JHVEPhoto/iStock Editorial via Getty Images

Thesis Summary

Intel Corporation (NASDAQ:INTC) has been beaten down by the market following poor results. The company is in the middle of transforming its business, and while some view this as a negative, I believe Intel stands to gain a lot from investing in foundries. The CHIPS Act and the looming Taiwan conflict will act as catalysts to lift Intel’s stock back up.

What’s Going On With Intel

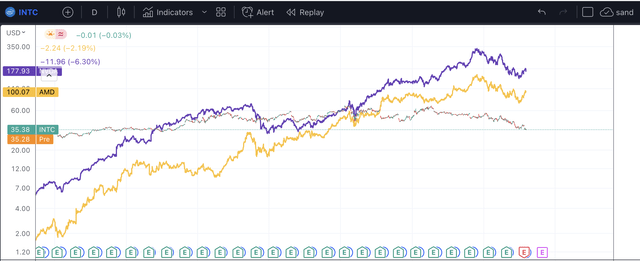

Intel has been performing poorly over the last few months, and over the past couple of years, it has delivered much more modest returns than competitors like Advanced Micro Devices (AMD) and NVIDIA Corporation (NVDA).

Intel, AMD, NVDA Price (TradingView)

Intel is trading today at the same price as in 2016 while its competitors have rallied significantly. One might have argued that AMD and NVIDIA were being fueled by the easy monetary policy, since they can be categorized as growth stocks. However, since the market peaked and the Fed started tightening, Intel has suffered just as much. The fact that it has a more reasonable valuation, established profitability and even pays out a dividend has not been enough to entice investors.

The last nail in the Intel coffin was the disappointing Q2 results that came out at the end of July. Revenues dropped by 19% YoY, and non-GAAP EPS came in at $0.29, well below the analyst consensus of $0.7.

Revenues for “Client Computing Group” and “Data Center and AI Group” went down double-digits, and this took an even bigger toll on operating income. With smaller production, unit costs increased, and to this, we can add supply chain challenges, higher input costs, and lower inventory demand from customers. And while revenues for “Network and Edge Group” were up by 11%, the operating margin contracted from 29% to 10%.

It is undeniable that Intel is suffering, and the current stock price reflects this. However, under the right circumstances and with the right investment, Intel can turn things around.

Why Now Is The Time To Buy

While Intel is clearly falling behind from a technological design perspective, the company is undergoing a transformation to become a chip foundry. This decision has been criticized in the past, but this time could indeed be different, thanks to the confluence of numerous catalysts.

First off, as I write this, President Biden is signing off on the CHIPS and Science Act. This bill will serve to funnel $52 billion into semiconductor investments. It also includes billions in tax credits to help incentivize investment in semiconductor infrastructure.

This is, of course, incredible news for Intel. In fact, Bank of America (BAC) analysts see Intel as the largest beneficiary of this deal. The company could be set to receive $10-15 billion worth of aid. On top of that, Intel is also benefiting from similar policies in the EU, where the company has rolled out an $88 billion investment plan. One example of this is the factory that Intel plans to build in Italy, worth around $5 billion.

My point here though is that this is only the beginning. Part of the reason behind the CHIPS legislation is to reduce dependence on Taiwan. It is clear following recent events that the country is in a complex situation and tensions have been on the rise. China has increased its military drills, following Pelosi’s visit, and tensions are higher than ever. The signs are all there, but as always, the market is taking its time to process the news.

The situation is not unlike what we saw happen in Ukraine. This was by no means a surprise war. In 2004, pro-Russian prime minister Viktor Yanukovych was ousted following the “Orange Revolution”, which confronted pro-Europeans with pro-Russians.

In 2014, protests sparked again and Crimea was annexed and Donbas declared independence. And in 2021, Zelenskyy went to Joe Biden to let Ukraine join NATO, a move that Putin had warned before would not be tolerated.

War finally broke out in 2022, and while many have suffered, there are numerous companies came out reinforced by this new market environment. Namely, companies involved in the production of energy and commodities, which Russia was a big exporter of.

Now, we could see a similar situation take hold, only this time the country is Taiwan, and the affected “commodity” will be semiconductors, which in today’s world have become as necessary as oil and gas.

