Pannawit Khongjaroenmaitree/iStock via Getty Images

Main Thesis & Background

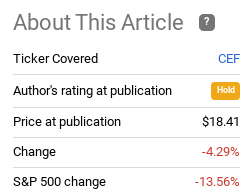

The purpose of this article is to discuss the Sprott Physical Gold and Silver Trust (NYSEARCA:CEF) as an investment option at its current market price. This is a fund I own for commodity exposure (aside from Energy funds), and generally like how it offers both gold and silver within the same basket. This eliminates the need for me to monitor multiple funds. When 2022 got underway, I advised my followers that I would be holding on to my CEF position, but felt there was little value in new buys. In hindsight, this was a reasonable call. CEF has definitely seen some weakness, but it doesn’t seem too bad when we consider the broader equity climate:

Fund Performance (Seeking Alpha)

Looking ahead, it is clear we have faced a difficult market and probably will continue to. This has made me consider putting some cash in to CEF again, as a way to hedge against further uncertainty in the market. At this juncture, I have been putting a lot of my cash to work. Moving from a 15% cash position down to a 5% position, and one of my buys has included CEF. There are a number of positive attributes I see at this juncture, and I will explain each in detail below.

Gold Is An “Everything Hedge”

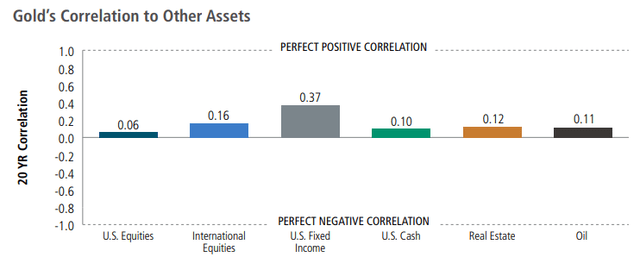

A primary reason for even considering CEF at any time begins with gold’s effectiveness as a hedge. This is an asset that has been debated for a long time – the merits of owning it and its usefulness. While there are pros and cons for buying it under any type of market condition, one attribute that stands out to me is the metal’s correlation (or lack thereof) with other assets. For example, if we look at a variety of other types of investments – stocks, bonds, foreign holdings, oil – we see the gold tends to march to the beat of its own drum. The correlation presented by gold with other popular assets is very low:

Gold’s Correlation to Selected Asset Classes (Sprott)

This helps to explain why CEF is down by less than half the S&P 500’s drop since my last review. And, unfortunately, why it is down while assets like oil have risen dramatically. There is no stable, predictable correlation between gold and most of the other asset types U.S. investors will consider. This is inherently a positive, in my mind, if one is looking for a portfolio hedge/diversifier, as I am.

Of course, there are downsides of this as well. It makes gold’s price hard to predict when looking at other markets. It also means that gold will probably not participate in a broad rally that will leave funds like CEF under-performing when times are good. But times aren’t exactly good right now, and investors need ways to protect themselves. Gold, and CEF by extension, offers such a way to do that.

This Fund Has An Attractive Valuation

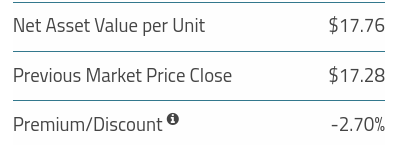

Digging in to CEF more specifically, a metric that sticks out to me for buying right now is the fund’s valuation. With markets experiencing plenty of turmoil at the moment, this is a factor I weigh very heavily. Fortunately, CEF is currently in discount territory, offering investors a chance to buy it on the open market for almost 3% less than the underlying assets are worth:

CEF Valuation (Sprott)

This is a straightforward attribute so I won’t say too much else on it. Simply, CEF is trading at a discount to NAV and, in this market, I am looking for value wherever I can find it. This appears to be one of those places.

What About Alternatives Like Bitcoin?

Looking at gold, silver, or any precious metal more broadly, we should recognize that investors do not buy equity hedges in isolation. For better or worse (mostly worse in my view), assets like Bitcoin and other cryptocurrencies have gotten lumped into the discussion when evaluating hedges like gold and silver. This is not a knock on Bitcoin on its own, but I simply don’t like the comparison between the two. Bitcoin is a new, highly volatile, and emerging play. Gold, and silver as well, are more traditional, time-tested portfolio hedges. Owning all of them together could make sense, but I do not like the “either or” discussion that sometimes crops up. I do not think readers should be sacrificing their metals exposure to buy riskier assets like crypto. This doesn’t mean stay away from those assets – buy them if you want to. But not at the expense of more traditional hedges.

