Ray Orton

A more in-depth version of this report, including metric definitions and targets, was first shared with members of my Quality + Value Strategies subscription service in the Seeking Alpha Marketplace on October 19, 2022.

An adage in marketing academia is that the best way to make a fortune in business is to produce in-demand everyday products, then “pile ’em high and sell ’em cheap.”

Littelfuse, Inc. (NASDAQ:LFUS) produces electronic components such as fuses, sensors, switches, relays, circuits, and surge protectors. Of course, technology components may not be inexpensive per se; however, Littelfuse has existed and grown for nearly 100 years, manufacturing and selling in-demand, predominantly micro-sized electronic products worldwide.

In this initial primary ticker research report, I put Littelfuse and its common shares through my market-beating, data-driven investment research checklist of the value proposition, shareholder yields, fundamentals, valuation, and downside risk.

The resulting investment thesis:

This under-the-radar quality electronic component manufacturer has been quietly growing organically and through acquisitions for decades. Littelfuse’s growth and profit will likely persist, and right now, its common shares present as a buy ’em low and pile ’em high conviction pick.

My current overall rating: Buy, based on a bullish view of the company and a bullish view of the stock.

Unless noted, all data presented is sourced from Seeking Alpha Premium as of the market close on October 29, 2022; and intended for illustration only.

Pile ‘Em High and Sell ‘Em Cheap

LFUS is a dividend-paying small-cap stock in the information technology sector’s electronic components industry.

Littelfuse, Inc. manufactures and sells circuit protection, power control, and sensing products in the Asia-Pacific, the Americas, and Europe. The company conducts its business through three reportable segments: electronics, transportation, and industrial. Littelfuse was founded in 1927 and is headquartered in Chicago, Illinois, USA.

My value proposition elevator pitch for Littelfuse:

Near-century-old electronic component manufacturer generates sustainable profit and cash flow by piling ’em high and selling ’em (relatively) cheap. Unlike the consumer, energy, materials, and industrials sectors, Littelfuse operates with a lesser threat of low-cost producer commoditization in the technology space.

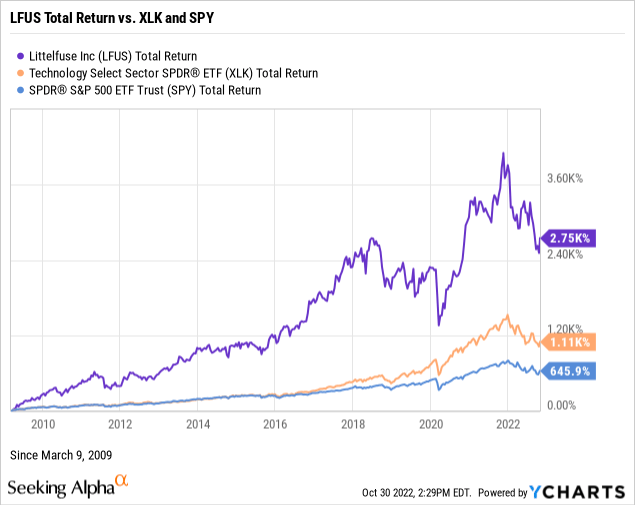

The chart below illustrates the stock’s performance against the Technology Select Sector SPDR Fund ETF (XLK) and the SPDR S&P 500 ETF Trust (SPY) since the market bottom on March 9, 2009. For example, LFUS has outperformed the total returns of its sector and the broader market during the epic bull run leading up to the coronavirus pandemic and the current bear market endemic.

My value proposition rating for Littelfuse: Bullish.

Yields Circuit-Breaking the 10-Year Treasury

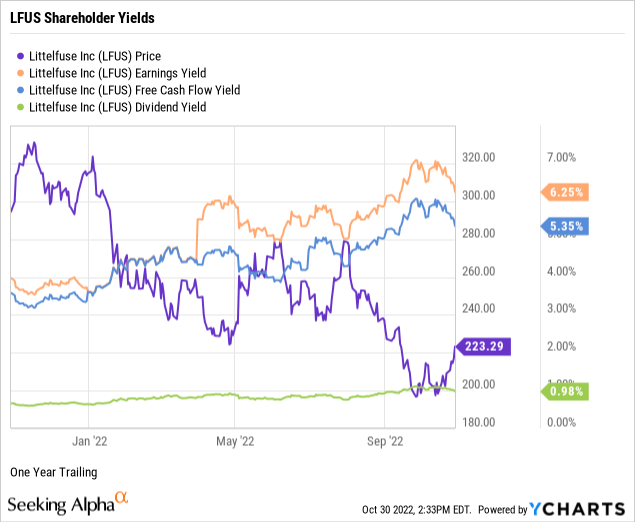

As part of my due diligence, I average the total shareholder yields on earnings, free cash flow, and dividends to measure how a targeted stock compares to the prevailing yield on the 10-year Treasury benchmark note. In other words, what is the equity bond rate of the common shares?

