jittawit.21/iStock via Getty Images

Service Properties Trust (NASDAQ:SVC) is a real estate investment trust (REIT) that owns a diverse portfolio of hotel properties and net lease services. These properties are located primarily in the United States, along with Canada and Puerto Rico. Most hotels are extended stay or luxury/upper upscale. Some of the major hotel brands include Courtyard by Marriott, Royal Sonesta, Crowne Plaza Hotels & Resorts, and Hyatt Place. SVC’s properties are primarily operated under long-term management or lease agreements. Service Properties Trust is managed by the operating subsidiary of The RMR Group Inc. (RMR), an alternative asset management company that is headquartered in Newton, Massachusetts.

Portfolio of Hotels and Retail Net Lease Assets

At present, Service Properties Trust has 298 hotels, and 786 retail net lease assets (including travel centers). Net lease retail properties are spread over 13.5 million square feet, generating an annual minimum rent of $372 million. Representing 43 percent of SVC’s overall portfolio, net lease assets were 98 percent leased by 179 tenants with a weighted average lease term of 10 years and operating under 144 brands in 22 distinct industries. Thus, Net Lease Portfolio continues to provide stable cash flows.

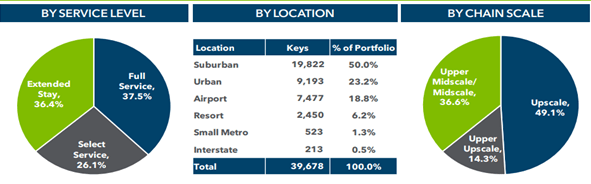

Service Properties Trust has an interesting mix of hotel properties. The hotels are distinguished between their service levels, which include full service, select service, and extended stay; and chain scale, which includes luxury/upper upscale, upscale, upper midscale/midscale. 37 percent of hotels offer extended stay, and another 37 percent are full service hotels. Half of the hotels are in suburban areas. Also 50 percent of hotels are luxury/upper upscale properties.

SVC Portfolio (Company website)

Financial Performance

During Q1, 2022, funds from operations (FFO) was negative $3.4 million, or $0.02 per share. Though negative, the performance was much better than the previous quarters. Adjusted EBITDA was $90.1 million for the same period. Despite the effect of the pandemic at the start of the year, demand accelerated in late February. The major drivers that impacted FFO was the performance of SVC’s hotel portfolio, which generated $5.2 million in EBITDA for the first quarter of 2022 compared to losses of $38.2 million in Q1, 2021.

With an EBITDA of $10.4 million, extended stay hotels continued to have the strongest performance. 49 full service and 92 select service hotels generated losses of $1.5 million and $3.3 million respectively. Performance of extended stay hotels benefited from relatively higher occupancy of almost 65 percent, whereas non-extended stay hotels recorded an occupancy of 44 percent. The occupancy level of the overall hotel industry was a little over 46 percent.

During March, 2022, Service Properties Trust successfully amended its revolving credit facility and extended the maturity date to January 2023, and can further extend the maturity for another six months. As part of the amendment, the credit facility was reduced to $800 million, and the company agreed to a minimum liquidity level in order to address near-term debt maturities. The amendment also allowed for up to $300 million of acquisition and increased the limit on amounts Service Properties Trust can fund for certain other investments to $100 million through the waiver period.

Emphasis on Renovation, Disposal & Acquisition

The company has a maintenance capital of almost $70 million and has estimated approximately $200 million of capital spend during 2022. Renovation jobs are undergoing on some of the premium properties of SVC, including the Hyatt Place portfolio, full-service routes in hotels in Salt Lake City, a dozen limited-service Sonesta hotels, and two full-service Sonesta hotels. In April 2022, Service Properties Trust made a $25 million capital contribution to Sonesta to partially fund their acquisition of the portfolio of hotels in New York City, and expect to fund another $21 million later this year.

The company has sold almost 60 hotels in Q1, 2022, and is in the process of selling another few hotels. These hotels generated a negative EBITDA of $3.4 million in the first quarter compared to positive $9.1 million for the non-exit hotels. Despite the strong performance of hotels in leisure markets and in warmer climates, three full-service hotels in Chicago generated operating losses of $5 million in the quarter. The Clift Hotel in San Francisco lost another $1.6 million. Full-service assets in Kauai and Irvine, California lost a combined $2 million due to renovation disruption.

After the $200 million capital spending and receipt of additional sales proceeds, Service Properties Trust had over $900 million of cash and expected another $300 million of sales proceeds in Q2, 2022. The next debt maturity is $500 million of senior notes due in August, which the management expects to redeem with the cash available with the company. The company has a debt service coverage ratio (DSCR) of 1.5 times.

Price and Dividend Yield

Shares of Service Properties Trust, which traded in the range of $21 to $31 for almost 8 years prior to covid-19 pandemic, dropped to a bottom of below $6 during the pandemic, and failed to recover since then. The price doubled in between, but ultimately came down to the same level. Such huge price loss generally results in higher yield. However, in this case, the company has drastically reduced its pay-out by more than 98 percent, which made the yield insignificant.

The management expects its hotel portfolio to generate an EBITDA in the range of 19 to 22 percent as the industry enters into seasonally stronger periods and demand for lodging continues to accelerate. Banking on such performance, Service Properties Trust will be able to maintain the current quarterly distribution rate of $0.01 per share through year-end 2022, as agreed to as part of SVC’s credit agreement amendments. However, this insignificant yield of almost 0.5 percent is of no use to investors, who used to earn a yield between 7 and 8 percent prior to the pandemic.

Investment Thesis

SVC’s extended stay hotels have relatively higher occupancy and the company is trying to turn around and grow through renovation, disposal & acquisition. However, the sales volume of Service Properties Trust doesn’t get reflected on its price, as suggested by a low Price/Sales (P/S) multiple of 0.6. At present, the market price is at a historical low, which made the stock highly undervalued. A Price to Book (P/B) ratio of 0.7 is extremely low as compared to 3.32 of that of index. The price to Cash flow (P/CF) multiple is at 9.76, whereas the P/CF of the index is at 14.05.

Service Properties Trust is expecting a higher occupancy and corresponding growth in its hotel portfolio. Necessity-based net leased retail assets with strong rent coverage, low capex requirements and long lease terms produce stable cash flows that balance the cyclicality of the hotel portfolio. The management is expecting a strong EBITDA growth in 2022. The company also has a strong liquidity. Looking at the current level of performance and expected future growth of this hotel REIT, I believe that this company is undervalued and the price should move only in one direction, that is upward.

Be the first to comment