hxdbzxy

Investment

We continue to see tremendous growth potential in the wider healthcare space looking down the line. Following our recent publications on Addus HomeCare and Apollo Medical Holdings [see: here for the Addus report and here for Apollo report], we also extensively reviewed our investment case for Acadia Healthcare Company, Inc. (NASDAQ:ACHC). We’re back today to share our findings.

Key to our investment thesis is ACHC’s goal of adding 600 beds under its wings in 2022, across existing and new facilities. We see value from our EPS growth assumptions looking ahead, and combined with the company’s Q3 numbers, we like the direction in which ACHC is moving. Moreover, the company’s differentiated offering in psychiatric care is equally as appealing as a tactical, liquid diversifier to broaden an investors’ healthcare exposure. Net-net, we rate ACHC a buy on the findings discussed in this report, seeking price objectives of $94 and then $127.

Q3 numbers demonstrate strengths in operating leverage

As we turn to ACHC’s Q3 quarterly numbers, we found several highlights worth mentioning. Chiefly, we saw upward mobility in the company’s bed count and admissions rate for the period.

Revenue growth of 13.5% pulled in $666.7mm, a tidy step up from the $587.6mm last year.

We should point out that ACHC added another 132 beds to its existing facilities, forecasting another 90 beds under its existing facility umbrella in Q4 FY22.

Combined, ACHC has added 200 beds to its bed count this YTD, with a goal of adding another 300 beds across all sites [existing, de novo] by the end of FY22. Helping fuel this growth, we noted the company’s acquisition of a 60-bed children’s hospital in July. It also expects first revenues from its 101-bed adult outpatient facility in FY23. These are both located at the company’s behavioral health operations in Chicago. We opine this is a good step for ACHC to fulfill its future growth aspirations and meet patient demand in its existing markets.

Switching to the operational highlights, we observed several data points worth mentioning. To list a few:

- We saw same-store revenue stretched up by 10.2% YoY to $59.4mm. Growth was underpinned by favorable trends in revenue per patient day (“RPPD”) and a corresponding increase in patient says (“PDs”).

- Speaking of, RPPD lifted 690bps YoY whereas PDs recognized a 310bps growth from this time last year. Management note it saw good trajectory in RPPD, PDs from rate increases across “several payers, geographic markets and service lines.”

- We should also note ACHC recognized these growth percentages on adjusted EBITDA of $162.8mm. Noteworthy, is it booked $7.7mm of income in its reconciled EBITDA number from the Provider Relief Fund. Recall, this was legislated under the CARES Act. Moreover, and for the most part, ACHC repaid the $45.2mm received under the Advanced Payment Program (CARES Act). It also retired the “remaining half” of its FY20’ $39.3mm payroll tax deferrals, wiping this liability from the balance sheet.

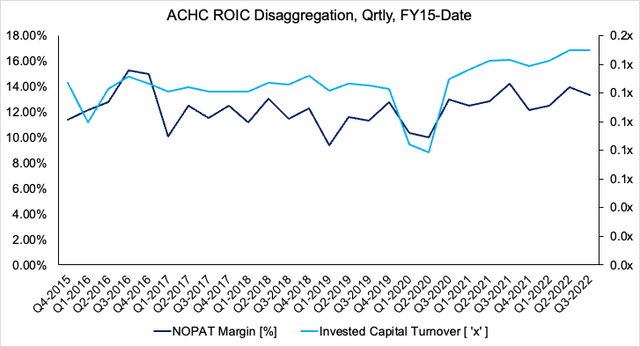

- We also checked ACHC’s profitability trends over the last few periods to date, to guide price visibility looking ahead. Specifically, we looked at the how much NOPAT the company generated from the last period’s invested capital [return on invested capital (“ROIC”)]. You can see in Exhibit 2 that, [in terms of quarterly ROIC], over time, management have been active on investing capital each quarter. Invested capital turnover has crept up from 0.1x to ~0.15x. Meanwhile, NOPAT margin has held a flat rate of ~12-13% over this time.

Exhibit 2. Continues to hold quarterly ROIC flat via invested capital turnover and NOPAT margin

ACHC: The technical view

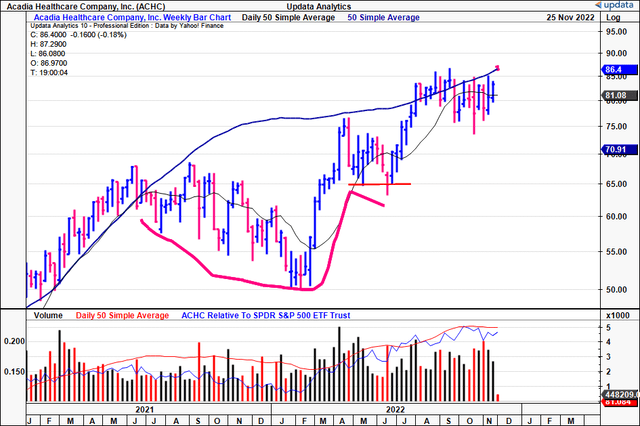

We looked at ACHC’s technicals to observe correlation between market data and fundamentals. We observed the stock completed a 52-week cup and handle from June FY21 to June of this year [Exhibit 3].

It then thrust off this base along with the broad market rally in June FY22, where it has since peaked in Sep. and traded in a sideways consolidation. It has now formed a flat base for the past 8 weeks.

At the same, you can see the overall weekly volume trend is increasing along with the stock’s relative strength rating to the S&P 500.