LFUS was trading with an earnings yield of 6.25% and a free cash flow yield of 5.35%, as demonstrated in the below chart.

Littelfuse offers a modest forward dividend yield of 0.98%. However, it has a very conservative 12.96% payout ratio indicating a safe, well-covered dividend with plenty of room for annual raises.

I prefer high dividend yields only when calculated on a long-term cost basis. For example, LFUS yielded 30.61% from its current annual payout of $2.40 on a split- and dividend-adjusted cost basis of $7.84 per share on March 9, 2009. Although an extreme example, with a yield-on-cost of 2,963 basis points above the forward yield, LFUS provides another reminder that buy-and-hold quality value investing works.

Next, I take the average of the three shareholder yields to measure how the stock compares to the prevailing yield of 4.01% on the 10-year Treasury benchmark note. For example, the average shareholder yield for LFUS was 4.19% but 14.07% if using the 2009 yield-on-cost basis. Conventional market wisdom holds equities as riskier than U.S. bonds. Thus, securities such as LFUS, which reward shareholders with yields above the government benchmark, argue for owning the stock instead of the bond.

Remember that earnings and free cash flow yields are inverse valuation multiples, suggesting that LFUS trades at a reasonable, if not bargain, stock price. I’ll further explore valuation later in this article.

My shareholder yields rating for LFUS: Bullish.

Blowing Away Tech Sector in Fundamentals

Let’s explore the fundamentals of Littelfuse, uncovering the performance strength of the company’s senior management.

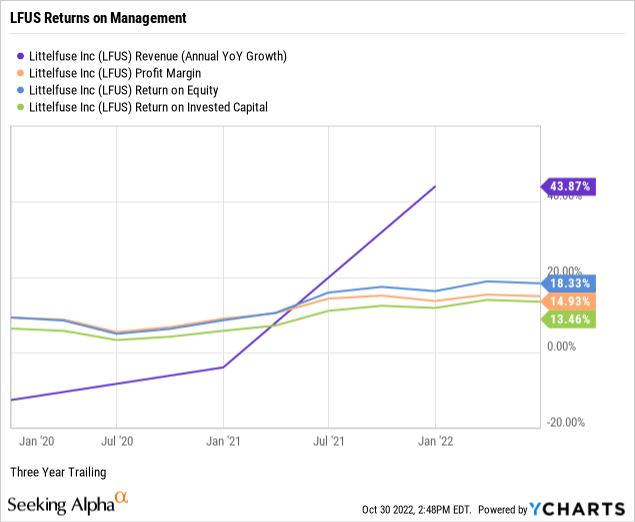

Per the below chart, Littelfuse had a three-year annualized revenue growth of 43.87%, exceeding the 18.83% median growth for the information technology sector. Notably, acquisitions contributed a significant portion of the company’s recent growth.

The company had a trailing three-year double-digit pre-tax net profit margin of 14.93%, outperforming the sector’s modest median net margin of 3.75%.

Littelfuse was producing a trailing three-year return on equity or ROE of 18.33% against a median ROE of just 6.63% for the sector.

On April 28, 2021, Littelfuse’s board of directors authorized the repurchase of up to $300 million in shares of the company’s common stock between May 1, 2021, and April 30, 2024. However, the company did not repurchase shares of its common stock during the fiscal year ending January 1, 2022. (Source: Littelfuse Annual Report).

At 13.46%, Littelfuse’s return on invested capital or ROIC, triples the sector’s median ROIC of 3.73%, indicating that its senior executives are capable capital allocators. But, notably, Littelfuse’s ROIC barely exceeds its trailing weighted average cost of capital or WACC of 10.05%, a higher-than-average capital cost basis. (Source of WACC: GuruFocus).

Nonetheless, the accelerating revenue growth, double-digit net profit margin, and sector-exceeding returns on equity and capital indicate quality management performance in The Windy City.

My fundamentals rating for Littelfuse: Bullish.

Underpriced Stock of Highly Capable Producer

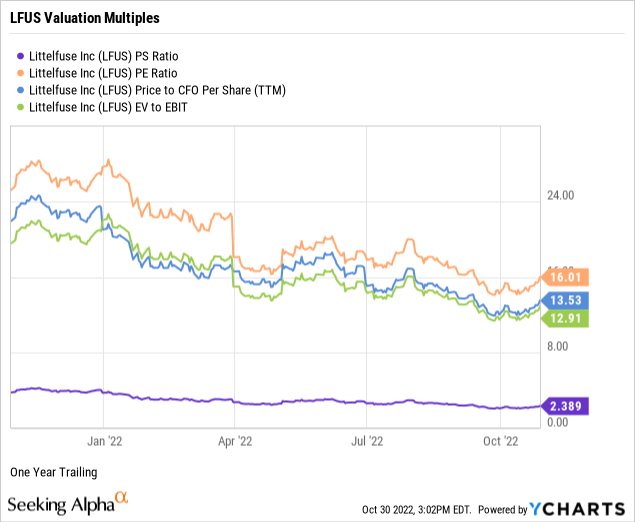

I rely on just four valuation multiples to estimate the intrinsic value of a targeted quality enterprise’s stock price.

