NataliaDeriabina/iStock via Getty Images

This article was coproduced with Mark Roussin.

Last week we got the May inflation report that showed year-over-year growth of 8.6%, which was the highest growth seen in over 40 years.

On top of that, we also got a preliminary June consumer sentiment report showing a reading of 50, which also was the lowest level we’ve seen for over 40 years.

Consumer debt is rising fast while the personal savings rates in the US collapse, creating what could be the start of a possible recession.

As such, the Federal Reserve has decided to wake up and finally attempt to fight back against inflation. Fed Chair Jerome Powell announced a 75bps increase to the Fed Funds rate to help curb inflation.

He also described the plan for the remainder of the year, which is to stay aggressive with rate hikes in order to get inflation numbers back in the 2% range.

After announcing the 75bps rate hike, the markets quickly cheered as we saw a relief rally, but you would be kidding yourself if you did not think more pain is ahead. The next few CPI readings will be crucial for the markets and before we see any dip in inflation, expect continued volatility in the markets.

High volatility in the markets does not have to be a time to be fearful, instead, it should be a time to accumulate high-quality companies at discounted valuations.

There’s still certainly money to be made in the markets. That, at least, hasn’t changed.

Let’s just focus on safe-haven ways of getting it…

#1 – AvalonBay Communities (AVB)

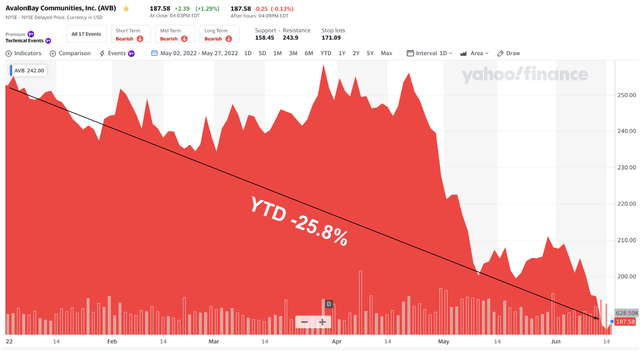

Yahoo Finance

The first Safe Haven REIT we will look at is AvalonBay, which is the largest apartment REIT on the market today. The cost of homeownership has been rising over the past few years as we have seen price appreciation unlike any time in recent history. In addition to rising prices, we have seen interest rates on a 30-year mortgage go from below 3% to now over 6% in a matter of months.

As such, many Americans are finding themselves priced out of homeownership, thus leaving them with the only other logical option which is to rent (that is unless you have the option to stay in your parents basement).

Landlords know this information. As a result, we have seen the cost of renting increase as well. The difference between the cost of owning a home and renting has never been more disconnected.

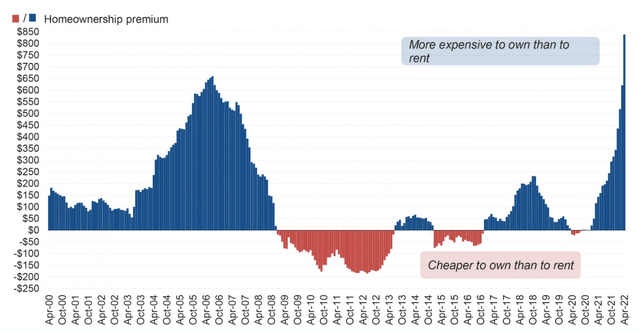

Take a look at this graph by John Burns Real Estate showing the premium one is paying to own a home right now compared to choosing to rent.

iREIT on Alpha

The cost of buying a home right now is going to cost you roughly $850 more per month than it would be to rent, which directly benefits rental landlords.

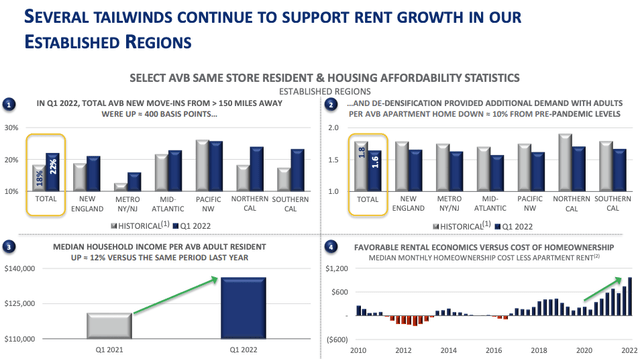

AvalonBay happens to be one of the largest rental landlords having a portfolio that consists of 84,525 apartment homes. During Q1, AVB reported FFO growth of 15.9% behind same-store revenue growth of 10%.

