Win McNamee/Getty Images News

The futures knew it, bonds knew it, and the dollar knew it. Once again, the only market living on an alternate planet was equities, which proves that paying attention to the landscape around you matters.

Powell finally delivered a direct message. In his Jackson Hole speech, in the opening paragraph, he made it clear that his remarks would be shorter and the message would be more direct. That it was.

Very simply, rates still have further to rise, and once there, they will stay there for some time.

He noted that reaching an estimate of the longer-run neutral rate is not a place to pause or stop. He said the June FOMC projections suggest rates would rise to just below 4% through the end of 2023 and that historical accounts warned against loosening policy too soon.

It’s evident that the Fed is aware of the mistakes made in the 1970s and 1980s with the stop-and-go monetary policy approach that led to even higher rates, and the Fed appears to be determined not to repeat those mistakes.

Nobody should have been surprised by Powell’s speech. All Powell did was summarize and repeat what nearly every board member and Fed governor had said over the past two to three weeks. Futures, bonds, and dollar markets were already picking up on that message. The only market left out, of course, was equities. Because instead of listening to the messages of the FOMC members and other markets, stocks were too busy daydreaming about rate cuts and not paying attention.

In essence, the equity market has been living in the past, believing that the Fed would pivot and ease policy just as it has done every time the market fell, or the first sign of slowing growth crept into the equation. Since 2010, that has been the mantra of the buy the dip crowd. Unfortunately, as I have explained, this time is different.

Over the past 12 years, the Fed didn’t have to deal with inflation running at high rates. In the past, the Fed could pivot quickly at the first sign of slowing growth. In the past, inflation was running too low and on the cusp of deflation. In the past, the Fed did not want to have the challenges of running a negative interest rate policy or have the economy slip into a deflationary spiral.

That was then, and this is now.

Powell noted in the speech today that fighting inflation will take a sustained period of below-trend growth and a softening labor market, which could bring pain to households, and are the costs of reducing inflation. In the third paragraph of his speech, it’s right there. The Fed is willing to sacrifice growth and face rising unemployment to bring inflation down. He is telling the market there will be no “pivot” anytime soon.

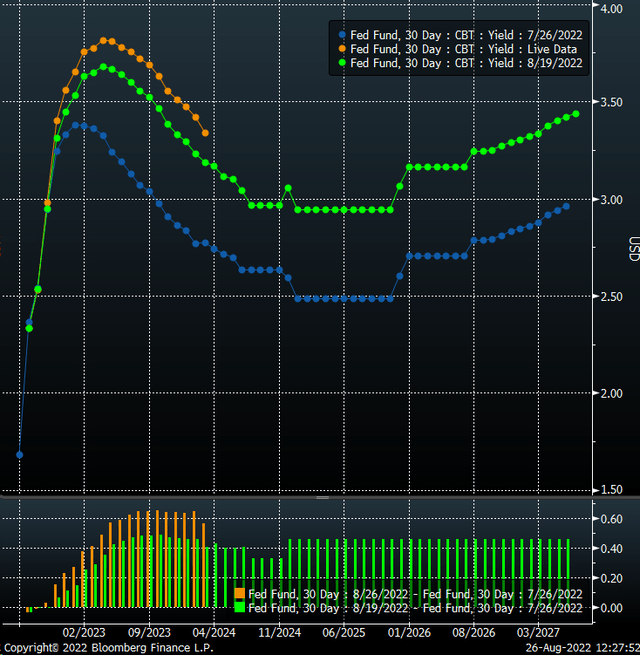

Following the speech, the Fed Fund Futures rates are again moving higher and, more importantly, at the back of the curve. This shift indicates that the market continues to price in a “higher for longer” regime.

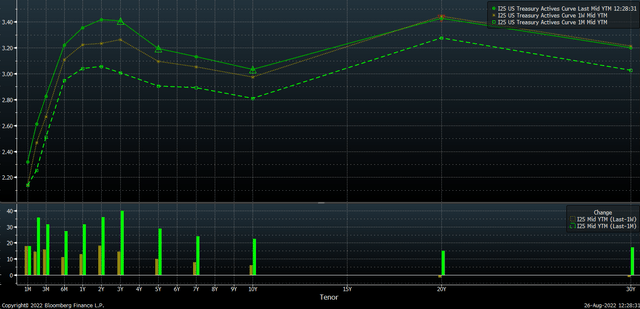

The Treasury curve also continues to see rates moving higher. More importantly, if the Fed Funds Futures reprice to reflect the June FOMC projections of 3.8%, then the two and three-year Treasury should also rise towards that 3.8% to 4% range.

Meanwhile, the dollar continues its push higher. It has been steadily rising over the past few weeks and probably has further to climb, especially if more rate hikes start to get priced in the Fed Fund Futures.

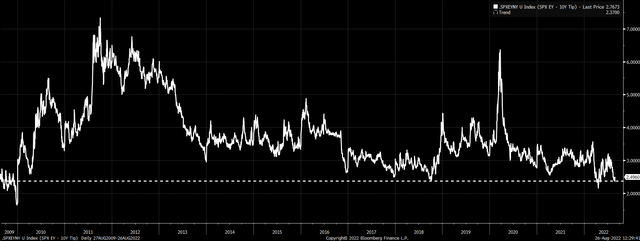

In terms of stocks, well, they aren’t cheap and have become disconnected from bonds and the dollar, which means there’s significant downside risk from here. The spread between the S&P 500 earnings yield and the 10-year Treasury has collapsed to around 2.4%. The only time the spread between the Treasury rate and the earnings yield of the S&P 500 was closer came in April 2022. The only other time the spread has been this low on a rate-adjusted basis was in the fall of 2018, and no other time over the past 12 years.

If that spread were to return to around 3%, assuming the 10-Yr Treasury remains about 3%, the earnings yield on the S&P 500 would need to rise about 6%, or equal to a PE ratio of about 16.6. With S&P 500 2022 earnings estimates of $226.60, the index would be worth about 3,750. The higher rates climb, the further the S&P 500 PE ratio would fall, and we could also assume that the spread between the 10-Yr and the S&P 500 earnings yield should widen, which means that ultimately that PE ratio needs to fall potential much more.

Unfortunately, reality can bite at times. It is crystal clear now, there is no dovish pivot, there was no dovish pivot, and there will be no dovish pivot for some time.

That means stock now needs to reset lower. It was right there for everyone to see.

Be the first to comment