HJBC

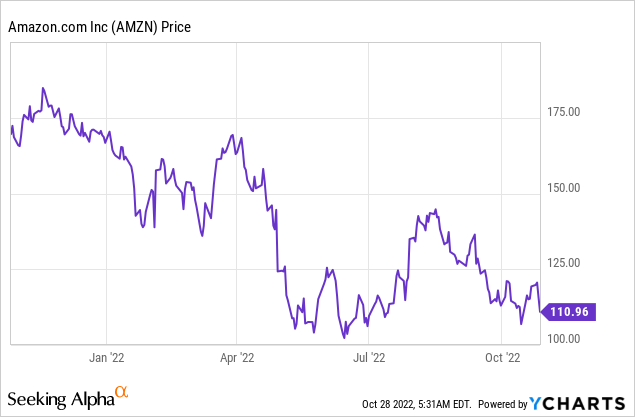

Amazon.com, Inc. (NASDAQ:AMZN) is the world’s largest and most dominant e-commerce company. The company benefited from a lockdown of brick and mortar retail during the pandemic and the subsequent surge in demand. However, now the business is facing a series of macroeconomic headwinds, from unfavorable foreign exchange rates to inflation. The company has missed top-line growth estimates and the stock price has plummeted by ~14% in pre-market trading. The good news is the cloud business [AWS] is still growing strong and is the crown jewel of the company. Thus, in this post, I’m going to break down the company’s third-quarter results in granular detail and dive into the valuation. Let’s dive in.

AMZN Third Quarter Break Down

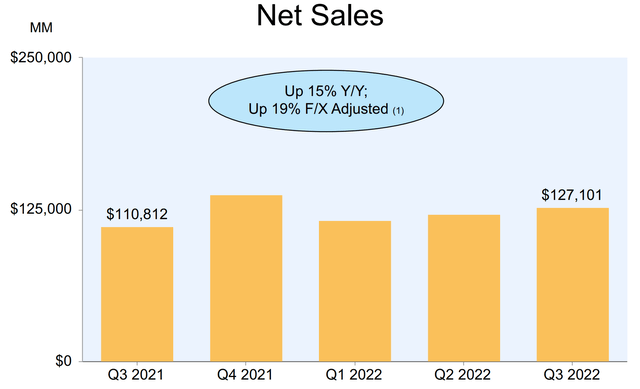

Amazon generated mixed results for the third quarter of 2022. Revenue was $127.1 million, which increased by 15% year-over-year but missed analyst estimates by $370 million. The main headwind against sales was a 5% decline in international revenue, to $27.7 billion. This decline was driven by a strong U.S dollar, which caused unfavorable foreign exchange rates. On an FX-adjusted basis, International sales would have increased by 12% YoY and Net Sales by 19% year-over-year.

Net Sales (Amazon Q3 Earnings Report)

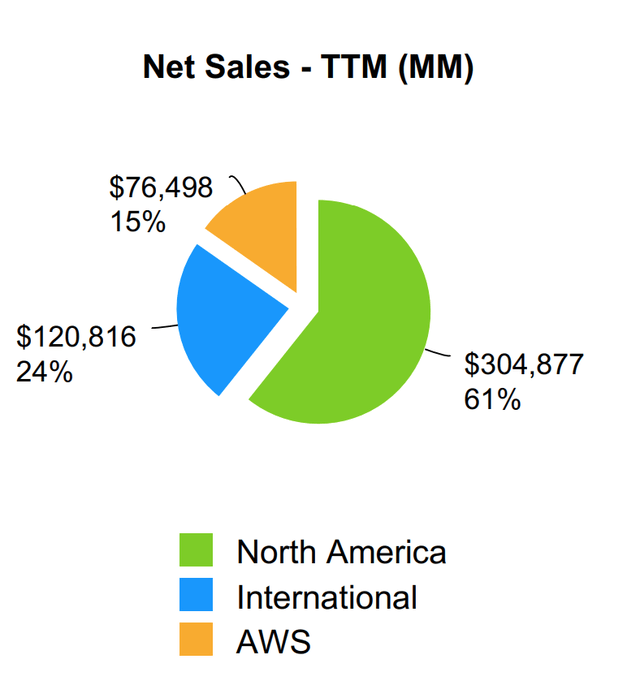

North America was a strong market for Amazon, as segment sales increased by a solid 20% year-over-year to $78.8 billion. North America made up ~61% of Net Sales in the trailing 12 months, whereas International revenue made up just under a quarter of sales (24%). This means we can clearly see the percentage of Amazon’s sales that are exposed to foreign exchange rate issues. The good news is the company can choose to keep some its funds in a local currency (and invest locally) in order to avoid exchange rate headwinds, but management didn’t allude to whether this was part of the strategy.

