Dan Kitwood

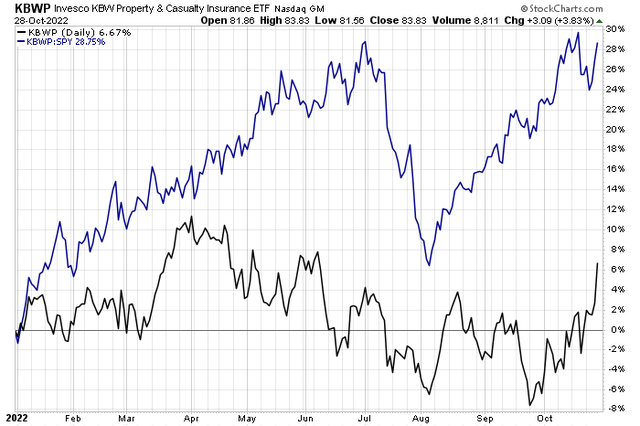

A spot of green in a sea of red this year is the insurance group. The Invesco KBW Property & Casualty Insurance ETF (KBWP) has returned more than 6% in 2022, dividends included. That’s a massive 29-percentage-point alpha figure against the S&P 500 Trust ETF (SPY). One of its biggest holdings reports quarterly results Tuesday night, with an earnings call Wednesday morning. Is AIG a buy here? Let’s check it out.

P&C Stocks A Huge 2022 Relative Winner

Stockcharts.com

According to Bank of America Global Research, American International Group (NYSE:AIG) is a multi-line insurer with a global P&C footprint specializing in commercial and personal lines. The life and retirement business is U.S.-centric, with a large presence in fixed annuities and group retirement. Following a government bailout during the GFC, AIG has struggled to reach levels of profitability delivered by peers. The recent AIG200 initiative aims to right-size AIG’s cost structure following years of business sales and the introduction of new technologies.

The New York-based $43.2 billion market cap Insurance industry company within the Financials sector trades at a low 3.8 trailing 12-month GAAP price-to-earnings ratio and pays a 2.3% dividend yield, according to The Wall Street Journal.

AIG has a focus on cost-cutting and returning some cash to shareholders via buybacks. With the insurance cycle perhaps having peaked, earnings are seen as dipping this year. Inflation is a wildcard for AIG – being unable to increase rates that keep pace with higher costs could pressure EPS and margins. A drop in CPI, though, is generally seen as a tailwind for the industry and company. But higher yields also are a benefit to AIG’s business – Goldman upgraded the stock a few weeks ago on that development. Also keep your eye on how AIG’s significant 76% stake in Corebridge, formerly AIG Life & Retirement.

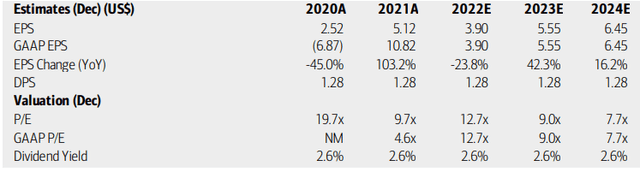

On valuation, analysts at BofA see earnings having fallen sharply in 2022 after a massive jump that coincided with the insurance cycle in 2021. Per-share profits are then seen as rebounding impressively next year before moderating in 2024. The dividend is forecast to remain stable, but significant stock buybacks are accretive to shareholders.

Meanwhile, the valuation suggests the stock is cheap. Both AIG’s operating and GAAP P/E ratios are low right now and expected to stay that way, barring a massive stock price jump. Thus, Seeking Alpha rates the firm with a solid B+ valuation rating with an A growth rating. I also like the insurance company’s price-to-book ratio which is under one, historically a low multiple for AIG, per BofA.

