Khanchit Khirisutchalual/iStock via Getty Images

Investment Thesis

ServiceNow (NYSE:NYSE:NOW) is an IT service management and workflow productivity company. It’s a business that nearly always discloses 98% to 99% customer renewal rates.

ServiceNow is a strong cash flow generating business that’s well positioned to withstand a recession, that’s the thesis that I noted in my previous bullish article on ServiceNow. And since then, in the past 2 months, it appears that the stock has been an underperformer.

Author’s work

Typically, I wouldn’t call this underperformance. However, given that “junkier” tech stocks have soared in the past 2 months, I believe that’s better to be upfront with this dynamic.

Nevertheless, I argue that the bull case here is found in its free cash flow line. That being said, I temper my bullishness given that the macro backdrop has weighed on ServiceNow’s near-term prospects.

Hence, weighing up all different sides, I remain tepidly bullish on this name.

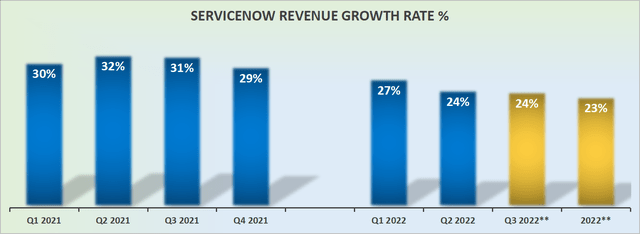

Revenue Growth Rates Trend Lower

During the past few years, being a global company had huge advantages. Companies attained scale and could continue to seek growth at any cost. As we’ll soon discuss, ServiceNow didn’t fit into that bucket.

After all, ServiceNow has consistently reported robust non-GAAP profitability. But I get ahead of myself, as we’ll soon discuss its profitability.

The theme for large multinational tech companies was to seek exposure far and wide. Today, multinationals are struggling on two fronts. One temporary and one more lasting.

The temporary impact that the market is looking beyond is the currency headwinds. This is plaguing the companies’ revenue growth rates by approximately 300 to 600 basis, and ServiceNow is no exception.

The second headwind that’s both more serious and uncertain is about Europe. Companies such as ServiceNow are seeing Europe as creating headwinds in their businesses.

Along these lines, this is what ServiceNow’s CFO Gina Mastantuono said during ServiceNow’s recent earnings call,

[…] we do expect the elongated deal cycles that we experienced in the last couple of weeks of June to persist for the remainder of the year.

Then, these comments were echoed at a conference earlier in September,

[…] what we saw was, deals getting higher level of scrutiny and more approvals that just elongated that sales cycle.

However, in both cases, Mastantuono moved quickly to reassure the investment community that she is “confident” that ServiceNow would meet its guidance.

ServiceNow’s Near-Term Prospects

ServiceNow believes that as more companies are forced to be frugal with their budgets, given that for many enterprises there’s been a proliferation of workflow platforms, the industry is now seeking platform consolation.

The drive is not only to drive efficiencies throughout the workplace but also to reduce companies’ overall expenses.

For their part, ServiceNow makes the case that even though the sales cycle has elongated, it will not have difficulty in reaching its revenue targets.

However, the big focus here from the investment community is that ServiceNow’s current remaining performance obligations (cRPO) dipped to 21% y/y, down from 29% y/y back in Q1 2022.

In practical terms, ServiceNow’s cRPO is a leading indicator of the trajectory that its revenue growth rates will be recognized over time.

Ideally, investors want to see software companies’ cRPO figures higher than their revenue growth rates, or at least match the revenue growth rates. What investors don’t like to see is a dip lower between cRPO figures and revenue growth rates.

Obviously, management would make the argument that investors shouldn’t be short sighted and overly focused on one quarter’s results.

On the other hand, keep in mind that any investor that invested in this stock in the past 2 years is unlikely to be holding onto gains. Hence, these dynamics have been plaguing its share price for a while now, this is not just one quarter’s performance.

Next, we’ll turn our attention to discussing its profitability profile.

Profitability Profile in Focus

What follows are ServiceNow’s GAAP operating margins:

- Q2 2021: 4%

- Q3 2021: 5%

- Q4 2021: 2%

- Q1 2022: 5%

- Q2 2022: 1%

What you see is a business that is barely reporting GAAP profitability. And for a while investors didn’t care that a lot of software companies had excessive stock-based compensation, but in the past several months, investors have increasingly questioned whether some of these businesses are not as profitable as we were previously considering.

Ultimately, the whole point of paying up for these highly recurring business models is that they should see significant “clean” free cash flows returning to shareholders.

Furthermore, the full-year free cash flow guidance at the end of Q1 2022 was for a 31% free cash flow margin, while recent headwinds have dampened these prospects so that ServiceNow only guides for a 30% free cash flow for the year as a whole.

However, given that Q1 2022 reported 45% free cash flow margins, while Q2 reported just 16%, investors are now skeptical that in 2023 ServiceNow’s free cash flow margins may not bounce back higher, but could actually dip below 30%.

Given that the business has more than 60% of the free cash flow for H1 2022 made up of stock-based compensation, investors are rightly asking “what’s left for me?”

NOW Stock Valuation — 11x Next Year’s Revenues

Back in 2020, a business that could be relied upon to grow at 20% CAGR investors would easily be willing to 10x forward sales. The problem for ServiceNow is that we are not in 2020. Indeed, we are getting close to 2023.

And 2023 will not only be a more challenging environment for companies with exposure to Europe, which is likely to be in the throngs of a significant recession, not to mention that the comparison with H1 2022 will be onerous, to say the least.

Then, to further complicate the investment thesis, investors are not asked to pay 10x this year’s revenues, but 11x next year’s revenues.

When many software companies are being priced at a very similar multiple to ServiceNow but can be expected to grow at a faster rate, it’s difficult to get too excited about ServiceNow.

Or perhaps investors can be willing to pay a slightly higher multiple, but seek out cybersecurity companies that are not only likely to be even more defensible plays, but also expected to consistently grow at a faster rate than ServiceNow.

The Bottom Line

The tide is slowly turning. The winners of the previous bull market are rarely the winners of the next bull market.

There’s a lot to like about ServiceNow, for instance, the fact that it’s a blue chip enterprise, with significant global reach.

The problem here is that the multiple hasn’t come down sufficiently to afford new investors into the stock a large margin of safety.

On yet the other hand, the business is clearly reporting strong free cash flows. Even if there’s a temporary dip in its free cash flow profile, investors can feel reassured that ServiceNow is very well set up to have lasting free cash flows.

Consequently, when all the positives and negatives are weighed up, I remain slightly bullish on this name.

Be the first to comment