Brycia James

We are surprised to see Williams-Sonoma (NYSE:WSM) trading at a very cheap valuation, with its shares coming under significant pressure despite delivering decent results. There are genuine reasons for concern, such as the fact that the pandemic pulled-in a lot of demand from the future, a trend that could be starting to reverse. There are a lot of investors also worried about a potentially weaker consumer in this difficult environment of high inflation and rising interest rates. Williams-Sonoma does not appear immune to this, and has in fact pulled its fiscal year 2024 guidance, causing shares to drop significantly. The reasons given for not being able to reiterate fiscal year 2024 guidance or update it was due to increased macro uncertainty. The company said that guidance for fiscal year 2023 and beyond will be shared at their next call.

One thing the company did say is that they remain confident in the long-term fundamentals of the business, and their ability to take market share, as well as the strength of the balance sheet. We also found comments from CEO Laura Alber during the earnings call reassuring, where she explained why they were no longer providing fiscal year 2024 guidance by saying:

It’s not that we’re not confident in our business, it’s that it’s really hard to tell what’s going to happen in the macro. If that was even just going to be as it is today, we would predict it. But it’s changing so rapidly.

There was also a very interesting response from CFO Jeff Howie to a question from an analyst regarding headwinds. He lists several headwinds the company is currently facing, but sounds surprisingly more optimistic about the second half of 2023 and 2024:

I think all of them are heavy pressures on our gross margin, as we’ve been communicating. There are the product costs, which have been with us all year as part of inflation. There’s the ocean cost, which, although we see ocean costs overall coming down, we still have the cost in our balance sheet and need to sell through that higher cost inventory. Our shipping costs domestically have been high as we talked about because of out of market and shipping multiple times a customer. As I said in the answer to the first question, we still have quite a bit of work to do to get our inventory in the right composition as well as the right location to properly service our customer and work on this backlog we have. So, we think it will be — continue to be a headwind for Q4 and into the first half of ‘23.

The thing I’m really optimistic about is when we turn the corner and we start to look at the back half of ’23 and into ’24, it’s going to be a tremendous tailwind. And I’m optimistic that we can really sustain our margins when I think about all the cost pressures we’ve been under and still delivered the results we’re delivering today.

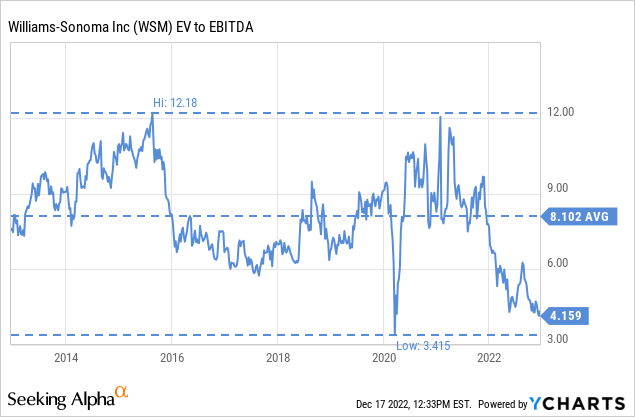

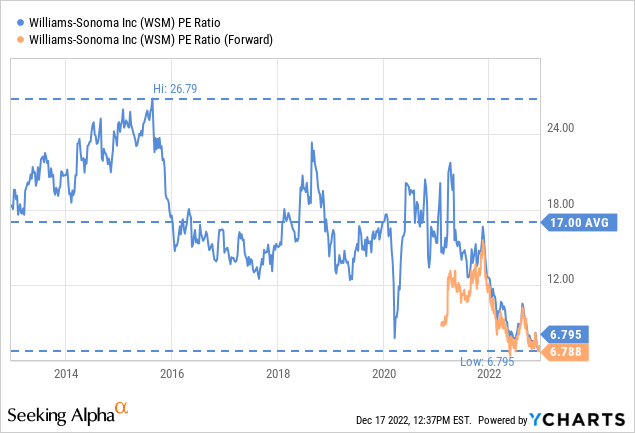

We therefore believe investors might have over-reacted to the news, with shares now trading with a forward p/e of only ~6.7x. We believe this is incredibly cheap for a company that is still growing at a very rapid pace, and that has mostly become an e-commerce business, as most of its revenues are now from this channel.