Amazon Net Sales (Q3 Earnings Report)

In terms of business strategy/updates, Amazon has continued its Customer Centric, “Everything store” approach which takes advantage of the “long tail” of niche consumer products that cannot be all stocked in physical stores. Personally, I have even found Amazon to offer a better selection and lower prices for tools and builder’s hardware than DIY stores, which is astonishing.

Third-party sellers currently make up a staggering 58% of total paid units sold in the third quarter, which is a testament to the strong ecosystem Amazon has built. For example, the company recently hosted an event called Amazon Accelerate where the company introduced new tools that included email marketing, free-to-use shipping software, and better analytics for its sellers.

Amazon also has a solid advertising business which is continually improving. Advertising Sales increased by 30% year-over-year, as advertisers build brand awareness or drive direct product purchases.

Amazon Prime had its eighth Prime Day in July, which makes a historically low consumer season (summer) a real winner for the company. Prime members purchased over 300 million items, which was a record Prime day for the company. The event added an extra 400 basis points to overall third-quarter revenue, which is astonishing.

Amazon Prime Video premiered The Lord of the Rings: The Rings of Power, which attracted over 25 million eyeballs on its release day alone. Even founder and now Chairman Jeff Bezos was heavily promoting the movie on his Twitter. This movie generated more Prime signups globally than any other historic Amazon Original. Amazon also launched a Thursday night NFL slot, which attracted over 15 million viewers during its first broadcast.

Cloud is the Growth Driver

Amazon Web Services [AWS] is the largest cloud infrastructure provider in the world and Amazon’s not-so-secret weapon. The “Cloud” is just a series of datacenters owned or leased by Amazon. The company uses this vast infrastructure to sell “compute” and “storage” in a pay-as-you-go model to its customers. As someone who is AWS Cloud Certified, I have a lot of knowledge regarding this side of the business.

The real problem the service solves is traditional major organizations will have a vast amount of IT services on their premises (“On-Prem”). The issue with this is it can be expensive to purchase the hardware and time-consuming to manage, with limited flexibility. The “Cloud” solves this as enterprises effectively outsource their IT needs to Amazon. This is extremely powerful, as let’s say an e-commerce website has high traffic during the holiday season, its cloud IT can automatically scale to meet the peak demand. Whereas, historically companies would have had to buy more hardware. Amazon has built an entire ecosystem of products on top of its cloud infrastructure. I joke that they have a service for pretty much everything, from Artificial Intelligence to Satellite Communications (AWS Ground station).

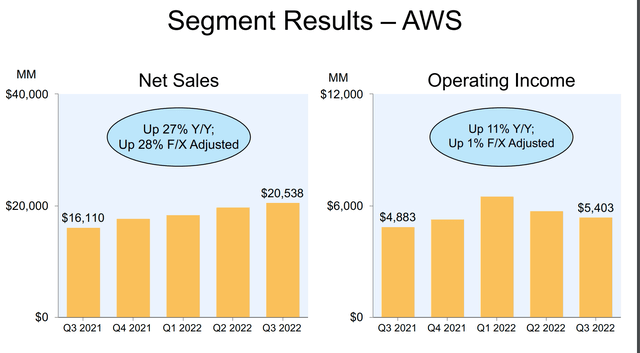

AWS continued to grow strong and generated sales of $20.5 billion in the third quarter of 2022, up a rapid 28% year over year. The business also has an annualized sales run rate of ~$82 billion, which is astonishing. AWS generated an 11% increase in operating income to $5.4 billion year-over-year and is the key profit driver for the company.

The company’s Graviton3 processors offer 40% better price performance than comparable to x86-based instances. New product launches include EC2 (Elastic Compute) machine learning training instances for its AWS IoT (internet of Things) fleet-wise service.

The cloud is also still in its early innings, as AWS has only just launched its Middle East Region in August and its Asia Pacific region in Thailand.

Activist Statement: Although I am not an activist investor, I would be happy to see Amazon spin off its profitable and fast-growing cloud segment AWS. As an Investor, I would prefer to invest directly in that business as opposed to the low-margin, slow-growing e-commerce segment. Internally inside Amazon, both segments already act as two separate companies and are extremely different in their offerings. Perhaps Jeff Bezos, Andy Jassy, or an activist Hedge Fund will read this post and get some inspiration (you heard it here first).

