JHVEPhoto/iStock Editorial via Getty Images

Swiss flavors and fragrances manufacturer Givaudan (OTCPK:GVDBF), reported full year growth of 5.7% in 2021 driven by contribution from high-growth markets (such as Latin America and China) and acquired businesses. Going forward, under the company’s 2025 growth strategy Givaudan expects to achieve an average organic sales growth of 4%-5% during the 2021-2025 cycle.

Actively capitalizing on emerging trends in the ingredients space

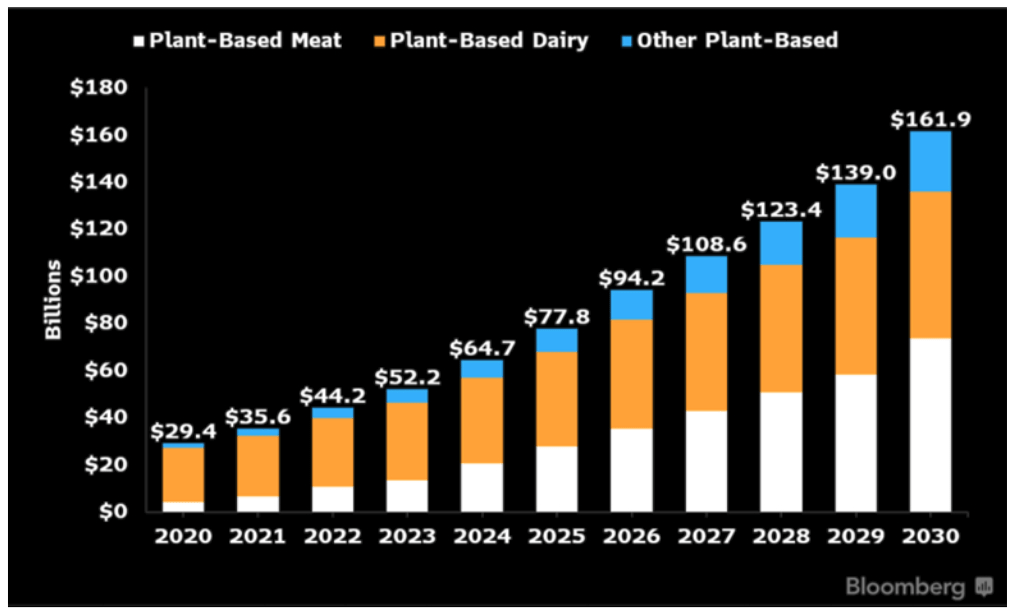

The plant-based protein market is on a solid growth path driven by growing consumer concerns about health, animal welfare and sustainability. Yet, with the sector accounting for a single-digit share of the global protein market there is ample room for growth. A report by Bloomberg Intelligence expects plant-based proteins to grow to 7.7% of the global protein market by 2030.

Food Business News

The challenge however is to recreate the appearance, taste, mouthfeel, cooking experience, and nutritional profile of plant-based protein products to resemble that of meat, a tremendous business opportunity for flavor houses like Givaudan. From an expanding global network of protein innovation centers to heavy R&D, Givaudan, like major rivals Symrise and IFF (IFF), is looking to capture a bigger bite of the market. Givaudan’s plant-protein sales grew by double digits in 2021, and Givaudan Taste & Wellbeing has launched several new products such as sensory tools and AI-based flavor formulation tools, but the company expects its new breakthrough patent-pending technology – PrimeLock+ – could potentially be the key to drive further sales going forward.

PrimeLock+ is based on encapsulation which is the use of tiny fragrance or flavor-laden capsules that disintegrate very gradually, thereby helping retain the fragrance or flavor for a far longer time whether it’s deodorants that slowly release scent throughout the day, or fabric softeners and detergents that release scents for several days. The technology is already a big driver of profitability for Givaudan, and the company is bringing this tried-and-tested technology to plant-based meats to improve their flavor and nutritional profile; for instance, plant-based meats typically lose a considerable amount of fat during cooking which affects their taste, texture, and nutrition because fat lost during cooking affects the juiciness and flavor of the product, while the addition of more fat to counter this fat loss would increase the product’s calorie count. PrimeLock+ locks in the fat longer thereby allowing for a reduction of up to 70% of the fat, and 30% of the calories. Research indicates salt is easier to taste in juicy meats than dry ones, suggesting salt addition could potentially be reduced too.

Strengthening its offerings and building its market-leading position through investments and acquisitions

In line with Givaudan’s 2025 growth strategy, Givaudan has been making a slew of acquisitions and investments as part of their achieving that goal.