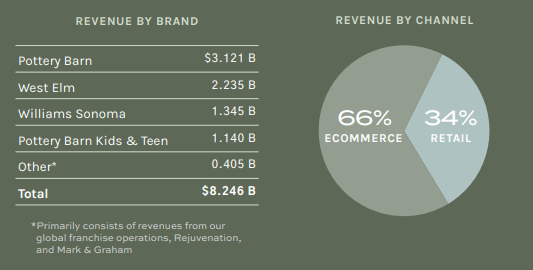

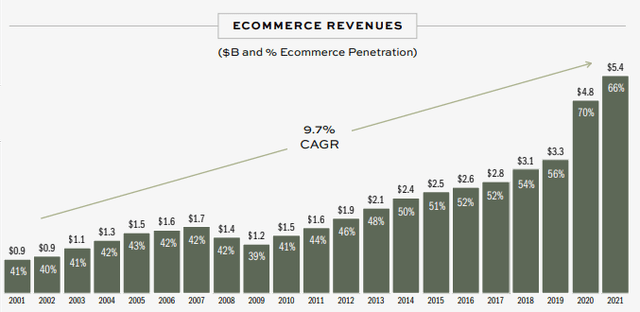

As a reminder, Williams-Sonoma sells home furnishings and products for the kitchen and home. It operates through a number of brands, including Williams-Sonoma, Pottery Barn, and West Elm, and has a significant e-commerce presence in addition to its brick-and-mortar stores. Approximately two thirds of its business come now from e-commerce.

Williams-Sonoma Investor Presentation

Williams-Sonoma’s main competitive advantage is its strong brand and reputation for quality products. The company has built a loyal customer base over the years by consistently offering high-quality products and excellent customer service.

In addition to being a quality retailer, we see four key reasons to consider investing in Williams-Sonoma shares.

1. Strong financial performance

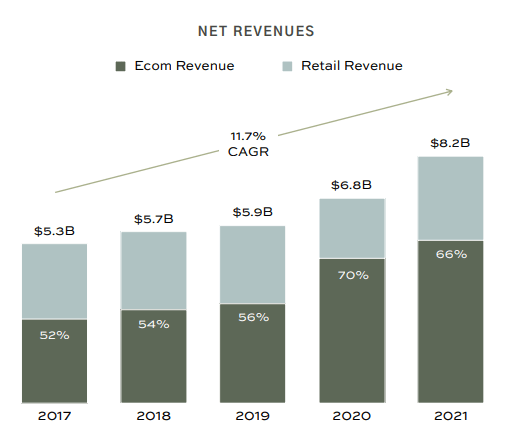

Williams-Sonoma has a history of strong financial performance, with a track record of high revenue and EPS growth. Its net revenues have been increasing at a CAGR of 11.7% the last few years. The company now has annual revenues exceeding $8 billion, when in 2017 they were only a little over $5 billion.

Williams-Sonoma Investor Presentation

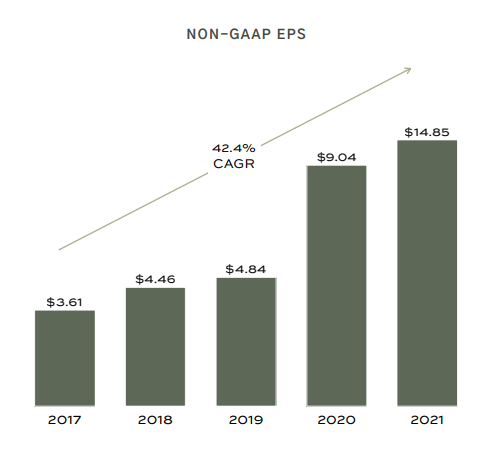

The growing revenues together with operating leverage and increased efficiency have resulted in very fast non-GAAP EPS growth of ~42% CAGR. Shares are currently trading as if investors were worried that earnings would regress to 2019 levels, but so far, we see little evidence of that, and instead we believe that in the next few years the company will deliver new record earnings.

