We Are

Several contributors here on Seeking Alpha (SKNG), myself included, have written about the various headwinds and tailwinds that Digital World Acquisition (NASDAQ:DWAC) faces. The SPAC is an avenue to which Truth Social, a social media platform linked to former President Donald Trump, is taking itself public and with merger delays and volatile shareholder votes it’s taken on a more bearish stance in recent weeks.

But then Elon Musk bought Twitter (TWTR).

So What’s Going On?

Digital World Acquisition, or Truth Social, as I shall henceforth refer to it, had high hopes earlier in the political cycle after Twitter, Facebook (META) and Facebook’s Instagram all banned former President Trump after his actions surrounding his defeat in the 2020 Presidential election and ensuing riot and insurrection on January 6th.

As a result, many of his followers reluctantly left Twitter and various other platforms. After a short time and after a blog-type social media platform failed, the former President announced his support of one of the politically-conservative platforms – Truth Social.

It was aimed at just that – being a social media platform where the Trump can “tweet” and share what he was thinking and who he was endorsing in election cycles and the like. The company sought to go public to raise capital for expansion and chose to do that through a SPAC – DWAC.

Existing Problems Persist

There are several existing issues that the company and social media platform face, even before Musk’s recent closing of his purchase of Twitter.

Competitive Pressures

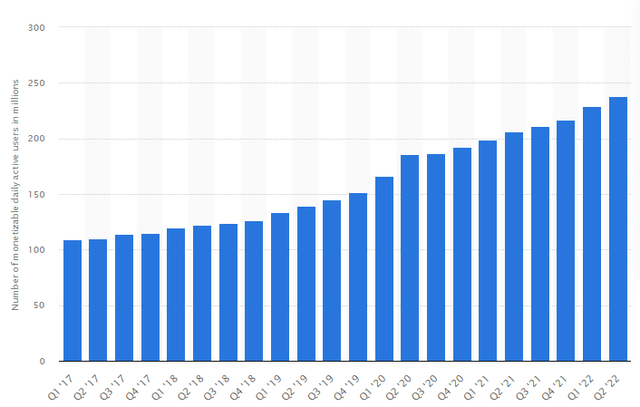

The first part is that even without Musk at the head of Twitter, it was the main social media platform with more than 237 million monetizable daily active users, and it was set to remain as such as both political figures and social media personalities want to enjoy the larger audiences.

Twitter mDAU’s – Latest (Statista TWTR mDAUs)

Beyond Twitter, which together with other social media platforms like Facebook, Instagram, TikTok (BDNCE) and Snapchat (SNAP) make up nearly all of the market share, there were other platforms where individuals loyal to Trump can go to, like Parler, Gettr, Gab and the like.

This competition isn’t going away anytime soon and as we’ve seen and as I’ve discussed earlier – it isn’t even close to all the ~74 million individuals who voted for Trump which gravitated to Truth Social, since the vast majority of those voters are probably not diehard supporters, but only policy and issue voters.

I continue to believe that the small portion of those who will want to get off of platforms they’ve been on for decades, like Facebook, Twitter and Instagram, there are plenty of options out there, and it’s no guarantee that they will choose Truth Social.

The second part of this competitive pressure story, and one which relates more closely to the main point I’ll be touching upon in a minute, is that Kanye West’s recent offer to buy Parler will without a doubt increase these competitive pressures after the former rap star’s aggressive foray into extreme right-wing politics over the past few years.

While other social media platforms may enjoy some business, I believe that Kanye West and his audience are a force to be reckoned with and that Truth Social will have its work cut out for it if that transaction were to go through.

Advertisers Remain Wary

As many have mentioned before, myself included, it should remain relatively hard to find enough advertisers for the platform given its reputation and associated personalities. This isn’t something I bring up lightly in lieu of political controversy on this site – it was said so by company management and various industry experts and analysts many moons ago.