AIG: Earnings, Valuation, Dividend Forecasts

BofA Global Research

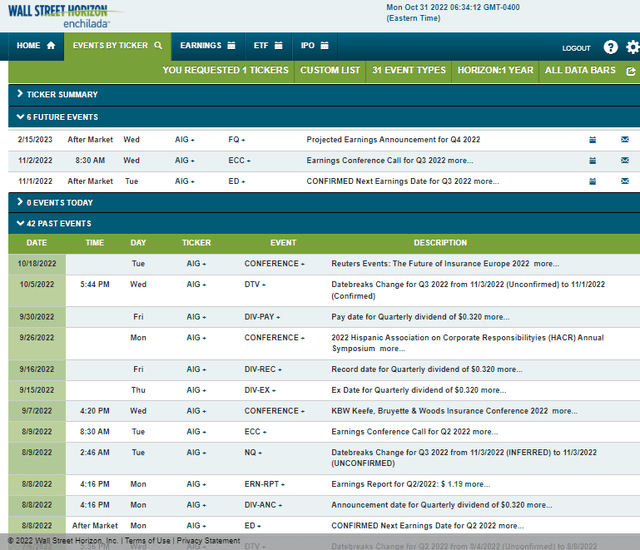

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2022 earnings date of Tuesday, Nov. 1 AMC with a conference call the following morning. You can listen live here. The calendar is light outside the Q3 report.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

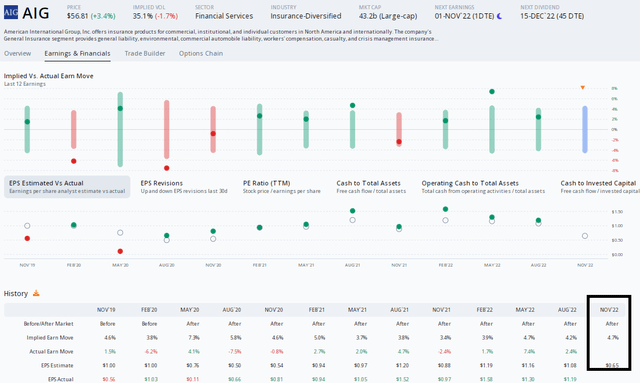

Digging into the earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.65 which would be a large 33% year-on-year decline in per-share profits. On the bullish side, though, is AIG’s strong EPS beat rate history – with results topping expectations in each of the previous nine reports. Shares also have traded higher post-earnings in six of the last seven reports.

Meanwhile, options traders have priced in a 4.7% earnings-related stock price swing using the nearest-expiring at-the-money straddle – that move is on the high-end of the historical range, but the stock did rise a large 7.4% after its Q1 report earlier this year, so options appear fairly priced today.

AIG: A Strong EPS Beat-Rate History

ORATS

The Technical Take

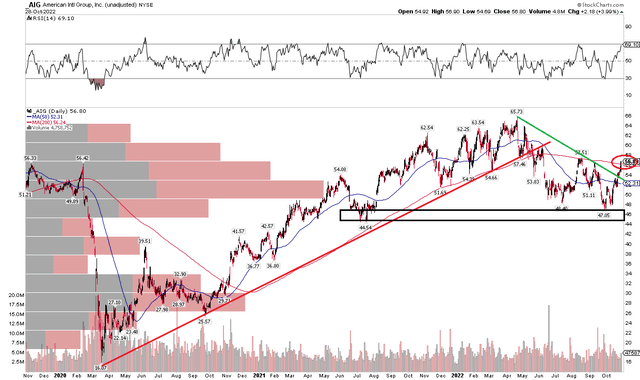

AIG perked up above its falling 200-day moving average to close out last week. That’s a bullish sign. The stock may have eyes on its 2022 high above $65. The bulls want to see the 200-day hold; it has been a significant trigger, marking support and resistance in the past year-plus.

I also notice that shares are breaking out from a downtrend resistance line off the Q2 2022 peak – another bullish factor, confirmed by a new high in RSI. The stock had been in correction mode after breaking an uptrend late in the first half. Importantly, the $44 to $48 range attracted buyers. Being long here with a stop under $44 makes sense, but perhaps some initial profits should be taken on a first approach of the $65 peak.

AIG: Shares Eye A Bullish Breakout

Stockcharts.com

The Bottom Line

Insurance stocks keep working in 2022, and AIG might just be breaking out ahead of its earnings report Tuesday night. Shares looks cheap, and the technical setup leans bullish.

Be the first to comment