Williams-Sonoma Investor Presentation

2. Strong brand and customer loyalty

Williams-Sonoma has a well-established and highly regarded brand, which has helped it to build a loyal customer base. This helps drive repeat business and encourages customers to try new products. In addition, Williams-Sonoma has a huge loyalty program, and its loyalty members spend 3-4x more than non-members. Its cross-brand loyalty and credit card members spend even more, roughly 9x more than single brand non-members.

Younger generations continue to represent an increasing share of the company’s revenue and customer base, fueled by strong growth among Gen Z and Millennials.

3. Attractive valuation

Williams-Sonoma’s shares are currently trading at a very attractive valuation compared to its historical average. For example, the EV/EBITDA is at only ~4.1x, this is nearly half that of the company’s ten-year average.

The price/earnings ratio, including the forward p/e, is considerably below the ten-year average as well.

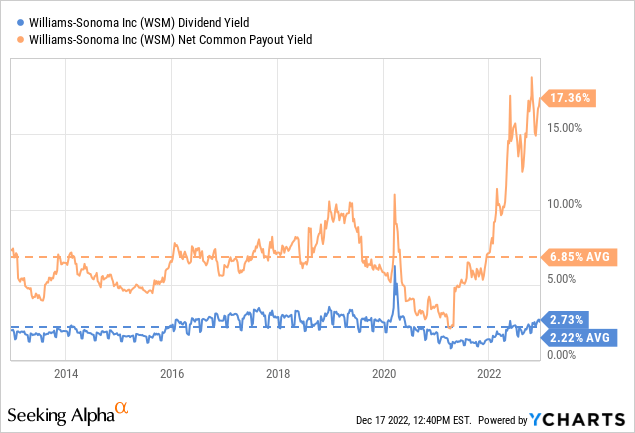

Finally, the dividend yield, and the net common payout yield, are both above their historical average. The net common payout yield is particularly high, as the company has been doing significant buybacks recently. All these indicators point in the same direction, that the shares are currently significantly undervalued.

4. Growing e-commerce business

Williams-Sonoma has a large and growing e-commerce business, which has been a major driver of its success in recent years. We don’t think Williams-Sonoma gets enough credit for being such an important e-commerce business, and it certainly does not get the valuation multiple that pure play e-commerce retailers get on average. With roughly two thirds of revenues coming from the e-commerce channel Williams-Sonoma can be considered a true online retailer, or at least a real omni-channel business. E-commerce revenues have been growing with a CAGR of 9.7% for a very long time. We cannot think of any other growing online retailer trading at such a cheap valuation.

Williams-Sonoma Investor Presentation

Risks

In the short to medium term the biggest risk we see is that of economic uncertainty and a potential recession in 2023. We believe that even considering a mild recession next year, shares are cheap with a p/e of only ~6.7x. Of course, if there is a recession or the economy worsens significantly earnings are likely to take a hit, but we believe they would eventually recover and post new records. In the long-term, one big concern we have is if online retailers like Amazon (AMZN) make a stronger push into Williams-Sonoma’s categories. While the companies are already competing, so far Williams-Sonoma has been able to protect its niche relatively well.

Conclusion

We shared the four key reasons why we believe Williams-Sonoma is an investment worth considering, and why we believe the market is over-reacting to guidance for fiscal year 2024 being pulled. The company is seeing some headwinds, and there is the risk of a recession next year, but shares are very attractively priced. We therefore believe long-term investors should give serious consideration to Williams-Sonoma shares at current prices. The company certainly appears to agree, as it has been buying back shares at an impressive rate.

Be the first to comment