onurdongel

The First Trust MLP and Energy Income Fund (NYSE:FEI), the “Fund”, is a non-diversified, closed-end management investment company.

According to the Investment Advisor, First Trust Advisors L.P.:

The Fund’s investment objective is to seek a high level of total return with an emphasis on current distributions paid to common shareholders. Under normal market conditions, the Fund invests at least 85% of its managed assets in equity and debt securities of publicly traded MLPs, MLP-related entities and other energy sector and energy utility companies that the Fund’s Sub-Advisor believes offer opportunities for growth and income.

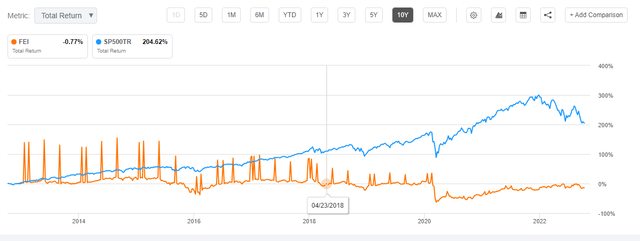

The date of inception of the Fund was November 27, 2012. Over the past ten years, FEI’s total return was -14.13%. That compares unfavorably to the S&P (SP500TR) return of +204.62%.

However, over the past year, FEI’s total return was 2.34 %, as compared to the loss in SP500TR of 16.58 %.

Holdings

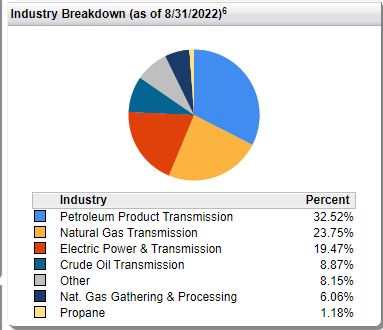

The industry breakdown of FEI’s holdings is detailed below. I note that the primary holdings are in Petroleum Product Transmission (32.52%) and Natural Gas Transmission is secondary (23.75%). Natural Gas Gathering and Processing is relatively small (6.06%).

First Trust Advisors L.P.

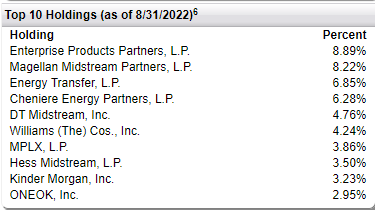

The Top 10 Holdings in the portfolio are listed below.

First Trust Advisors L.P.

Expenses and AUM

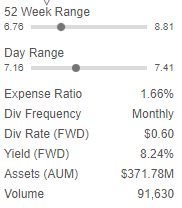

The expense ratio of the Fund is 1.66% and the assets under management is about $372 million.

Seeking Alpha

Sub-Advisor

The Fund’s subadvisor is Energy Income Partners, LLC., (“EIC”). EIC states on its website:

Founded in 2003, EIP manages an approximate $4.9 billion (as of June 30, 2022) portfolio of high quality, well-managed publicly traded energy infrastructure companies that own natural or legal monopolies operating under state and federal cost-of-service regulation or long-term contracts. EIP seeks a diversified portfolio of publicly listed non-cyclical power and pipeline utilities operating poles, wires, pipes and tanks that are the low-cost way of shipping the lowest cost energy, agnostic to asset class and index categorization.

This is how the partners at EIP manage their own capital. We care about total return, not benchmarks. We are very long-term investors. We care about multi-generational wealth transfer. We seek investors who understand our approach and are willing to invest alongside EIP partners.

EIC EIC

Analysis of Holdings

In an article, Kayne Anderson Energy Infrastructure Prospects And DIY Portfolio (Part 1), I provided a business summary of each of 7 of the above Top 10 Holdings directly from each of their own respective websites, i.e., EEP, MMP, ET, WMB, MLPX, LNG, and OKE. I followed that by an analysis of 12-month performances.

The Top 3 holdings of FEI are more petroleum-centric and only Chenier is NGL-centric. I found that:

In light of investor sentiment and preferences, I think that allocating energy infrastructure investment tilted toward natural gas liquids and away from petroleum would produce the best returns.

That finding was based on another article, Kayne Anderson Energy Infrastructure Prospects And DIY Portfolio (Part 2), in which I discuss the short- and longer-term market outlooks for natural gas liquids v, petroleum. I found that investments involving fossil fuels face a tough future, given investor sentiment and climate change imperatives. However, there are some bright areas, such as natural gas liquids and renewables.

However, EIP published an article, The Inflation Reduction Act is Really the Energy Expansion Act, to give context to the Energy Provisions in the Inflation Reduction Act (IRA) of 2022, signed by President Biden on August 16th. It concludes:

This act incorporates many of the prior ‘Build Back Better’ or BBB energy and climate provisions, but slightly less than half of those are simply extensions of incentives that have been in place for some time, mostly relating to renewables and energy efficiency investments. It’s the new provisions, however, that should be of interest to investors in energy in general and utilities and pipelines in particular.

FEI Principal Risk Factors

According to the Prospectus:

the Funds are subject to risks, including the fact that each Fund is a non-diversified closed-end management investment company. Because the Funds are concentrated in securities issued by MLPs, MLP-related entities, and other energy and utilities companies, they will be more susceptible to adverse economic or regulatory occurrences affecting those industries, including high interest costs, high leverage costs, the effects of economic slowdown, surplus capacity, increased competition, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors.

The Funds invests in securities of non-U.S. issuers which are subject to higher volatility than securities of U.S. issuers. Because the Funds invest in non-U.S. securities, you may lose money if the local currency of a non-U.S. market depreciates against the U.S. dollar.