Once again, the market is undermining just how likely this conflict is, and how much of an effect it would have on the world. In one fell swoop, the world could be cut off from 66% of its semiconductor supply.

At that point, the West will be forced to increase its chip manufacturing capabilities, and no doubt investment in the sector will be quickly increased. Intel is positioning itself well to meet the potential needs of the West, and while it still needs to roll out infrastructure and improve its technology, they are making the right moves.

Valuation

With Intel investing heavily in foundries, a clear trend is developing, which has been appreciated by analysts.

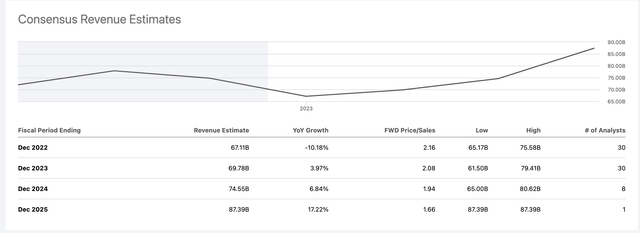

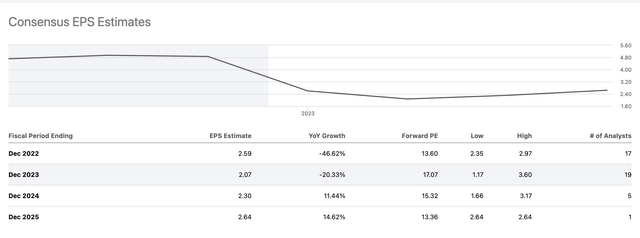

As we can see, analysts expect EPS to decline until 2023, and only then to slowly increase.

Revenue Estimates (Seeking Alpha)

However, revenues should begin to increase significantly as we move past 2023, with a potential $80 billion forecast for December 2024.

The great thing about investing in Intel at this point in time is that it allows investors to gain exposure to a company with growth potential that is entering a fast-growing market, while also owning one of the largest companies in the world, with a solid track record of profitability and a dividend.

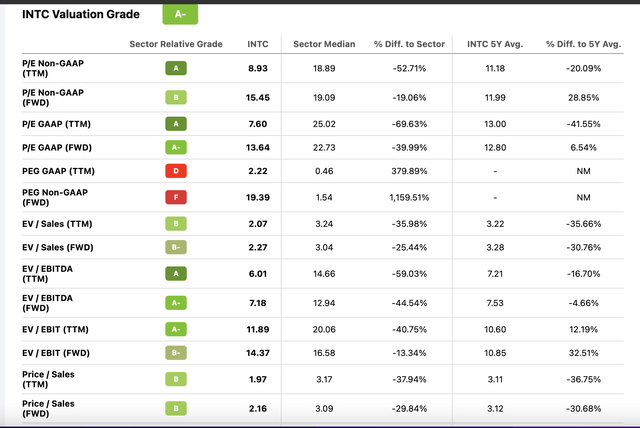

Intel Valuation (Seeking Alpha)

Intel is cheaply valued when compared to peers. By 2024, Intel’s implied P/S at this price would be 1.94. If we were to apply the sector median P/S of 3.17, that would imply an appreciation potential of 63%.

Risks

While I am bullish on Intel’s strategy, there are some potential risks. One problem, which was mentioned by BofA Analyst Vivek Arya, is the fact that Intel’s integrated design discourages engagement from its rivals like AMD and NVIDIA. In other words, these companies are not going to want to rely on Intel. I believe this might be why Intel is focusing its efforts more on Europe.

On top of that, Intel is lacking a lot of technology. For example, it lacks the capacity to build 40nm nodes, which are required for auto parts. And on top of that, Intel has to compete with other existing foundries in the west, which already have a head start on Intel, such as GLOBALFOUNDRIES (GFS).

However, given Intel’s size, and with some help from its friendly government, Intel could earn itself a spot in this market.

Takeaway

Intel is a beaten-down stock with a tough road ahead, but for those investors with some foresight, this could be a chance to get in on the ground floor of something big. Furthermore, Intel’s already profitable business offers a good margin of safety for investors.

Be the first to comment