The company expects the trend to continue as management sees several tailwinds for the business, including the shift that I described above.

AVB is seeing a stronger tenant, in terms of income per adult resident, which is up 12% year over year. Based on the work from home phenomenon, AVB has seen a much larger percentage of residents move further than 150 miles from major metropolitan areas.

AVB Investor Relations

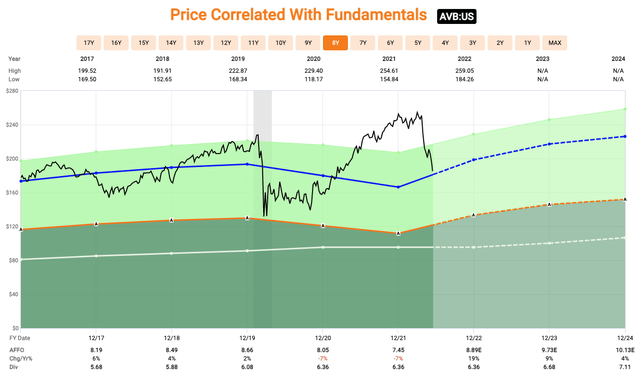

Shares of AVB are currently down over 25% on the year and trade at forward P/AFFO of 21.1x. Over the past five years, shares of AVB have traded at an average P/AFFO multiple of 22.3x, suggesting that shares of AVB are slightly undervalued.

This certainly was not the case a few months ago when AVB shares were trading at an AFFO multiple over 30x, which we suggested to iREIT members was way too high.

Now however, we believe AVB shares have some nice cash flow upside from the rental tailwinds we see lasting for the foreseeable future, thus we have a “buy” rating now. During the remainder of the year when volatility is expected to remain, you can take solace in owning shares of AVB due to their fortress A- rated Balance Sheet in addition to a dividend that yields 3.4%.

Fast Graphs

#2 – Public Storage (PSA)

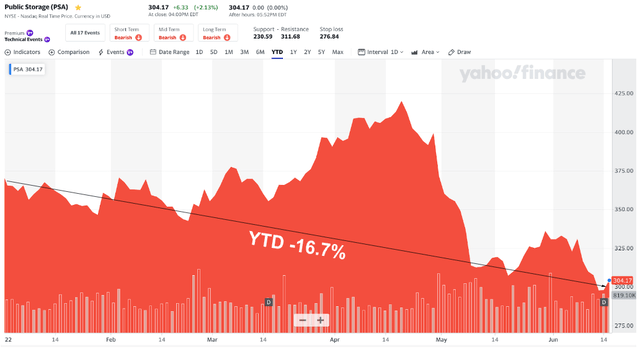

Yahoo Finance

Next we will move over to the self-storage sector.

Public Storage is the largest self-storage REIT on the market today with a market cap north of $53 billion. Public Storage is larger than the next four largest self-storage REITs combined.

I’m sure you have driven down the road before and noticed multiple PSA self-storage facilities. In fact, I would imagine many of you have probably used a PSA facility at some point in the past.

Owning a stock like PSA can go along with the same narrative we were discussing when it came to AVB. The cost of owning a home is getting out of reach for many potential homebuyers, but here in America we’re never short on stuff. If we do not have a home, or even if we have a home, we need somewhere to store that stuff.

You know this is true and I know this is true. It’s the exact reason why a company like Public Storage has been able to thrive and grow over many years, 50 years to be exact.