The current and expected future economic environment incorporates recession fears. According to Chase CEO Jamie Dimon,

The US and global economy is facing a ‘very, very serious’ mix of headwinds that is likely to cause a recession by the middle of next year.” The benchmark S&P 500, Dimon said, could fall by “another easy 20%”.

On interest rates, an article on Fox Business news reported:

The Fed has already raised interest rates five times this year as it tries to wrestle inflation that is still running near a 40-year high back to its 2% target goal. In its latest move, the Fed approved a third consecutive 75-basis-point rate hike, lifting the federal funds rate to a range of 3% to 3.25% – near restrictive levels. It also indicated that more super-sized increases are likely in the coming months.

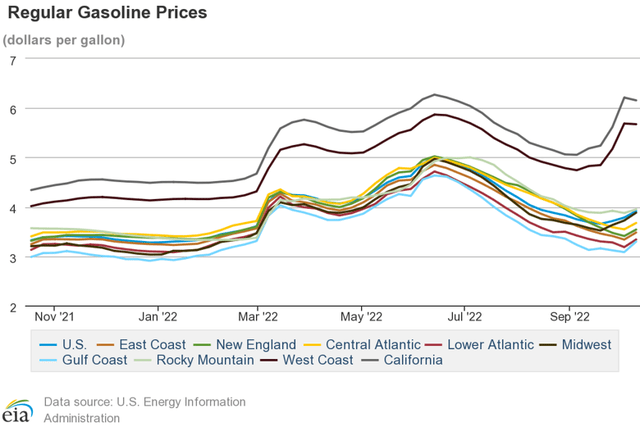

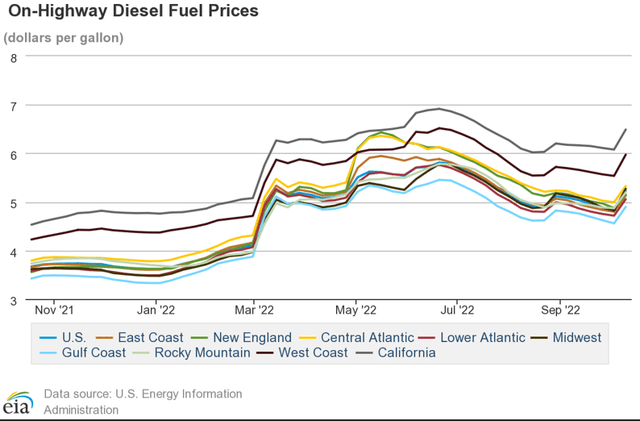

On oil product prices, retail gasoline and diesel prices remain high…

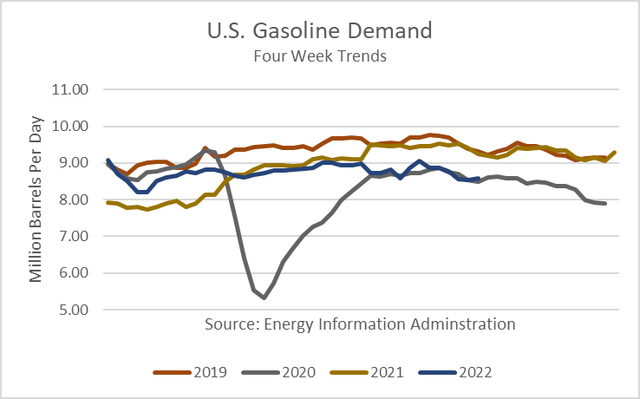

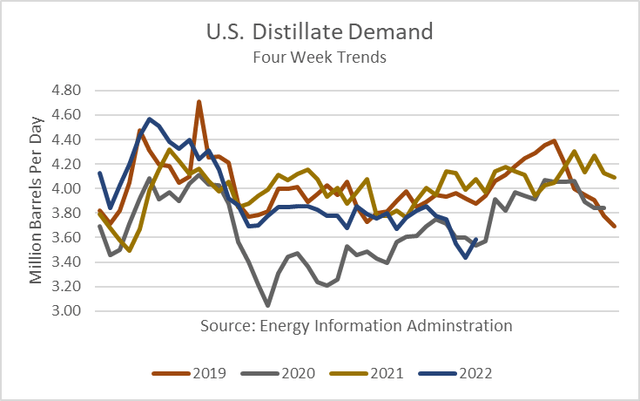

And gasoline and distillate fuel demand (including diesel) remain seasonally low.

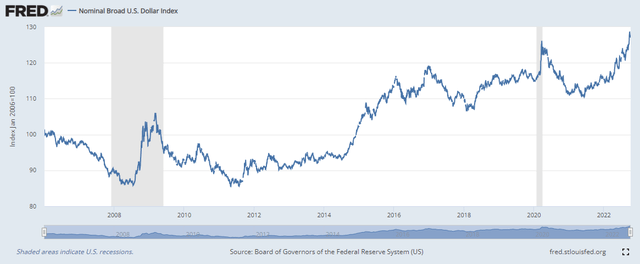

And based on data from the Federal Reserve database (“FRED”), the dollar is at its highest point in more than a decade.

Conclusions

The long-term return of an investment has been dismal, a loss of 14% over the past ten years. The most recent one-year return has lagged other energy investments substantially.

The holdings of FEI are petroleum-centric, and the outlook for petroleum expansion pales that of natural gas and natural gas liquids. Moreover, the principal risks of FEI are economic recession, high interest rates, and a strong dollar. Those risks are being experienced and are likely to grow.

For these reasons, I would not hold an investment in FEI. It may even be a good “short” for investors who will take such positions.

Be the first to comment