simarts

Thesis

UBS’ (NYSE:UBS) Q3 profits dropped versus the same period one year earlier. But in my opinion, the results are good enough to justify a ‘Buy’ recommendation. Investors should consider that trading at a P/E of about x7, UBS stock is very cheap. Moreover, following the Credit Suisse (CS) bankruptcy discussion – and various scandals – UBS is well positioned to claim market share in the high-margin private banking and wealth management business.

Personally, I believe UBS should be valued at $23.90/share. I base my thesis on a residual earnings valuation, with analyst consensus estimates as the anchor.

UBS Q3 Results

During the September quarter, UBS generated $8.2 billion of revenue and a net-income of $1.7 billion. Although net income contracted by about 20% versus the same period one year prior, results are ahead of analyst consensus, which has estimated revenue and net income at $8.07 billion and $1.5 billion, respectively. Reflecting on year over year drop in both revenues and net income, Ralph Hamers, CEO of UBS, commented:

The macroeconomic and geopolitical environment has become increasingly complex. Clients remain concerned about persistently high inflation, elevated energy prices, the war in Ukraine and residual effects of the pandemic …

… We remain disciplined on risk management and cost efficiency as we head into the fourth quarter.

But overall, as the stock price jump following the announcement highlights (plus 5% approximately), UBS’ results were better than expected.

The performance was driven by an attractive cost to income ratio of 71.8%, which is within the bank’s target range of max 73%. Moreover, UBS’ investment banking division remained relatively resilient – given the circumstances – and decreased by only 19% year over year, to $2 billion. The bank’s revenue from ‘global markets’ decreased by approximately 1%.

Finally, UBS’ balance sheet remains very strong and (arguably) resilient against the multitude of macro-economic challenges, as the bank ended the quarter with a 14.4% CET1 capital ratio (as compared to JPMorgan Chase’s (JPM) 12.6%, for reference).

Credit Suisse Loss Might Be UBS Gain

Although UBS’ investment banking arm and global markets division is lagging US peers, the bank remains one of the leading houses for wealth management – with a focus on serving UHNWI (ultra-high net worth individuals). In Q3, UBS’ wealth management segment accounted for $4.79 billion of revenues and $1.45 billion of pre-tax operating income.

Following reputational damage for Credit Suisse, I believe that UBS’ UHNWI segment might take some of the Swiss peer’s market share. (Read my article about Credit Suisse – here). For reference, only recently has CS’ deputy head of Asia wealth management resigned. And interestingly, UBS management today said that the bank is aiming to ‘improve its business in Asia-Pacific’ and mentioned ‘some opportunities to grow in China’ – commentary that comes only one day after the historic market sell-off in China-based equities.

Valuation Is Attractive

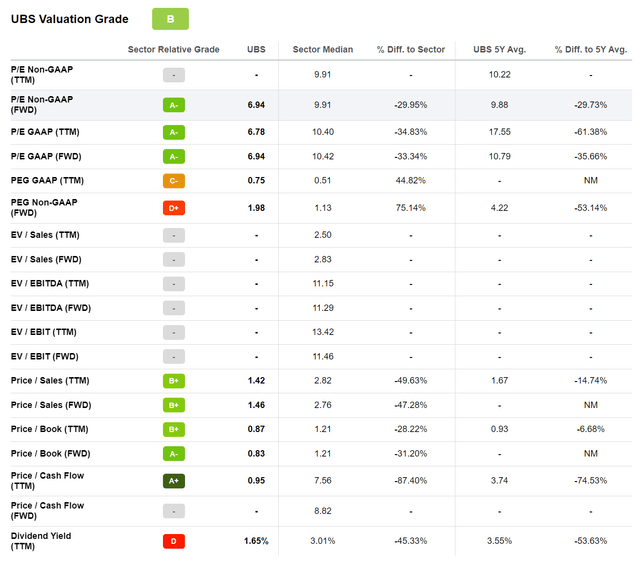

UBS valuation is definitely attractive, in my opinion. UBS shares are currently valued at a one year forward P/E of x7, which implies a 30% discount to the sector. Similarly, UBS’ P/B is also priced at an approximate 30% discount to the industry median, at x0.8.

Seeking Alpha

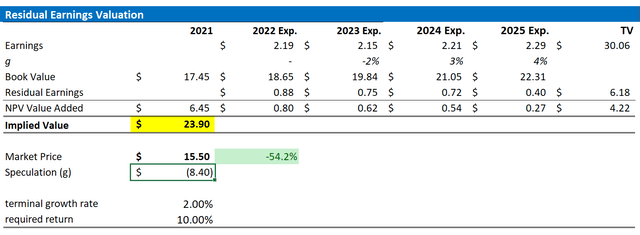

But I understand that multiples do not fully capture a company’s intrinsic value. Thus, to derive a more precise estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

Residual Earnings Model

With regard to my UBS stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on UBS’s cost of equity at 10% – which I believe is conservative for a bank.

- For the terminal growth rate after 2025, I apply 2%, which (approximately in line nominal global GDP growth).

Given these assumptions, I calculate a base-case target price for UBS of about $23.90/share.

Analyst Consensus; Author’s calculation

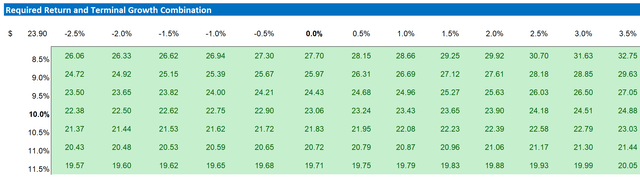

Notably, my base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of UBS’ cost of equity and terminal growth rate, I have constructed a sensitivity table. Note, the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus; Author’s calculation

Risks

Investing in banks implies elevated risk, as the latest Credit Suisse episode has highlighted. But investors should consider that as of Q3 2022, UBS is well capitalized – with an industry leading 14.4% CET1 capital ratio. Moreover, the lion share of UBS banking revenues is connected to wealth management, which is generally not considered as a risk-taking unit, but more like a high-margin advisory business.

In any case, investors are advised to closely monitor macro developments, including global economic and financial conditions.

Conclusion

Reflecting on a strong Q3 quarter from UBS, I am confident to claim that the Swiss bank is undervalued as compared to the company’s financials (and peers). In my opinion, UBS stock should be valued fairly at $23.9/share – which I calculate based on a residual earnings model. Thus for me, UBS stock deserves a ‘Buy’ rating.

Be the first to comment