing MFA equity investors to start receiving dividends again.

Other important features include:

- This preferred is now callable, though at the current price, open market purchases make more sense. There is no maturity date.

- Part of the proceeds from this issue were used to retire the 8.5% coupon Series “A” preferred at Par. Since “B”s coupon was 100bps lower, I would assume “A” was trading above Par at the time.

- The 7.5% coupon is fixed, unlike the other Preferred covered later, which will float in the future if not called.

- Being a REIT, the dividends paid are not eligible for the special 15% tax rate.

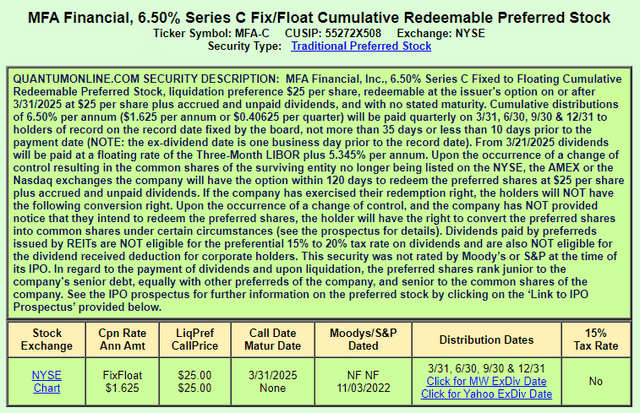

Exploring the MFA Financial, Inc. 6.50 PFD SER C

Like the “B” issue, investors had their March payment delayed until the summer. There are three major differences between the two securities:

- The current coupon on this issue is 100bps lower than what “B” offers.

- Unlike “B”, this issue cannot be called until 3/31/2025, providing just over two years of call protection that “B” does not offer.

- Once callable, the 6.5% fixed rate converts to a fixed component (5.345%) + the 3-month LIBOR rate, which current stands at 4.7%, up from almost zero a year ago. If the forecast holds, that LIBOR (or its replacement SOFR) rate would mean a coupon over 10%.

- Like “B”, this issue also doesn’t mature, not is it eligible for the 15% tax rate.

Comparing both preferreds + one other

Along with comparing both MFA Financial preferreds, I will include the Rithm Capital Corp. 7% RT REST PFD D (RITM.PD), which I mentioned earlier as recently reviewed.

SeekingAlpha.com (Total Return)

| Factor | MFA’B | MFA’C | RITM’D |

| Price | $19.66 | $17.95 | $18.83 |

| Coupon | 7.50% | 6.50% | 7.00% |

| Yield | 9.54% | 9.05% | 9.29% |

| Call date | Past | 3-31-25 | 11-15-26 |

| YTC* | 14.72% | 22.36% | 15.45% |

| Floating Formula | NA | 5.345%+3M LIBOR | 6.223+5Y TSY |

| Possible rate | 7.50% | 10.04% | 10.07% |

* Assume called 11/15/26; otherwise meaningless outcome.

In my view, MFA will Call the “C” preferred first unless the 3-mo LIBOR is near 2%. They could redeem “B” now by issuing a new preferred but when the “B” issue was floated to retire the “A” issue, the coupon was set about 400bps above the going rate for BBB bonds. At today’s BBB rate, the coupon for a new preferred issue, everything else being the same, would be near 10%, so it seems safe until after the “C” version is redeemed. If investors believe short-term rates will be above 2.155% in early 2025, MFA would call “C” before “B”. If not, then “B” would be better buy today with its higher current and fixed rate past 2024. At current rates, Rithm most likely would call its “D” preferred before the others, something to keep in mind.

Portfolio strategy

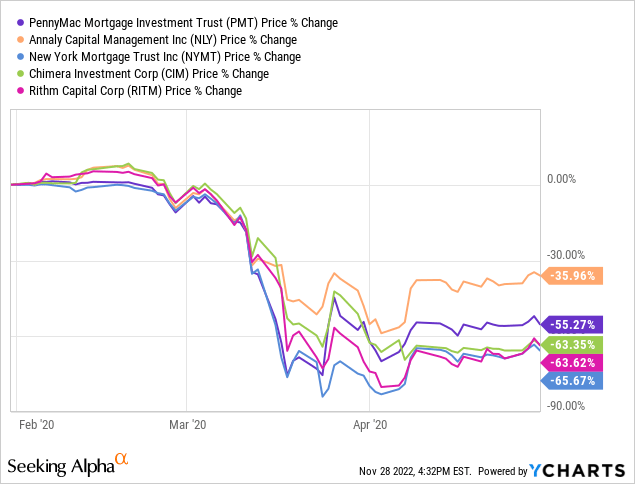

Uncertainty shares the dickens out of the market when it comes to mREITs. Look what COVID did to these stocks (and their preferreds).

