akinbostanci/E+ via Getty Images

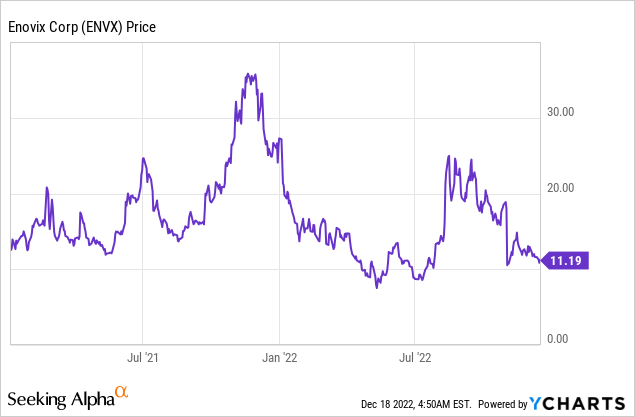

The pullback of Enovix’s (NASDAQ:ENVX) common shares has created the entry point I needed to start a position in the next-generation battery manufacturer. The catalyst for the downside movement was fiscal 2022 third quarter results that saw revenue come in below consensus estimates as most of the batteries shipped during the quarter were samples. This is a temporary blimp; the company is still so early in its commercialization journey that it’s hard to lean on analyst estimates as reflections of true commercial progress. Bulls have a number of factors to consider, not least T.J. Rodgers being appointed Executive Chairman. The role will see the founder and former CEO of Cypress Semiconductor take on a more expansive role in Enovix.

Rodgers will oversee strategic decisions and will be more active in quarterly earnings calls. The appointment follows fiscal 2022 third quarter earnings that saw common shares fall markedly on the back of revised revenue expectations for 2023. The downward revision was done in somewhat of a confusing manner that implied that there were problems with the traction of their 3D silicon batteries. Fab-1’s 2023 manufacturing ramp is set to be delayed due to shipping issues stemming from China’s now abandoned zero-COVID policy. Essentially, the company could not ship Fab-1 equipment on time due to their Chinese suppliers no longer receiving guests and also being prevented from travelling as a result of COVID.

T.J. Rodgers And The Enphase Miracle

Whilst it’s not entirely prudent to piggyback on investments being made by accomplished investors, a position by T.J. Rodgers warrants a look due to his early involvement in Enphase (ENPH). The microinverter manufacturer has come to represent the immense opportunity posed by the shift to clean energy. Its common shares are up 1,000% over the last three years and by an even more material amount from when Rodgers invested back in 2017. Enphase has now become the golden boy of clean energy ETFs and climate economy-orientated investors everywhere. Rodgers holds 21.4 million common shares of Enovix and most recently bought $3.5 million worth of shares when the stock dropped into the $8.85 range.

To be clear here, I don’t expect Enovix to all of a sudden put out Enphase-like returns over the next few years. Firstly, the valuation of Enovix is a lot higher than when Rodgers first invested in Enphase and the challenges and market opportunities faced by both companies are clearly not the same. What Rodgers brings will be a clearer vision and unrivalled operational experience that will enable Enovix to better navigate the competitive landscape for its next-generation battery technology. Enphase has grown to become one of the largest clean energy companies in the world and Rodgers would have helped shape the operational decisions that got the company to this state. Hence, my position in Enovix has partially been influenced by the executive depth he will bring from his expanded role as Executive Chairman. Indeed, he is already looking to improve transparency and is set to give a special presentation early next year to update shareholders on progress.

The Future Of Electronics And Electric Vehicles

There is nothing wrong with Fab-1 and its end customers are currently underway with the design of products that critically depend on Enovix’s batteries to facilitate their full potential. The safer and higher-density batteries are set to power the next generation of consumer technology with OEMs from smartphones and laptops to wearables all having partnered with Enovix. The company most recently signed a non-binding MOU with IPG Photonics (IPGP) to optimise its battery cell manufacturing processes with laser tooling. It also entered into a partnership with an undisclosed company described as one of the world’s largest consumer electronics firms. The partnership builds on a qualification program and existing purchases of Fab-1 battery cells by the firm for a smartwatch program.

There is a risk that I’m too early with my position and that buying an essentially pre-revenue company trading at a $1.76 billion valuation retrospectively turns out to not be prudent. This risk is heightened with the diverse and intensely competitive landscape for next-generation battery technology. Sila Nanotechnologies, Group14, and Amprius Technologies (AMPX) are all vying for market share whilst all claiming to have the highest-performing batteries. This early landscape is ripe for volatility and Enovix stands to be able to better meander through the uncertainty ahead with Rodgers taking on a more expansive role. There could also be a further pullback if there are more operational delays beyond the control of the company.

Enovix will sit in the climate economy section of my portfolio with the company increasingly engaging with EV manufacturers. During the third quarter, their batteries were shipped for testing to a Tier 1 EV battery supplier and a top 10 global auto OEM. All this will come on the back of the Gen2 Autoline which has 10x faster throughput relative to its Gen1 Freemont facility. Enovix ended the quarter with $1.1 billion in engaged opportunities, defined as customers that have determined that its battery is applicable to their product and have started evaluating it with their technology. Active Designs and Design Wins ended the quarter at $423 million with Enovix stating it has the near-term liquidity to fully develop its Gen2 line to see this business through in the years ahead. This was at $349 million against cash burn from operations that came in at $20.6 million during the third quarter. I am long with a manageable position that will be expanded as quarters of operational progress roll in.

Be the first to comment