xeni4ka/iStock via Getty Images

This article first appeared on Trend Investing on May 17, 2022, but has been updated for this article.

2022 Bear Market Bargains Series – Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

As the 2022 U.S equity bear market continues (S&P 500 index is now at 3,666, down 23.07% YTD, PE is now 18.33), we take a look at Lithium South Development Corp. (“Lithium South”).

CNBC market report on June 15, 2022:

The S&P 500 and Nasdaq Composite fell further into bear market territory, ending the session down roughly 24% and 34% from their all-time highs, respectively, as inflation and fears of slowing economic growth weigh on investors. The Dow, meanwhile, is 19% below its Jan. 5 all-time intraday high.

For a background on Lithium South you can read:

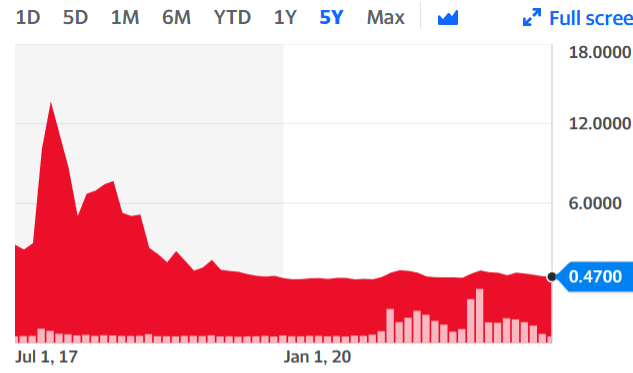

Lithium South Development Corp. [TSXV:LIS] [GR:OGPQ] – Price = CAD 0.47, USD 0.36

Yahoo Finance

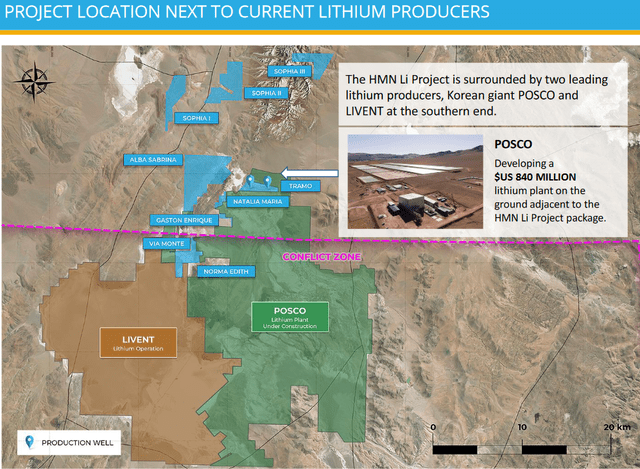

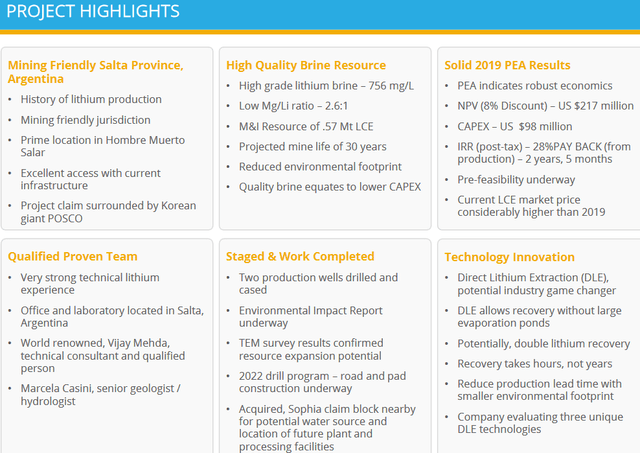

Lithium South Development Corp. [TSXV:LIS] (“Lithium South”) owns 5,687 hectares of tenements (3,287 hectares fully paid) known as the Hombre Muerto North (“HMN”) Project, located mostly in the Salta province of Argentina. The Project is adjacent and near three leading lithium producers/projects, Livent (LTHM), Allkem [ASX:AKE] (OTCPK:OROCF) and POSCO [KRX:005490] (PKX) at the northern end of the renowned Hombre Muerto salar.

