Alexyz3d/iStock via Getty Images

Investment Thesis

QUALCOMM Incorporated (NASDAQ:QCOM) showed its global ambitions during its Investor Day in November 2021, when the company aimed to serve $700B of the total addressable market through its full-stack hardware and software integrated businesses. For the automotive and broad IoT segments, QCOM had estimated a Total Addressable Market worth $100B presently untapped. Since most automakers, if not all, are already converting their gas/oil vehicle productions to full electric models with autonomous driving capabilities, we may expect QCOM to benefit from this massive technological evolution through the next decade.

For this analysis, we shall focus on QCOM’s EV automotive segment.

5G Capabilities In Cloud Connected Devices, Including The Automotives

Integration Of Arriver Into QCOM’s Existing Capabilities

Qualcomm

QCOM recently closed its acquisition of Arriver, which is expected to boost its capabilities in autonomous driving often offered in EVs. QCOM will be able to combine Arriver’s vision stack with its existing Snapdragon Ride SoC and Snapdragon Digital Chassis scalable cloud-connected platform. Combined with the entire digital cockpit experience, including the driver’s intelligent dashboard, front and rear seat infotainment, and other smart displays, QCOM will be able to further develop its premium Advanced Driver Assistance Systems (ADAS) customizable software for automotive OEMs.

QCOM Smartphone On Wheels With Cloud Connectivity

Seeking Alpha

In addition to the monetizable over-the-cloud upgrade capabilities, QCOM estimated it has a planned pipeline worth $13B in the automotive sector as its next potential revenue generator. Given the company’s expertise in 5G handsets, QCOM is also looking to integrate its technology into the automotive ecosystem of cloud-connected devices in the future.

To date, QCOM has already signed 26 global automakers, such as BMW, General Motors (GM), Hyundai, Ferrari, Volvo, Honda, and Renault as its partners. This is important since GM is the largest automaker in the world, with nearly 6.3M vehicle deliveries in 2021, which also aims to exclusively produce only EVs by 2035. GM will be launching the Ultra Cruise driving assistance feature on its luxury Cadillac sedan in 2023. Certain models from Volvo and Honda using its chips will also begin production in 2022 and potentially start their vehicle deliveries in 2023. As a result, we expect QCOM to report a massive jump in its automotive-related revenues from FY2023 onwards.

In addition, since the global electric vehicle industry is expected to grow fivefold from $163.01B in 2021 to $823.74B in 2030, at a CAGR of 18.2%, we expect more automakers to adopt full stack offerings, such as those offered by QCOM, as more consumers embrace autonomous EVs moving forward. Of course, it is assuming that QCOM can ensure enough supply, given the current global shortage gating its revenues. Nakul Duggal, SVP of automotive in Qualcomm, said:

As we become a key technology partner to the automotive industry, Arriver’s Driver Assistance assets will accelerate our efforts to deliver a leading, ADAS solution as part of our Snapdragon Digital Chassis platform. (Seeking Alpha)

The automotive industry is currently dominated by conventional combustion automotive chip makers, such as NXP Semiconductors (NXPI), Infineon Technologies (OTCQX:IFNNY), and Renesas Electronics (OTCPK:RNECF). However, these companies have been keeping up with technological advances and began to offer similar advanced capabilities from cutting-edge chip makers, including Nvidia (NVDA), Intel Corp’s Mobileye (INTC), and Huawei Technologies, in offering full-stack hardware and software offerings, similar to Tesla’s (TSLA) in house services.

As a result, we expect the future automotive chips market to be rather crowded with possible pricing and margin pressures moving forward. Nonetheless, the global semiconductor market is also huge, potentially doubling from $430B in 2021 to $808.5B in 2030, at a CAGR of 6.6%. As a result, the pond is growing large enough to accommodate multiple big fishes in the future, thereby ensuring QCOM’s future growth.

QCOM has also been expanding its offerings in other sectors, similar to its fellow chip designer, NVDA. It includes:

- Gaming – Snapdragon G3x Gen 1 Gaming Platform with Adreno™ GPU & G3x Handheld Gaming Developer Kit in partnership with Razer.

- Security – Qualcomm Mobile Security Suite offers machine learning malware protection.

- Datacenter/ Cloud computing – Qualcomm Cloud AI 100 with AI inference accelerators.

- Metaverse – Snapdragon Spaces XR Developer Platform and Snapdragon Spaces™ XR Developer Platform for the creation of immersive experiences for Augmented Reality. (In addition, QCOM is already powering Meta’s Virtual Reality headsets and Ray-Ban smart glasses, on top of Microsoft HoloLens and ByteDance’s device.)

- AI capabilities for national security, manufacturing, research, agriculture, etc.

