TU IS

In my last article on DigitalOcean Holdings, Inc. (NYSE:DOCN), I explained why I was impressed with the business’ recent performance, and how overall I was a believer in its long-term potential as a cloud provider for small and medium sized businesses (SMBs). At the same time however, the stock valuation implied too much growth for my taste: something that could very well materialize, but that left too much room for stock depreciation in case of execution bumps or a further souring of the market sentiment.

It was worth for me to review again DOCN’s position following the latest earnings report; there was a lot to like in my opinion, however the stock sold off about 10% in the following couple of days, ultimately sitting down about 27% from my latest hold recommendation. That was when I decided to pull the trigger for a small position given that the valuation was much more palatable than when I last wrote about the stock. The bull thesis seems intact, the company is increasing its moat and the total addressable market is constantly expanding. There are some near term uncertainties due to the market slow down, but the excellent execution cannot be ignored.

Fantastic results for 3Q 2022

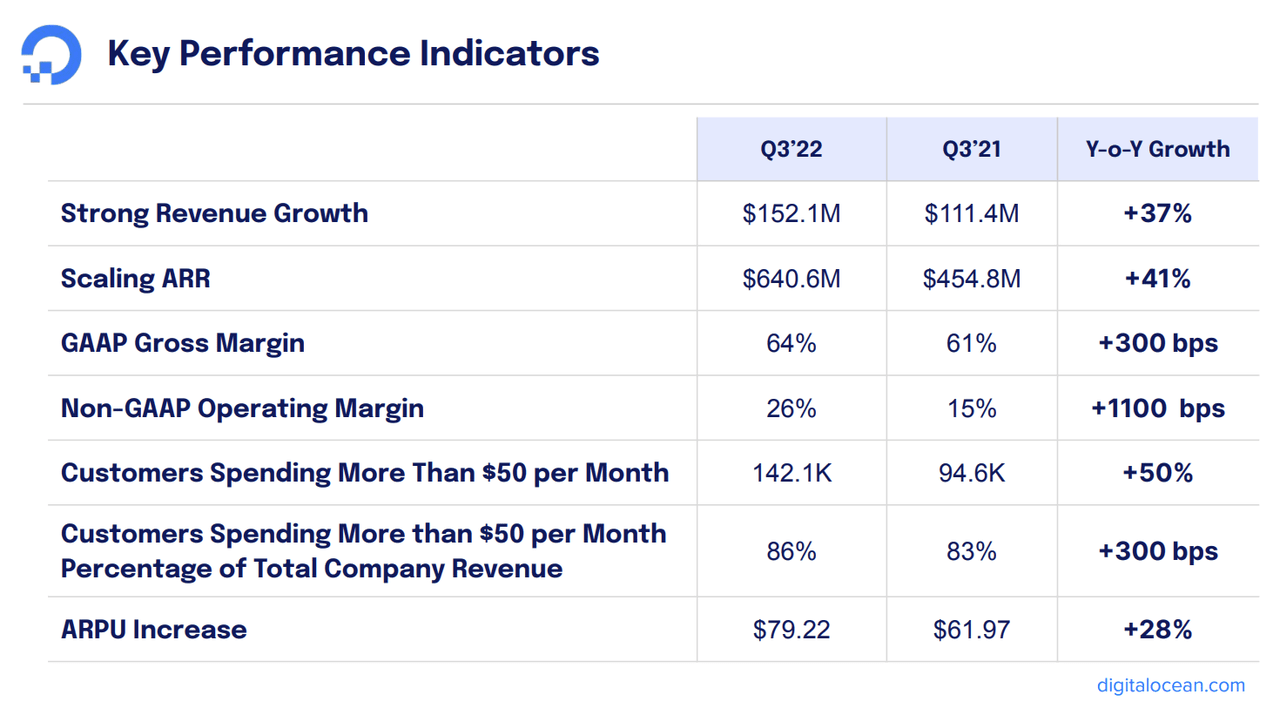

The cloud network provider released its third quarter financial results on November 7, and all the headline numbers were really good. Revenue came in at $152.1 million, up 37% YoY. GAAP gross margin also improved an impressive 3%, from 61% to 64% as well as Non-GAAP operating margin, which jumped from 15% to 26%. Free Cash Flow margin was also an impressive 15%.

DOCN Earnings Presentation 3Q 2022

The company’s metrics were boosted primarily by two factors: the acquisition of Cloudways which is about two months into its integration with the company, and the price hikes of the core DigitalOcean subscription plans.

Management had a lot to say about both. Cloudways seems like a perfect fit for DigitalOcean: their offerings are clearly complementing organic services that DigitalOcean already offered to its customers, while also being operationally aligned in the search for growth at a sustainable pace. Cloudways has in fact similar free cash flow margin than DOCN, which among growth stocks is actually top tier. Since the acquisition management was also already able to realize some of the revenue synergies between the two companies, mainly through cross selling between the two user bases. Overall in the third quarter Cloudways contributed to about 4% of revenue growth.

Cloudways brings deeper SMB customer insights to DigitalOcean, as a managed service entails a deeper relation with end customers that provides valuable insights about the opportunities and challenges businesses are facing as they grow. […]

They’re growing faster with free cash flow margins in line with ours and we will invest to keep it that way and leverage Cloudways capabilities to accelerate growth across the business.