In 2021, Givaudan invested in Next Beauty, a leading incubator for emerging brands looking to grow in China. Givaudan then acquired a 25% stake in B.Kolormakeup & Skincare (b.kolor) which the company said would expand their offerings in the consumer packaged goods and luxury segments. In early 2021, Givaudan acquired Myrissi, A French company with a patented AI technology that would enable Givaudan to translate fragrances into color patterns and images. In late 2021, Givaudan acquired U.S. fragrance-creation house Custom Essence which would expand Givaudan’s capabilities in natural perfumery in North America. Givaudan’s acquisition of DDW the Color House, announced in December 2021, would strengthen the company’s global leadership position in the natural colors business.

Tapping into opportunities in China

China is a key growth market for Givaudan, and the company has been making several moves in the market to win wallet share. Givaudan opened a new state-of-the-art production facility in China in 2020 and launched product lines tailored to suit the Chinese market, such as RitualEssenz™ (a Traditional Chinese Medicine based beauty product range launched by Givaudan Active Beauty).

Chinese consumers are increasingly moving away from leading prestige brands and seeking niche products and experiences, particularly those that are highly localized. To capitalize on this trend, Givaudan tied up with Alibaba’s Tmall to launch a laboratory aimed at anticipating, identifying and capturing opportunities for scent creation in China. The partnership gives Givaudan access to Tmall’s vast trove of consumer data to identify trends and create products to capitalize on opportunities arising from changing trends. The first of its kind collaboration has already produced a series of new fragrances inspired by the Chinese classic tale Journey to the West.