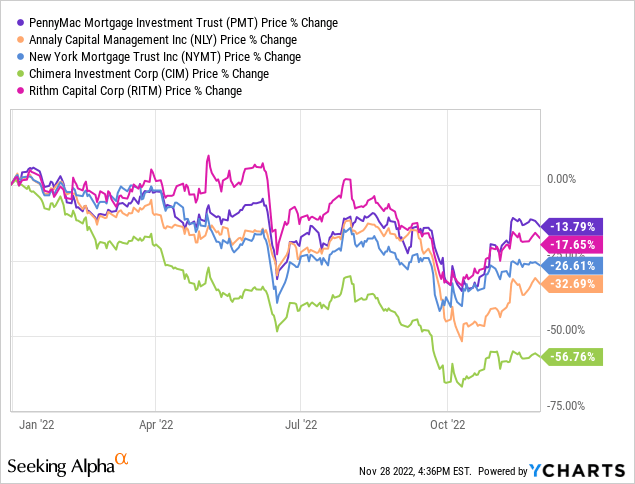

The fear now is with mortgage rates at levels not seen in decades, are they in for another major tumble? This is how the same stocks have done since 2021.

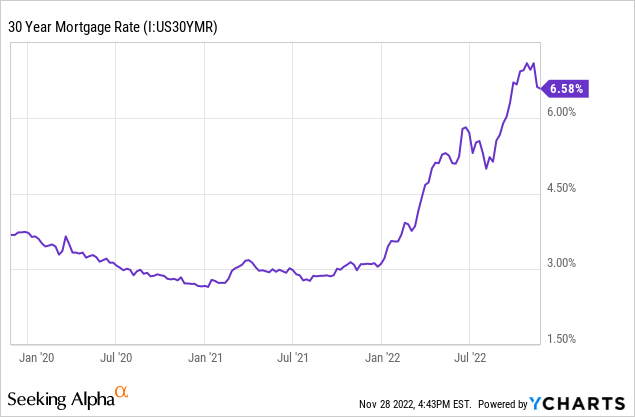

Whether the recent bottom holds could depend on what the FOMC does going forward: keeping with the predicted 125bps increase and/or slowing the pace. After peaking at over 7% for the first time since 2002, 30-year rates as of today are:

A recent Barron’s article listed several reasons that Harley Bassman, former head of mortgages at Merrill Lynch, is bullish on this sector.

- Mortgage securities issued by agencies, such as Fannie Mae and Freddie Mac, effectively have a government guarantee. But their yields over benchmark Treasuries have widened to 1.75 percentage points, a spread seen previously only in times of significant financial crises.

- The supply of new MBS will contract significantly as worsened affordability slows housing activity. Refinancing, which makes the duration of mortgage-backed securities less predictable, will grind to a halt.

- With most MBS trading at a significant discount to their par, or face, values, their prices should benefit if yields fall.

He did express concerns over what the Fed will do with all the MBS securities they hold, currently $2.68 trillion, as they want to sell up to $35b/month. Homeowners with loans costing as little as 3% are loath to refinance at 7%, resulting in prepayments on MBS slowing significantly. These prepayments counted toward the reduction goal.

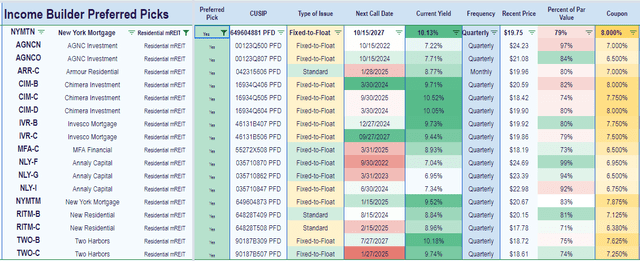

Assuming you are okay having exposure to mREITs, Hoya Capital Income Builder likes the following for consideration.

Final thoughts

On the 30th of November, the market jumped 2% as Federal Reserve Chairman Jerome Powell confirmed that smaller interest rate increases are likely ahead and could start in December, but he cautioned that monetary policy is likely to stay restrictive for some time until real signs of progress emerge on inflation. “We will stay the course until the job is done,” he said during a speech in Washington, D.C. at the Brookings Institution.

My preference would be to consider the MFA Pfd D over the MFA Pfd C. For those favoring call protection, there are several listed above that are not callable until 2027.

Some readers might prefer owning the common stock, not the preferred stock of a mREIT. I this article, PennyMac Investors Have A Choice: Equity Or Preferreds, I covered points to compare in helping with that decision.

Be the first to comment