We believe this is a tremendously good setup for ACHC to extend its FY22 rally. In particular, the periods from Feb/March FY22’ and June/July exhibited heavy volume spikes with corresponding price action. We estimate this to be institutional accumulation, forming a solid bedrock to continue this momentum.

Exhibit 3. ACHC 18-month price action [weekly bars, log scale shown]

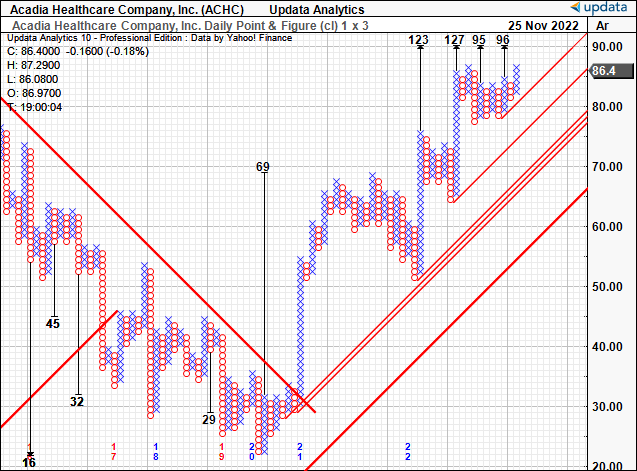

Meanwhile, we have mid-term price targets ranging from $95–$127 as seen in the point and figure chart below.

Combined with the chart analysis above, this adds to our buy thesis.

Exhibit 4. Upside targets to $127

Data: Updata

Valuation and Conclusion

Before valuing ACHC, we should first note that management revised guidance to the downside on the Q3 earnings call. It now projects $2.58–$2.6Bn at the top line for FY22, calling for 12.5% YoY growth from the year prior.

It expects adjusted EBITDA of $611–$621mm and adjusted EPS of $3.13–$3.23. All projections are inclusive of income from the Provider Relief Fund discussed earlier.

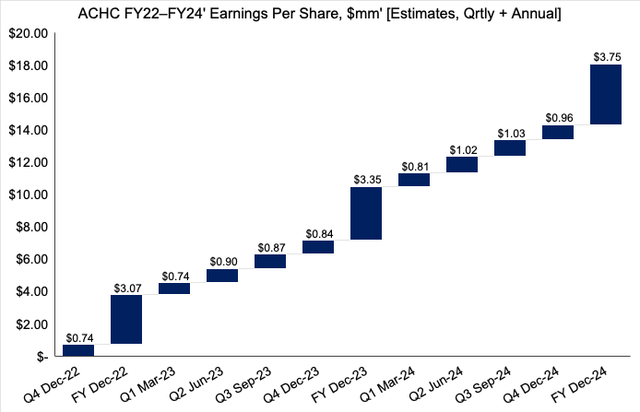

We are slightly behind management’s EPS growth assumptions and forecast FY22 EPS of $3.07, stretching up to $3.35 and $3.75 respectively. You can see our bridge of ACHC’s bottom-line forecasts below [Exhibit 5].

Exhibit 5. ACHC FY22–24’ EPS growth assumptions

In that regard, it depends on how one views ACHC’s earnings trajectory looking ahead.

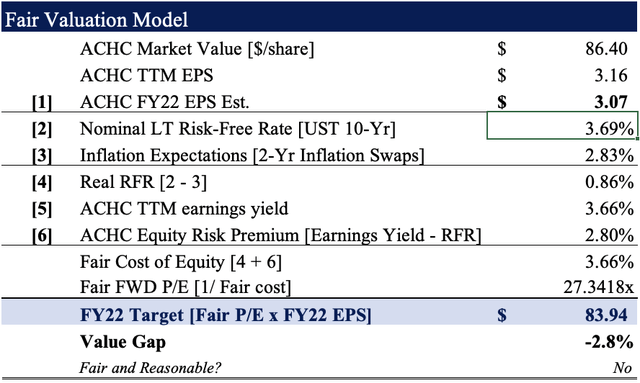

Factoring in the company’s top-bottom line revisions, it would suggest that ACHC would be fairly valued at 27x forward P/E or $83.94. This is a value gap of 280bps to the downside [Exhibit 6].

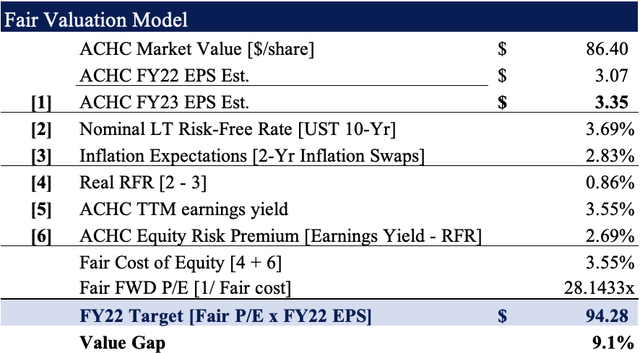

Rolling our FY22 EPS growth assumptions forward, however, would imply the stock trades fairly at 28x forward earnings to an initial price objective of $94.28 [Exhibit 7]. This is well supported by technical studies above.

Exhibit 6. Fair value estimate with FY22 EPS assumptions.

Exhibit 7. Fair value estimate when rolling FY23 EPS assumptions forward

Net-net, we rate ACHC a buy on its operational strengths, growing bed count on a manageable cost base and on valuation. We are seeking price objectives of $94.28 and then $127 for Acadia Healthcare Company, Inc. based on our analysis.

Be the first to comment