Phynart Studio

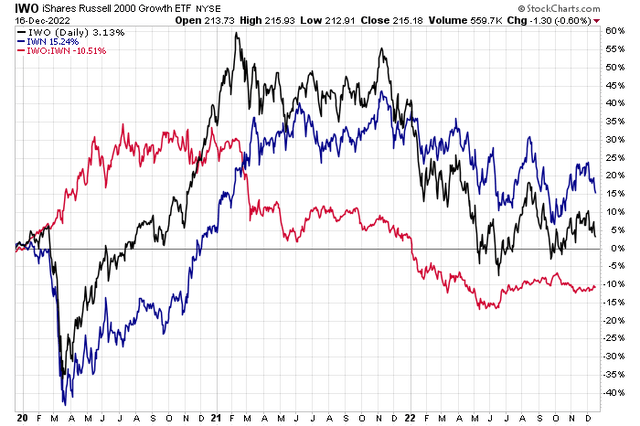

Small-cap growth stocks have outpaced small-cap value shares since the May through June timeframe this year. The broader relative trend, however, is lower for the growth space in the Russell 2000. Even with a drop in intermediate-term interest rates over the last two months, this high-duration part of the stock market has not found much of a footing.

Recession risks now weigh on the small-cap growth style. One of the components in the iShares Russell 2000 Growth ETF features big earnings potential, but is the stock a buy in this volatile market? Let’s investigate.

Small Cap Growth Treads Water Vs Value Lately

Stockcharts.com

According to Bank of America Global Research, ShockWave (NASDAQ:SWAV) is a vascular-focused medical device company that offers a novel medical solution for treating calcified artery disease and calcium buildup in the intimal (inner layer inside the artery) and medial (middle layer of the artery) layers of the arteries through the combination of traditional balloon angioplasty and lithotripsy. The company’s balloon-lithotripsy system is used for calcified peripheral arteries (below and above the knee) and coronary arteries.

The California-based $7.4 billion market cap Health Care Equipment & Supplies industry company within the Health Care sector trades at a high 87.7 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal.

The company handily beat on earnings back in early November and top analysts’ revenue expectations. There has even been some minor takeover chatter with the stock which helped lift shares back in Q3. Recently, though, Wells Fargo downgraded ShockWave to equal weight as it sees the firm’s growth outlook largely priced in.

There’s upside potential for SWAV as it continues to grow sales in a $1.5 billion market. BofA notes that reimbursements are no longer a major headwind either, though competitors may soon enter the market which could be a risk and there’s uncertainty regarding how the firm penetrates new markets. ShockWave offers one of the safest alternatives for highly calcified cases of arterial diseases, per BofA.

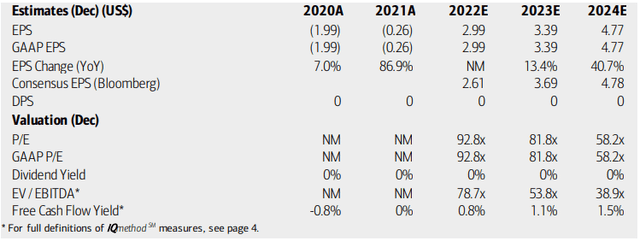

On valuation, analysts at BofA see earnings turning sharply into the black in 2022 with continued EPS growth through 2024. The Bloomberg consensus outlook is about in-line with what BofA sees. Even with a growing bottom line, the firm’s operating and GAAP P/Es are sky-high while its EV/EBITDA ratio is extreme. The good news is that the company is now free cash flow positive. Still, with a price-to-sales ratio valuation above 15, the stock is no doubt expensive.

ShockWave: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

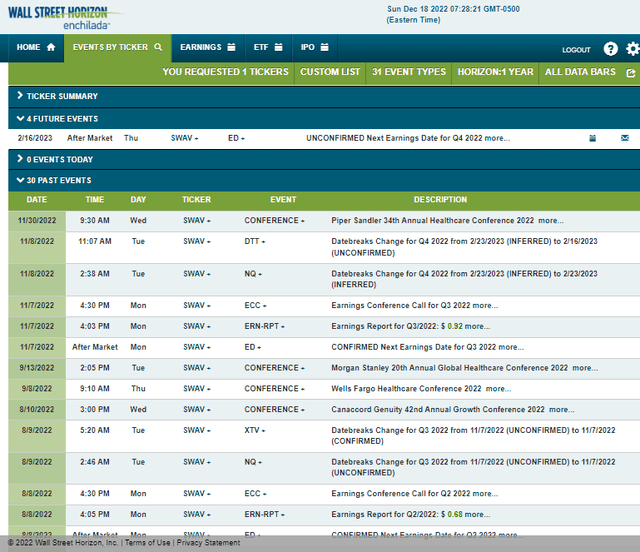

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 16 AMC. The calendar is light aside from that earnings date, though.

Corporate Event Calendar

Wall Street Horizon

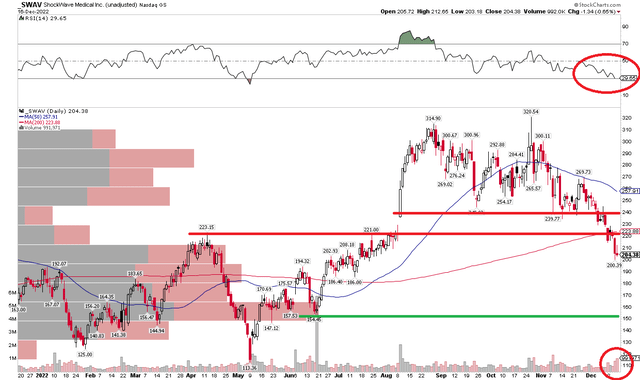

The Technical Take

With a high valuation and a recent downgrade, the technical situation also warrants caution on this growth stock. Notice in the chart below that SWAV has fallen below key support in the $221 to $245 range. The stock had rallied big starting in August, then held the $240 spot before sellers emerged on big volume lately. Shares are now below their April high and August gap. RSI is also bearish on ShockWave, further lending credence to the negative outlook. I see downside risk to the $154 spot – there is a significant amount of volume at the June low.

SWAV: Bearish Price Trends Confirmed By Volume & Momentum

Stockcharts.com

The Bottom Line

With a high valuation and a bearish chart, I am a seller of ShockWave. There is certainly a growth story and even some possibility of a takeover, but price action and ultra-high valuation metrics are big risks.

Be the first to comment