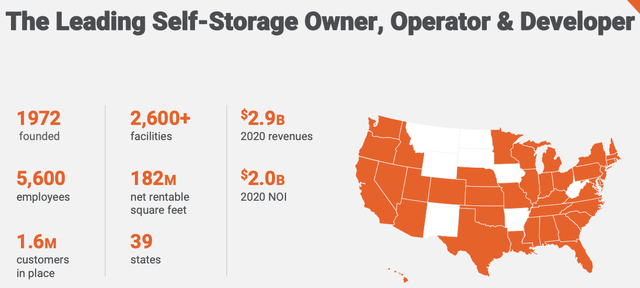

Public Storage has a portfolio that consists of over 2,600 facilities made up of 182 million square feet of rentable space. For those of you that have not seen a Public Storage facility, it may be due to the fact you live in one of the 11 states where they do not have any facilities.

PSA Investor Relations

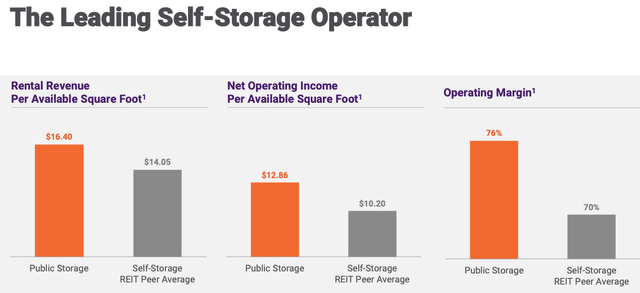

Over the years, management has been able to effectively and efficiently scale the business, which has allowed them to expand and separate themselves from the competition in the sector. Looking at the slide below, you can see how PSA outperforms in a variety of different areas.

PSA Investor Relations

Regardless of the economic backdrop, a company like Public Storage can perform well, but in times of economic slowdown, including a recession, Public Storage can thrive.

Not only do renters use self-storage facilities already, but when consumers fall on economic hardship, you could see homeowners looking to downsize or sell their home all together to cash in on their equity and choose to rent. All this leads back to Public Storage, as all that “stuff” needs somewhere to collect dust.

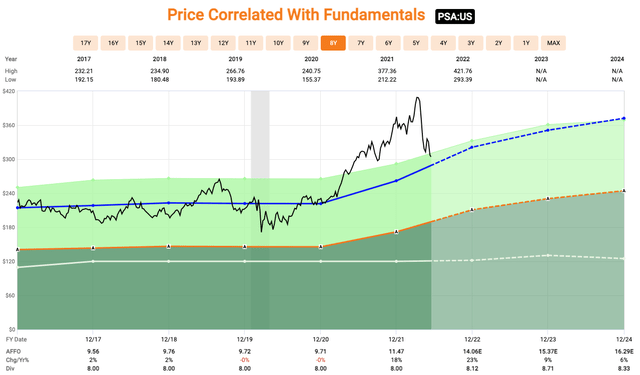

Shares of Public Storage currently trade at a forward P/AFFO multiple of 21.6x. Over the past five years, shares of PSA have traded at an average P/AFFO multiple of 22.8x. These metrics are almost entirely the same as what we just saw with AvalonBay. A few months back, investors were paying over 32x AFFO when buying shares of PSA, but the recent sell-off has presented a much better entry point.

Public Storage is the epitome of a Safe Haven REIT, as it has the ability to perform well in any economic backdrop and it is backed by an A rated balance sheet. The company also sports a dividend yield of 2.7%.

Fast Graphs

#3 – Prologis (PLD)

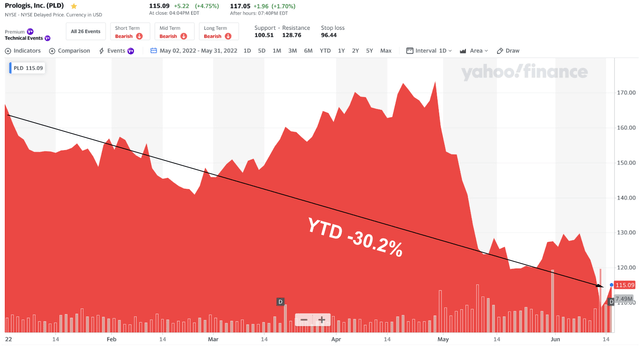

Yahoo Finance

The third and final Safe Haven REIT we will cover today is the Industrial REIT Giant known as Prologis Inc. All three of these stocks have almost identical charts on the year with them moving higher through April before falling hard the past 6-8 weeks.