Profitability Review

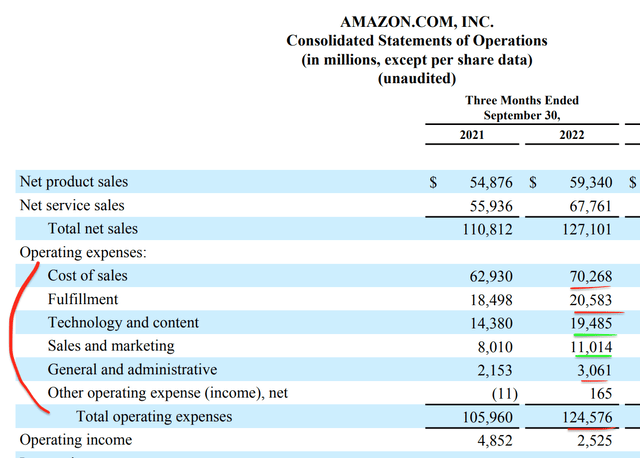

Back to the overall financials and more importantly profitability and cash flow. Amazon reported $2.5 billion in operating income in Q3,22 which was down an eye-watering 48% from the $4.9 billion generated in Q3,21. This decline was driven primarily by its International Segment, which reported an operating loss of $2.5 billion in Q3,22 compared with a loss of $0.9 billion in Q3,21. Its North American segment also included an operating loss of $0.4 billion in Q3,22, which was worse than the operating profit of $0.9 billion generated in Q3,21. This operating income decline was driven by a ~17% spike in Operating expenses to $124.6 billion. This was further driven by an 11% increase in the cost of sales and an 11% increase in fulfillment costs to $20.6 billion (see my income statement red lines below). High inflation, high freight costs, and oil prices have all compounded together to squeeze the profit margin of Amazon’s e-commerce segment. The good news is management announced that they have generated $1 billion in operations cost improvements and are working on “key initiatives” to further improve the efficiency of its network.

Amazon Costs (Income Statement)

I have highlighted some of Amazon’s expenses in green on the graphic above, these are expenses that I believe are not negative long term. For example, the company had a 37% increase in its Sales and marketing expenses to $11 billion. This is a discretionary expense and was primarily driven by the launch of the successful Prime video content Lord of the Rings and the NFL, mentioned prior, of which both have been successful.

The company also reported a 45% increase in its technology and content expenses to $19.5 billion, which I don’t believe is a bad sign overall. Again, this was driven by the new Prime video content, as well as investments in AWS product builders and new regions.

Profitability was negatively impacted by the wind-down of poor-performing business segments such as Amazon Care (employee Healthcare segment), Amazon Explore (travel-related) and Fabric.com. Personally, I think these are all good moves, as the businesses are unrelated to Amazon’s core business.

The company reported stock-based compensation of $5.6 billion in the third quarter, up from $5.2 billion in the second quarter. This was driven mostly by a technical policy change and thus not an issue overall. I believe compensating employees well through stock is a key method to increase employee loyalty and retention.

Amazon’s net income was $2.9 billion, down 10% year-over-year, and is driven by fluctuations in EV maker Rivian Automotive’s (RIVN) stock price, which Amazon invested into. Rivian’s stock price is down ~73% since November 2021. This decline has primarily been driven by macroeconomic forces such as the high inflation and rising interest rate environment.

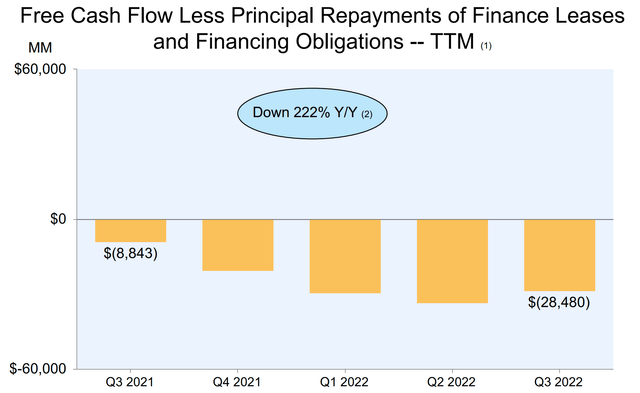

Overall operating cash flow declined by 27% year-over-year, to $39.7 billion. Free cash flow (“FCF”) decreased to an outflow of $19.7 billion in the trailing 12 months compared to a $2.6 billion inflow in the prior year. The adjusted free cash flow details are shown in the chart below. These results have been primarily driven by the aforementioned expenses and investments.

Free cash flow adjusted (Q3 report)

Amazon has a solid balance sheet, with cash, cash equivalents and marketable securities of $96 billion. In addition, that is, to $48.7 billion in long-term debt.