LFUS was trading at a price-to-sales ratio or P/S of 2.39 times per the below chart. In addition, the trailing P/S ratio was in line with 2.53 for the information technology sector and 2.27 times for the S&P 500. (Source of S&P 500 P/S: Charles Schwab & Co.) Thus, the weighted industry plus market sentiment suggests a reasonably-priced stock relative to Littelfuse’s topline.

LFUS had price-to-trailing earnings or P/E of 16.01 times against a sector median P/E of 21.20, indicating investor sentiment discounts the stock price relative to earnings per share. Further, LFUS traded at a discount to the S&P 500’s overall P/E of 18.68. (Source of S&P 500 P/E: Barron’s).

At 13.53 times, LFUS’s price-to-operating cash flow multiple traded at a discount to the sector’s median of 19.01, indicating that the market prices the stock below fair value relative to current cash flows.

Against the broader sector median of 17.42, LFUS was trading at 12.91 times Enterprise value to operating earnings or EV/EBIT, signaling the stock was oversold or underbought by the market.

Weighting my preferred valuation multiples suggests the market assigns a discount to Littelfuse’s stock price relative to sales, earnings, cash flow, and enterprise value. Therefore, based on the fundamentals and valuation metrics uncovered in this article, risks and potential catalysts notwithstanding, I would call LFUS an underpriced stock of a market-dominant, A-rated, highly-capable electronic components producer.

My valuation rating for LFUS: Bullish.

Small Cap with a Large Cap Risk Profile

When assessing the downside risks of a company and its common shares, I focus on five metrics that, in my experience as an individual investor and market observer, often predict the potential risk/reward of the investment. Hence, I assign a downside risk-weighted rating of above average, average, below average, or low, biased toward below-average and low-risk profiles.

Alpha-rich investors target companies with clear competitive advantages from their products or services. An investor or analyst can streamline the value proposition of an enterprise with an economic moat assignment of wide, narrow, or none. For example, Morningstar assigns LFUS a narrow moat rating.

Long-term debt coverage demonstrates balance sheet liquidity or a company’s capacity to pay down debt in a crisis. For example, as reported on its July 2022 quarterly financial statements, at 1.94 times, Littelfuse could readily pay off 100% of its longer-term debt obligations using its liquid assets, such as cash and equivalents, short-term investments, accounts receivables, and inventory. In a further test of its paydown capacity, Littelfuse’s long-term debt to equity was a responsible 44.68%.

Littelfuse’s short-term debt coverage was a stellar 4.31 times. Thus, its balance sheet provides significant liquid assets to pay down 100% of its current liabilities, including accounts payable, accrued expenses, short-term borrowings, and income taxes.

As a long-term investor, I use a five-year beta trend line, and LFUS’s 60-month trailing beta was 1.23. At 1.10, its shorter-term 24-month beta was less volatile. Thus, with price volatility near the S&P 500 standard of 1.00, LFUS trades with large-cap market-average volatility as a small-cap portfolio holding.

The short interest percentage of the float for LFUS was a bear paws-off of 1.68%. So perhaps the near-sighted traders view the stock as a market-dominant electronic components staple with a loyal and sustainable customer and investor base.

Littelfuse is a fundamentally superior company with a market-dominating value proposition and an attractive risk profile against a broader bear market.

My downside risk rating for Littelfuse: Below Average.

Under the Radar Quality Value Opportunity

Catalysts confirming or contradicting my overall buy investment thesis on Littelfuse, Inc. and its common shares include, but are not limited to:

- Confirmations: Global trends in renewable energy and electric vehicles should boost demand for Littelfuse’s products. The company’s recent entry into the carbide semiconductor market could fuel additional rapid growth. Littelfuse’s enduring worldwide customer relationships help it earn excess returns on capital in the face of cyclical downturns. As a result, shares appear undervalued for a company that is high-quality and high-growth.

- Contradictions: Littelfuse relies on acquisitions to fund its long-term growth. The company’s niche semiconductor business could struggle to gain material market share over larger, better-capitalized industry players. Reliance on constant innovation to stave off the commoditization of its products or the entrance of an acquisition-elusive disruptive competitor could threaten its legacy market share.

(Additional source of catalysts: Morningstar.)

Littelfuse is an under-the-radar, small-cap electronic components producer that presents as bullish in all five areas of my proprietary research investor checklist. Although its narrow moat rating prevents a “strong buy” recommendation, LFUS trades at a discount price despite representing a high-quality business model. Thus, I am initiating coverage of LFUS with a “buy” rating.

In reverse deference to the old marketing adage of “pile ’em high and sell ’em cheap” to build fortunes in business, investors can accumulate LFUS shares on the cheap and pile them high in an appropriate portfolio.

Be the first to comment