Financials

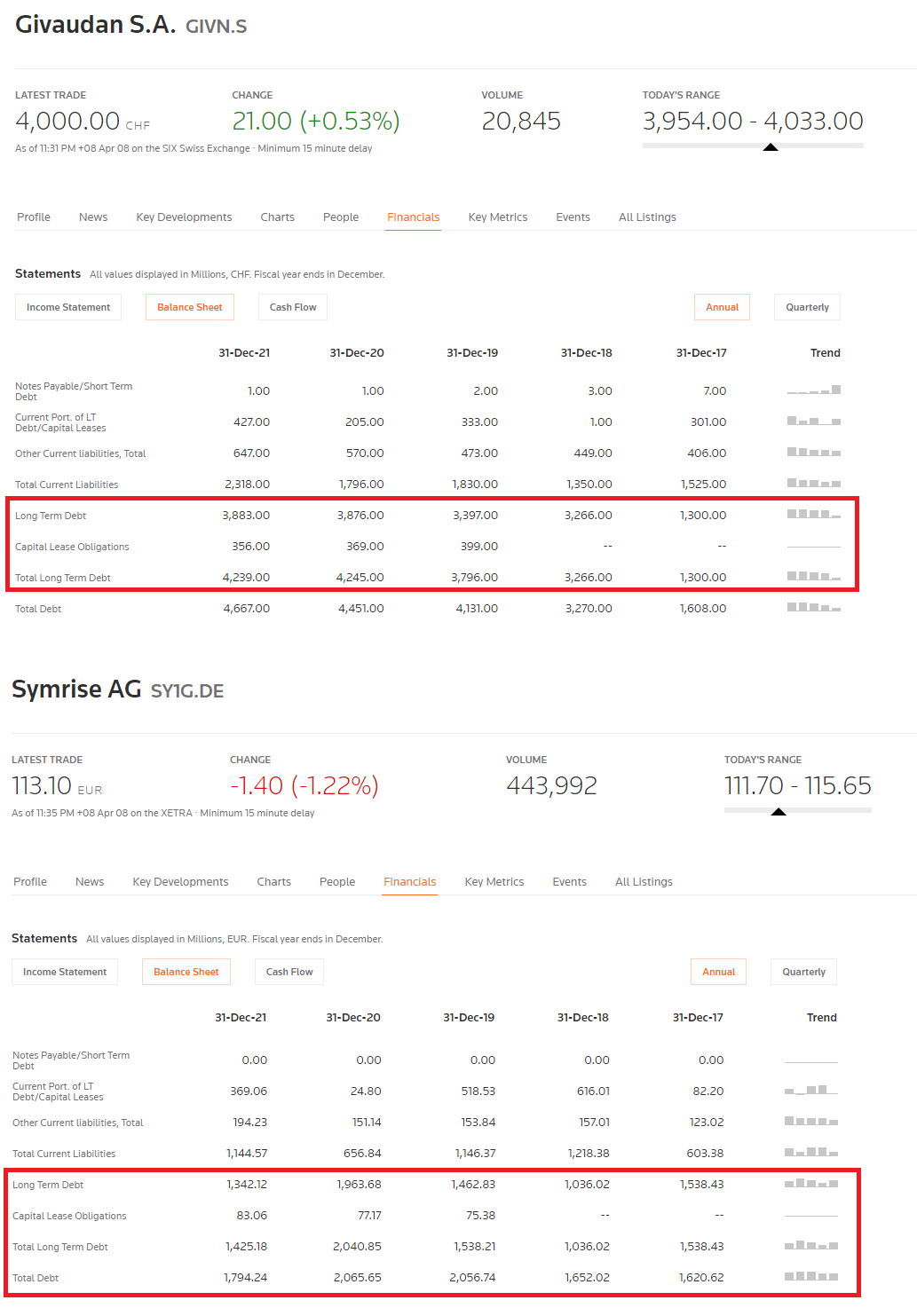

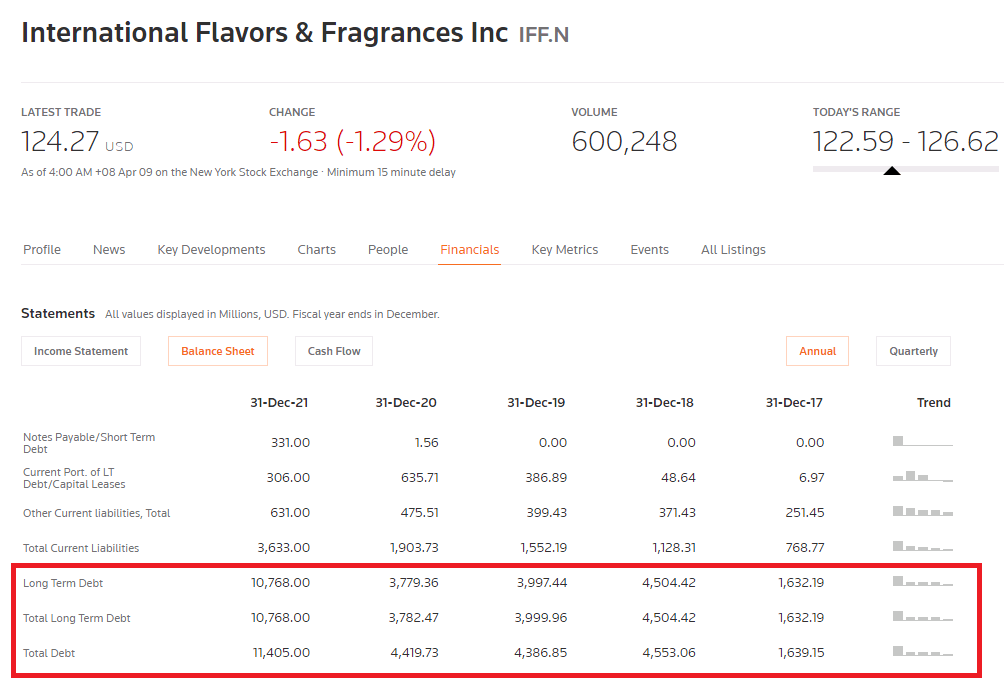

Givaudan’s aggressive investment and acquisitions, however, are leading to significantly higher debt, compared to Symrise (OTCPK:SYIEF). Givaudan’s debt has been on a consistent uptrend over the past few years (versus Symrise whose debt burden has had ups and downs but has largely remained within a certain range).

Reuters

IFF has also seen a considerable jump in debt after its merger with DuPont’s Nutrition & Biosciences business last year.

Reuters

Nevertheless, Givaudan is slightly worse than Symrise and in some areas against IFF too in terms of leverage and financial strength metrics.

|

As at December 2021 |

|||

|

Long term debt/equity |

107.9% |

44.7% |

51.1% |

|

Total debt/Total equity |

118.8% |

56.3% |

54.1% |

|

Interest coverage |

11.6x |

14.6x |

3.07x |

On the plus side, relative to rivals Symrise AG, and International Flavors & Fragrances, Givaudan fares consistently better across several profitability metrics.

|

FY 2021 |

|||

|

Gross margin % |

42.4% |

38.7% |

32% |

|

Pre-tax margin % |

14.4% |

13.5% |

3% |

|

Net margin % |

12.3% |

10.1% |

2.4% |

|

ROA % |

7.4% |

6.2% |

1.05% |

Risks

Rising competition could affect pricing power

Givaudan’s position as a leading player, its ownership of formulas that are used in their customers’ products, and high customer switching costs are advantages that have given the company considerable pricing power against customers over the past several years while their sheer size gives some bargaining power against suppliers, which explains the company’s ability to generate superior profits.