Advanced Valuation

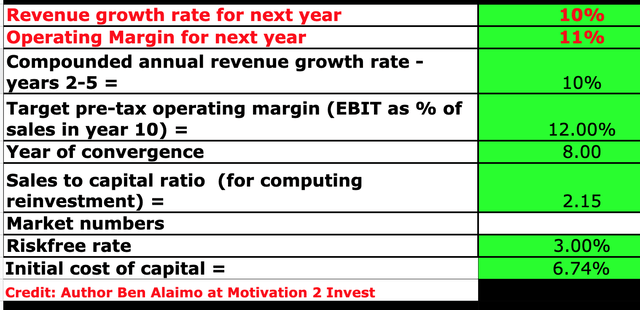

In order to value Amazon, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) valuation method. I have forecasted a conservative 10% revenue growth per year over the next 1 to 5 years. I expect this to be driven by the continual growth in the cloud segment and steady growth in Amazon prime.

Amazon stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation I have capitalized the company’s R&D expenses, which have boosted its operating margin. In this case, I am forecasting just a 1% increase in operating margin over the next 8 years, which is conservative given most macroeconomic factors, from inflation to interest rates, are cyclical by nature. In addition, the company’s cost-cutting and efficiency measures will take a couple of quarters (at least) to show up on the income statement.

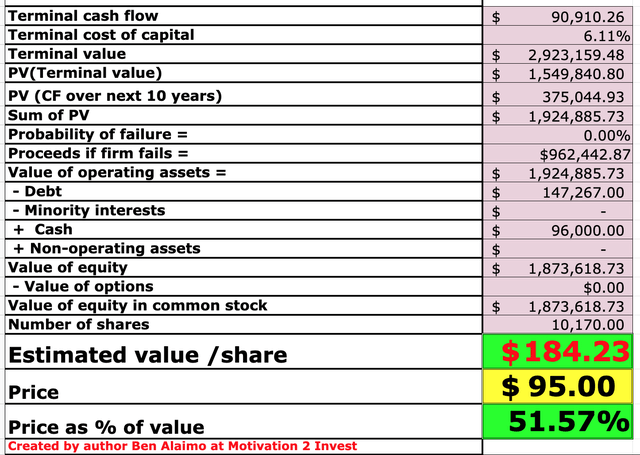

Amazon stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $184 per share. The stock is trading at ~$95 per share at the time of writing, and is thus ~48% undervalued.

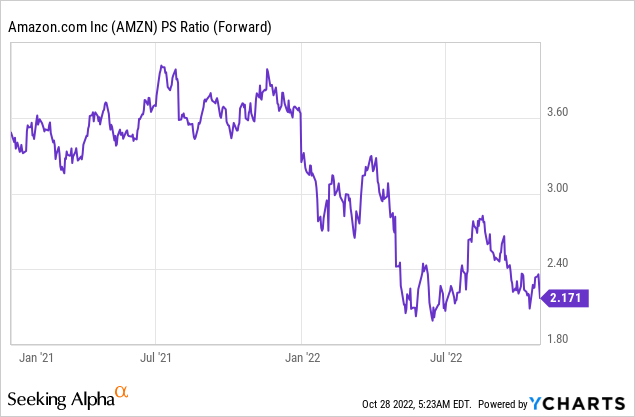

As an extra data point, Amazon is trading at a Price to Sales ratio = 2.17, which is ~34% cheaper than its 5-year average.

Risks

High Inflation/Recession

I will leave you with a note from Amazon CFO Brian Olsavsky, with regards to the business challenges.

“While we are encouraged by our progress across the business, the macroeconomic environment remains challenging worldwide.

The continuing impacts of broad-scale inflation, heightened fuel prices and rising energy costs have impacted our sales growth as consumers assess their purchasing power and organizations of all sizes evaluate their technology and advertising spend.”

“We aim to strike the right balance between investing for our customers for the long-term, while driving operational efficiency improvements and accomplishing more with less.”

Amazon is vertically integrated by nature, with a range of fulfillment centers and even a fleet of planes. Therefore, they are in a better position to weather the logistics storm than any other business “on planet earth.” However, the sheer scale of the company means the impact is still felt.

Final Thoughts

Amazon is a technology titan which dominates the e-commerce landscape. The company is facing a series of macroeconomic headwinds driven by high inflation, FX changes, and a rising interest rate environment. The good news is I forecast the majority of these issues to be cyclical by nature and should not materially impact the business long term. Its cloud business AWS is the crown jewel of the company, as it is the market leader and is still growing rapidly. Amazon is deeply undervalued at the time of writing and thus could be a great long-term investment.

Be the first to comment