Given how NVDA had already envisioned a $1T market opportunity while serving $100T industries through the next decade, QCOM’s $700B addressable market is probably right on the mark. In addition, given that QCOM is trading at $135.36 as of 11 April 2022 with a market cap of $152.5B, we reckon that the company is vastly undervalued and has a higher potential for growth than NVDA, at $219.17 with a market cap of $549.2B. Cristiano Amon, CEO of Qualcomm, said:

We are at the beginning of one of the largest opportunities in our history, with our addressable market expanding by more than seven times to approximately $700 billion in the next decade. Our one technology roadmap positions us as the partner of choice for both mobile and the connected intelligent edge. (Qualcomm)

QCOM Reported Excellent Sales In FQ1’22

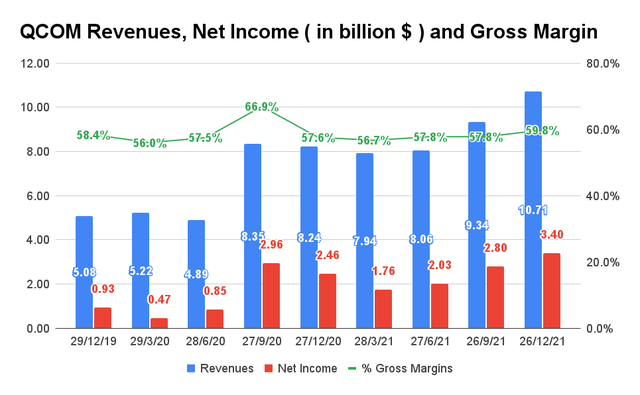

QCOM Revenue, Net Income, and Gross Margin

S&P Capital IQ

In the past five years, QCOM reported steady revenue growth at a CAGR of 8.88%. In the last twelve months alone, the company reported excellent revenue growth and expansion in gross margins. For FQ1’22, QCOM reported revenues of $10.71B and net income of $3.4B, with gross margins of 59.8%. It represented an excellent improvement of 14.6% QoQ/ 29.9% YoY, 21.4% QoQ/ 38.2% YoY, and 200 points QoQ/ 220 points YoY, respectively.

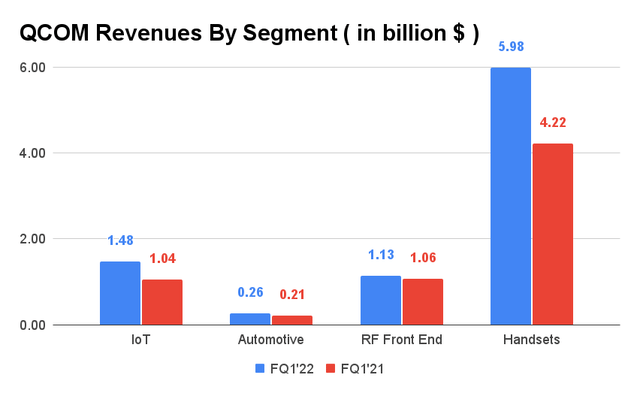

QCOM Revenue By Segment

S&P Capital IQ

For FQ1’22, QCOM reported its fastest-growing segment in handsets, with revenues of $5.98B, representing excellent growth of 27.6% QoQ and 41.76% YoY. The handset segment also accounted for the majority of its revenue at 55.8%. It is evident that the company offers cutting-edge 5G technology, given its partnership with multiple smartphones, tablets, and laptop makers, including Samsung, Asus, and Sony. Notably, Samsung, as the company adopted QCOM’s Snapdragon 888+ 5G Mobile Platform in 2021, despite also designing and manufacturing its own 5G processor chips then.

On the other hand, its automotive segment declined by $10M QoQ and only grew by $50M YoY in the same quarter. Despite the lackluster performance of its automotive segment, the company is aggressively investing in the segment’s future growth, through the Arriver acquisition, amongst other things. Therefore, given the ongoing partnerships with multiple automakers, QCOM’s automotive segment should perform better in the next twelve months.

So, Is QCOM Stock A Buy, Sell, or Hold?

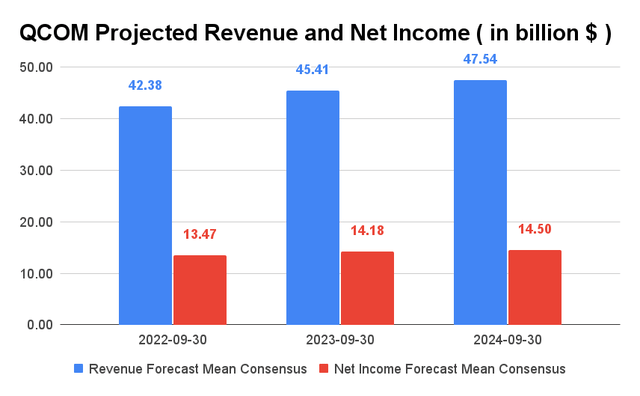

QCOM Projected Revenue and Net Income

S&P Capital IQ

QCOM is expected to grow its revenues at a CAGR of 5.91% over the next two years. For FY2022, consensus estimates that the company will report revenues of $42.38B and a net income of $13.47B, representing YoY growth of 26.2% and 47.8%, respectively. It is also evident that consensus projects QCOM to continuously improve its gross margins over time. In addition, in its last earnings call, the company guided FQ2’22 revenues in the range of $10.2B to $11B, representing an excellent increase of 2.7% QoQ and 38.5% YoY. As a result, QCOM will also likely beat consensus estimates as it has for the past three years (except for one occasion in FQ1’21).

QCOM is currently trading at an EV/NTM Revenue of 3.58x, lower than its 3Y mean of 4.72x. Consensus estimates also rate QCOM’s stock as attractive now given its undervaluation and massive potential in the automotive segment. In addition, its stock price is currently at $135.36 on 11 April 2022, down 30% from its 52 weeks high of $193.58. As a result, we encourage investors to add this winning stock during the dip.

Therefore, we rate QCOM stock as a Buy.

Be the first to comment