Matt_Gibson

The merits of owning REITs versus rental properties is a topic that’s up for debate. In fact, a fellow Seeking Alpha contributor devotes a number of articles to the topic. For one thing, rental properties give one a sense of control in terms of choosing how much to leverage, what repairs are to be made, and the direct cash flows that come with private ownership.

With REITs, one is essentially outsourcing day to day management duties to other professionals and asserts virtually no direct control over the enterprise. There’s a school of thought that publicly traded shares should be purchased at a discount to fair value.

This brings me to STAG Industrial (NYSE:STAG), which remains well below its 52-week high of $48 from earlier this year. This article highlights why its worth taking a stab at STAG for potentially strong long-term returns.

STAG Stock (Seeking Alpha)

Why STAG?

STAG Industrial is an industrial REIT with a national presence, with 563 properties covering 112 million square feet across 41 states. Its strategy is to acquire and lease out properties in secondary markets, where it’s able to obtain more favorable deal pricing due to less competition from bigger players such as Prologis (PLD) and Rexford Industrial (REXR), which are focused on the more competitive Tier 1 markets.

STAG differentiates itself from the rest of the pack in that it’s solely focused on acquiring single tenant properties (like most net lease REITs) rather than multi-tenant ones. This results in simplicity and better deal pricing for STAG. That’s because a single tenant property is far more risky for a private owner of just a handful of properties compared to STAG, which is able to diversify away its risk across a broad portfolio of 563 properties. That means that the same property is far more valuable for STAG than it is for a private owner.

STAG has bolted out of the gate since IPO in 2011, at which time it had just 93 properties. Since then, it’s reduced its flex office/industrial exposure from 21% of annual base rent to just 0.1% at present. Moreover, its weighted average annual rent escalators are also higher now, at 2.5%, compared to 1.25% at IPO time.

Meanwhile, STAG continues to demonstrate respectable growth, with Core FFO per share rising by 7.5% YoY during the third quarter. Same-store cash NOI grew by 5.6% YoY, driven in part by robust lease spreads of 14% and 25% on a cash and straight-line basis, respectively, signaling strong market demand for its properties.

Notably, STG maintains a strong balance sheet, with a net debt to EBITDA ratio of 5.0x, and has plenty of flexibility at the total portfolio level, considering that just 0.3% of STAG’s total debt is in the form of secured debt (i.e. property level mortgages). This means that STAG is able simplify its financing terms at the company level rather than having to deal with a multitude of property appraisals and mortgages.

This lends support to STAG’s dividend, which is well covered by cash available for distribution, at a 78% payout ratio. This gives STAG an internal source of capital, with which it can use to help fund growth.

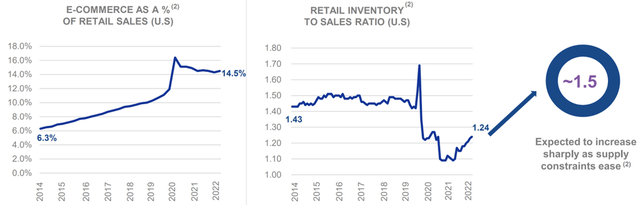

Looking forward, there appears to be plenty of greenfield (pun intended) for STAG, as e-commerce remains the key driving force behind demand for industrial properties. As shown below, e-commerce has grown to 14.5% of total retail sales. Retail inventory also continues to rebound, as supply chain issues have largely eased.

E-Commerce Growth (Investor Presentation)

Management also expects to see opportunities open up on the acquisition front, as higher leveraged players may seek to sell in order to cover upcoming debt maturities, but this may take time to play out. This was highlighted during the recent conference call:

The ongoing capital market volatility continues to weigh on the asset transaction market as sellers continue to seek price stability. We expect attractive opportunities to develop as sellers become motivated by capital needs and upcoming debt maturities. These market dynamics have resulted in a more tempered acquisition and disposition guidance range for the remainder of the year.

Lastly, I continue to see value in STAG at the current price of $32.74 with a forward P/FFO of 14.9. While this sits just slightly below STAG’s normal P/FFO of 15.3, I believe a higher valuation in the 16-18x range is warranted considering STAG’s balance sheet improvements over the past decade and the strong demand trends for its properties. Analysts have a consensus Buy rating on STAG with an average price target of $36, implying potential for double digit returns over the next year.

Investor Takeaway

Overall, STAG Industrial remains a sound investment opportunity due to its strong balance sheet and strong rental rate growth. With e-commerce continuing to drive demand for industrial properties and a well-covered dividend yield of 4.5%, STAG presents investors with both income and long-term capital appreciation potential.

Be the first to comment