The company introduced a new pricing model on July 1. While generally raising prices for some of the most popular products, DOCN also introduced a cheaper, lower tier. Management had obviously forecasted some customer’s churn as well as some customers deciding to downgrade to the cheaper tier. Overall however the results exceeded expectations despite the economy slowing as a whole at the same time: the estimated benefit of the pricing increase is about 12% top line growth.

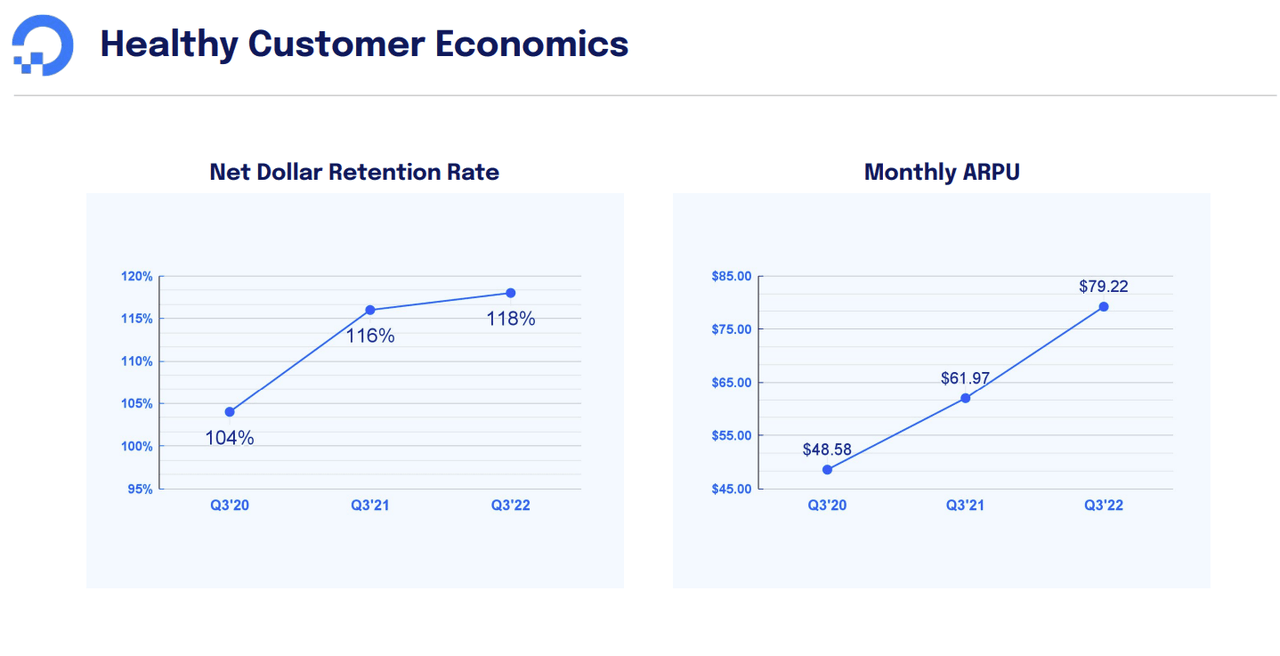

On top of this, the company also grew more organically. Average revenue per user (ARPU) grew in the quarter by an impressive 28%, while the customers spending more than $50 per month also grew 50% (or 29% excluding the impact from the Cloudways acquisition). The numbers tell a clear story, that the price increase was well justified by the quality and reliability of DOCN’s offerings.

These results have confirmed our thesis that our customer base sees tremendous value from the platform improvements we have made across time. We are still roughly half the cost of the hyperscaler pricing and our prices still could constitute a small expense as a percentage of their revenue for our SMB customers that view us as a critical requirement to run their entire business.

DOCN Earnings Presentation 3Q 2022

Despite all the goods, obviously DigitalOcean is not immune to the macro uncertainties. During this quarter every cloud operator noted a slowdown in customers spending and DOCN was no less: management has estimated around 9% headwind from factors such as the war in Ukraine, lower usage of blockchain services, global slowdown of the economy, high inflation and U.S. dollar strength. However, I am personally not too worried: all of these will be temporary issues, meanwhile the business is growing fast, generating huge amounts of free cash flow and investing in becoming the global cloud infrastructure for SMBs.

Valuation and key takeaways

The recent quarter provided a lot of good news that bolstered the bull thesis on the stock. Management was even more convinced to reiterate their guidance of a consistent top line growth of at least 30% every year until reaching about $1 billion of revenue in 2024 with 20% Free Cash Flow margin. In my last article I argued that $200 million of FCF in 2024 seemed too optimistic given that it would imply a CAGR of 94% until then, however the recent quarter was definitely a first step in the right direction. Considering today’s market cap of $3 billion, if management will really reach this target it implies a valuation of Price to Estimated 2024 FCF of just 15. And that will be for a business coming out from years of at least 30% revenue growth and very high margins. On top of that, DOCN is also slowing considerably Stock Based Compensation while also repurchasing shares. As a result, Total Shares Outstanding decreased 11% this quarter compared to a year ago, benefiting current shareholders.

Although still risky, the recent price drop made the stock a whole lot more interesting in my opinion, and for this reason I opened an entry position with a cost basis of $27.50. Immediately after my purchase the stock sharply rose together with the market as a whole, which is somewhat unfortunate given my long-term horizon. I don’t think I will ever be comfortable making DOCN a big portion of my portfolio, however as of now it only represents about 0.5% of it and I was looking for a slightly bigger exposure than that. Nevertheless, I still think that at today’s price the risk-reward profile is positive for long-term investors.

Be the first to comment