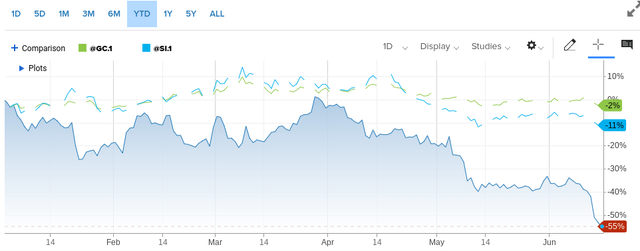

To understand why I say this, let us look no further than 2022. On a year-to-date basis, gold and silver have not exactly knocked it out of the park. But they are down modestly when compared to equities, bonds, and Bitcoin:

YTD Returns (Gold, Silver, Bitcoin) (CNBC)

My takeaway here is that sometimes the more traditional play is the better one. Bitcoin, and other cryptos, are flashier and sexier, no doubt about it. But that does not always translate in to returns. If one had shifted out of precious metals and in to crypto to hedge risk in 2022, the result would have been disastrous. While a reversal in fortune for Bitcoin could easily be in the cards when the risk-on sentiment returns, the first half of the year reaffirms for me why I own CEF in the first place. It helps protect my portfolio against wild swings, and Bitcoin does not.

Stocks Aren’t Cheap

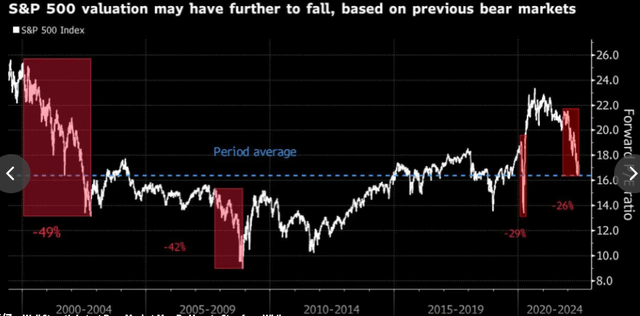

Another macro-factor that has me adding to CEF is the fact that stocks aren’t exactly cheap right now. Despite the major indices being either in correction territory (the Dow) or bear market territory (the S&P 500 and the NASDAQ), stock valuations are still elevated if we compare them to prior periods of stress. What I mean is, during past bear markets, the S&P 500’s valuation has dropped by substantially more than it has this time ahead. While the past doesn’t always repeat itself, and there is certainly an argument to be made for buying stocks now, we should proceed cautiously. In prior years, the S&P 500’s valuation has moved in a more dramatic fashion, suggesting more pain could be coming before the bottom is in:

Past Recessionary Performance (Yahoo Finance)

Of course, doom and gloom is not really my mantra. I have been adding to my equity positions during this sell-off as well, foreign and domestic. If stocks drop another 10-15% I will just admit defeat and bite the bullet. But to protect myself, I am buying gold and silver as well, to hopefully minimize future pain.

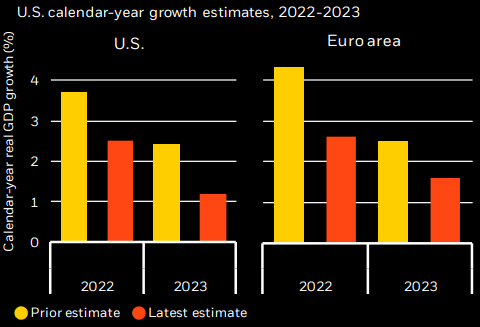

Further, there are justifiable reasons for why stocks could keep trending lower. One of them is GDP growth. Across the developed world, growth concerns persist between of weak consumer sentiment, central bank rate hikes, and the continued conflict in eastern Europe. This has weighed on growth outlooks, to the point where GDP growth has been revised downward in both the U.S. and in the Euro-zone:

GDP Growth Estimates (BlackRock)

Again, this is not meant to be alarmist, but to reiterate that investors should tread carefully here. The macro-backdrop is difficult, so focus on quality companies with strong earnings (and preferably ones that pay a dividend!). To protect against more downside, use hedges that have proven themselves over time – like gold and other industrial metals.