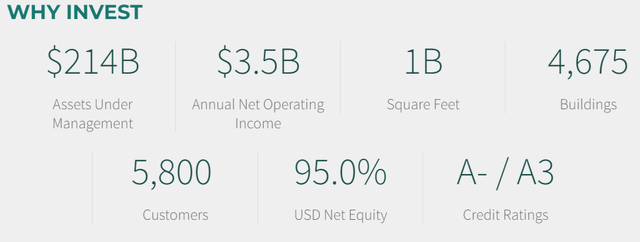

Prologis has an industrial focused portfolio with 4,675 properties across the globe that are leased out to 5,800 customers. PLD is one of the highest quality REITs on the market today and they are backed by their A- rated balance sheet.

PLD Investor Relations

When uncertainty is at its highest, high-quality companies are ones you will lean on the most. These companies have weathered economic slowdowns before and have proven to investors and credit agencies that they are worthy of their high-quality title. A stock like Prologis, along with the other two REITs we have discussed, is no different.

Prologis posted Q1 FFO of $1.09, beating consensus estimates by $0.02/share. Sales for the quarter grew 6% year over year to $1.22 billion, which also beat analyst estimates. Regardless of the comments made in the Amazon (AMZN) earnings report, which I will touch on, the company continued to see strong demand.

Occupancy at the end of the quarter was 97.4%, up 110bps year over year.

PLD was in the news this week as they entered into an agreement to acquire Duke Realty (DRE) in an all-stock transaction valued at $26 billion. Initially, this put added pressure on a stock that had already been selling off in recent weeks, as investors feared the M&A approach given where the market is and where we think we are headed.

The Amazon comment I alluded to, revolved around the company commenting on the amount of warehouse space they currently had, which appeared to be more than they needed. This sent shockwaves through the industrial REIT sector, hitting other logistic and warehouse REITs as well.

Regardless, I have taken the sell-off in shares of PLD as an opportunity to add to a high-quality, industry leading REIT that has a strong outlook. Think about the growth ahead in e-commerce and the warehouse space that will be needed for that going forward.

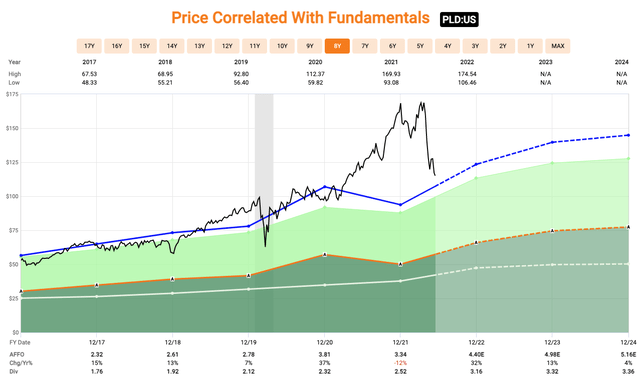

Shares of PLD currently trade at a forward P/AFFO multiple of 26.2x compared to a five-year average AFFO multiple of 28.1x. As you can see, the multiple is a bit higher for PLD as compared to AVB and PSA that we saw earlier, but PLD has been growing at a much faster clip than the other two.

Shares of PLD yield a dividend of 2.86% with a five-year dividend growth rate of 10.5%.

Fast Graphs

Closing Thoughts

These three REITs are not the only safe-haven stocks to buy, and in a few days I will provide readers and followers with another list. As I have been preaching now for quite a while here on Seeking Alpha, the key to sleeping well at night is to buy quality stocks when they’re on sale.

Real estate is a terrific asset class, especially REITs, and because of reliable rent checks, landlords can capitalize on a steady stream of reliable income. Importantly, most expenses are passed through to the landlord, so the income being generated is not affected.

I know you like to sleep well at night, and I can assure you that I sleep like a baby these days, thanks in large part to the fact that I recognize quality and value. Remember to always focus on the financials of the company and avoid chasing yield. As Ben Graham reminds us,

“To have a true investment, there must be a true margin of safety. And a true margin of safety is one that can be demonstrated by figures, by persuasive reasoning, and by reference to a body of actual experience.”

Be the first to comment