HMN Project location and concessions (in blue)

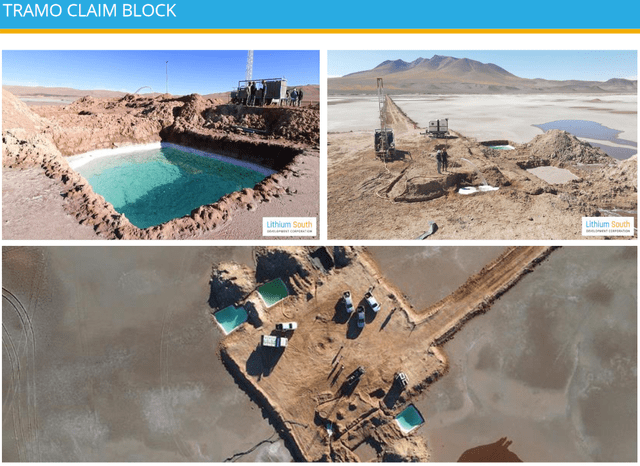

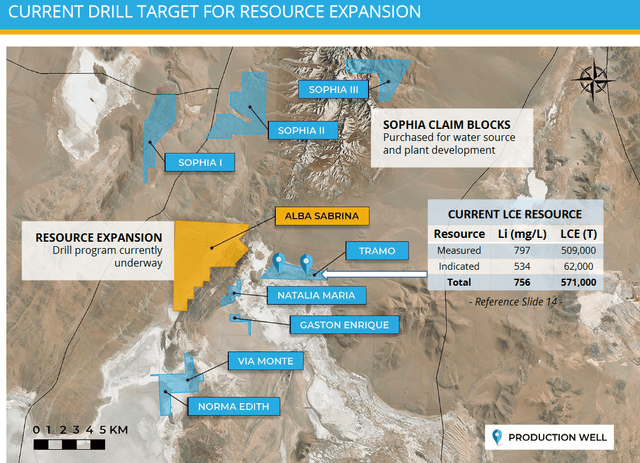

Lithium South’s Tramo concession has a M&I Resource of 571,000t contained LCE at 756mg/L

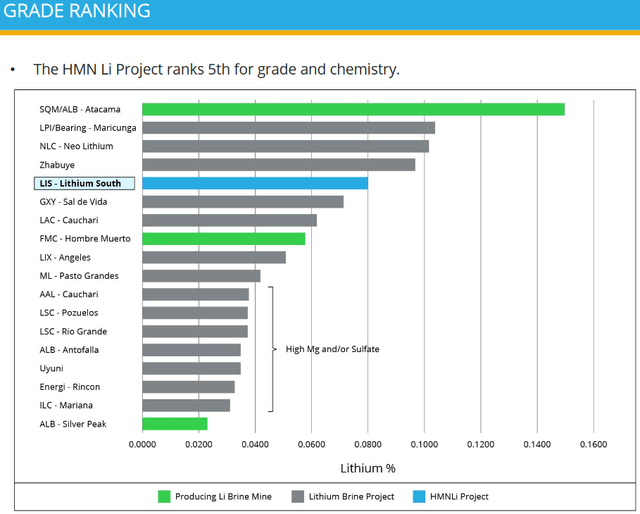

Lithium South is currently drilling to grow their resource from its current level of M&I Resource of 571,000t contained LCE at 756mg/L (the Resource is based only on exploration at the Tramo concession). The Resource has global leading high grades (see chart below) with very low Mg/Li ratio of 2.6:1.

Lithium South stated the following: “Potential to expand to 2 MT LCE with 2022 drill program.” They are current working at the Alba Sabrina concession.

Note: 2 MT means 2 million tons.

Valuation

Lithium South’s current market cap is C$45m (US$35m) with no debt. As of December 31, 2021, cash was at ~C$16m.