What’s To Like About Silver?

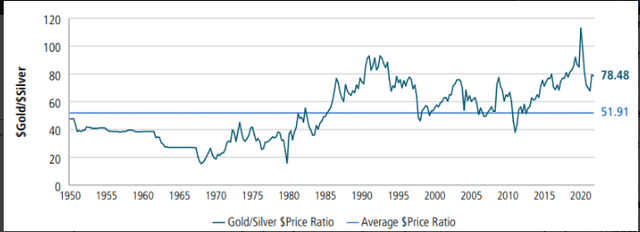

When one invests in CEF, they are obviously getting both gold and silver. I am supportive of this make-up, since I like the idea of owning both assets without the need to monitor two funds. But this also means that investors want to have bullish outlooks on both metals, before buying this product. In truth, silver is a more volatile asset, but I have discussed at length why I think demand will keep rising in the future. Renewable projects, like solar panels, utilize silver as an input, and that is something that is only going to get more popular in the future. Further, silver, like gold, has physical demand for jewelry and other goods, giving it practicality as well. Finally, silver is cheap in relation to gold at this juncture. This makes me willing to have some exposure to the metal, in the hopes its valuation will normalize going forward:

Gold versus Silver Valuation (Sprott)

The thought here is that silver adds some value to this fund. Of course, if silver rises at gold’s expense, then the benefit is negated somewhat. But I like the diversification, and with silver trading at a historically cheap level in comparison to gold, it makes sense to have a fund that owns both.

Don’t Be Blind To The Risks

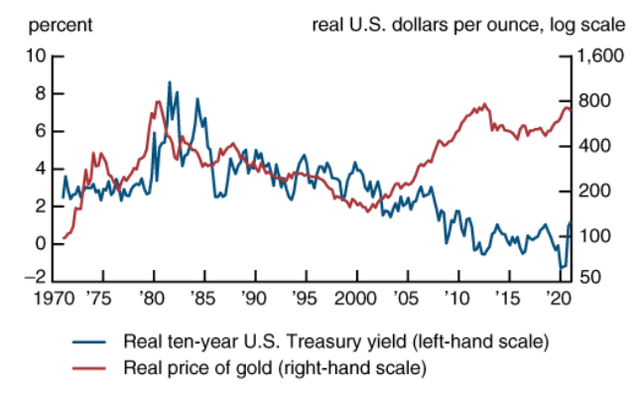

Through this review, I have painted a bullish outlook for gold and silver, and CEF by extension. But I always moderate my views with a discussion of the risks. No investment in life is a sure thing, and CEF is included. Despite a positive outlook and a reasonable valuation, there are headwinds that readers should be aware of. The primary among them is the likelihood of higher interest rates and rising bond yields. These factors weigh on the non-interest bearing precious metals, making the Federal Reserve’s aggressive tightening stance a top-of-mind risk for CEF. To understand why, consider that there is an inverse relationship between gold’s price and treasury yields. While not perfect, it illustrates why investors should be cautious, as the expectation is rates are indeed going to rise going forward:

Gold vs Treasury Yields (Chicago Fed)

However, this time around could be different. The Fed’s willingness to get more aggressive has also triggered recession fears, particularly in the United States. If that does indeed materialize, then gold will likely perform well. So, that is a bit of a paradox: if yields go up and the economy holds up well, gold should suffer. If yields go up and this forces the economy to recede, then gold could very well benefit. This is due to the fact that if a recession does occur, the Fed will have to pump the brakes on more tightening and rates hikes, pushing us back in to a more accommodative environment that is good for precious metals.

Bottom Line

This is not 2021, more’s the pity. This market is increasingly hostile, volatile, and uncertain. Major macro-problems are plaguing the world, especially in Europe, and this is impacting traditionally safer investments like developed-world stocks. The U.S. equity markets have seen major losses, and this may unnerve some investors from putting more money to work there. If you fall into this category, I’d suggest giving CEF some consideration. The fund holds gold and silver, which have been reliable performers during periods of stress over time. Rising yields and more central bank tightening cloud the outlook to be sure, but this is why funds like CEF trade at a discount to NAV. This helps mitigate the downside potential somewhat. Ultimately, I see this as a smart way to hedge against further equity downside, and will be putting more cash to work here while I wait out another potential drop in stocks.

Be the first to comment