With the toughness of bringing in advertising dollars in its current state, adding in a possible recession in the United States which would curtail advertising apatite of major companies as it is, it’s hard to see how much ad dollars will be flowing into the social media platform given the amount of money major companies spend which Truth Social will not be able to enjoy.

Financial Woes Accelerate

It ain’t just about what competition and advertising dollars do that matters, it’s also simply the current state of the company. While the premise of Truth Social’s financials is that there can be a major investment from the former President and various other conservative billionaires who contribute to various social causes – none of these have yet to materialize.

The company still remains with virtually no cash or liquidity to speak of, is increasing their overall expenses trying to reach advertisers which are yet to respond with real offers of advertising dollars and the growth to their platform doesn’t warrant a second look by medium-sized advertisers who may not care about the political affiliation of a social media platform and just want to get their products in front of consumers.

The New Problem: Twitter and Elon Musk

With the recent news that Musk, CEO of Tesla (TSLA), SpaceX (SPACE) and others, is going through with his acquisition of Twitter (which should be closed and done with by the time you read this article), means a great deal for Truth Social, and it’s not in the direction current analysis is telling us.

Currently, several analysts have talked about both headwinds and tailwinds about what an acquisition of Twitter would mean for the various social media startups in this space. The bottom line is – it won’t mean much upside and a whole lot of downside.

There’s little doubt in my mind, and shouldn’t be in yours, that if Musk allows Trump back onto the platform as the new CEO of the company – he’ll get back on in a heartbeat. With only a fraction of the following he had on Twitter on Truth Social, and with the prospects of him running for President of the United States again in 2024, it’s a near certainty he’d be right back on the platform tweeting away.

This means that Truth Social will all but be neglected. Sure, there will likely be a staffer who would continue to run the platform and Trump’s account and retweet his Twitter posts on the new social media platform, but there will be no incentive for individuals to not return to Twitter – spelling potential doom for Truth Social and its SPAC Digital World Acquisition.

Are There Risks? Sure

Are there risks associated with either shorting or just avoiding a company like Truth Social through Digital World Acquisition? Absolutely.

Not only is the company, which generally trades on quite a low volume, susceptible to large spikes like we’ve seen with other companies which fell prey to the “meme stock traders,” but there’s also the possibility, however small, that Musk does not allow the return of Trump to the platform, and West decides to not acquire Parler, and Truth Social grows.

After they announced earlier that the app is now available on the Google Play store, it can come to the Apple App Store as well and the company’s share price can surge. But at the end of the day, if you’re willing to endure a rollercoaster ride for a shorter period of time, including an options hedging position I talk about at the end of this article, it’s highly likely the company will be worth a fraction of its current price in just a few quarters or years.

So Now What?

With all of these negative factors, it’s no wonder I hold a strong sell rating on the SPAC as it readies to embrace whatever the potential reinstatement of Trump on Twitter is going to mean. But even beyond that, I believe there’s very little that shows that the platform has any chance of succeeding to the levels laid out in the company’s going-public documents.

As it said it was going to take on Twitter, Facebook and Instagram in the social media space, cable news shows and Alphabet’s YouTube (GOOG) (GOOGL) and others, I believe it was pushed to a high valuation which didn’t make much sense then, and it still does not now.

When it comes to valuation, I continue to stand by my earlier projection that the company should have a fair value of around $62.5 million. Their current market capitalization is a tad over $620 million.

I remain highly bearish on the company’s near and long-term prospects and continue to hold the company’s shares short with a $10.00 per share target to begin reducing my exposure. I have also recently initiated a small options position to limit my upside exposure to the stock with Jan’23 and Jun’23 call options with a $40 and $50 strike price.

I believe that while there isn’t much cost to shorting the company’s stock due to lack of dividends or any natural readjustments in share price, the time frame for this short position is rather elastic. That being said, I believe that a good time frame for a potential short position is roughly two quarters, as I believe that in that time we’ll be able to get a good sense of how Twitter’s reshuffling goes under Musk, and we’ll get a few more reports on DWAC’s cash position and other financial positioning ahead of any ramp up in marketing.

Be the first to comment