Based on the HMN Project our price target for end 2025 (assumes 5,000tpa production at OpEx US$3,112/t, CapEx US$93m, 100% ownership, ~5% gov. royalty, 3% land seller royalty) is:

- Base case (assumes selling LiCarb at US$20,000/t) – C$3.75 (8x higher).

Further upside if production volumes grew beyond 5,000tpa lithium carbonate or if lithium prices remain high.

We were unable to find any analyst’s price target.

Peer comparison

Given Lithium South’s high grade and low impurity resource its market cap of US$35m is well below most of its peers, including Alpha Lithium [TSXV:ALLI] (OTCPK:APHLF)(US$94m) and Galan Lithium [ASX:GLN] (US$232m).

The chart below shows Lithium South’s stock price has performed poorly compared to the Lithium/battery/EV ETF (LIT).

Price chart comparison of TSXV:LIS [blue] and LIT [red]

Current stage

Lithium South is still at the early to middle stages with a Resource estimate, 2019 PEA completed (Tramo claim only), as well as the recently completed Environmental Baseline Study.

For details on the HMN Project PEA, off-takes, infrastructure, and management you can view our past article here or check Lithium South’s website.

Next steps

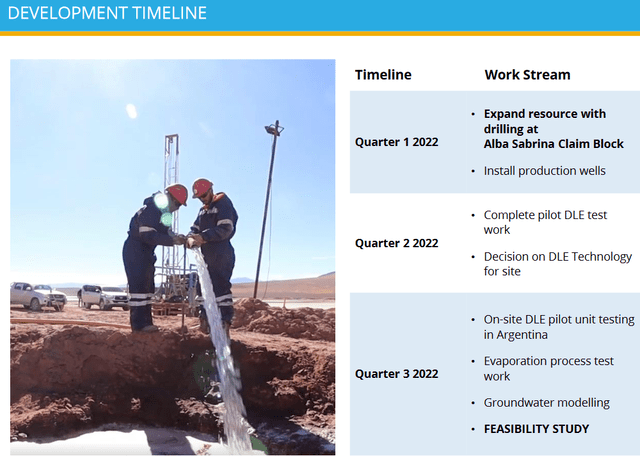

The next main catalyst for Lithium South will be the drill results from the current drilling program at the Alba Sabrina claim followed potentially by a resource upgrade.

Also during 2022 will be ongoing pilot testing of lithium extraction methods with Lithium South evaluating both conventional evaporation and Direct Lithium Extraction (“DLE”), perhaps Eon Minerals absorbent technology will be selected (read page 19 here). Some process test work results are due in Q2, 2022. This will lead to design of a pilot plant and a DFS.

Risks

- Global, China, Europe, USA slowdown resulting in less EV sales, therefore less demand for batteries and hence lithium.

- Falling lithium prices.

- The usual mining risks – Exploration, permitting, production, partner, environmental risks. Lithium South is still at a relatively early stage which makes the stock more risky.

- Business risks – Management, liquidity, debt, and currency risk.

- Sovereign risk – Moderate in Argentina.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange), market sentiment.

Further reading

Lithium South Highlights

Conclusion

Lithium South is a 2022 beaten down bargain. We would not be surprised to see the stock price double (or even triple) in 2022 if drill results are strong and the resource grows significantly.

Its valuation looks exceptionally attractive on a current market cap of only C$45m for a top quality lithium brine resource in a world renowned salar. Current high lithium prices make Lithium South look ridiculously cheap and it may well be a takeover target.

Risks revolve mostly around Lithium South progressing towards production as well as lithium prices and moderate country risk in Argentina. Please read the risks section.

We view Lithium South Development Corp. as a great speculative buy, suitable for a 5-year plus time frame, especially if you are positive on the outlook for junior lithium miners.

As usual, all comments are welcome.

![Price chart comparison of TSXV:LIS [blue] and LIT [red]](https://static.seekingalpha.com/uploads/2022/6/16/37628986-16554353605245445.png)

Be the first to comment