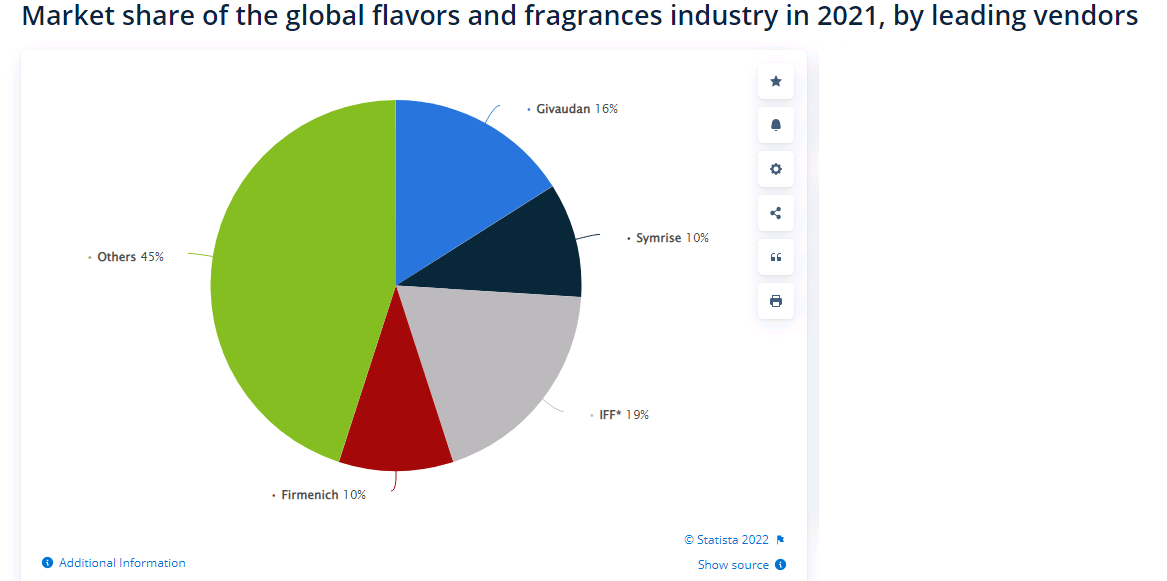

Going forward, however, it remains to be seen whether Givaudan can maintain its pricing power amid rising competition; IFF has stood out as a serial acquirer in the last few years, and its acquisition of flavors and natural ingredients company Frutarom in 2018 propelled IFF ahead of Symrise and Firmenich to number two behind Givaudan. A few years later in 2021, IFF’s merger with DuPont’s Nutrition & Biosciences business helped it overtake Givaudan to number one in the flavorings and nutrients industry with annual revenues of USD 11 billion (versus Givaudan’s CHF 6.6 billion which is approximately USD 7 billion) and a market share of 19% versus Givaudan’s 16%.

Statista

The IFF-DuPont merger creates operational advantages in terms of IFF’s food, flavor and fragrance expertise and DuPont’s manufacturing strengths which could help capture a bigger chunk of sales from big clients as well as potential cost savings from scale economies. More revenues could also help increase R&D budgets, and widen the company’s competitive advantage which could thereby help the company win new customers, increase market share, and improve pricing premiums. Givaudan’s R&F spending has outstripped rivals both in absolute and relative terms over the past few years, except last year when IFF’s R&D spending leapfrogged ahead to overtake Givaudan following its DuPont merger. Despite this, IFF’s R&D spend to total revenues was still lower than its historical average which means there is plenty of room for this to increase in the coming years. Prior to the completion of the merger, DuPont chairman Ed Breen had promised that the combined IFF-DuPoint entity would have “double the R&D of any other company in the industry”.

R&D spend

|

Givaudan (CHF) |

Symrise (EUR) |

IFF (USD) |

|

|

FY 2021 |

562 million |

220 million |

629 million |

|

FY 2020 |

536 million |

213 million |

356.8 million |

|

FY 2019 |

528 million |

213 million |

346 million |

R&D Spend/Total Revenues (%)

|

Givaudan |

Symrise |

IFF |

|

|

FY 2021 |

8.4% |

5.8% |

5.4% |

|

FY 2020 |

8.5% |

6% |

7.% |

|

FY 2019 |

8.5% |

6.3% |

6.7% |

Acquisitions could help Givaudan counter this threat (since it is faster than developing capabilities and technologies in-house, and IFF – busy with integrating DuPont – could be out of M&A for a while) however Givaudan’s relatively high debt burden could constrain the company’s ability to do so.

Summary

Givaudan is positioned to benefit from growth opportunities and is aiming to deliver revenue growth in the mid-single digits under its 2025 growth strategy. The company is no longer the market leader in the flavors and fragrances space but they continue to be ahead in terms of profitability. Patent-pending breakthrough technologies for growth markets like plant-protein can help drive top-line and bottom-line growth in the medium term; however, it remains to be seen whether they can maintain above-average profitability in the longer run amid rising competition.

Be the first to comment